The Solana launch pad is a mysterious enigma. While other blockchain networks like Ethereum or BNB Chain are filled with dozens of different IDO launchpads that help bring cutting-edge new cryptocurrency projects to market, Solana (SOL) appears to have chosen a different path.

The Solana blockchain continues to subvert expectations as ecosystem builders buck the trends of previous cryptocurrency cycles. The cryptocurrency industry’s new ‘build first, fund later’ approach has made Solana Launchpad redundant and a fresh, more equal approach has taken its place.

Why are the Solana Launchpad and IDO platform out of fashion, and how will the Solana project complete fundraising without them?

What is Launchpad?

Launchpad is a very popular way to bridge the gap between early-stage cryptocurrency projects and enthusiastic investors.

In theory, this relationship benefits both parties. The new project offers a token sale to a wide range of investors, giving the general public the opportunity to invest in the innovative Web3 platform before it hits the public market.

Retail investors have particularly liked these contracts because they allow them to participate in private sales and IDOs typically reserved for institutional funds and cryptocurrency venture capital firms.

Likewise, Launchpad operators have been able to generate revenue through platform fees and partnerships with emerging cryptocurrency projects.

Although it seemed like a perfect setup, the cryptocurrency launchpad still had its flaws.

Launchpad pitfalls

Most cryptocurrency launchpads are businesses in their own right. In addition to functioning as an incubator, it usually has its own native token. Users will need to purchase and stake these tokens to secure allocation or whitelisting in upcoming token launches.

Inevitably, this reproduced the problem that Launchpad was originally built to solve. To access high-quality IDO tokens, investors must first purchase large quantities of Launchpad’s native tokens. This has again divided the investor community into those who can afford to use IDO platforms and those who cannot.

But that’s not the only problem. When the cryptocurrency industry succumbed to the downturn, most launchpads saw their pipelines dry up and their revenue streams evaporate. Launchpad has had to make a living by delivering substandard projects in difficult market conditions, which has resulted in years of disappointing results for all parties.

Fortunately, the Solana ecosystem and the broader cryptocurrency market are experimenting with new approaches.

Solana’s airdrop revolution

In the past, the development of new cryptocurrency projects followed a relatively formal process.

- conceive an idea

- fund raising

- Building a product

- Product launch

Naturally, this formula paved the way for dozens of project failures and fraud scams, leaving investors with empty, broken promises.

Fortunately, the cryptocurrency space has become much more competitive over time, requiring projects in every sector to demonstrate why their products should be preferred over their competitors.

Investors have become reluctant to invest capital solely on ideas and promises, and are demanding more substance to base their thesis on. This results in a proven model that places more responsibility on builders and opens the door for greater end-user involvement.

- conceive an idea

- Building a product

- Product launch

- attract users

- fund raising

- reward users

Before a team can raise capital, they must demonstrate that they can do the work. One way to do so is to incentivize users with generous plans. This usually means offering airdrops to users and providers who promote activity in specific applications.

By providing liquidity pools for Decentralized Finance (DeFi) apps, executing swaps and trading on DEX and NFT marketplaces, and interacting with various smart contracts, end users are rewarded with token allocations from their favorite dApps for free.

Participating in airdrops is much more cost-effective as users gain exposure to new protocols without having to invest capital upfront. Additionally, airdrops are generally KYC-free, making them more popular among cryptocurrency believers.

The airdrop model has proven to be very popular on Solana, with dozens of protocols utilizing the method to get tokens into the hands of the most enthusiastic users. Some of the biggest projects in the Solana ecosystem, including Jupiter, Tensor, and Kamino Finance, have used airdrops to spread token distribution.

But what does this mean for Solana Launchpad?

Does Solana Launchpad still exist?

The spread and popularity of the Solana Airdrop revolution has made the Solana Launchpad unnecessary.

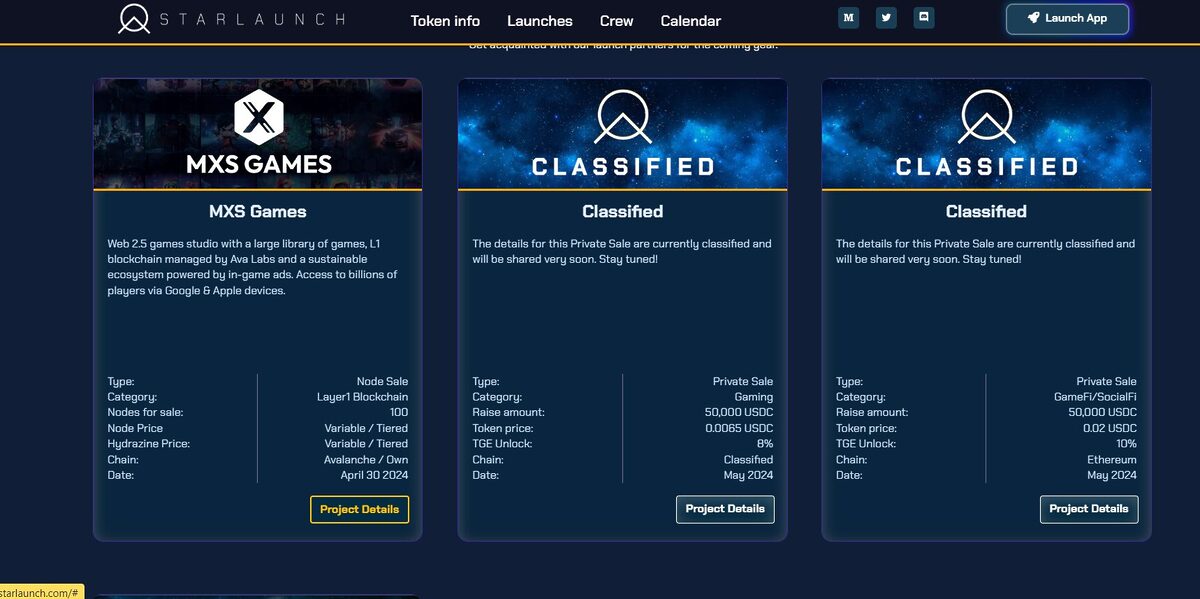

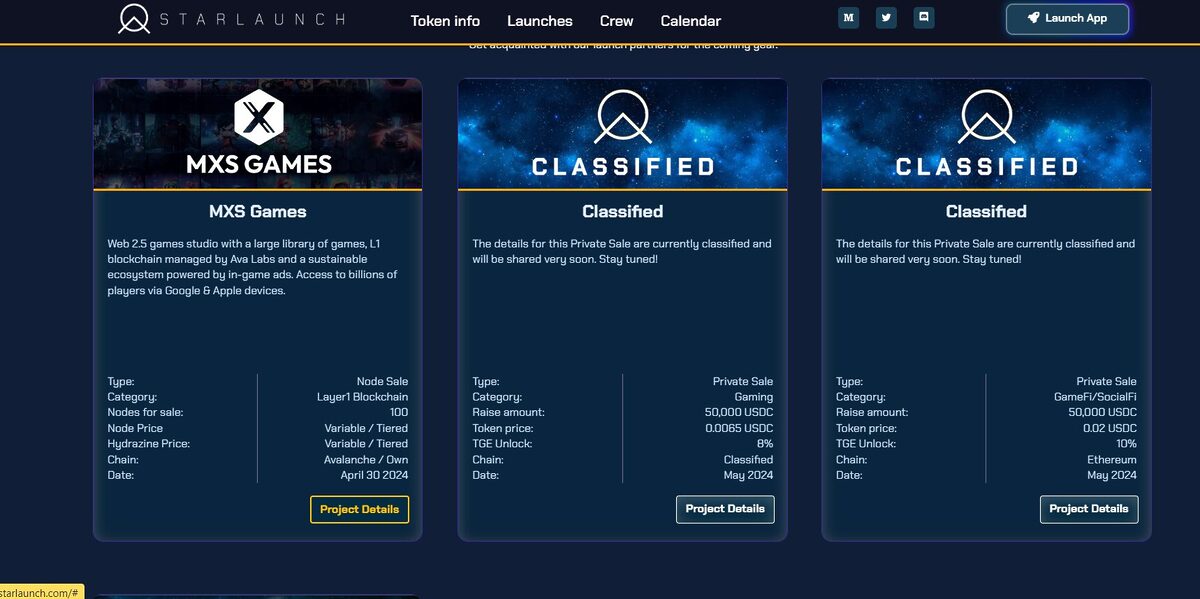

Sure, Solana launchpads like Starlaunch and Solanium still exist, but their proposed deals are largely unknown and demand is embarrassingly low. Let’s take a look at the Starlaunch homepage to give you an idea.

Despite calling itself “Solana’s #1 launchpad,” Starlaunch only has one scheduled release date. Not only was the project details link broken, but the IDO in question was scheduled to launch in April and would be released on Avalanche, not Solana.

Ultimately, Solana Launchpad was replaced by what cryptocurrency users and teams chose as a better and fairer token distribution method. However, Solana’s airdrop is not perfect.

Solana Launch Strategy: Pros and Cons

Despite all its benefits, the Solana airdrop is not without its flaws. What are the pros and cons of Solana’s ecosystem launch strategy?

Advantages

- ‘Create first and grow later’ – Solana’s airdrop story means that ecosystem participants can avoid the disappointment of investing significant capital in failed projects or the fraud commonly seen on launchpads hosted by other blockchains.

- User Rewards – Large airdrops like JUP and TNSR provided users with significant token allocations, with advanced users receiving airdrops worth 5-6 figures.

- healthy competition – With so many high-quality platforms competing for engaged and active users, Solana-based teams must deliver a top-of-the-line product that makes them stand out.

disadvantage

- artificial statistics – Airdrop farmers are known to create fake activity and laundered transactions between their wallets to attract larger airdrops. This results in indefinite statistics and distorts important blockchain data.

On the flip side

- Airdrop farming promises ‘free rewards’, but the reality is that transaction and protocol fees may end up costing some users more than they receive. This begs the question: are you farming the protocol, or is the protocol farming you?

Why This Matters

Solana Launchpad may have once been a key part of the ecosystem, but public airdrop campaigns have replaced it.

Frequently Asked Questions

Given that most Solana projects run airdrop campaigns, Solana Launchpad was somewhat redundant. As a result, the Solana project is technically self-starting.

You can buy Solana (SOL) on major cryptocurrency exchanges like Binance.