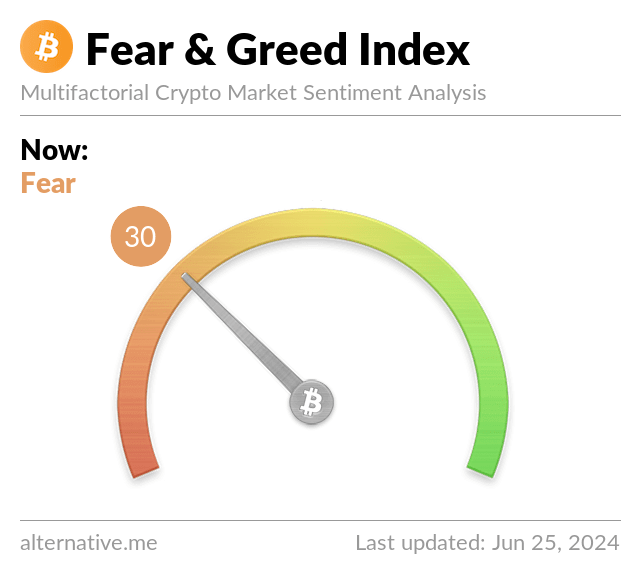

- The Cryptocurrency Fear and Greed Index is currently in the ‘fear’ zone with a score of 30.

- This is the lowest sentiment reading for Bitcoin (BTC) in nearly 18 months.

The Crypto Fear and Greed Index, which measures market sentiment for Bitcoin (BTC) and the broader cryptocurrency market, fell to 30, its lowest point in a year and a half.

BTC has been trading lower during the current market cycle and the cryptocurrency Fear and Greed Index has fallen into “fear” territory, but it has done so for the first time since January of last year.

Cryptocurrency Fear and Greed Index drops to 30

With the price of Bitcoin falling below $60,000 on Monday, June 24, the index score plummeted more than 20 points into “fear” territory.

This decline means that the Bitcoin Fear Greed Index is currently trending towards levels last seen in January 2023. At the time, the price of Bitcoin was trading around $17,000 following the market reaction to the industry’s most shocking collapse to date: the collapse of the FTX cryptocurrency exchange. .

In May of this year, the price of Bitcoin fell to a low of $56,500 and the index score fell from neutral to fearful.

As prices rebounded, sentiment improved significantly, with the Fear and Greed Index rising to 74. At the time, “greed” dominated as Bitcoin surpassed $71,000, but the score shifted to neutral and reached 30 within a few hours on June 24.

Mt. Gox repayment and German government sale

Catalysts for the recent decline include Mt.Gox redemption news.

Monday’s notice said the exchange would begin rewarding customers who have been waiting since the 2014 hack. Mt.Gox customers will receive Bitcoin and Bitcoin Cash.

More than $8.5 billion in BTC is held by custodians on exchanges. Last April, analysts at K33 Research warned that Mt.Gox’s Bitcoin redemption could impact the price.

Also causing negative emotions is the German government’s sale of Bitcoin. After sending 1,700 BTC to exchanges including Coinbase and Kraken last week, Germany is at it again.

Lookonchain on Tuesday shared wallet tracking on-chain data related to the seizure of 50,000 BTC conducted by the German government earlier this year. The details show an additional 400 BTC deposited to CEX.