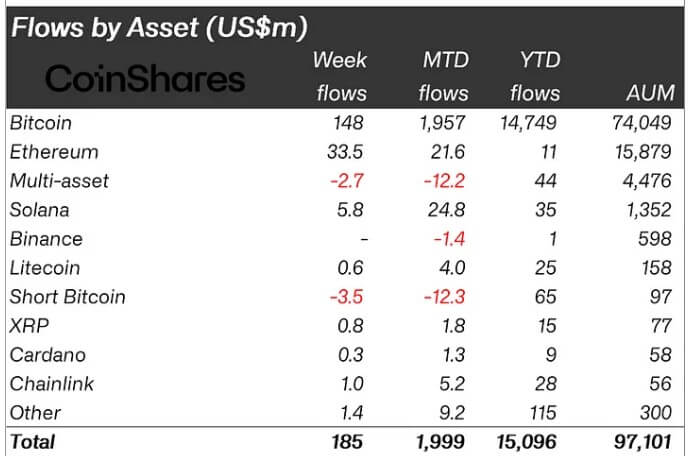

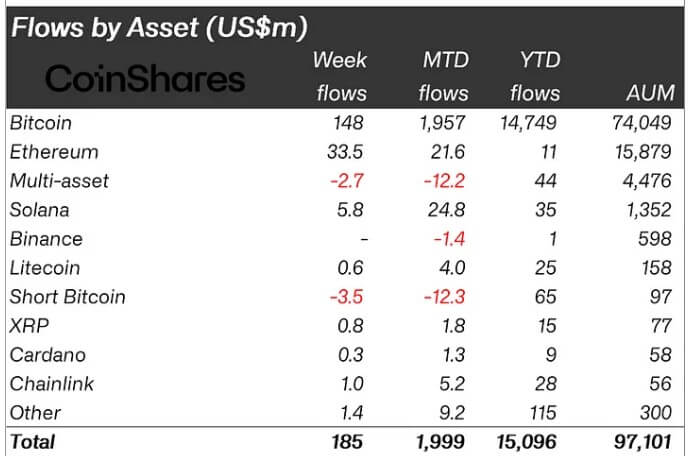

Global digital asset investment products recorded four consecutive weeks of inflows, totaling $185 million, according to CoinShares’ weekly report.

The report said these inflows brought May’s total to $2 billion, bringing cumulative inflows this year to more than $15 billion for the first time. However, trading volume decreased from $13 billion the previous week to $8 billion.

Bitcoin leads the US

Investor interest in BTC is generally positive as Bitcoin continues to lead the flow of cryptocurrency investment products. Over the past week, the flagship digital asset has recorded total inflows of $148 million, while short BTC products have seen outflows of $3.5 million.

Regionally, the United States maintained the lead with inflows of $130 million despite outflows of $260 million from Grayscale’s GBTC. During the period, BlackRock and Fidelity’s spot Bitcoin ETFs saw significant inflows totaling $475 million.

Meanwhile, Switzerland recorded the second-largest inflow of $36 million this year. Canada, recovering from last week’s outflows, contributed $25 million in inflows despite monthly net outflows of $39 million.

Surprisingly, Hong Kong was able to curb the outflow trend, recording a modest inflow of $1.7 million last week.

Ethereum ETF approval changes investor sentiment.

Meanwhile, Ethereum-related cryptocurrency products recorded inflows for the second week in a row, with investors pouring $34.5 million into these financial products. Last week, ETH recorded $36 million in inflows, the highest since March.

CoinShares attributed this shift to the Securities and Exchange Commission’s (SEC) decision to approve the 19b-4 filings of several spot Ethereum ETF products. Prior to this approval, ETH had recorded a total outflow of $200 million over 10 weeks.

Some experts have predicted that the Ethereum ETF could begin trading as early as July, but Bloomberg ETF analyst James Seyffart said the launch is unlikely because financial regulators have not yet approved the issuer’s S-1 filing. He said there is no definite schedule.

Meanwhile, positive sentiment towards Ethereum has also fueled investment in other large altcoins, such as Solana, which saw inflows of $5.8 million. Other assets such as Chainlink, XRP, and Litecoin recorded smaller inflows of less than $1 million.