- Solana’s founders proposed a mechanism to lower the barrier to entry for running a node.

- To solve this problem, management thought about how to handle voting fees.

Solana (SUN) and Ethereum (ETH) Leaders have been debating a variety of issues in this space for some time.

Most recently, the Solana Foundation’s crackdown on validators using Maximum Extractable Value (MEV) sandwich attacks received a lot of attention.

The foundation has withdrawn financial support from some validators to reduce attacks.

It turns out that running Solana validator nodes is very important. costlyIt costs approximately $65,000 per year, and in some cases the Solana Foundation must provide financial support.

Conversely, an Ethereum validator costs 32 ETH as a one-time payment, excluding hardware and other resources.

Why Solana nodes are 10x more expensive

Anatoly Yakovenko, founder of Solana clarify Cost difference for ‘better investments in Ethereum’ in the consensus system.

The economic barrier to honest nodes participating in Solana’s consensus is 10x higher than that of an Ethereum ATM. This is thanks to Ethereum’s investment in BLS aggregation for consensus messages.”

BLS stands for Boneh-Lynn-Shacham, an efficient signature scheme utilized by Ethereum. In particular, this scheme may contain multiple messages that are independently verified by validators.

This allows you to effectively aggregate multiple messages to lower overall costs.

As Yakovenko pointed out, Solana’s current mechanisms do not match Ethereum’s technology. However, the founder added that Solana will eventually implement such a system.

‘Maybe it’s something Solana ends up implementing, maybe it’s a subcommittee vote, maybe nothing. As hardware improves, the floor fee for sending a message to the entire cluster will be lowered, thus lowering the cost per vote and lowering the economic barrier.

However, one user noted that most of the costs were inflated by voting fees and asked how Solana would address this. In response to this, Yakovenko said,

‘Voting subcommittees will allow us to lower voting fees and rotate boxes in and out of committees, which will reduce the burden of voting and lower the cost of voting.’

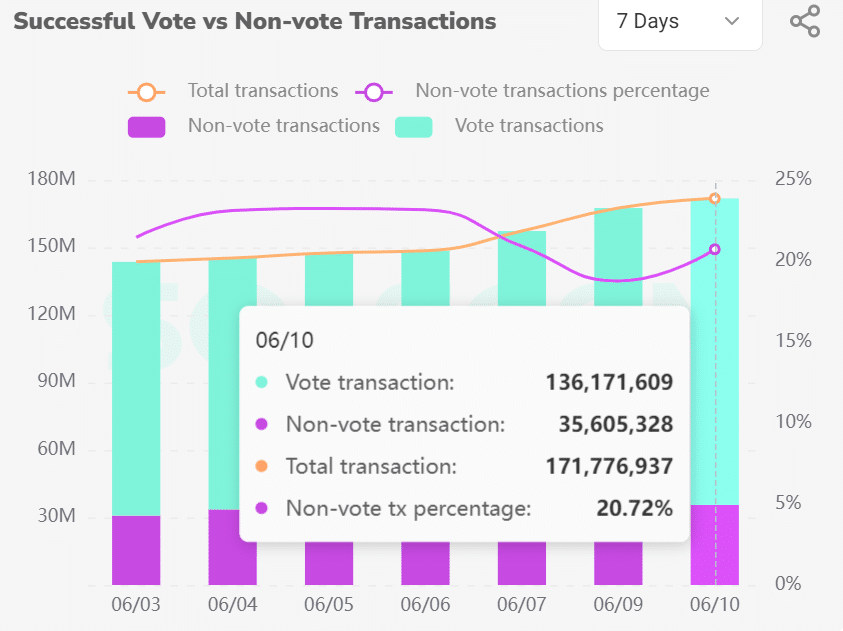

Over the past 7 days, 80% Voting involved during the entire Solana transactionEmphasizes dominance over block transactions.

Source: SolScan

Voting transactions, like all other transactions, are subject to fees, so the cost is borne by the validator. Their high dominance suggests that voting fees may be a major contributor and possibly a barrier to entry into the space.

It remains to be seen whether Solana will implement the solution as laid out by its founder.

Meanwhile, SOL fell 6% as cryptocurrency investors took risks ahead of the Federal Open Conference Committee (FOMC) meeting.

SOL hit a low of $145 on June 11, last seen in mid-May, as the market rout led to widespread liquidation across the market.