- LINK surged 7.7%, sparking optimism among analysts.

- Despite the surge in prices, market sentiment remains bearish with few bullish signals.

After several weeks of declines, Chainlink (LINK) has posted a strong rally. Recent developments have pushed it above the support level around $12.96. As it moves out of this zone, bulls are expecting a continued upward trend despite the volatility of the altcoin.

Recent market activity has captivated various cryptocurrency stakeholders, sparking speculation and bold predictions. One notable analyst said world of charts, LINK shared that:

“It’s still heating up within the wedge that finally falls. The more it consolidates, the higher it will go after the breakout and I still expect a move towards $22-$25.”

This bold prediction shows a continued bullish trend after a breakout of the current zone.

Also a widely known Chainlink analyst @Linktoad Generic HBARI This is what was shared by X.

“After 110 days, the LINK USDlongs chart finally surrendered… Compared to ETH, ETH outperformed Old ATH by 271% over 57 days. If we apply these same metrics to the LINK price we chart, we get a price of $47-$49.”

This analyst uses historical data to predict the future and assumes that LINK will reach a new ATH. If the current situation continues

What do LINK basics tell us?

At press time, LINK was trading at $14.01, up 7.7% in 24 hours. During the same period, trading volume increased 102.25% to $444 million. According to Coinmarketcap, LINK’s market capitalization surged to $8.5 billion in 24 hours.

However, overall market sentiment remains bearish.

Despite the optimistic forecast, AMBCrypto analysis shows that LINK price action has shown few bullish signals over the past 24 hours.

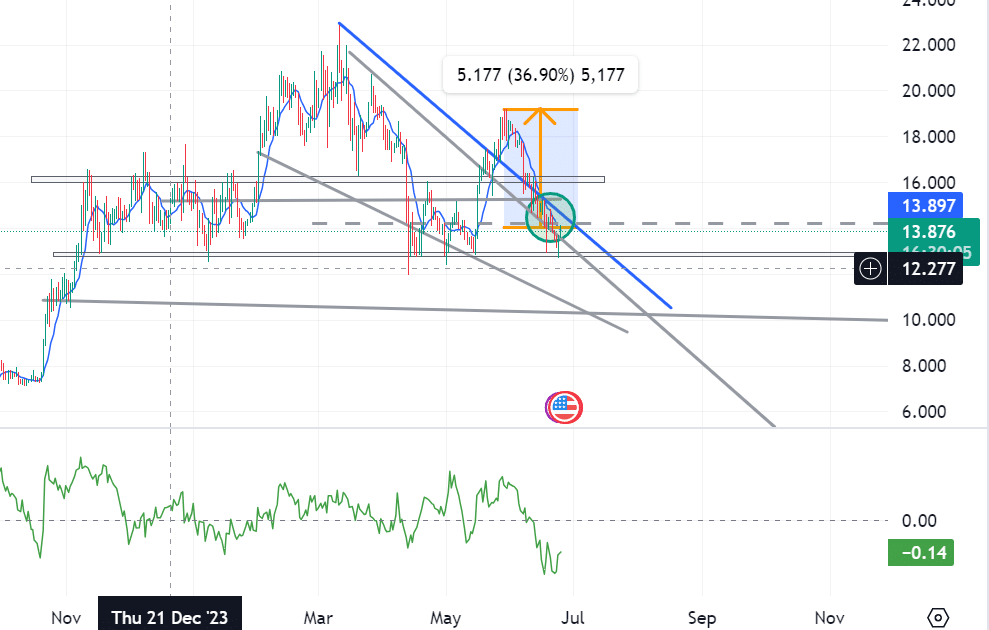

Source: TradingView

Looking at CMF, LINK has a negative CMF, which indicates bearish market sentiment. As of this writing, LINK’s CMF is -0.13.

A negative CMF indicates increased selling pressure, which means money is flowing out of the asset.

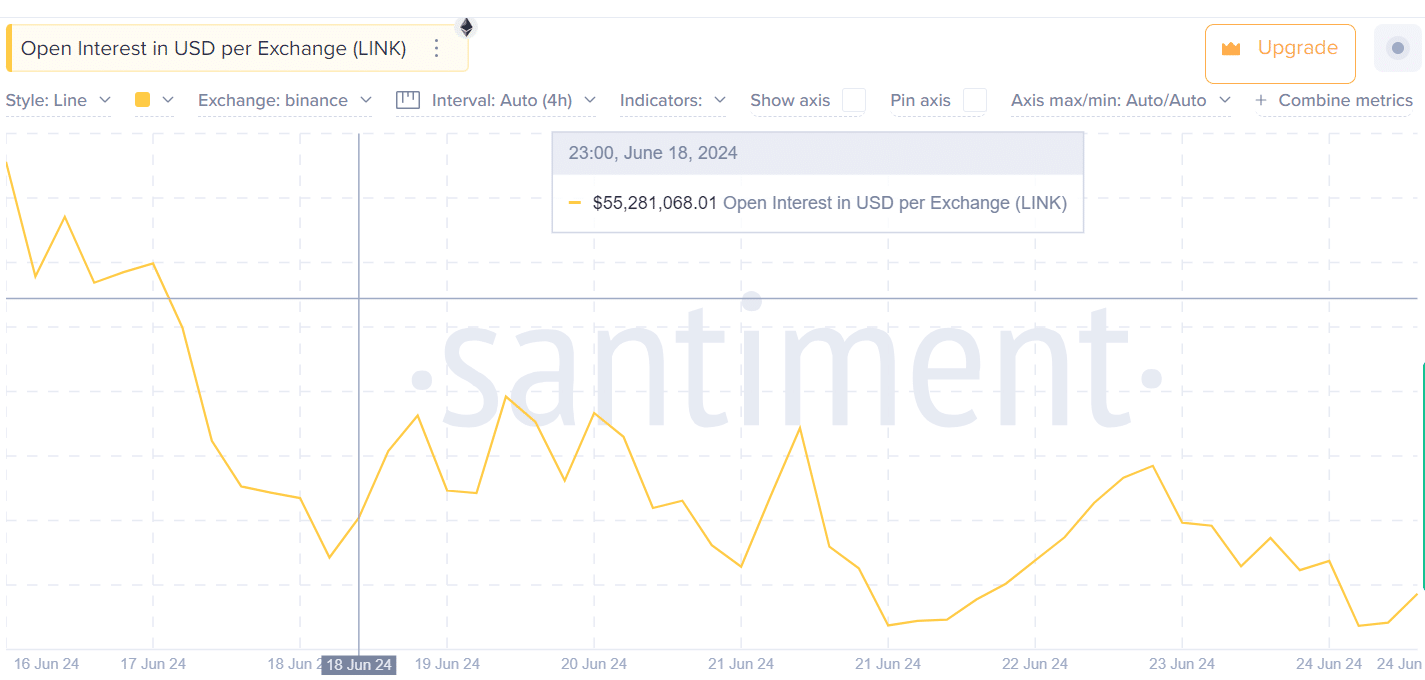

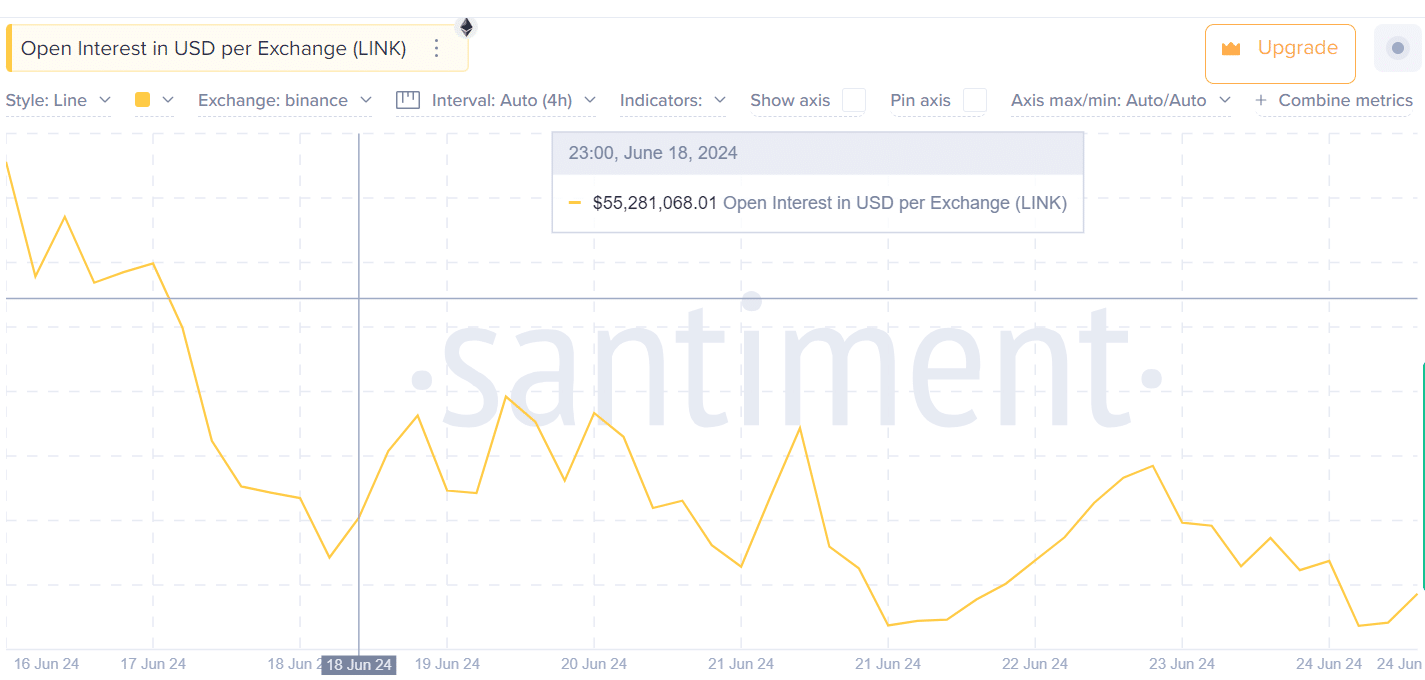

Additionally, AMBCrypto analysis of Santiment data shows open interest per exchange decreasing from $63,000 on the 16th to $53,000 on the 24th.

Decreasing open interest means investors are closing positions without the news being released. Investors fear that market volatility and indecisiveness will cause them to avoid new positions.

Source: Santiment

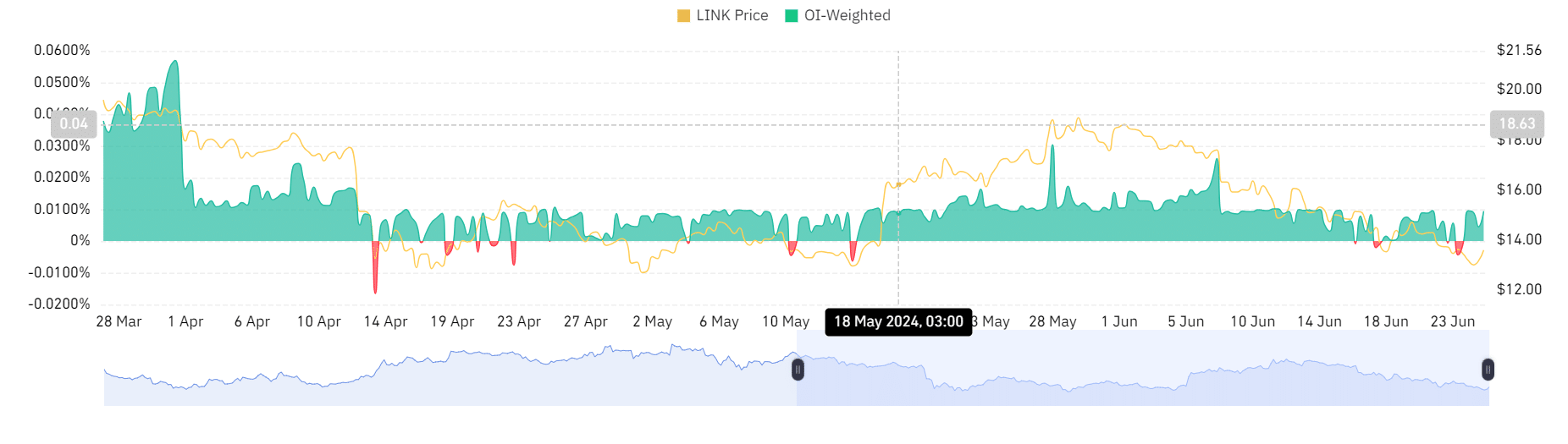

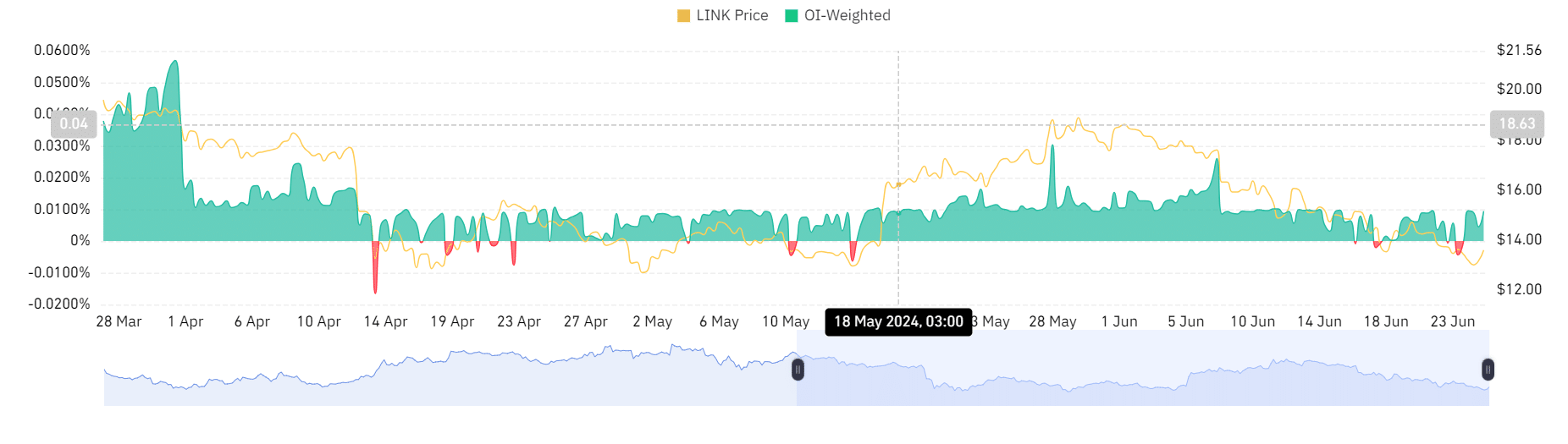

Analysis on Coinglass also shows that OI-weighted funding rates have experienced high volatility.

At press time, LINK reported an OI of 0.0094% after reporting -0.0007 on the 22nd and -0.0044 on the 23rd, indicating a possible reversal into a bull market after a sustained bearish trend.

Source: Coinglass

Can ChainLink maintain its recent surge?

This price action shows an upward move away from the resistance level around $12.9. Likewise, the chart shows strong movement above the bearish trendline around $13.661.

Realistic or not, LINK market cap in BTC terms is:

A breakout of this area would allow LINK to challenge the next resistance level around $14.205 and, in a more bullish scenario, $15.50.

However, if LINK fails to hit the $14.205 target, it will experience a correction and fall to around $12.939.