- Degen’s value rose 40% between June 18 and 19.

- Profit-taking intensified, pushing the token price back to all-time lows.

The native memecoin, Degen (DEGEN), has seen a significant drop in price over the past few days. This fall follows a 40% surge in value between June 18 and 19.

On June 18, the DEGEN cryptocurrency price plummeted to an all-time low of $0.0074, according to data from CoinMarketCap. However, due to the resurgence of the general meme market on this day, DEGEN attracted the attention of many traders.

assembly

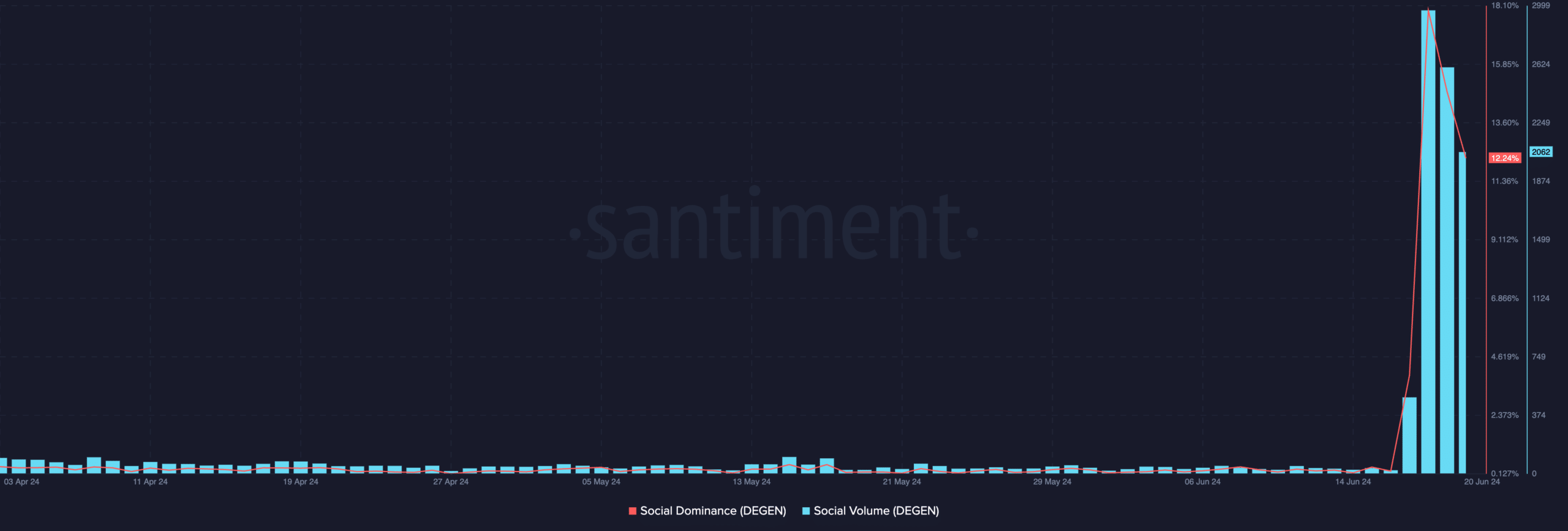

Social activity collected on-chain surged to an all-time high that day. According to Santiment, DEGEN’s social dominance was 17.92%, and its social volume on June 18 was 2970.

Source: Santiment

An asset’s social dominance measures the share of online discussions that specifically mention that asset compared to overall discussions about the top 100 cryptocurrencies by market capitalization.

This shows that on June 18th, discussions about DEGEN accounted for 17.92% of all online cryptocurrency conversations. The token was mentioned 2,970 times on this day.

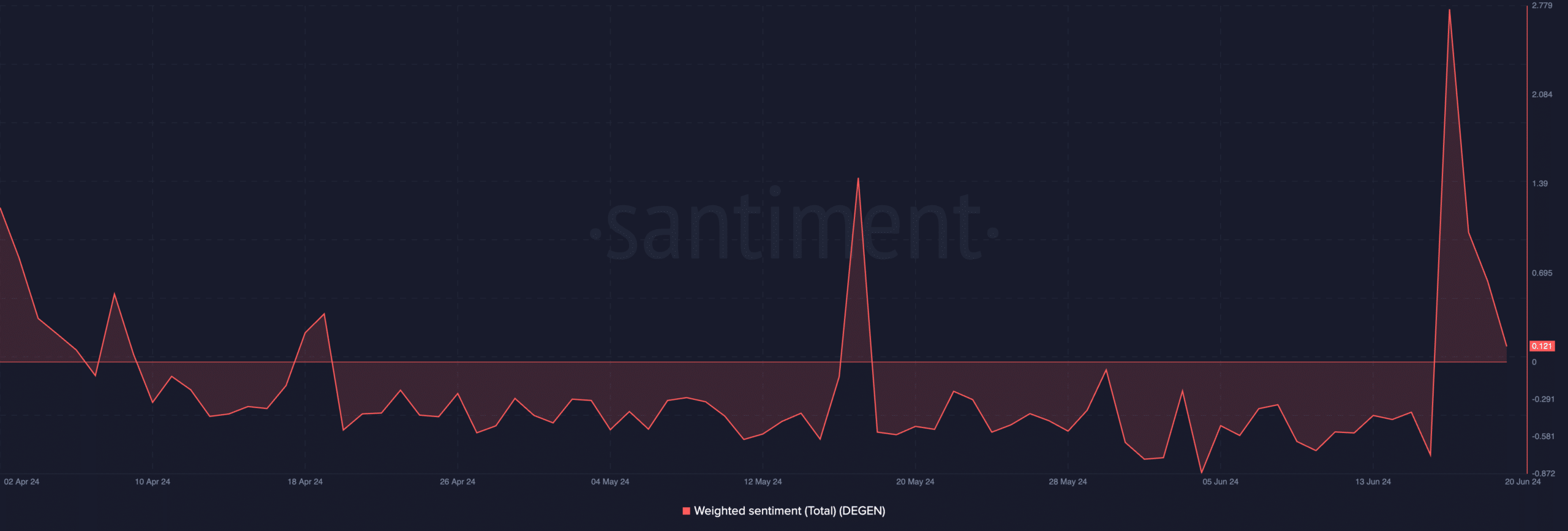

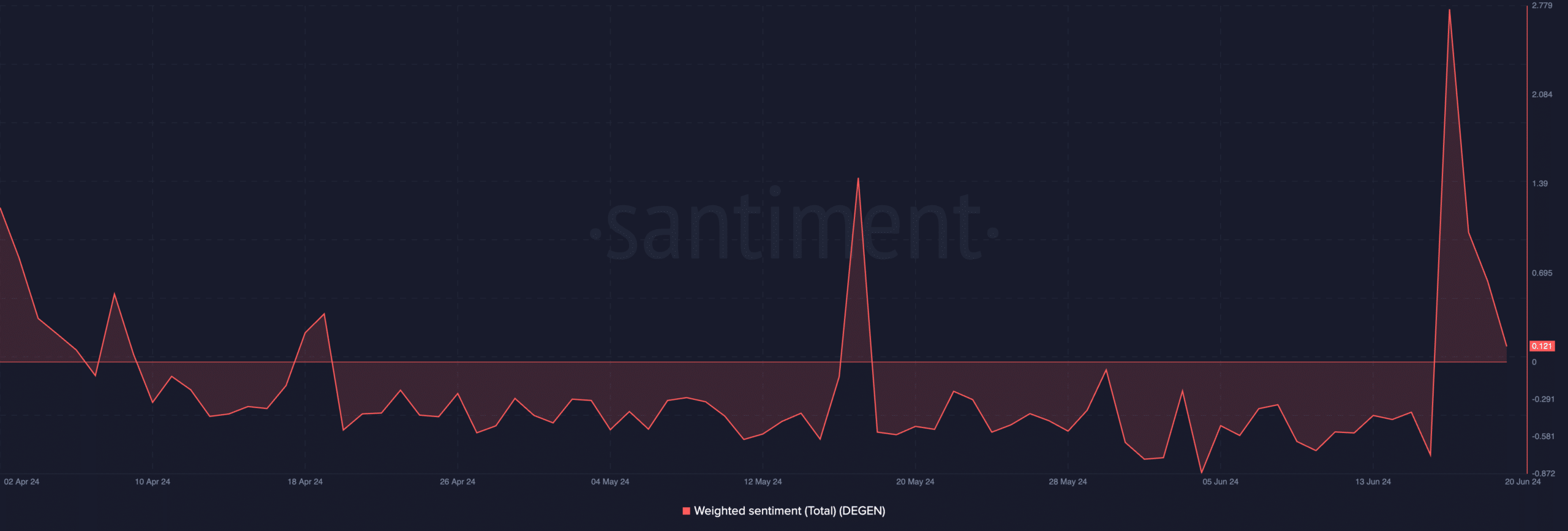

As traders began to get “lured” into meme coins, market sentiment towards them turned bullish.

For context, prior to June 18, the coin’s weighted sentiment had been bearish since May 18. However, on June 18, DEGEN’s weighted sentiment rose to an all-time high of 2.75.

Source: Santiment

decline

The increased trading activity witnessed between June 18 and 19 pushed the price of DEGEN above $0.01. At this point, selling soon began as many holders took profits. At press time, the value of the meme coin had plummeted 14% to $0.0097.

AMBCrypto’s assessment of daily chart price movements confirms the possibility of further decline in the value of the meme coin.

The point forming DEGEN’s Parabolic Stop and Reverse (SAR) indicator was positioned above the price at the time of press. They have been in this position since June 6th, even during DEGEN’s double-digit price rally between June 18th and 19th.

The asset’s Parabolic SAR indicator measures potential trend direction and reversals. If the dots are above the asset price, the market is said to be in a downward trend. This indicates that asset prices have been falling and may continue to do so.

Is your portfolio green? Check out the DEGEN Profit Calculator

Degen’s Arun downline, which confirmed the downward trend, was 78.57%. This indicator measures the strength of an asset’s trend and identifies potential price reversal points.

Source: TradingView

If the downward line is close to 100%, it means that the downward trend is strong and that the most recent low was reached relatively recently.