- Chainlink has a bullish market structure at press time.

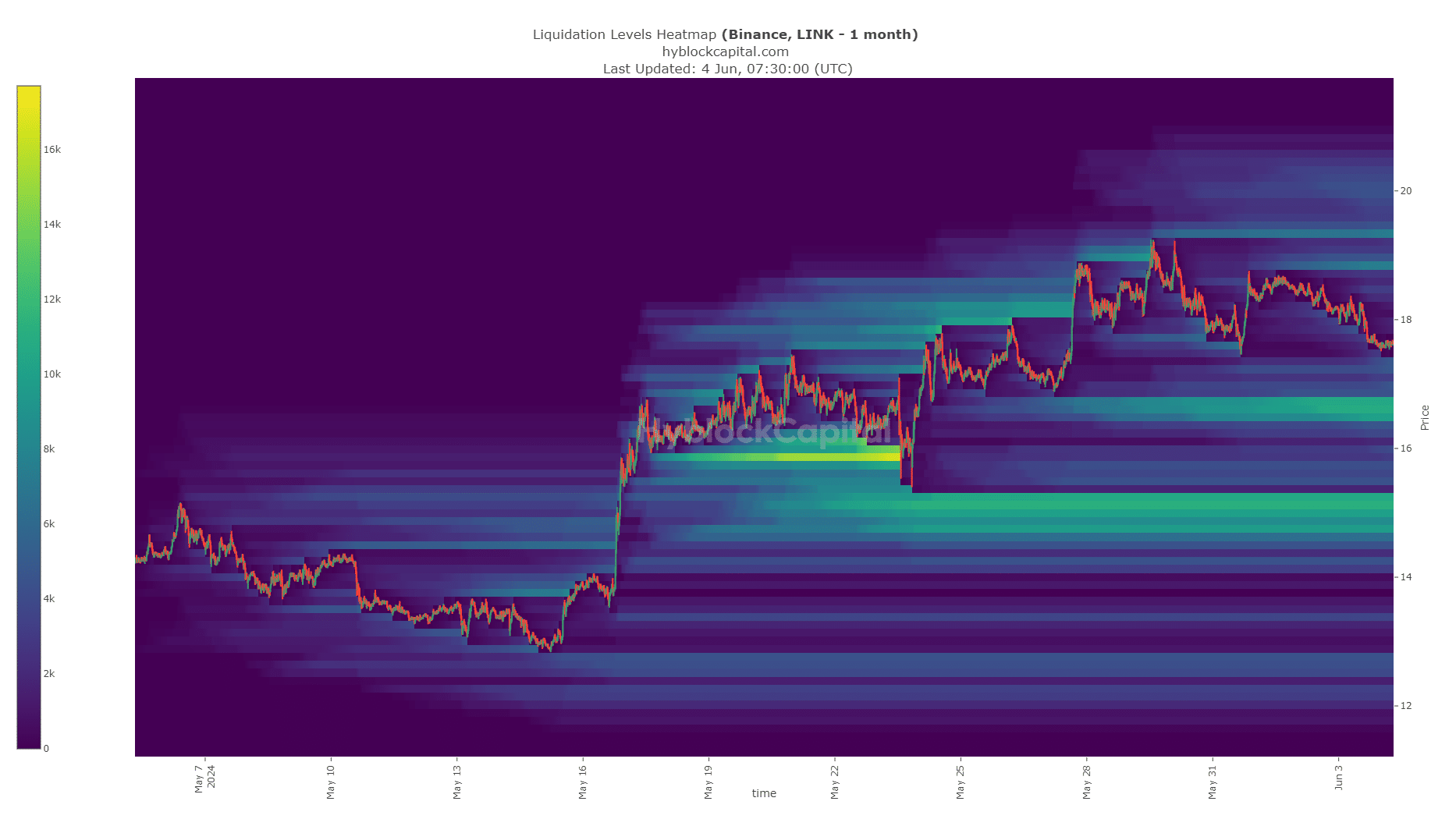

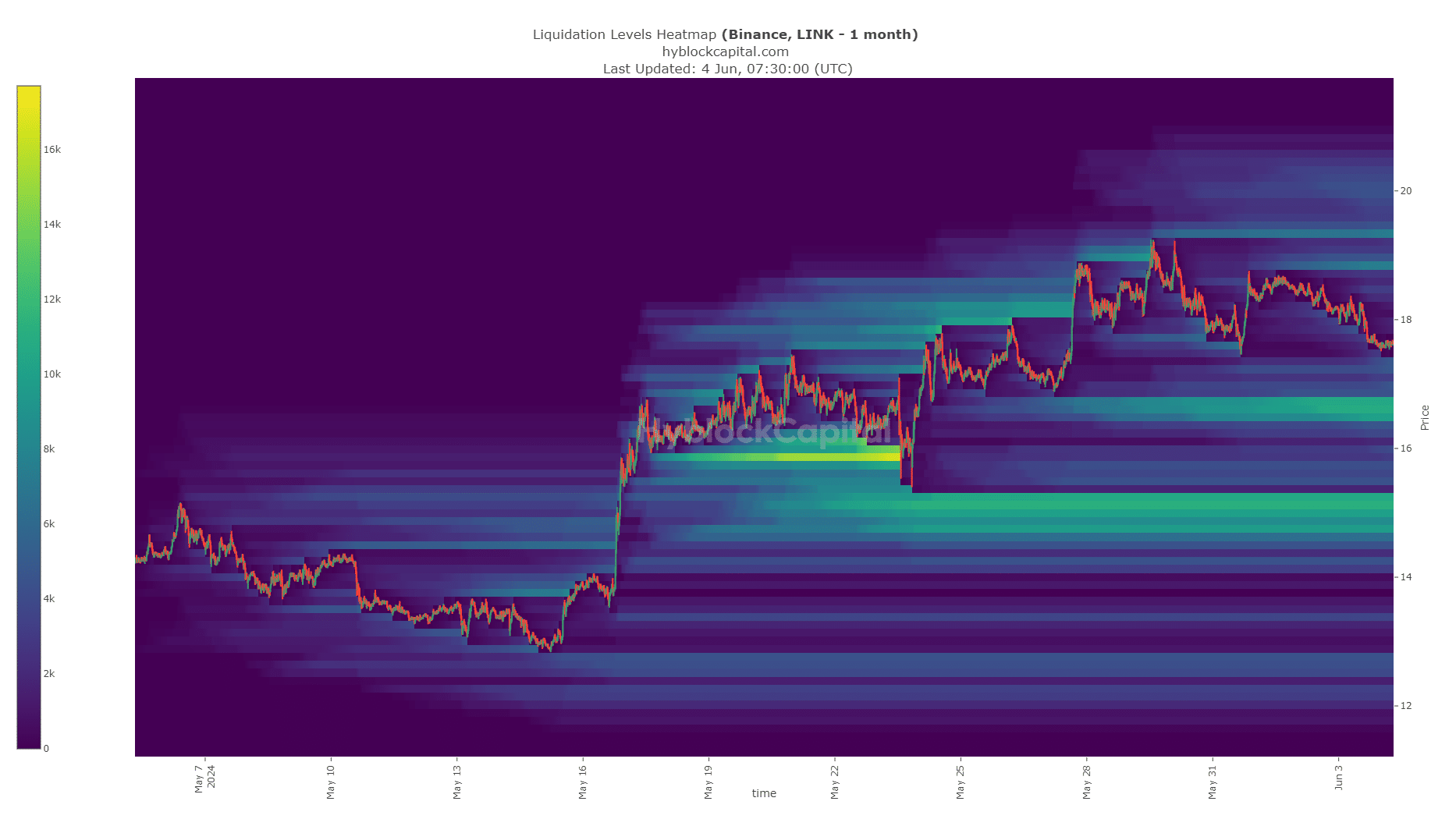

- The decline could extend to $16, which could lead to bulls entering this liquidity cluster.

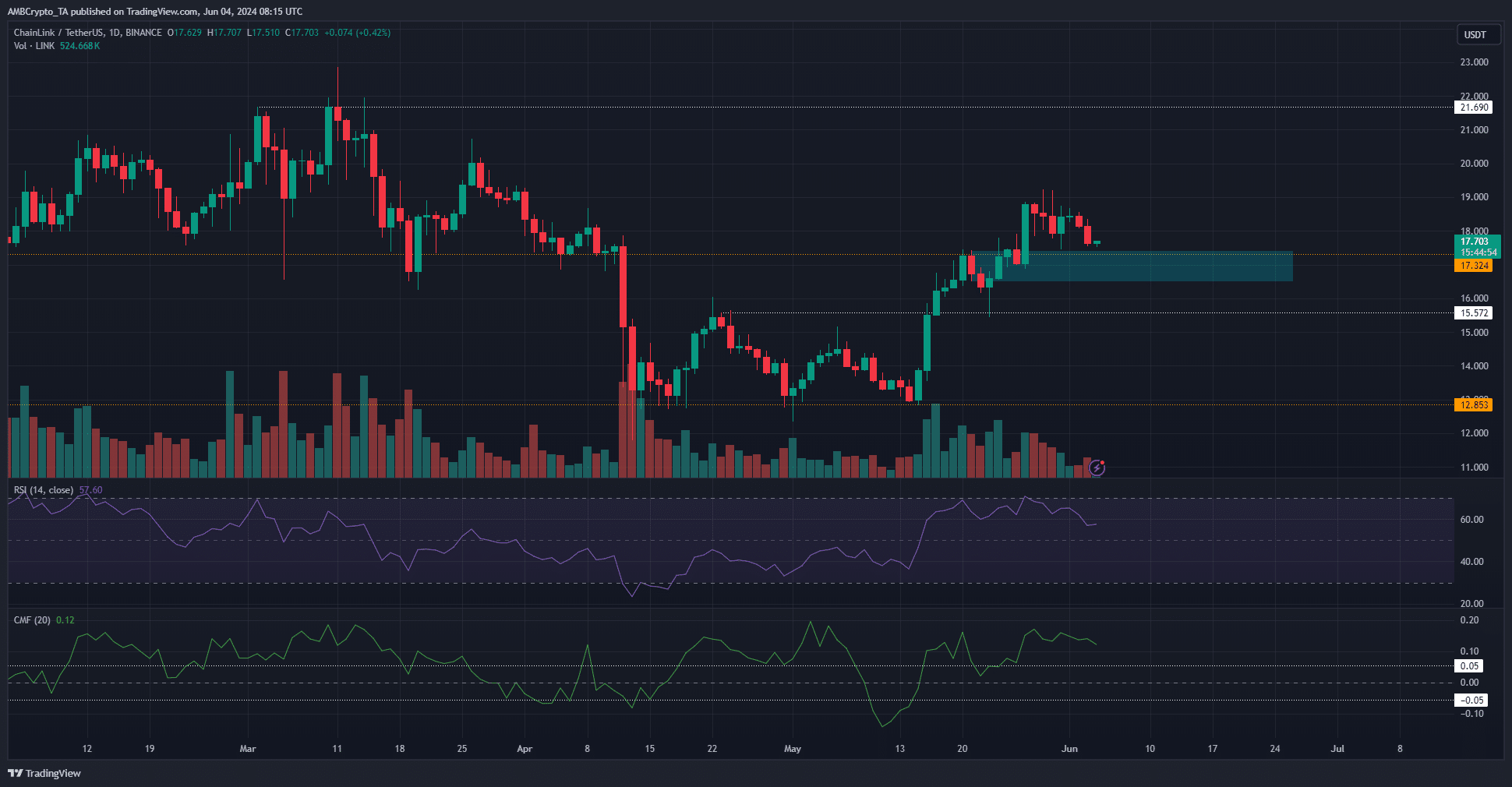

Chainlink (LINK) broke the $17.1 resistance level last week. Prices were approaching this level at press time and a bounce higher is expected after testing it as support. Technical indicators were also strong.

According to Chainlink price predictions, a double-digit percentage rally is likely in the next month or two. However, the higher term trend lacked optimism as LINK has been between $12 and $21 since November 2023.

The daily chart showed strong bullishness.

Source: LINK/USDT on TradingView

After breaking above the $16.04 level in mid-May, the market structure was once again bullish. The RSI on the daily chart read 57.6, reflecting the preference for upward momentum.

Chaikin Money Flow’s +0.12 figure indicates strong capital flows into the market. This highlights solid buying pressure. Therefore, Chainlink is expected to perform well in the future.

The previous resistance area at $17 has now turned into support and the bulls are expected to keep the price above the $16.5-$17 area.

The recent decline from $19 was accompanied by lower trading volume, which reinforced the idea of weak selling pressure and sustained gains.

LINK’s next magnetic field is consistent with its technological findings.

Source: Hiblock

Liquidation levels showed a cluster of buying liquidations in the $16.48-$16.7 region. This is consistent with the demand area highlighted in the daily price chart.

Read Chainlink’s (link) 2024-25 price prediction

The next cluster below the $16.5 liquidity pocket is at $14.8-$15.4. According to Chainlink price predictions, a strong bounce is expected from the $16.5 support zone to $19-$20, and could even go higher if Bitcoin (BTC) also starts to show an upward trend.

A drop below $16.3 would indicate weak upside and the decline could plateau around $15.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.