The investment environment is undergoing major changes, and at the center of these changes is the tokenization of real assets (RWA). This innovative method is poised to redefine our perception and interaction with traditional investment options.

BlackRock, the world’s largest asset manager, is a prime example of this change. Through our partnership with Securitize, we are taking practical steps to tokenize a massive $10 trillion worth of assets. The initiative aims to open investment opportunities to a wider range of investors. TV wine is leading the way by driving change in RWA investment and improving accessibility, transparency and efficiency.

Through this guide, we will explore blockchain’s transformative trend in democratizing finance. Specifically, we will look at the variety of real-world assets available through TVVIN’s innovative financial models and platform, highlighting opportunities for investors. Please join us on our journey to explore the attractive world of investment, where the convergence of technology and finance is changing the future.

Why is there so much hype about tokenizing real-world assets?

The hype around real-world asset (RWA) tokenization is growing for several compelling reasons. One surprising fact is that the RWA tokenization market is expected to become a huge $16 trillion industry by 2030, accounting for about 10% of global GDP, according to BCG. These impressive numbers highlight the enormous potential and growing demand for tokenized RWA.

First, RWAs offer a variety of benefits to your investment portfolio. By including assets such as real estate, commodities, and infrastructure, investors can reduce overall volatility and risk compared to traditional portfolios. For example, adding tokenized real estate to a portfolio can provide stability and potentially higher returns compared to stocks or bonds alone.

second, Many RWAs, such as gold and real estate, are considered effective hedges against inflation. When the purchasing power of a currency declines, its value tends to increase or remain stable, preserving the real value of investors’ capital. This is especially important in today’s economic environment where inflation concerns are prevalent.

third, Certain RWAs, such as rental properties or infrastructure projects, can generate stable and predictable cash flows, making them attractive even during periods of market uncertainty or low interest rates. Tokenizing these assets can increase the attractiveness of RWA investments by providing investors with a steady stream of income.

Additionally, tokenization of RWA can improve accessibility and inclusion. In the past, investing in assets such as real estate or precious metals required significant capital, limiting the participation of large institutional players. However, tokenization through TVVIN allows small investors to participate in these markets by purchasing fractional ownership and democratizing access to wealth-building opportunities.

Therefore, by incorporating tokenized RWA into their broader financial and investment strategies, individuals and institutions can achieve more balanced, resilient and comprehensive portfolios.

What is the role of blockchain in democratizing finance?

Blockchain technology, with decentralization as its core principle, is fundamentally changing the financial environment. Blockchain disrupts traditional and often opaque financial structures by empowering individuals and fostering more inclusive systems.

Transparency through distributed ledger

Traditional financial systems rely on centralized ledgers maintained by institutions such as banks. These ledgers are prone to manipulation and may lack transparency. However, blockchain utilizes distributed ledger technology (DLT).

These DLTs are public or permissioned databases shared across computer networks. All transactions are recorded chronologically and cryptographically hashed to create an immutable and verifiable record. This strengthens trust by ensuring transparency of financial activities by allowing all participants to access and audit the ledger.

Decentralization and Disintermediation

Traditional finance relies heavily on intermediaries such as banks for transactions. These intermediaries can add costs and limit access to some demographics. Blockchain enables peer-to-peer transactions, bypassing the need for a central authority. This disintermediation puts individuals in direct control of their finances, reducing transaction fees and increasing access for underbanked populations.

Cryptographically secure and tamper-evident records

Blockchain utilizes strong encryption to secure transactions. Every block in a blockchain is cryptographically interconnected with previous and subsequent blocks, establishing an immutable sequence of blocks.

Changing a single block requires changing the entire chain, which is computationally impractical because the ledger is distributed across a network of nodes. This cryptographic security protects financial data from unauthorized access and manipulation, enhancing trust and security in economic interactions.

Smart contracts (programmable money)

Smart contracts are self-executing contracts stored on the blockchain and do not require any intermediaries. These contracts automatically perform predefined tasks when certain conditions are met, ensuring that the terms of the contract are fulfilled without human intervention.

For example, a smart contract can automate loan repayment once the borrower’s salary is paid. This programmable currency increases efficiency and reduces the risk of human error in financial transactions.

Fractional ownership and democratized investment

Blockchain allows assets such as stocks and real estate to be divided. This allows individuals to invest in high-value assets with smaller amounts of capital and democratizes access to investment opportunities that were previously exclusive. Tokenization of assets also facilitates faster and more efficient transactions than traditional methods.

micropayment

Blockchain facilitates secure and cost-effective microtransactions. Traditional financial systems often charge high fees for small transactions. By leveraging the peer-to-peer structure of blockchain, which reduces the need for intermediaries, individuals can engage in secure and cost-effective microtransactions. This technology expands financial access to the unbanked and individuals who lack access to traditional banking services.

What is TVVIN’s financial model?

TVVIN’s financial model focuses on monetizing the underlying real-world assets (RWA), especially gold, that back tokens such as the $VVG gold token. TVVIN’s main revenue sources are:

- Transaction Fee: TVVIN charges fees for issuance, burning, transfer, and linking of RWA-backed tokens. This includes creation and destruction fees when $VVG tokens are created or burned, as well as gas fees for on-chain transactions.

- Storage/storage fees: TVVIN provides military-grade custody services for the physical assets, such as LBMA-certified gold, backing the tokens. We charge a fee for these audited and regulated storage services.

- Financialization/Interest Income: This is a significant source of revenue. TVVIN generates revenue using native gold in financial markets through various mechanisms.

all) Use gold as collateral for loans to purchase income-generating assets such as government bonds.

rain) We work with traditional and cryptocurrency exchanges to create gold futures contracts.

Seed) Gold is lent to manufacturers, jewelers, etc. for a fee.

d) Hold gold in an interest-bearing account.

- Partnerships with Institutions: TVVIN cooperates with market makers, hedge funds, exchanges, and institutional buyers. It generates revenue through contracts such as market making contracts, investment solutions, listings and liquidity provision.

- Educational Marketing: TVVIN plans to generate revenue through educational programs and marketing activities related to its products and services.

How can I grow my gold with TVVIN? (using yield bearing bolts)

TVVIN offers an innovative way to increase your gold holdings through a high-yield vault. The platform allows users to leverage their gold assets to generate additional profits by utilizing various financial mechanisms.

Firstly, TVVIN provides safe custody services for gold and other precious metals, ensuring your assets are stored safely and audited regularly. The platform’s native token, $TVVIX, grants access to a vault where you can deposit commodity tokens, such as gold-backed tokens, and earn returns over time.

Returns are generated through several financial strategies. TVVIN uses the gold deposited in its vaults to earn revenue through collateral, futures contracts, gold loans, and interest-bearing accounts. For example, gold can be used as loan collateral and typically guarantees lower interest rates compared to other business loans.

Futures contracts also allow investors to gain exposure to the price of gold without having to physically hold the metal, creating another revenue stream through the fees generated from these transactions. Gold loans to industries such as electronics and jewelery manufacturing further enhance income, earning interest by holding gold in accounts designed to earn interest.

The bolt mechanism is simple. Users must own $TVVIX tokens proportional to the amount of real-world asset (RWA) tokens, such as gold-backed tokens, that they wish to store in their vault. These tokens are locked in a vault for a specified period of time, during which time they generate revenue in the form of additional $TVVIX tokens.

The rate of return depends on the amount of RWA tokens deposited and the storage period. At the end of the storage period, users can withdraw their RWA tokens along with the profits generated.

What other real assets will TVVIN invest in?

TVVIN, which currently offers a secure blockchain-based method for investing in gold through tokenization, plans to expand its scope to encompass a variety of real-world assets (RWAs).

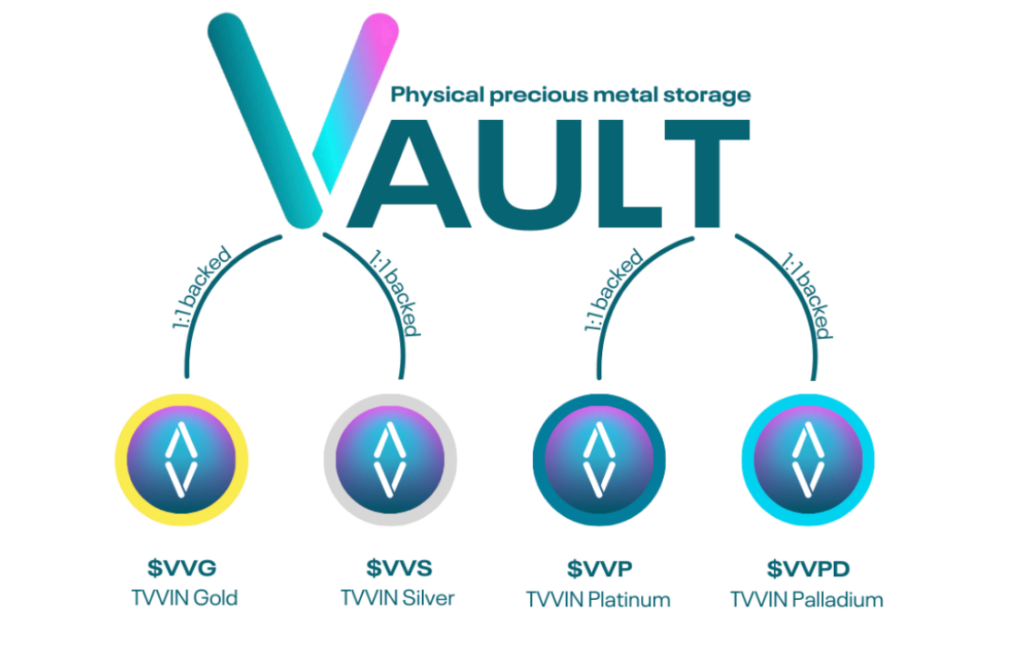

Future offerings may include tokens backed by silver, platinum, and palladium, giving investors a variety of options within the precious metal. In addition to metals, TVVIN aims to tokenize a wide range of RWAs, such as minerals, agricultural products, real estate, land deeds, intellectual property rights, and unique artist rights.

The efficiency and clarity provided by blockchain technology allows investors to diversify their portfolios across a wide range of digital assets. This gives you access to stable and real investment opportunities. By connecting traditional assets with modern digital solutions, TVVIN improves liquidity and provides new avenues for wealth growth and preservation.

conclusion

In a world where investment opportunities were previously dominated by large financial institutions and inaccessible to many, TVVIN is emerging as a game changer. TVVIN is transforming the financial industry by leveraging blockchain technology to provide individuals with a previously inaccessible means of creating wealth.

By democratizing investments and tokenizing assets, TVVIN has created a stable and transparent platform that allows everyone to participate in a market previously limited to a small elite. TVVIN’s unorthodox yield holding vault introduces a unique approach to increasing your gold holdings and diversifying your portfolio through a variety of real assets.

To find out how TVVIN can enhance your financial journey, visit: Website.

I hope you enjoyed today too article. Thanks for reading! Have a fantastic day! It will be live on the Platinum Crypto Trading Floor.

Import Disclaimer: The information found in this article is provided for educational purposes only. We do not promise or guarantee any earnings or profits. You should do some homework, use your best judgment, and conduct due diligence before using any of the information in this document. Your success still depends on you. Nothing in this document is intended to provide professional, legal, financial and/or accounting advice. Always seek competent advice from a professional on these matters. If you violate city or other local laws, we will not be liable for any damages incurred by you.