- The price of Ethereum has fallen by more than 2% over the past seven days.

- Indicators show that the price of ETH is close to the market bottom.

Ethereum (ETH) The bearish trend dominated last week as token prices fell. However, this may be the last opportunity for investors to accumulate more ETH while prices are low.

ETH was at an important resistance level, and a break above this level could trigger a massive rally in the coming weeks and months.

Should I Buy ETH Now?

Ethereum suffered a price correction last week, losing more than 2% in value, according to data from CoinMarketCap.

At the time of this writing, ETH was trading at $3,687.02, with a market capitalization of over $442 billion. However, this bearish price trend may change as soon as ETH tests a key resistance level.

Milkybull, a well-known cryptocurrency analyst, recently posted the following: Twitter We disclose this development. A break above the resistance line would trigger a massive rally.

So this may actually be the last opportunity for investors to buy ETH below $3,700 this cycle.

AMBCrypto then checked ETH’s on-chain data to see if investors had taken advantage of this opportunity to accumulate.

According to CryptoQuant analysis: data, ETH’s net deposits on exchanges were lower compared to the past 7-day average, reflecting high buying pressure. However, other data sets have suggested otherwise.

For example, Coinbase Premium for ETH was red. This clearly means that selling sentiment is dominant among US investors.

Source: CryptoQuant

Probability of Bull Rally

AMBCrypto then took a closer look at the current state of Ethereum to better understand whether a price increase is possible in the near term.

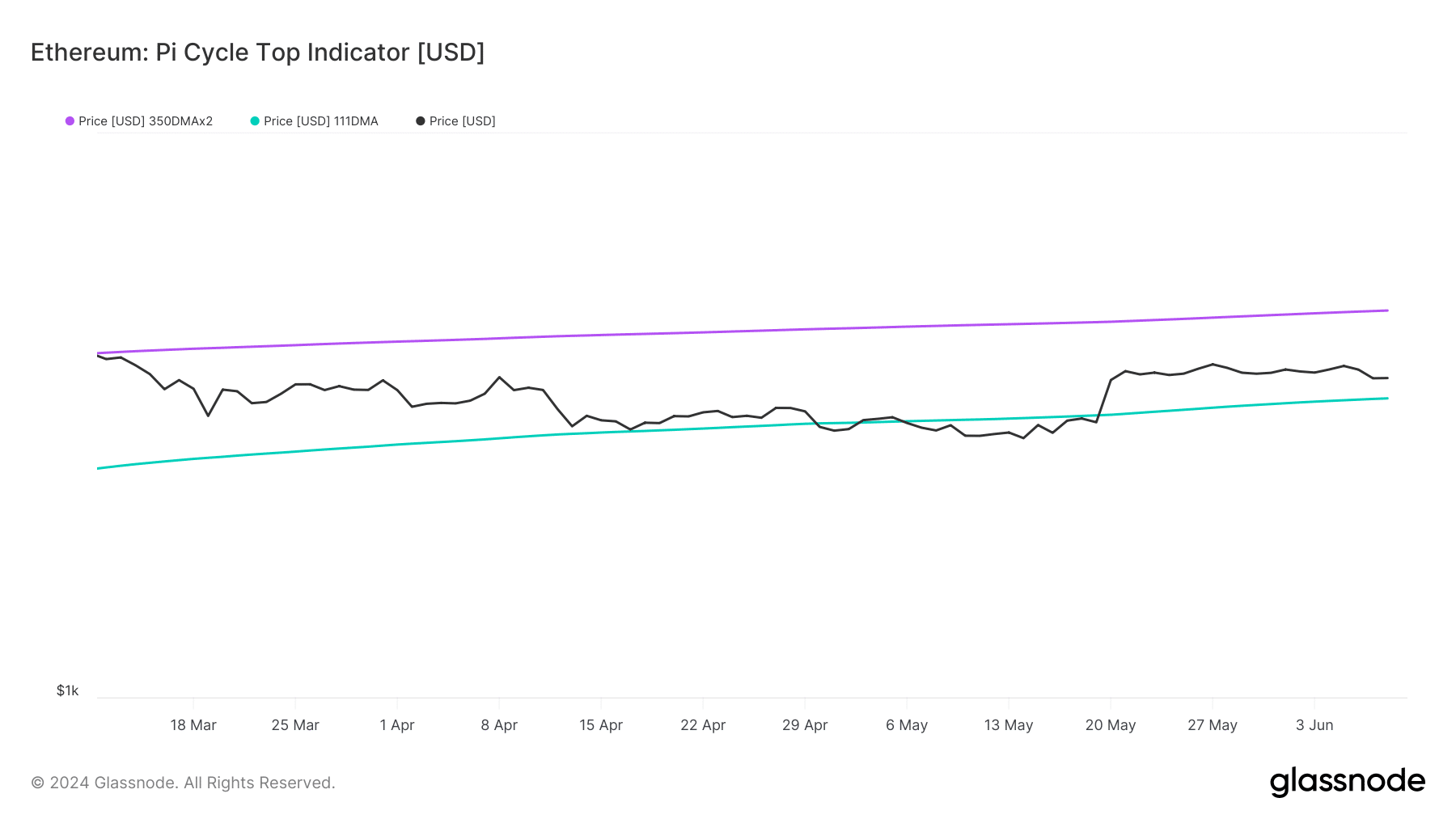

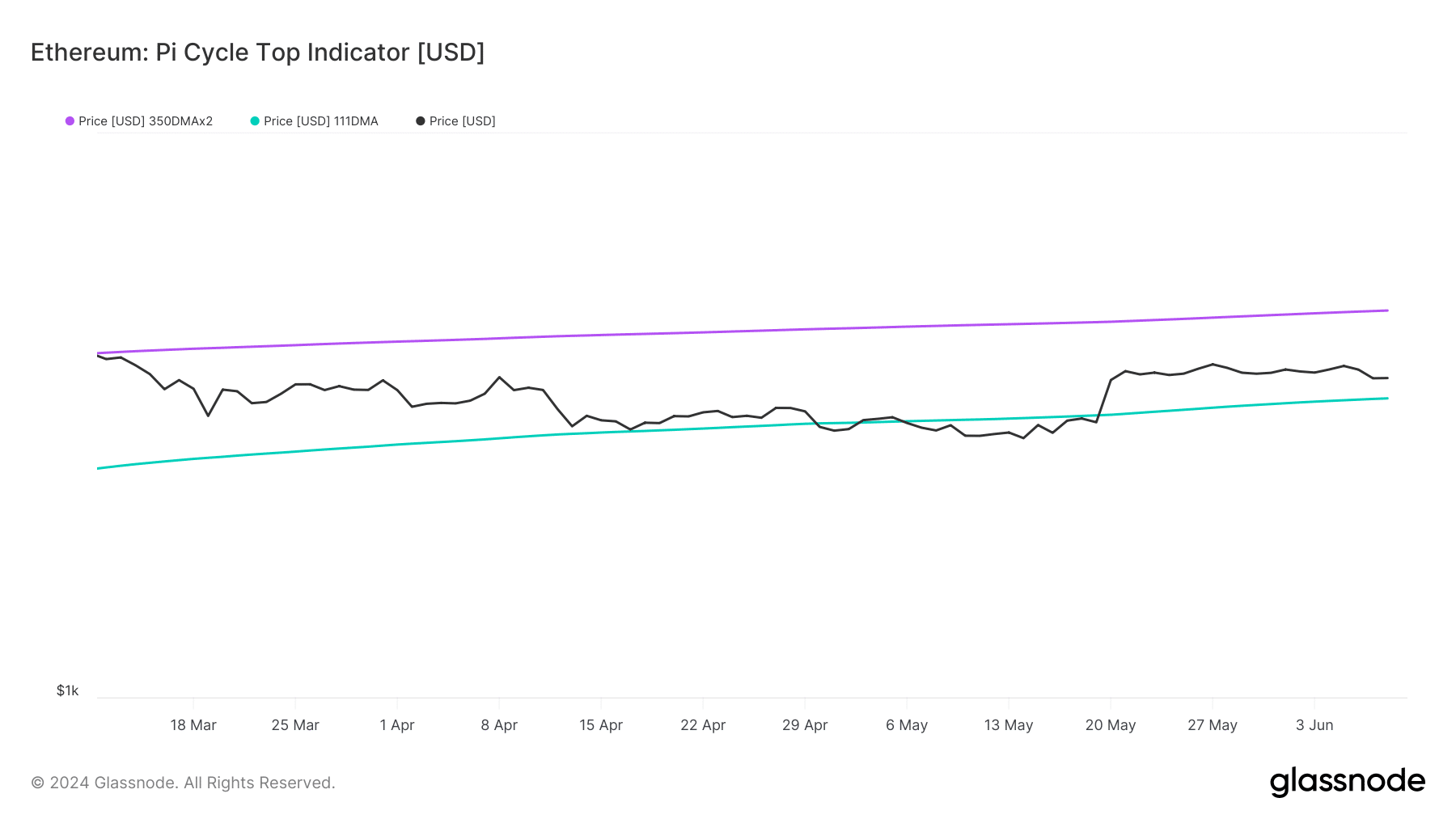

AMBCrypto’s look at data from Glassnode shows that the price of ETH is nearing the market bottom, according to the Pi Cycler top indicator.

This means that ETH is likely to remain strong over the next few days. If that happens, ETH could soon reach $4,800, which is an optimistic outlook.

Source: Glassnode

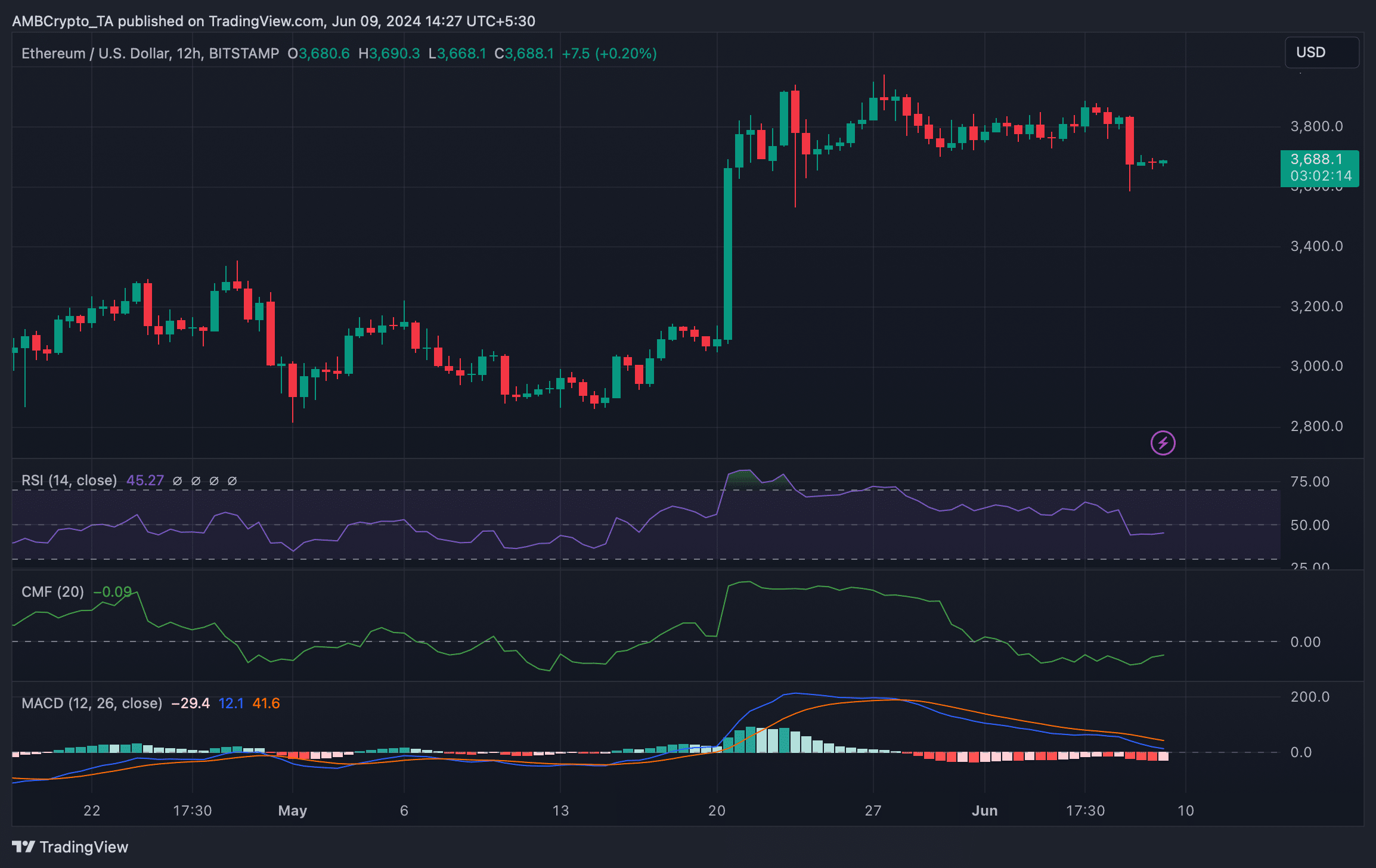

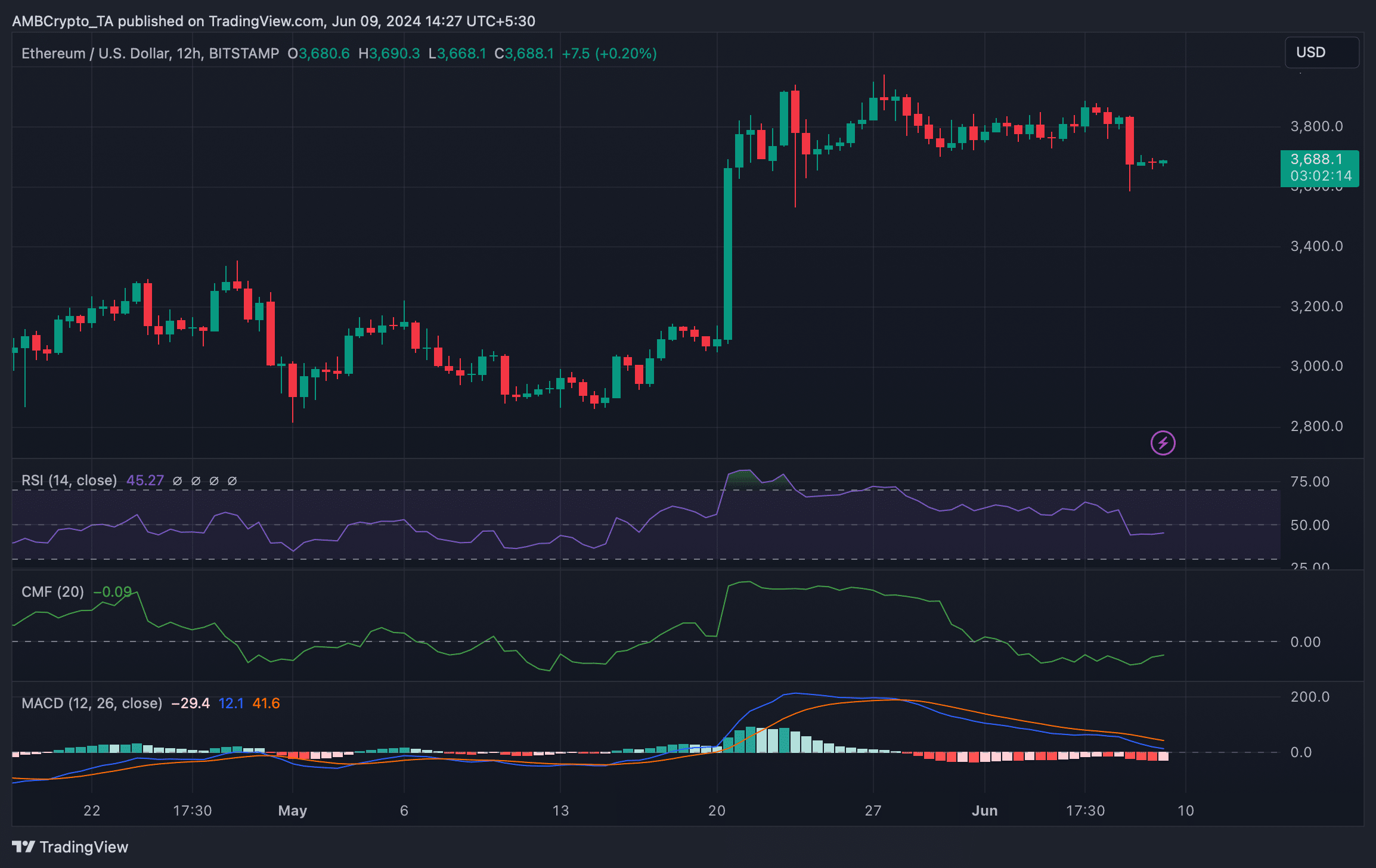

We then looked at the 12-hour chart of the token to see what market indicators were suggesting a near-term price increase.

Analysis shows that MACD shows a bearish crossover, favoring the sellers.

read Ethereum (ETH) price prediction 2024-25

The relative strength index (RSI) also remained weak, below the neutral line. These indicators suggested continued price declines.

Nonetheless, Chaikin Money Flow (CMF) has been strong over the past few days, moving north towards the neutral point.

Source: TradingView