Hong Kong, Hong Kong, June 3, 2024, Chainwire

Term Structure, a pioneering non-custodial fixed income protocol, has officially launched with the Ethereum mainnet. This launch revolutionizes the way liquidity is provided between lenders and borrowers in decentralized finance (DeFi) by introducing the first institutional-grade, market-driven fixed income protocol. Users can borrow tokens at fixed rates and terms using LST and LRT as collateral, and earn points and staking rewards on the main marketplace, where an auction mechanism facilitates borrowing and lending. Meanwhile, secondary markets support trading of these fixed-income tokens through real-time order books to increase liquidity.

Speaking from a traditional finance (TradFi) perspective, co-founder Jerry Li suggests that the lack of bond products in the market is a major factor hindering the exponential growth of DeFi. Term Structure Protocol fills this gap by providing fixed rate and fixed term products that enhance risk management and introduce a variety of trading strategies previously unavailable in the DeFi ecosystem. These strategies are important for both institutional and individual investment plans.

With its mainnet launch, Term Structure aims to establish a new global standard for liquidity management and enable users to secure a fixed cost of funds. This is essential for leverage opportunities to potentially earn higher variable APY or take advantage of token price increases. “Designed to meet the needs of institutional clients, traders, and retail investors, our mainnet represents a pivotal advancement for DeFi. This allows users to leverage digital assets at fixed rates and terms,” said Jerry Li.

Users can earn additional points and receive rewards by repeating LRT and LST in the period structure. Source: Term Structure

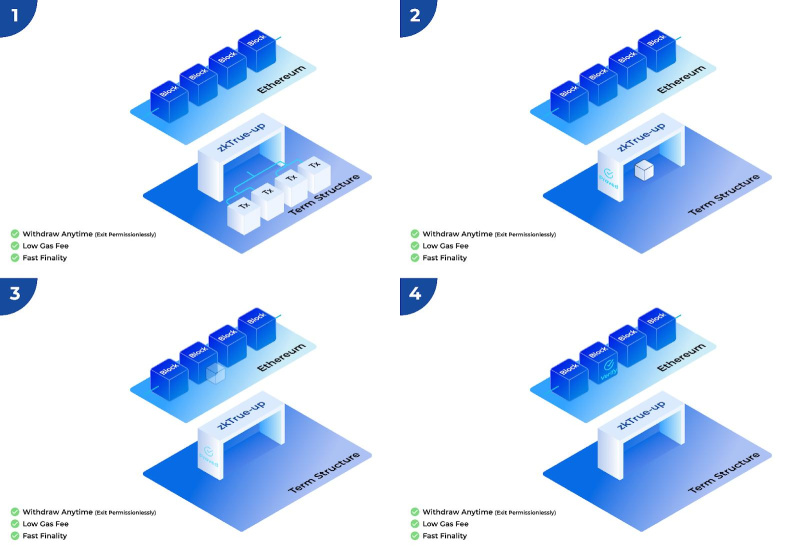

Term Structure stands out in that it provides an integrated bond market that integrates both primary and secondary markets, unlike other protocols that separate primary and secondary markets or use AMMs for different tokens. To get started, users can borrow tokens at fixed interest rates and terms using LST and LRT as collateral, set their preferred interest rate, and choose a maturity date on any of the major markets. If the order is matched, the borrower receives the borrowed tokens and must repay the debt by the maturity date to reclaim the collateral. Meanwhile, lenders receive fixed-income tokens that allow them to repay principal and interest at maturity. The secondary market supports the buying and selling of these fixed-income tokens through real-time order books. The protocol also utilizes zkTrue-up, a custom ZK rollup, to eliminate gas costs on orders and cancellations, ensure fast finality, and maintain data availability. Includes safety features such as forced evacuation and evacuation mode to protect user assets in emergency situations.

zkTrue-up allows users to withdraw funds at any time, eliminate gas fees for ordering and canceling, and achieve fast transaction finality. Source: Term Structure

zkTrue-up allows users to withdraw funds at any time, eliminate gas fees for ordering and canceling, and achieve fast transaction finality. Source: Term Structure

Prior to mainnet launch, Term Structure secured $4.55 million in seed funding through a series of seed funding rounds from industry-leading investors including Cumberland DRW, Decima Fund, HashKey Capital, Longling Capital, and MZ Web3 Fund. To further improve the security and reliability of the protocol, the protocol’s smart contracts and ZK circuit have been meticulously audited by two leading blockchain security companies, ABDK and HashCloak. The protocol also completed a trusted setup exercise for zkTrue-up in collaboration with ABDK, HashCloak, and Bware Labs, a Web3 software development company. This ensures the security of zkTrue-up by discarding “toxic waste” (i.e. data that can trick the system into accepting false proofs), ensuring that no one can control it and eliminating the possibility of rug pulling.

The protocol has also shown significant market traction through its testnet, with over 8,000 wallets verified and over 2 million transactions facilitated. “Our recent testnet trading competition saw enthusiastic participation, with 560 wallets actively participating and executing over 314,000 transactions, demonstrating the robustness and readiness of our platform for broader adoption,” Li said. added.

With the mainnet now live, Term Structure plans to release several innovative features that will further enhance the functionality of the platform. This includes trading APIs, layer 2 swaps, Aave rolls, and debt deregistration. Additionally, the protocol will support potentially high-yield tokens as collateral, implement RWA token collateral financing, and develop DeFi forward and term futures. Follow Protocol’s social media for the latest updates and information.

Term structure information

Term Structure introduces a unique ZK rollup solution that democratizes fixed-rate and fixed-term borrowing and lending, as well as fixed income trading, by offering low transaction fees. It is backed by Cumberland, HashKey Capital, Decima Fund, Longling Capital and MZ Web3 Fund.

For more information, visit Term Structure’s website at https://ts.finance/ and follow Term Structure’s social media updates.

x | discord | Telegram | linkedin

contact

Novalia Winata

term structure

(email protected)

Disclaimer: This is a sponsored press release and is provided for informational purposes only. It does not reflect the views of Crypto Daily and is not intended to be used as legal, tax, investment, or financial advice.

Investment Disclaimer