- The prospective issuer of the Spot ETH ETF is awaiting feedback from the SEC.

- ETH has been under significant selling pressure over the past few weeks.

Ethereum (ETH) selling pressure is growing as the issuer of a promising spot ETH exchange-traded fund (ETF) awaits comment from the Securities and Exchange Commission (SEC) on the status of its S-1 filing filed on May 31.

Many had expected regulators to provide feedback on the status of these filings by June 7.

However, no feedback was received from any of the eight potential issuers whose applications were approved on May 23.

It’s unclear how long this process will take, but SEC Chairman Gary Gensler noted in a recent interview: CNBC Approval of the agency’s S-1 form “will take some time,” he said.

ETH takes the biggest hit

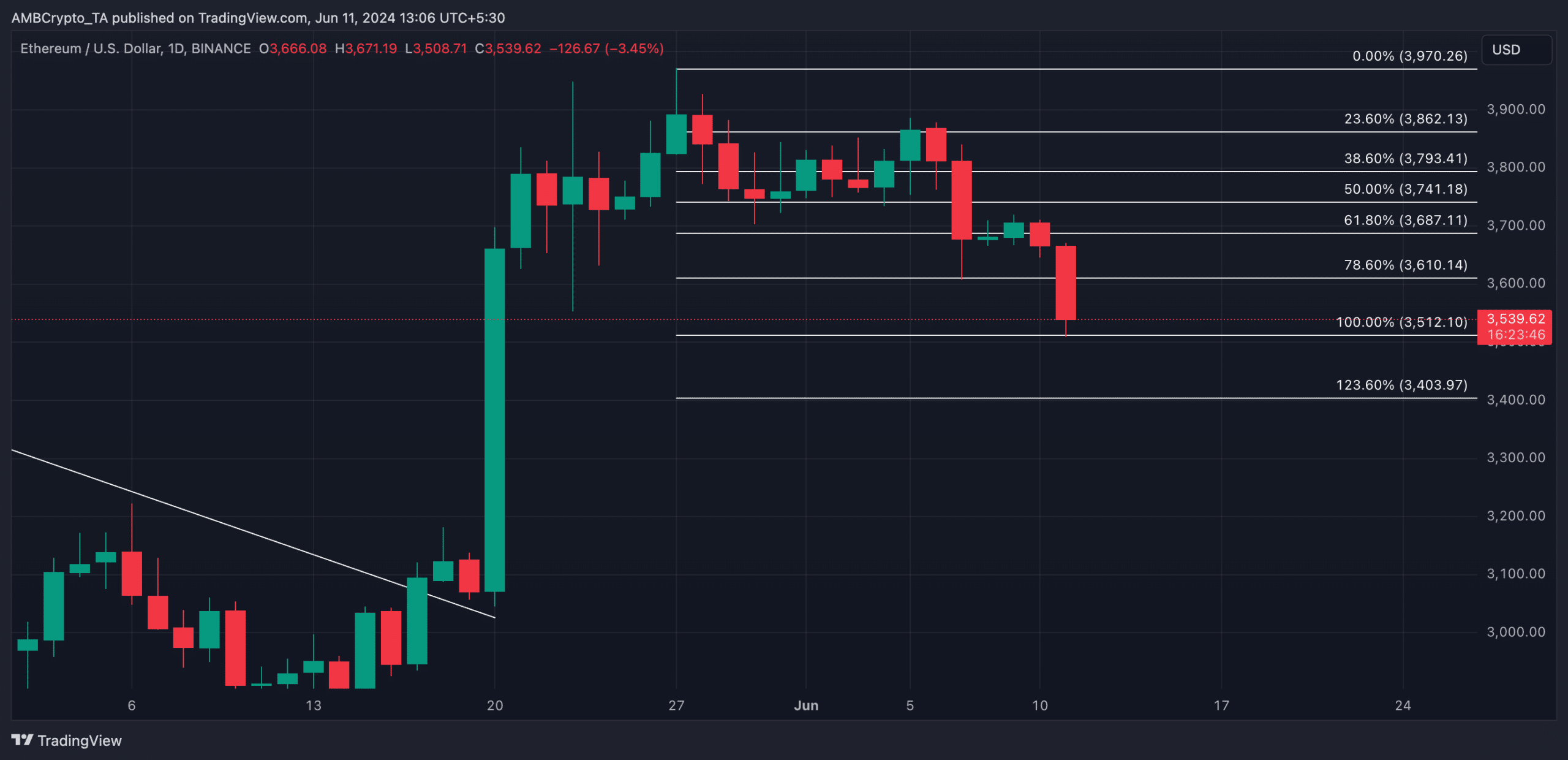

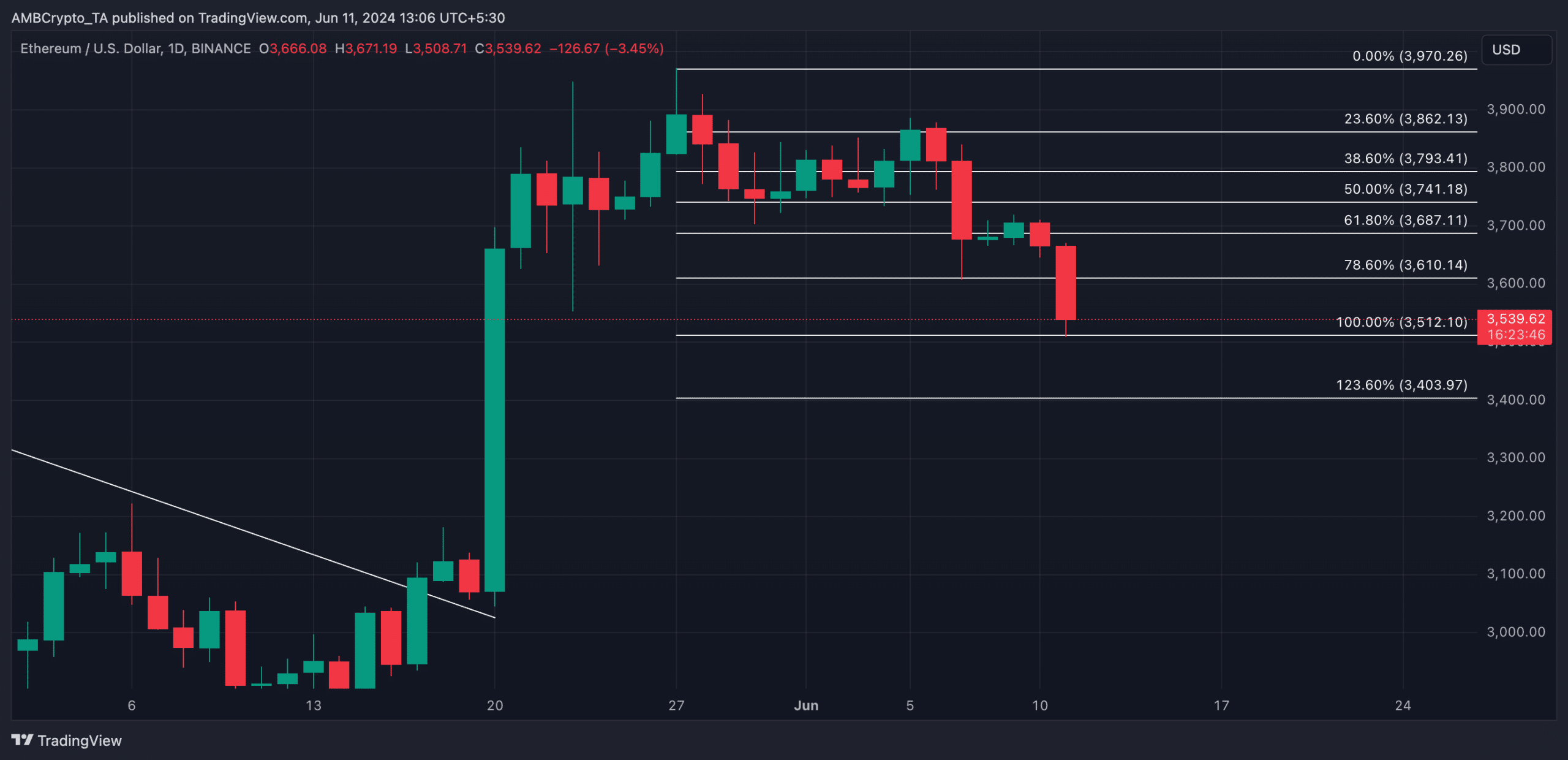

At press time, ETH was worth $3,539. According to CoinMarketCap According to data, the value of major altcoins has fallen nearly 10% in the past week.

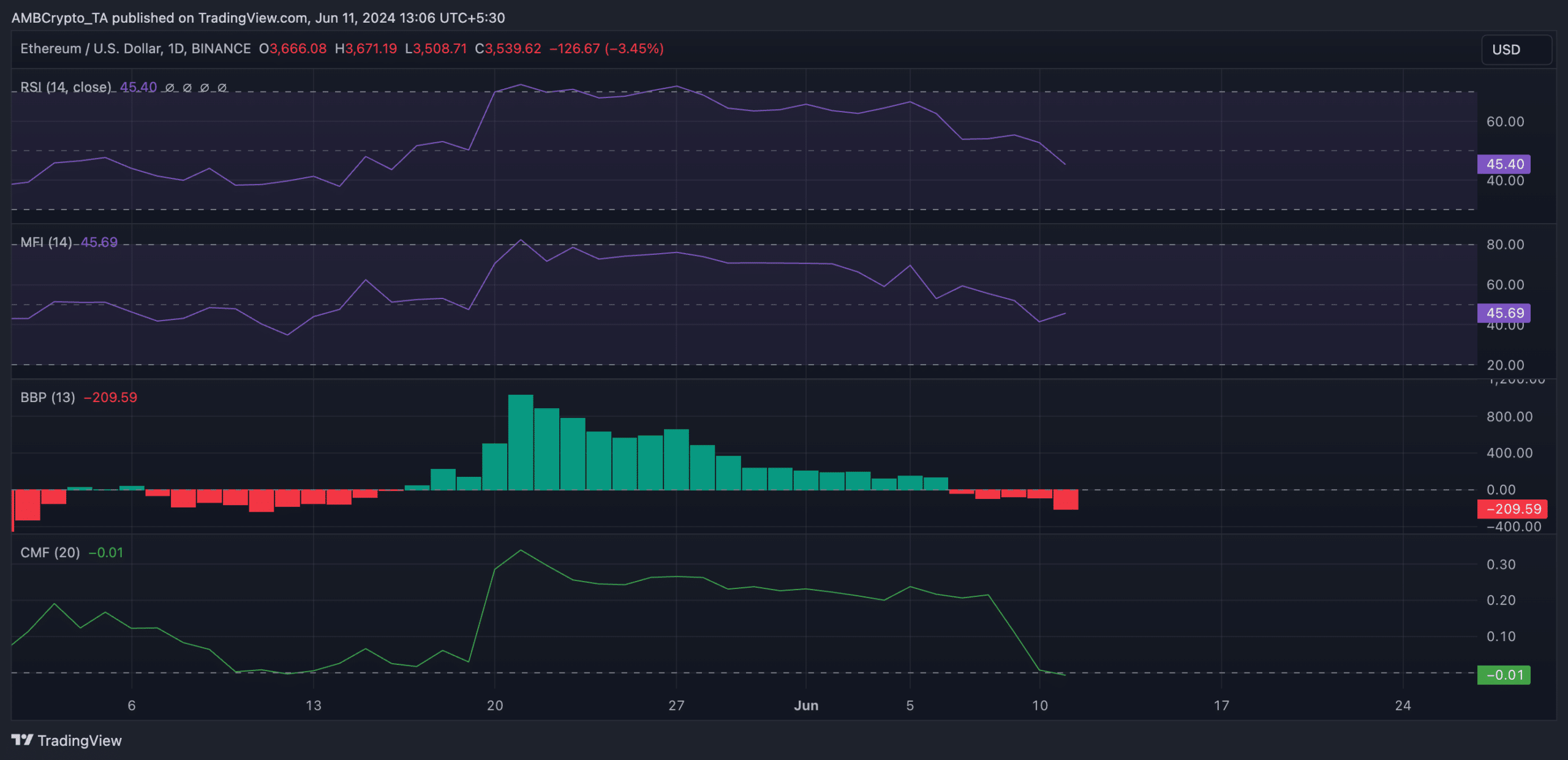

This price drop is due to a decrease in new demand for altcoins. At the time of writing, key momentum indicators lie below their respective center lines, confirming that selling pressure is surging.

For example, ETH’s Relative Strength Index (RSI) was 45.40, while its Money Flow Index (MFI) was 45.69. This indicator measures the momentum and intensity of asset price movements.

At these values, they suggest that market participants preferred selling ETH over accumulating new coins.

ETH’s decreasing Chaikin Money Flow confirmed this trend. At the time of writing, the coin’s CMF is in a downward trend and is below the zero line at -0.01.

This indicator tracks how money flows in and out of asset markets. Negative CMF values are a sign of market weakness. This suggests capital outflows and indicates a bearish bias towards the asset.

Additionally, the negative readings of the ETH Elder-Ray Index confirmed its bearish bias towards altcoins. This indicator measures the relationship between the strength of buyers and sellers in the market.

When the value is negative like this, bearish forces dominate the market.

As of this writing, ETH’s Elder-Ray Index value was -209.

Source: TradingView

Read Ethereum (ETH) price prediction for 2024-25

If ETH’s selling momentum increases, the price may fall below $3500 and trade at $3403.

Source: TradingView

If invalidated and bullish sentiment returns to the market, the price of ETH could rise to $3610.