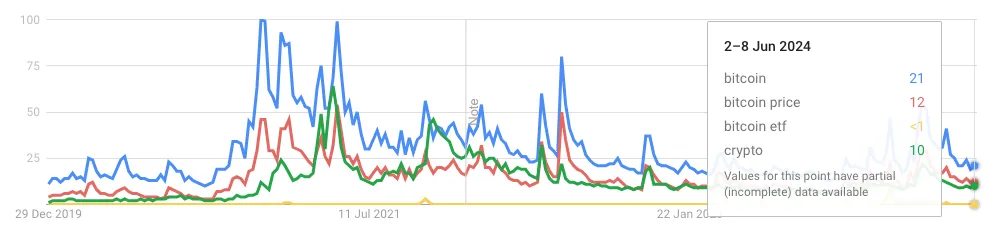

The US Bitcoin exchange-traded fund (ETF) experienced significant inflows amounting to $488.1 million on June 5, indicating a bullish development in the market. However, this financial momentum is juxtaposed with a sharp decline in retail interest, as reflected in Google Trends data that shows a sharp decline in Bitcoin-related searches compared to 2021 peaks.

Impressive influx despite low search volume

US Bitcoin ETFs recorded the second highest inflow day on June 4th with $886.6 million, followed by $488.1 million on June 5th. Leading the way was Fidelity’s Wise Origin Bitcoin Fund (FBTC), which accounted for $220.6 million of total inflows. BlackRock’s iShares Bitcoin Trust (IBIT) was second highest with $155.4 million, while Grayscale Bitcoin Trust (GBTC) also had $14.6 million despite experiencing net outflows exceeding $17.8 billion since January. There was a net inflow.

Despite this strong financial performance, Google Trends data shows a significant decline in search interest. A search for “Bitcoin” in the United States on June 5th scored only 31 out of 100, while “Bitcoin ETF” barely registered with a score of 1. This stands in stark contrast to the increased interest retail has seen during the 2021 bull run. Participation has reached its peak.

Retail Interest: Relative Decline

During the 2021 bull market, terms such as ‘Bitcoin price’ and ‘cryptocurrency’ recorded significant search volume. They are now down to 18 and 13 points respectively. The decline suggests that retail investors, who played a key role in driving the market frenzy in 2021, have yet to return in similar numbers. There was a brief surge in interest on January 11, when the United States approved 10 spot Bitcoin ETFs, and on March 5, when Bitcoin surpassed $69,000 for the first time since 2021, but it did not last.

Cryptocurrency YouTube Viewership: Another Metric

Further highlighting the lack of retail engagement, cryptocurrency analyst Miles Deutscher highlighted a significant drop in viewership for cryptocurrency-related YouTube channels. In 2021, when Bitcoin reached its peak, daily viewership was around 4 million. As of 2024, despite Bitcoin hitting new highs, viewership has plummeted to around 800,000 daily views. Deutscher’s analysis shows that retail investors have not yet re-entered the market in significant numbers, and YouTube views are used as an indicator of the current state of retail interest in cryptocurrencies.

Market sentiment and future outlook

Despite low retail participation, significant inflows into Bitcoin ETFs suggest that institutional interest remains strong. This institutional momentum and relatively muted retail participation may mean the market is still in the early stages of its next potential growth cycle. Analysts and investors alike will be watching closely for signs of increased retail participation, which could signal a broader market uptick.

There is no indicator in the world that better summarizes the current state of the market than the views of cryptocurrency YT.$BTC $70,000 in 2021: 4 million views per day$BTC $70,000 in 2024: 800,000 views per day

Retail isn’t back yet. Let’s take a look at some of the reasons below.👇

(h/t @intocryptoverse) pic.twitter.com/SznnugHR1d

— Miles Deutscher (@milesdeutscher) June 6, 2024