- The burn rate of SHIB increased by 347%, resulting in a significant decrease in market supply.

- Technical analysis suggests a potential bullish trend for SHIB following a pattern breakout.

The world of MEMCOIN is never boring. This is especially true for enthusiasts and investors of Shiba Inu (SHIB), a cryptocurrency that has been riding the wave of high volatility and community-driven initiatives for several years now.

Shiba Inu, the second largest Memecoin after Dogecoin, has been experiencing a steady upward trend so far. In the past week alone, SHIB’s value has risen nearly 10%, and over the past month it has surged more than 15%.

However, in the past 24 hours, Memcoin suffered a minor setback, with its price falling to $0.00002595.

This price drop is common in volatile cryptocurrency markets, but it coincides with a significant rise in Shiba Inu’s burn rate, a key indicator that can affect a coin’s valuation over time.

Unprecedented Burning, Unpredictable Market

Shiba Inus, known for their vibrant community and speculative appeal, saw their burn rate increase by an astonishing 347% on May 31. data This is a product of Shibburn, a token burn tracker for Shiba Inu.

This surge is part of a broader community-led effort to reduce the circulating supply of SHIB and potentially drive up prices through artificial shortages.

Source: Shibburn

This morning, approximately 9.74 million SHIB tokens were transferred to dead wallets, permanently removing them from circulation. These aggressive burns were carried out across multiple transactions in the community, highlighting a concerted effort to strengthen the market value of the tokens.

Three wallet addresses played a pivotal role in this surge. One notable contributor executed two major transactions, sending a total of 4.91 million SHIB to the burn address.

Another participant added to the frenzy by transferring 1.5 million SHIB to a dead wallet. These activities highlight strong community initiatives focused on creating value through scarcity.

SHIB’s incineration strategy

The implications of such aggressive burning are multifaceted. While immediate price fluctuations are common (SHIB fell slightly to $0.00002595 after the burn), the long-term outlook can be quite different.

Burning a token reduces the available supply, theoretically making the remaining tokens more valuable if demand remains stable or increases.

However, the effectiveness of the strategy largely depends on ongoing community engagement and broader market conditions. Cryptocurrency markets, known for their unpredictability, may affect the price of SHIB independently of internal token economics efforts such as burns.

Moreover, an increase in burn rate can signal an active community to potential investors, which can be an attractive quality that leads to increased buying pressure.

Will there be a huge surge ahead?

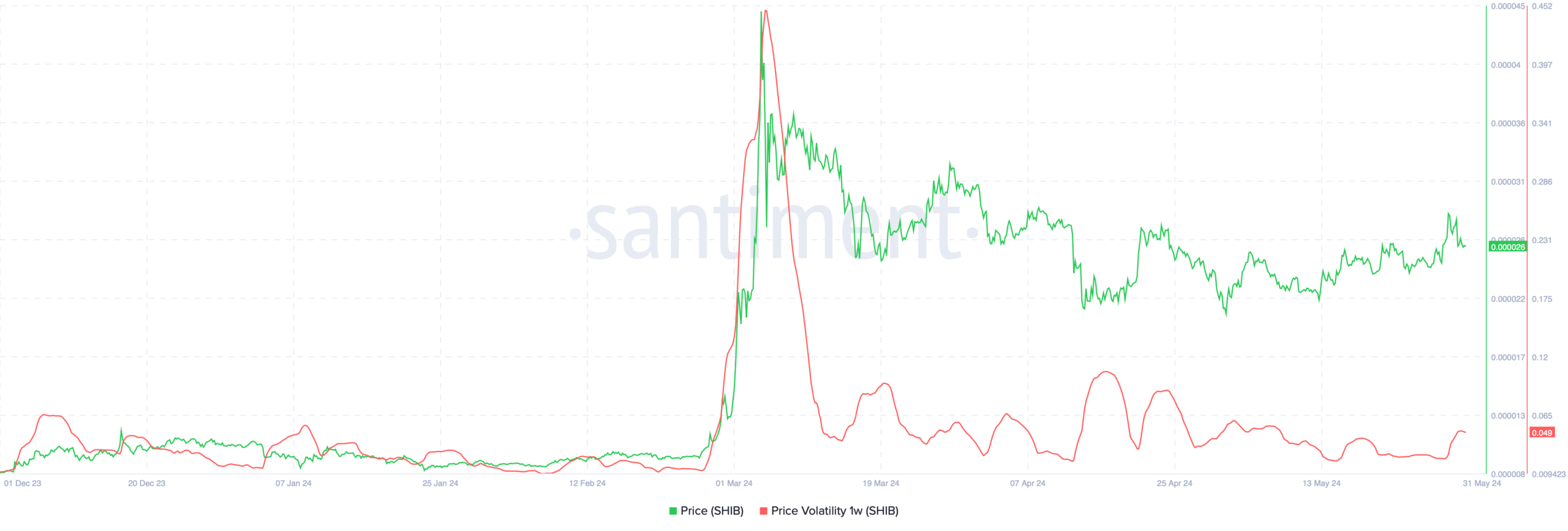

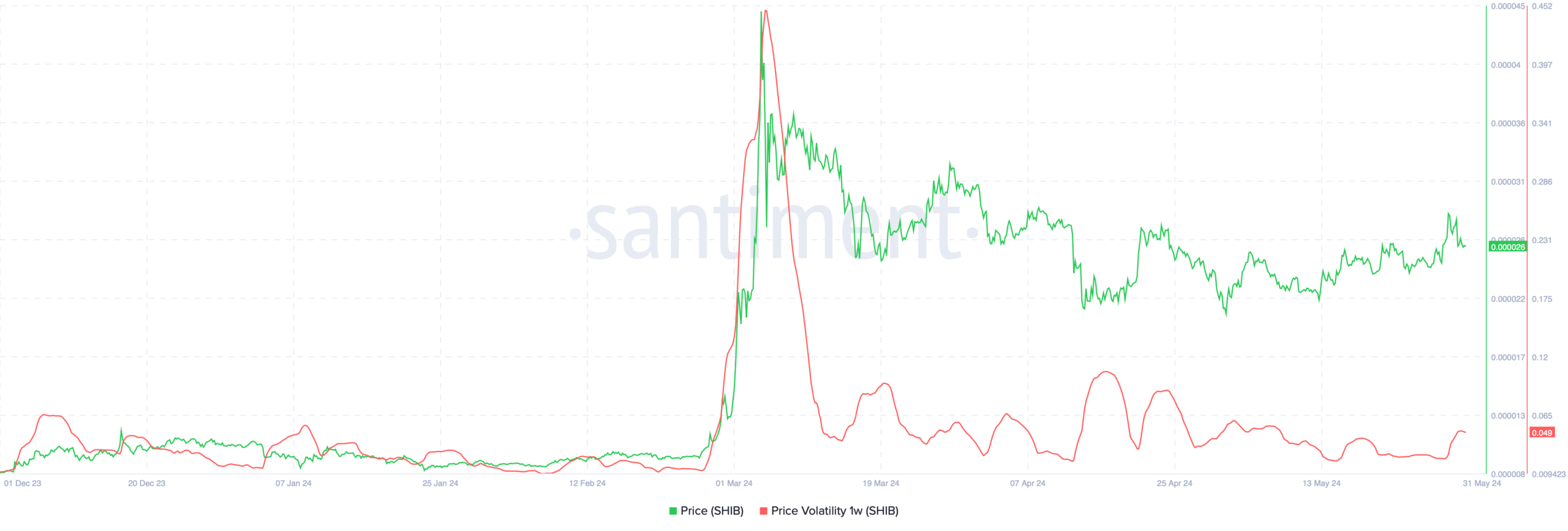

Amid these developments, a broader market analysis presents a more nuanced picture. data Santiment’s report suggests that SHIB’s price volatility has been steadily decreasing, which could mean the market is maturing and institutional interest is increasing.

Source: Santiment

In particular, the continued decline in volatility contradicts the general characteristics of memecoins, which thrive on rapid price changes and high trader participation.

Moreover, SHIB’s Open Interest There has been a noticeable decline, suggesting a period of reduced trading activity and cooling in trader interest.

Source: Coinglass

Meanwhile, technical analysis on SHIB’s daily chart indicates a recent breakout of a descending triangle pattern, which typically indicates an imminent retracement to the breakout point.

This retracement now appears to be complete and the SHIB chart is showing signs of stabilizing. In particular, the recent daily chart candles are forming a doji shape, which is a sign of market indecisiveness.

If this Doji candle is followed by a bullish surrounding candle closing above the Doji, SHIB could be poised for a significant upward surge.

Source: TradingView

Read Shiba Inu (SHIB) Price Forecast for 2024-25

This analysis is consistent with: AMBCrypto’s latest reportIt was noted that a long-term consolidation within this price range could open up significant pockets of liquidity near or above $0.000035.

This situation is likely to set SHIB’s optimistic target if market sentiment turns favorable.