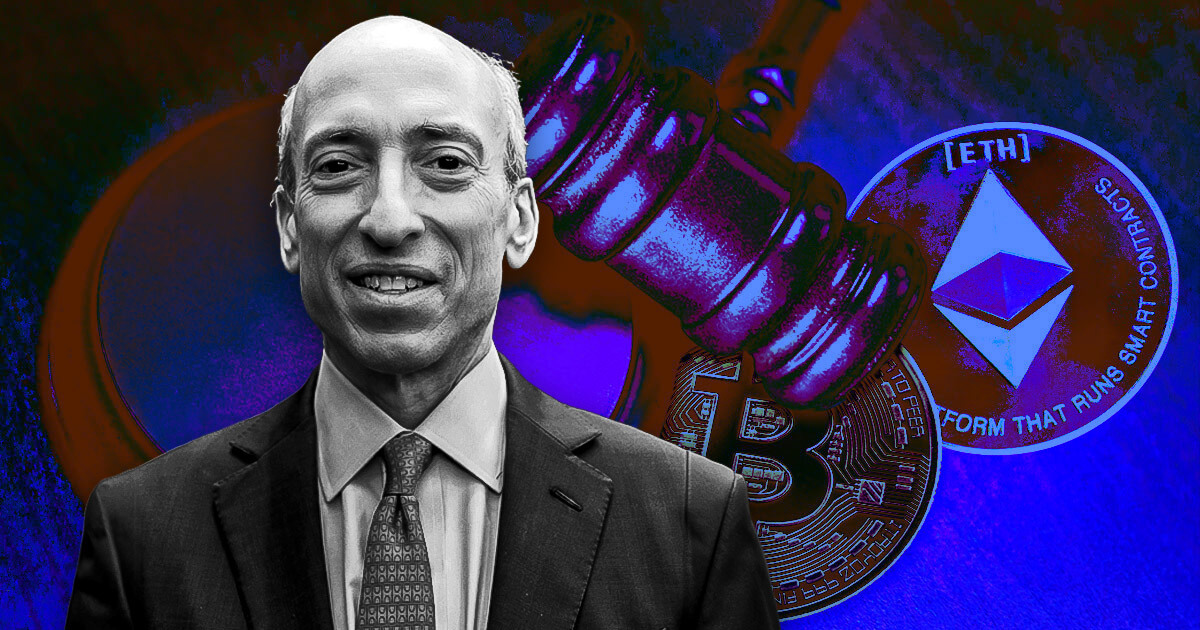

SEC Chairman Gary Gensler said it would “take some time” for a spot Ethereum ETF to launch despite approval of the related 19-4b filing last month.

Gensler said ETF applications are going through the normal process and may take some time. He remained vague about the exact release schedule.

The SEC chairman also criticized cryptocurrency exchanges for their unsavory practices and said the market is still rife with fraud and manipulation. He added that the SEC continues to work to ensure integrity throughout the market.

In a June 5 interview with CNBC, Gensler said the following in response to a question from Jim Cramer about potential exchange-traded products for cryptocurrencies other than Bitcoin and Ethereum:

Lack of appropriate disclosure

Despite the positive regulatory developments, Gensler expressed concerns about the lack of proper disclosure and regulation in the broader cryptocurrency market. He said most cryptocurrencies do not meet the “basic disclosure requirements” expected of a regulated asset class.

According to the SEC Chairman:

“These tokens, whether well-known or obscure, did not provide the required disclosures required by law.”

The SEC Chairman emphasized that investors are not receiving the information they need to make informed decisions, a fundamental principle of the securities market.

Gensler also addressed the potential risks posed by cryptocurrency exchanges, drawing a sharp contrast to traditional stock exchanges such as the New York Stock Exchange (NYSE).

The SEC chairman also accused cryptocurrency exchanges of engaging in activities that are not permitted under U.S. law, such as trading for customers, creating significant conflicts of interest.

He said:

“Cryptocurrency exchanges are engaging in practices that are never permitted on the NYSE. “Our laws do not allow exchanges to trade with their customers, but this is happening in the cryptocurrency space.”

Gensler emphasized the importance of protecting investors from fraud and manipulation, citing recent notable events such as the collapse of FTX and Chelsea Network. He added that such illicit activities continue to be a significant part of the cryptocurrency market and are a key area of focus for regulators.

He commented on ongoing enforcement actions and reiterated the SEC’s role as a civil law enforcement agency committed to maintaining market integrity.

AI and fair competition

Gensler’s remarks also touched on artificial intelligence (AI) and its impact on financial markets. He described AI as the most transformative technology of our time, but warned of the risks associated with its use.

According to Gensler:

“AI can enhance capital markets, but it can also bring risks of conflict, fraud and systemic problems if not managed properly.”

The interview also covered broader market topics, including the balance between public and private markets and the need for fair competition.

Gensler emphasized the importance of public markets that recognize the growth of private credit markets while providing transparent and accessible investment opportunities.