- Maker shares surged 8.93% in 24 hours after a week-long bull market.

- Market sentiment and key technical indicators point to a bull market.

MakerDAO’s MKR has been bullish over the past seven days. It surged 4.80% last week and recorded an increase of 8.93% in the last 24 hours.

At press time, Maker was trading at $2414.47 with 24-hour volume of $109 million. MKR is 61% higher than ATH and the current price is 11,475% higher than the lowest price.

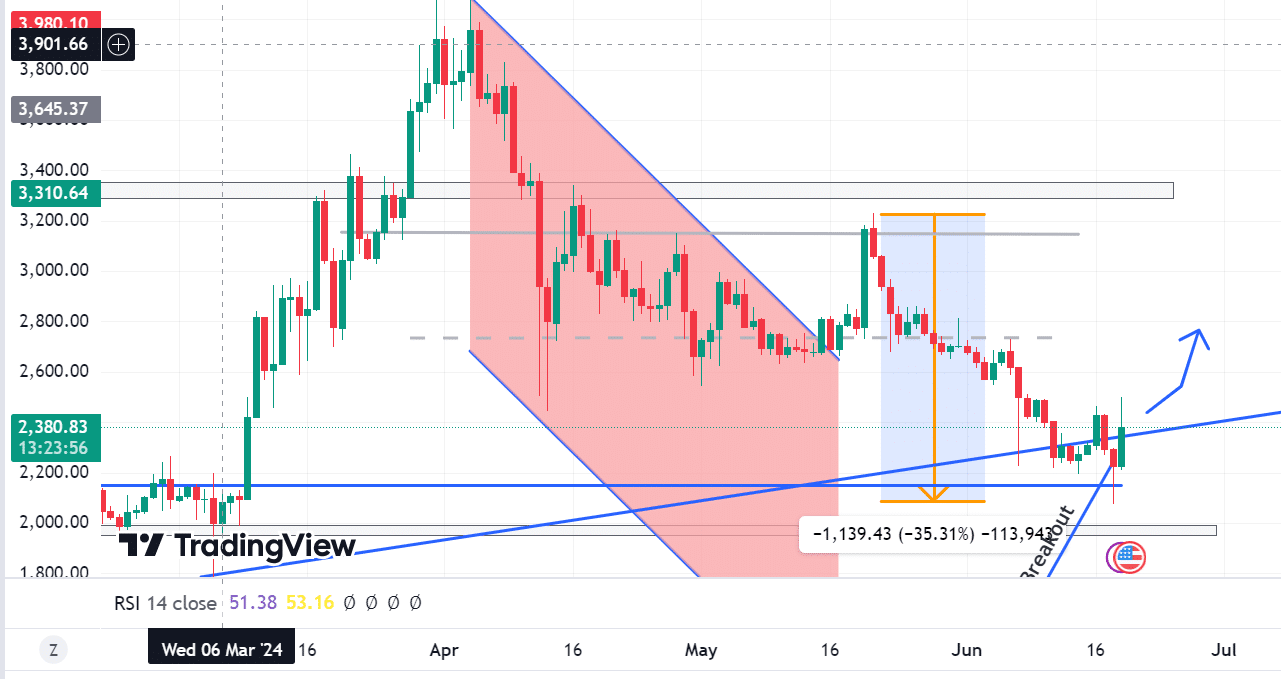

Source: TradingView

According to AMBCrypto analysis, MRK is showing strength as it attempts to challenge the nearest resistance level around $2729. A break from this level will target $3145 at the next level.

The current support level is around $2,150, with the lowest level being around $1,945. MKR aims to challenge $2,745, with indications that the $2,150 support level is in compliance.

MKR will likely break through with only a 2.7% change and aim for further gains.

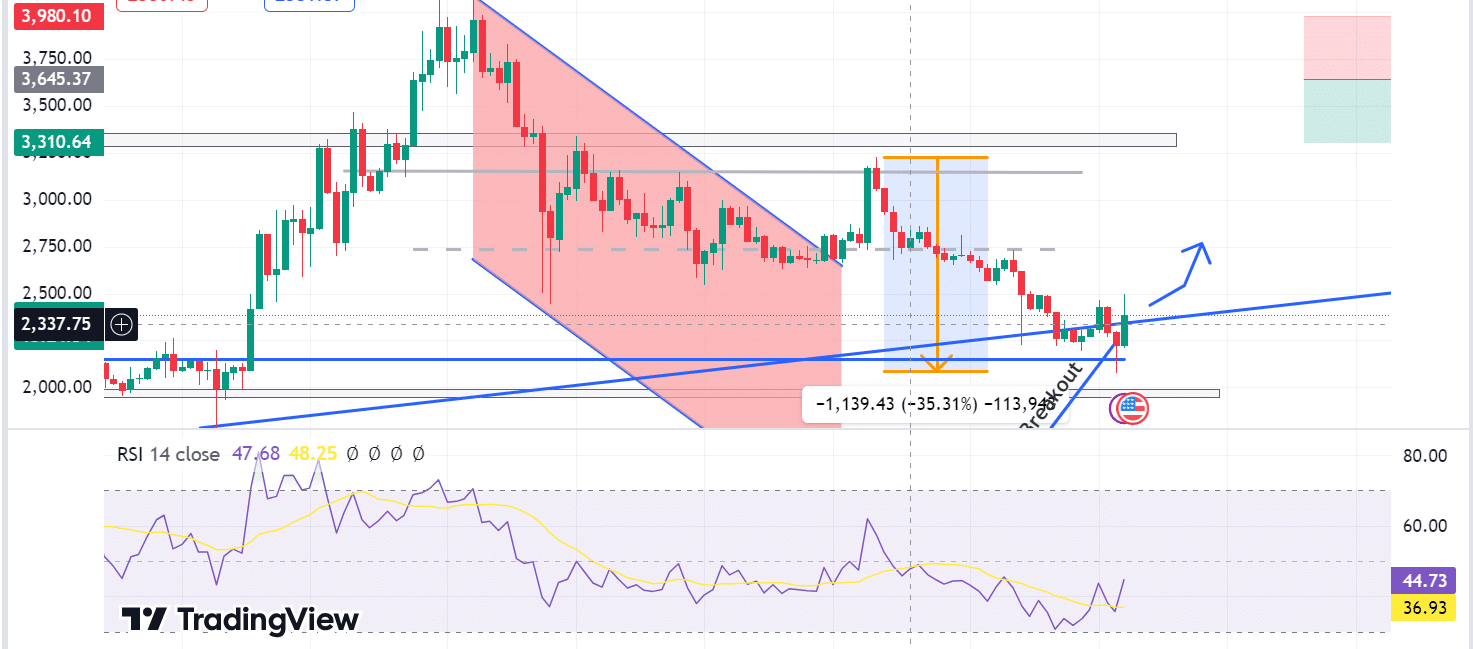

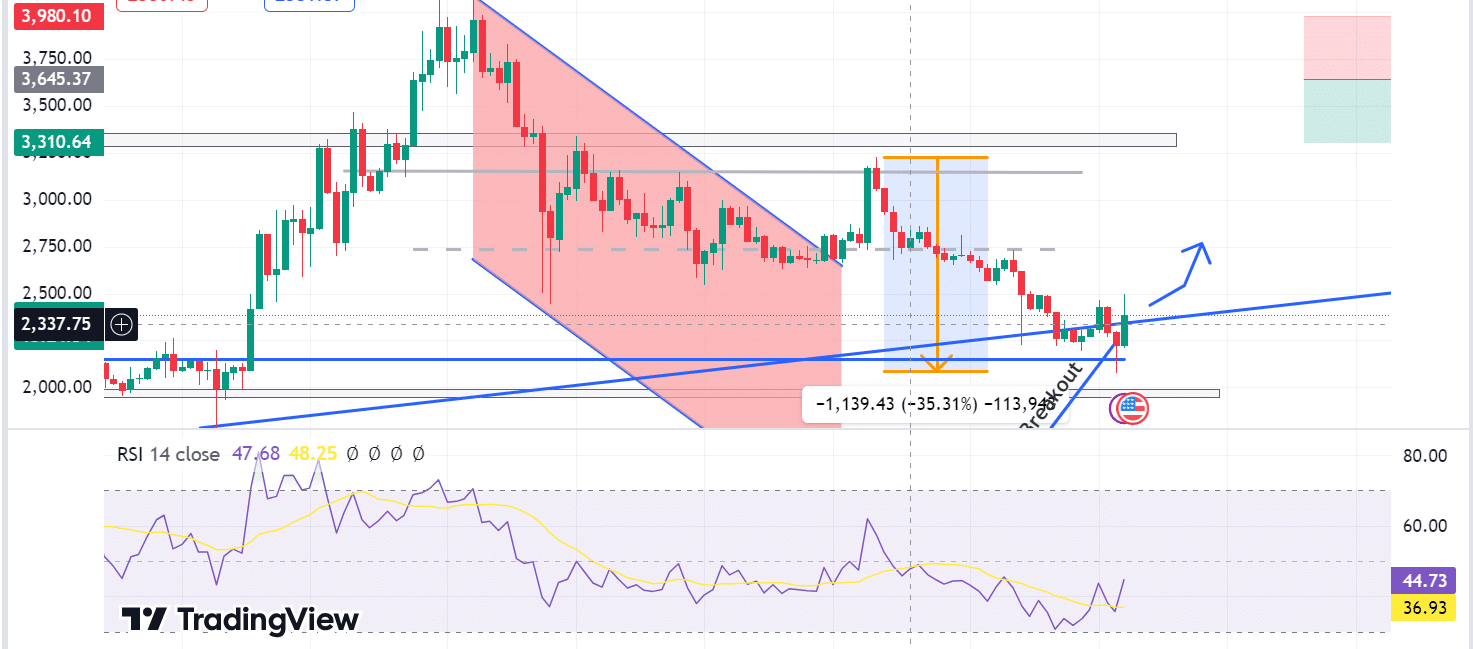

Source: TradingView

Additionally, RSI indicates solid bullish momentum over the past seven days. RSI 44.68 is above RSI-based MA 36.93.

When RSI is above the moving average, it indicates a bullish signal. Typically, current profits outweigh losses, indicating upward momentum.

Therefore, Maker with an RSI of 46 shows an opportunity for a long position as he expects price appreciation to increase.

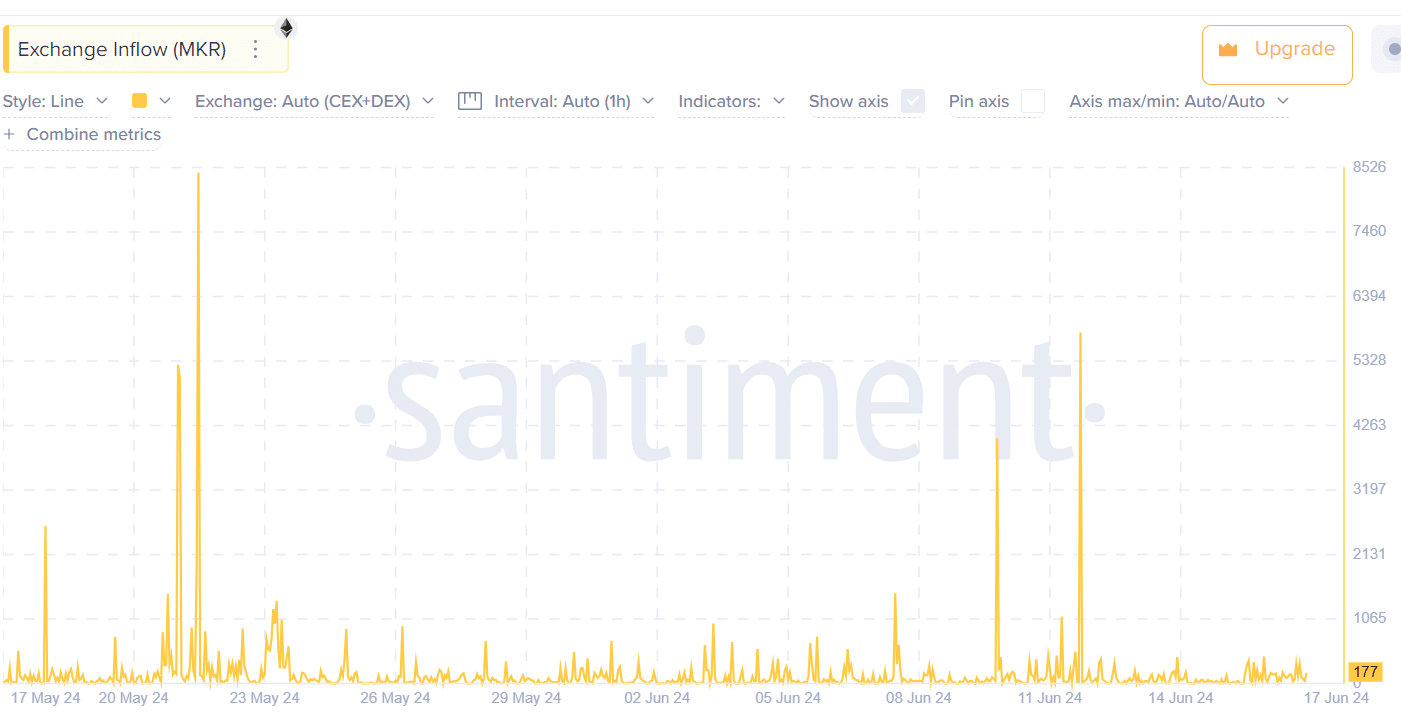

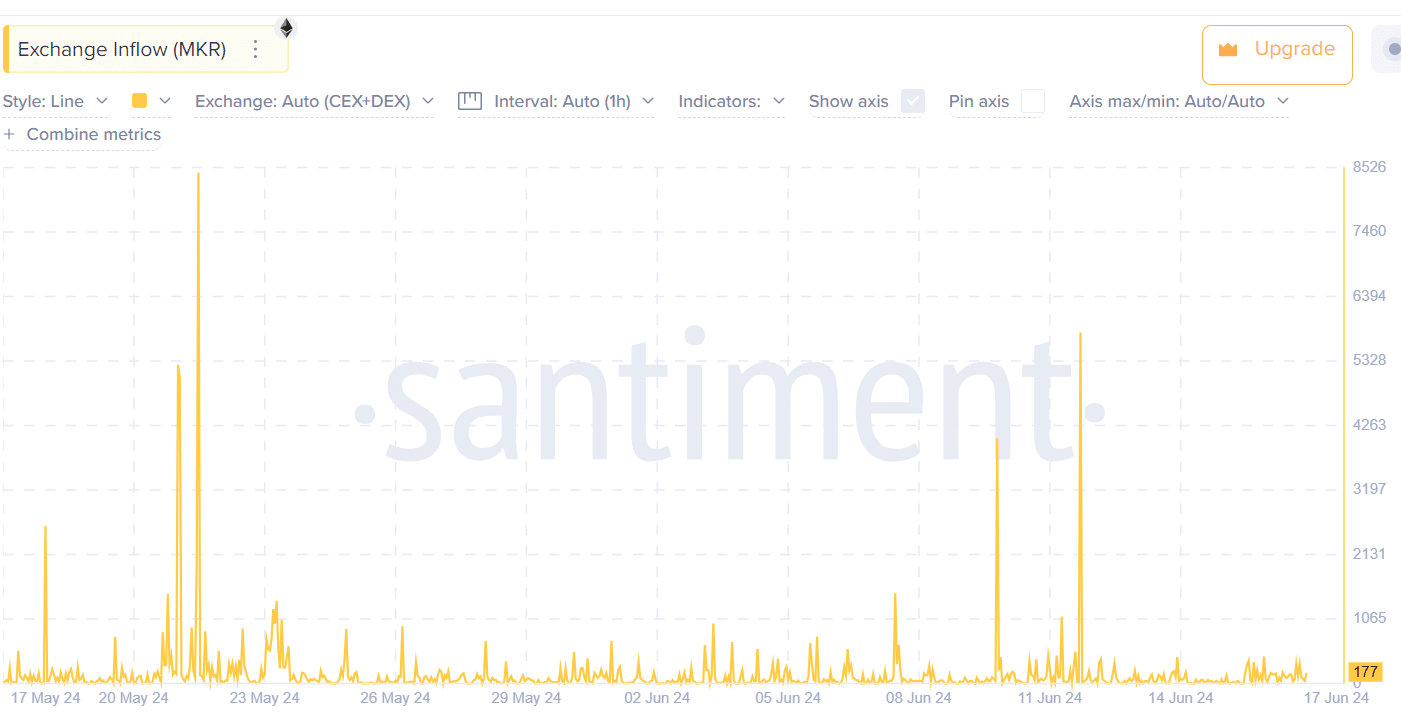

Additionally, according to Santiment, MKR exchange inflows have decreased over the past week. Exchange inflows decreased from a high of 5799 on June 12th to a low of 177 on the 17th.

Source: Santiment

Typically, high exchange inflows mean users are ready to trade an asset, which means increased selling pressure. As selling pressure increases, prices fall.

Therefore, the low exchange inflows reported by MKR mean that there are few assets available, which reduces selling pressure and pushes the price higher.

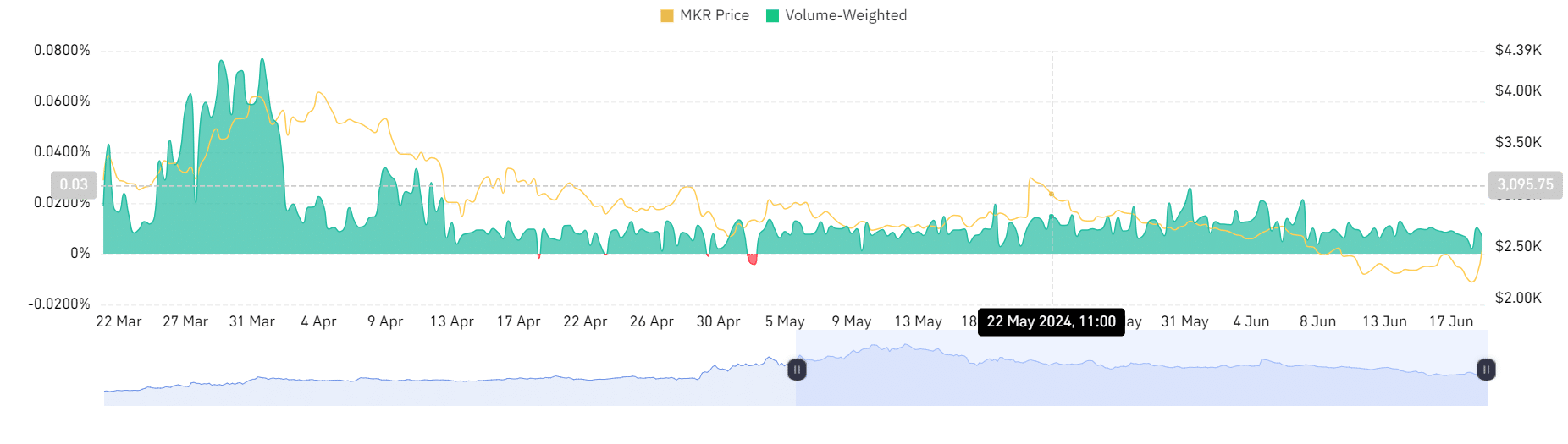

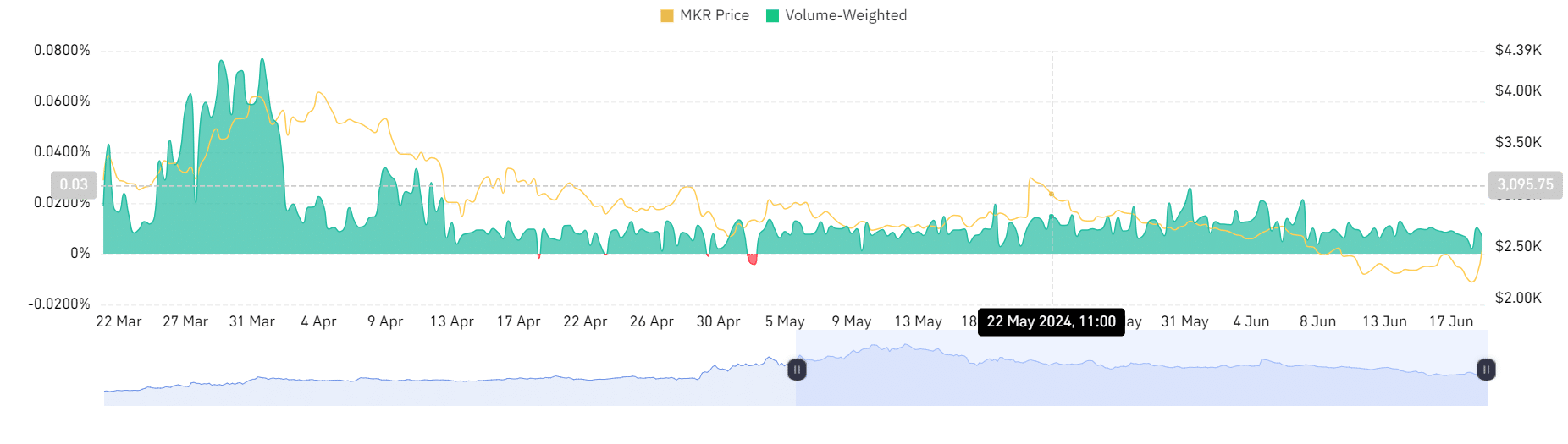

Interestingly, according to Coinglass, MKR has reported a balanced volume-weighted funding ratio.

Source: Coinglass

The funding ratio is neutral and positive. This means that buy and sell positions are balanced and the market enjoys stability without weakness or strength.

Realistic or not, the market cap of MKR in BTC terms is:

Will MKR’s recent surge sustain?

Over the past seven days, MKR has made significant gains. Key indicators suggest bullish momentum after the $2,150 support holds.

With a breakout of the bearish trend imminent, MKR aims to challenge the resistance level around $2729. Likewise, market sentiment is optimistic with RSI rising and Exchange inflows decreasing.