- The market structure for ETC was bullish at press time.

- Momentum and volume indicators turned bearish on the chart.

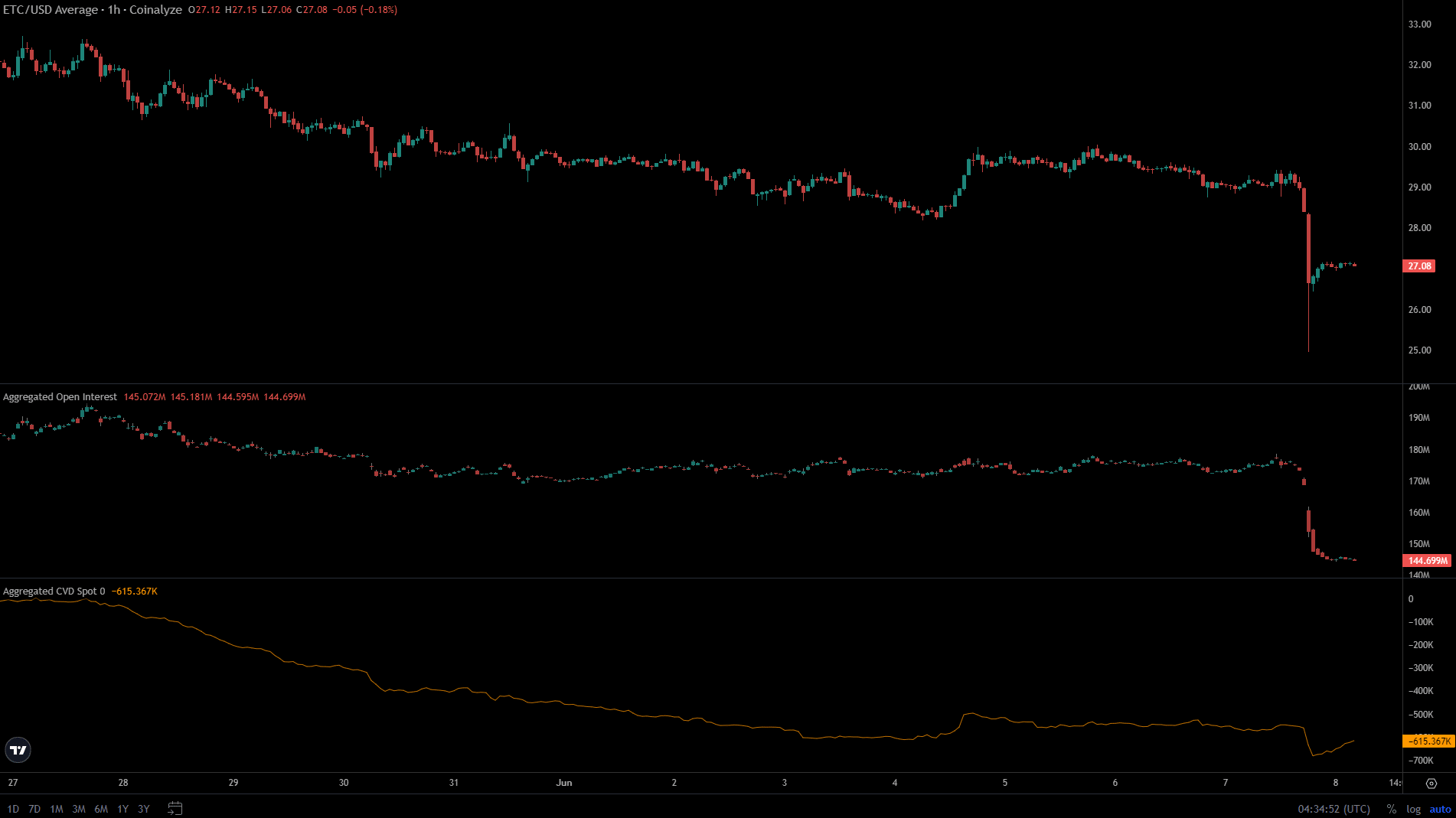

Ethereum Classic (ETC) retested the $25 support level and almost flipped the market structure on the higher period into a bearish one. This comes after an unfavorable US jobs report for May. Short-term momentum also appeared weak.

In a recent report, AMBCrypto noted that the $28.4-$29 area could be revisited before a rebound. Ethereum Classic fell more than expected. Ergo, Question – How are traders reacting to recent price movements?

The $29 support level did not hold.

Source: ETC/USDT on TradingView

The most recent high was set at $25.19 on May 13th. The price decline on June 7 reached $25.07, but no daily session closed below $25.19. So, although it seemed weak, the uptrend seemed to have the upper hand in the higher periods.

In the Directional Movement Index, -DI (red) exceeded 20 points. This was an early sign that the trend could turn bearish, as the ADX (yellow) would also need to rise above 20 to signal a strong downtrend in progress.

CMF is -0.09, indicating significant capital flows in the market. This selling pressure lasted for a week. The bulls will have to change direction if they are to regain hope.

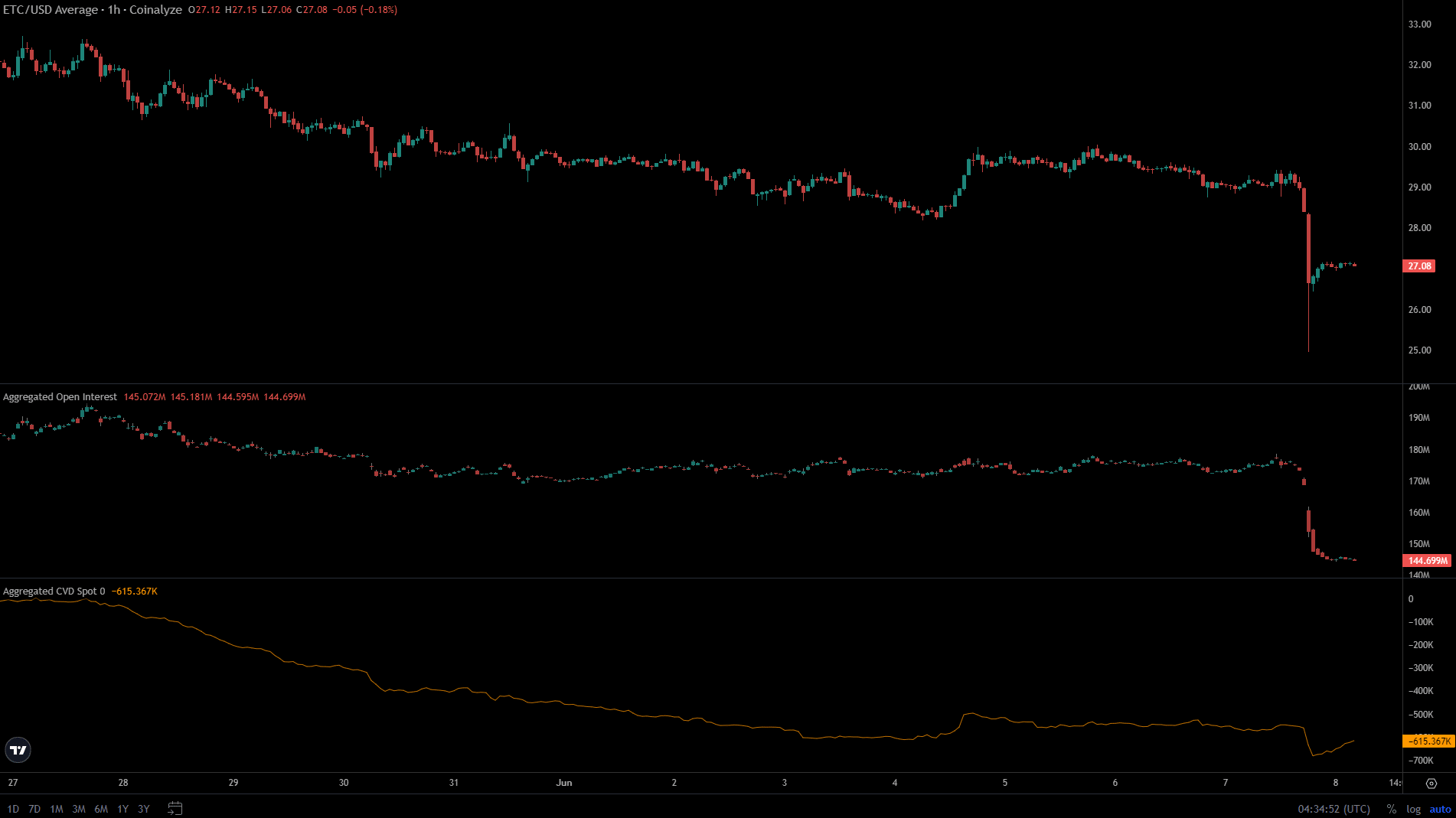

Futures markets highlighted strong decline

Source: Coin Analysis

Over the past 10 days, Ethereum Classic has risen steadily from $31 to $28.6. However, the past 24 hours have seen a surge in selling activity sparked by Bitcoin (BTC). Thus, ETC rebounded from $25.07 to $27 after falling 14.32% in a single 4-hour trading session.

Read Ethereum Classic (ETC) Price Prediction for 2024-25

Open interest also fell sharply along with the price, showing reluctance to enter positions due to bearish sentiment and volatility. Spot CVD also continued its downward trend. Volume indicators agreed that selling pressure was firm.

The bulls need to change this to re-establish the uptrend on a lower period.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.