- The price of Ethereum is nearing $4,000 as key indicators hint at a potential breakout.

- Market sentiment is optimistic as long positions in Ethereum are larger than short positions.

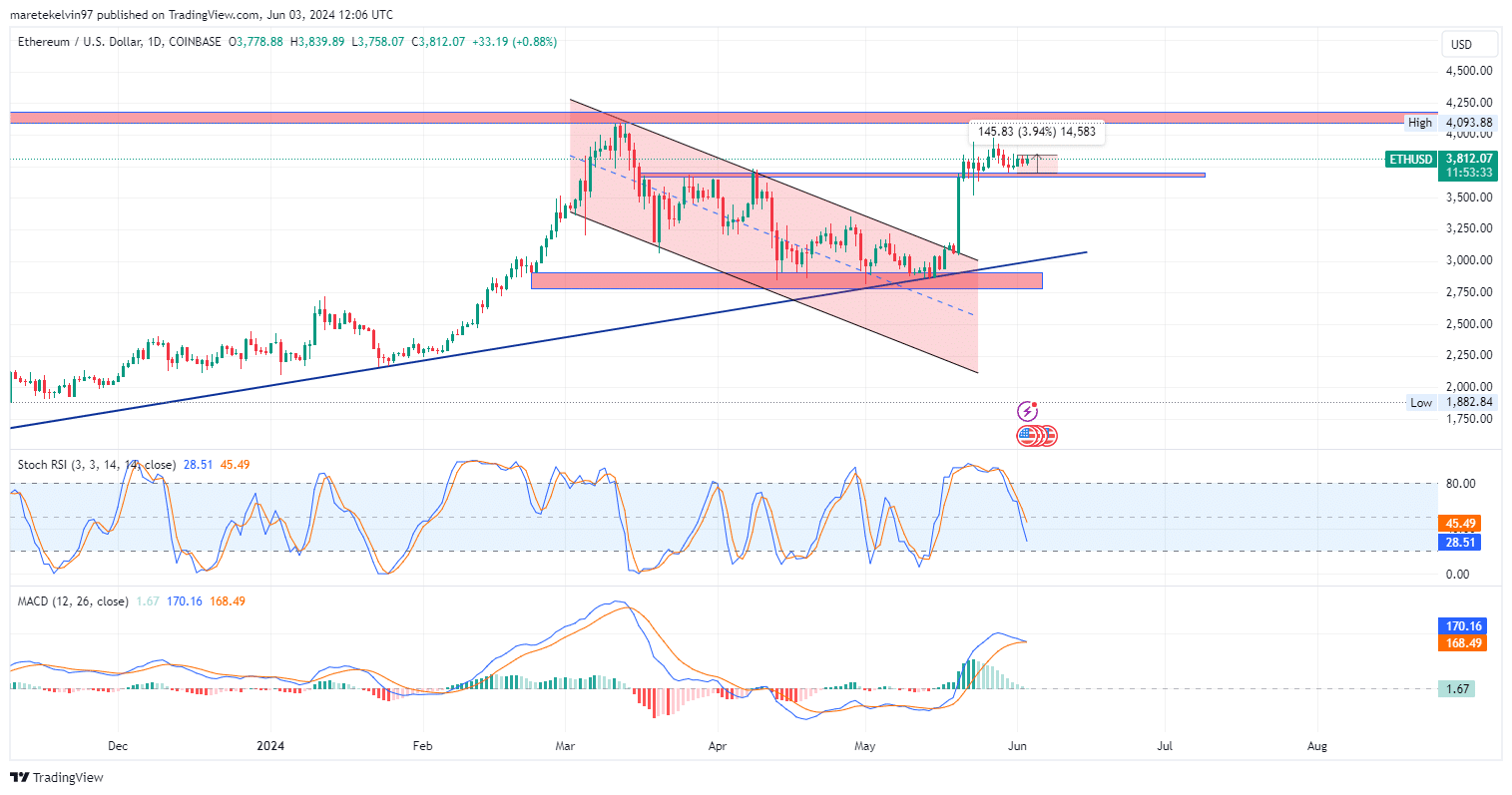

After breaking away from the bull flag Ethereum (ETH) It has tested $3.7 three times, a resistance level that has turned into support since May 21st.

The bulls have yet to accumulate enough momentum to push Ethereum past its all-time high of $4,000, but they are now getting a glimpse of where they are headed.

The price is building bullish momentum over the past three days, pushing ETH price from $3.7,000 to $3.8,000 at press time, up 3.94%. If it continues to operate, the price of Ethereum could hit an all-time high of $4,000.

Are whale spikes or social media controlling Ethereum?

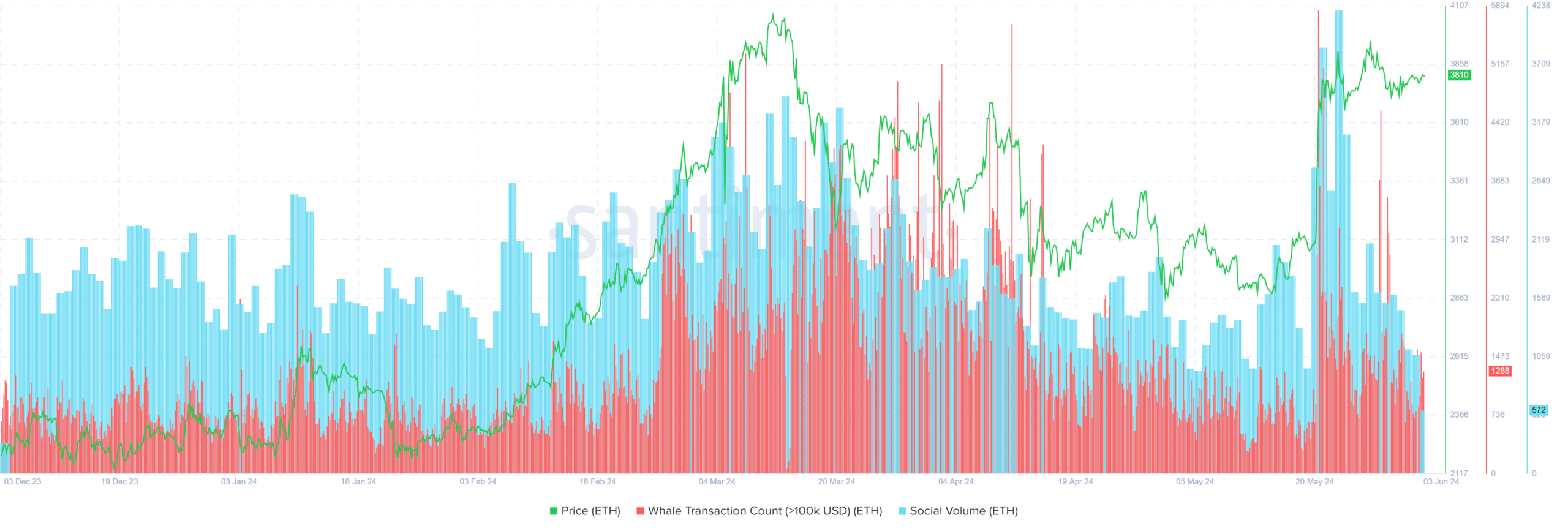

AMBCrypto analyzed Santiment social volume and whale trading charts.

Whale trading charts show an increase in whale populations, which has led to recent price highs. The participation of large holders indicates a bullish rally in the price.

Social trading volume has been correlated with price spikes, meaning increased market interest and discussion on social media platforms, which can lead to price spikes.

Source: Santiment

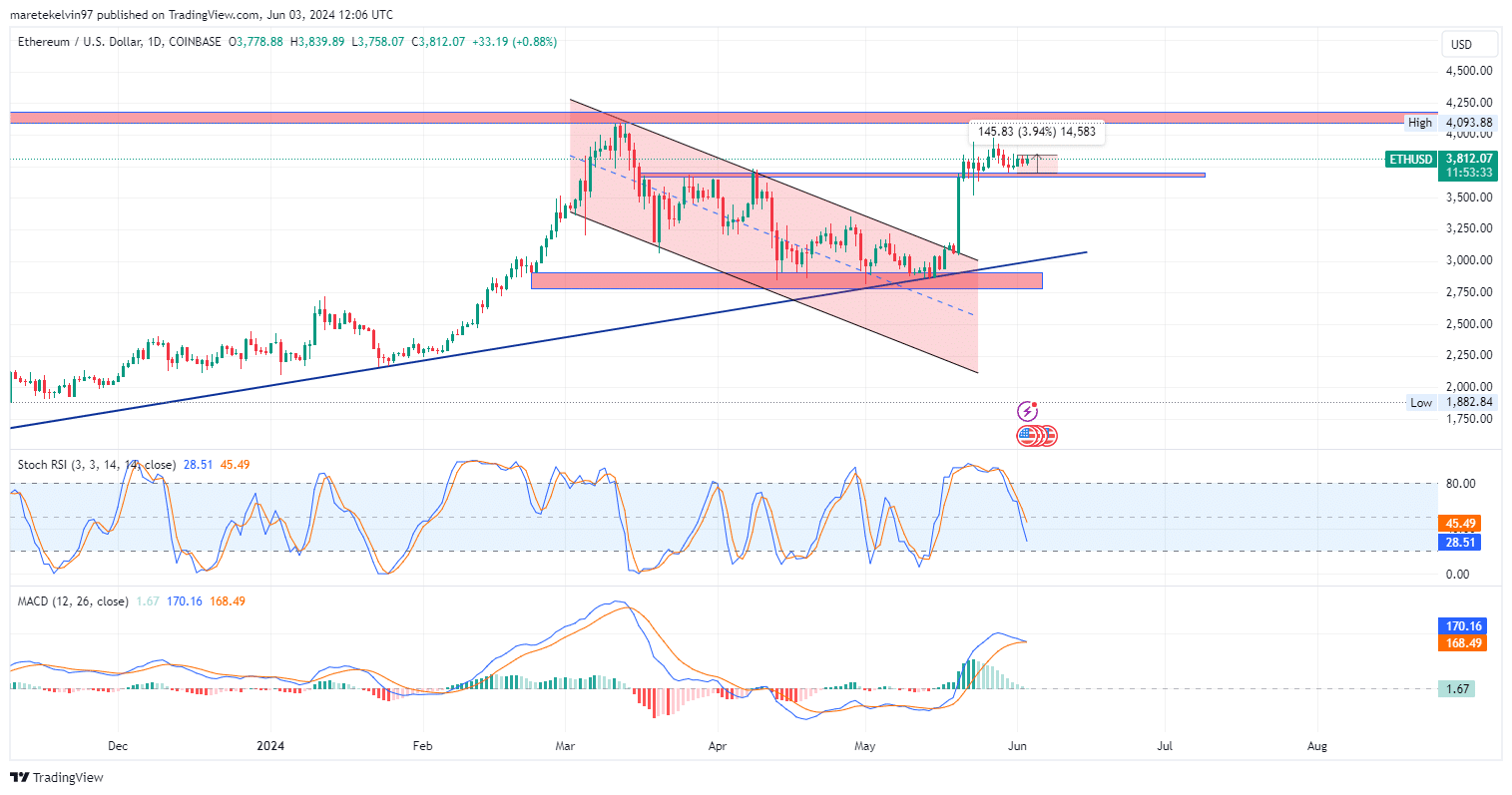

AMBCrypto also analyzed Ethereum’s long/short ratio, and found that long positions have significantly increased compared to short positions. This suggests that traders are becoming increasingly optimistic about ETH.

Source: Coinglass

The stochastic relative strength indicator (45.59) indicates that Ethereum is neither overbought nor oversold.

Is your portfolio green? Check out our Ethereum Profit Calculator

This neutral stance could leave room for potential price spikes or falls. The MACD histogram shows positive momentum, with a MACD line above the signal line indicating a bullish trend.

The MACD value of 1.67 further supports the upward momentum.

Source: TradingView