- Ethereum’s price action has finally turned bullish over the past 24 hours.

- Ethereum selling pressure increased last week.

Whale behavior has a major impact on the prices of cryptocurrencies, including top coins. Ethereum (ETH). The latest analysis has rightly pointed out one such interesting development. Separately, key ETH indicators suggest that investors could soon witness a price rise.

Connecting Ethereum and BitMEX

CryptoQuant analyst and author BlitzzTrading recently posted the following: analyze Highlights unique trends. Our analysis shows that after a sharp increase in Ethereum holdings, the price of ETH decreased significantly.

For example, on September 28, Bitmex exchange holdings decreased significantly, which caused the price of ETH to rise.

This correlation between ETH and Bitmex means that Ethereum whales on Bitmex are seeing their reserves decrease as they buy through Bitmex.

Conversely, when they sell, we see Bitmex’s holdings increase. At the time of writing, Bitmex’s ETH holdings remained relatively low.

Source: CryptoQuant

Ethereum at the bottom of the market

Meanwhile, the Ethereum price finally showed strength after several days of correction. According to CoinMarketCapThe price of ETH has risen by about 2% over the last 24 hours.

At the time of writing, ETH was trading at $3,428.69, with a market capitalization of over $412 billion. AMBCrypto’s examination of Glassnode’s data also pointed to optimistic indicators.

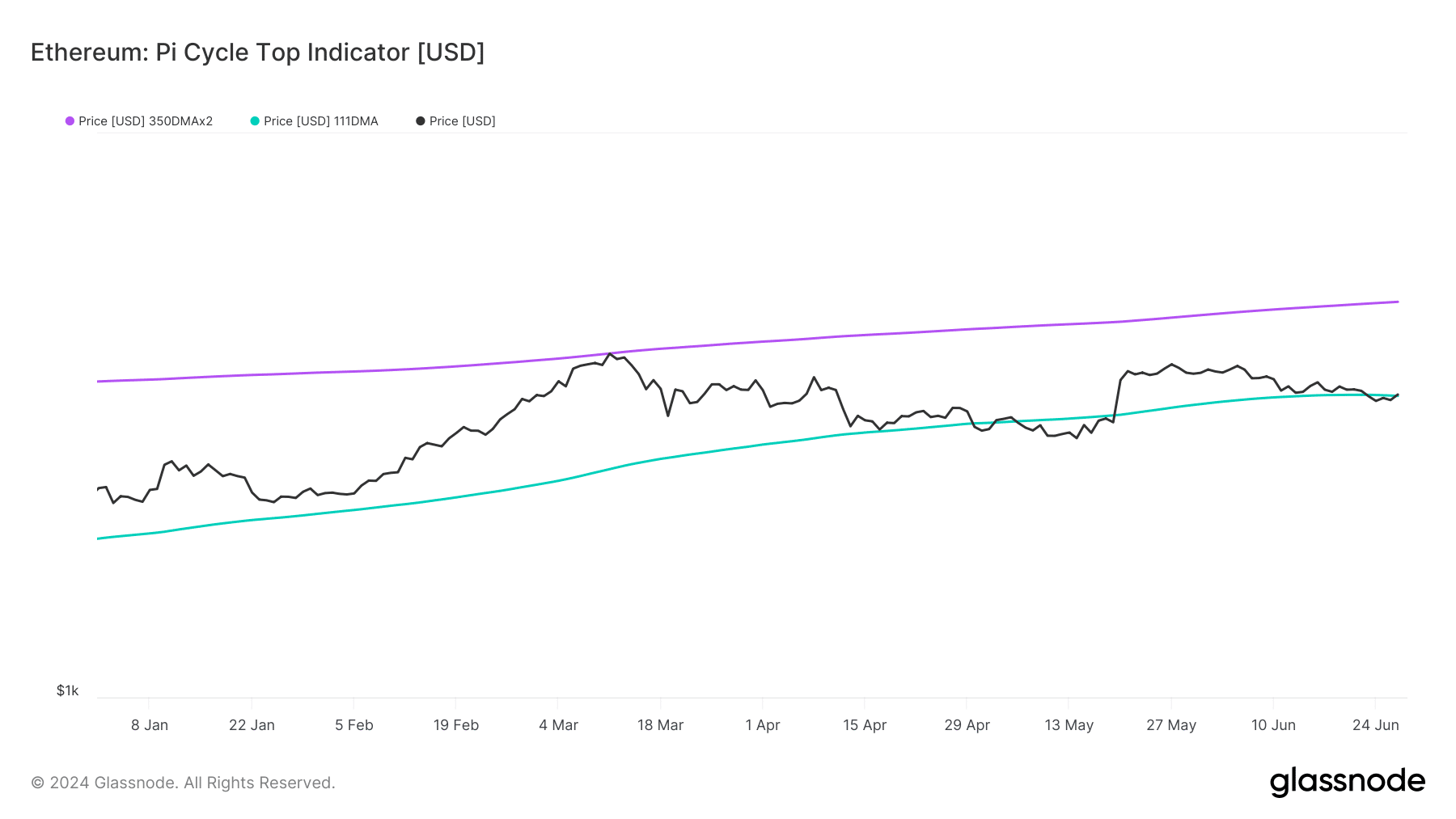

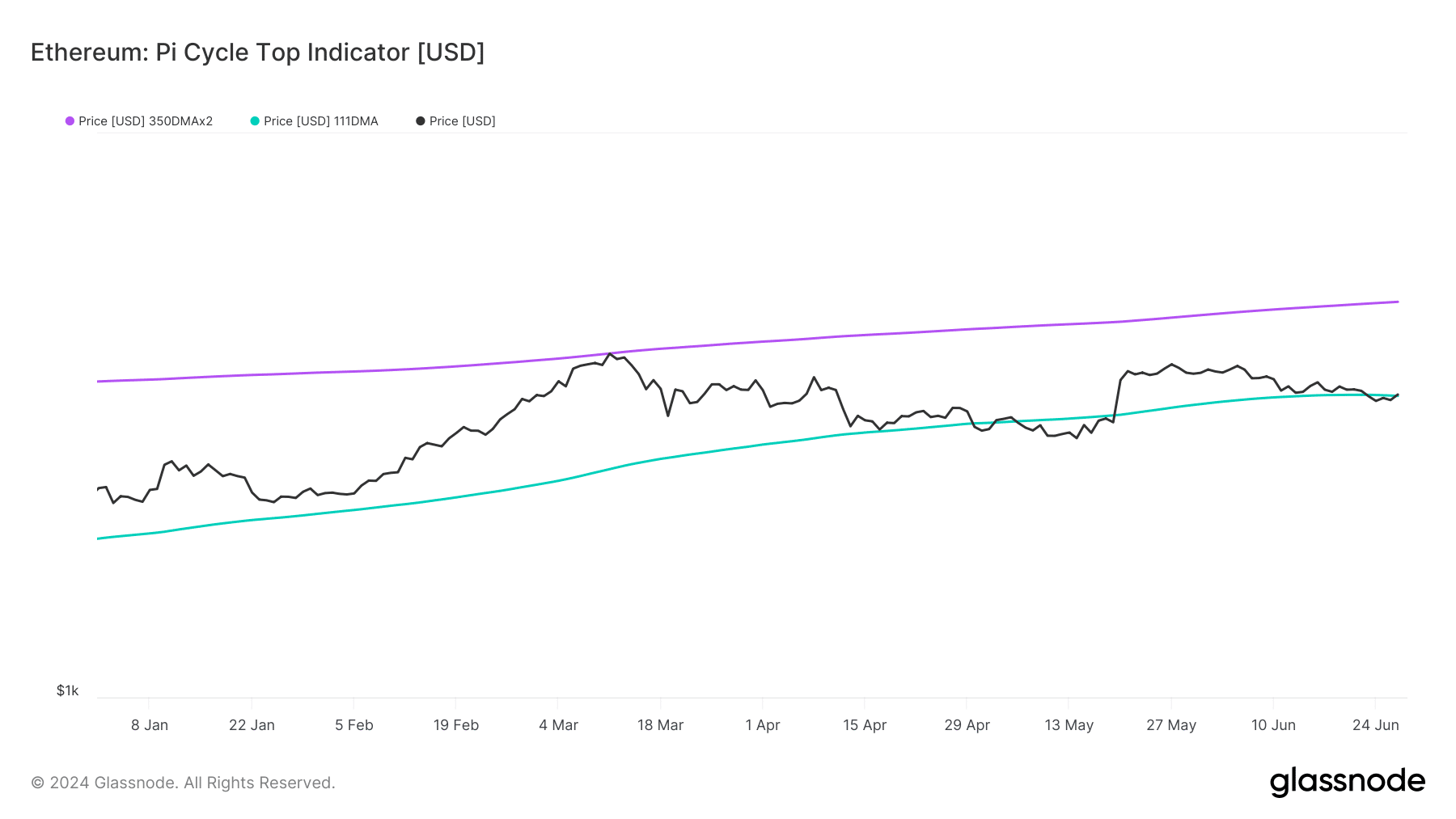

The Pi Cycle Top indicator shows that the price of ETH has reached the market bottom, suggesting a rally. If this turns out to be true on this occasion, ETH could soon reach $5,000.

Source: Glassnode

In addition to this, Ethereum Fear and Greed Index At the time of writing, it had a value of 32%, which means the market is in the “fear” phase. Whenever the indicator reaches this level, it indicates that there is a high probability of price increase.

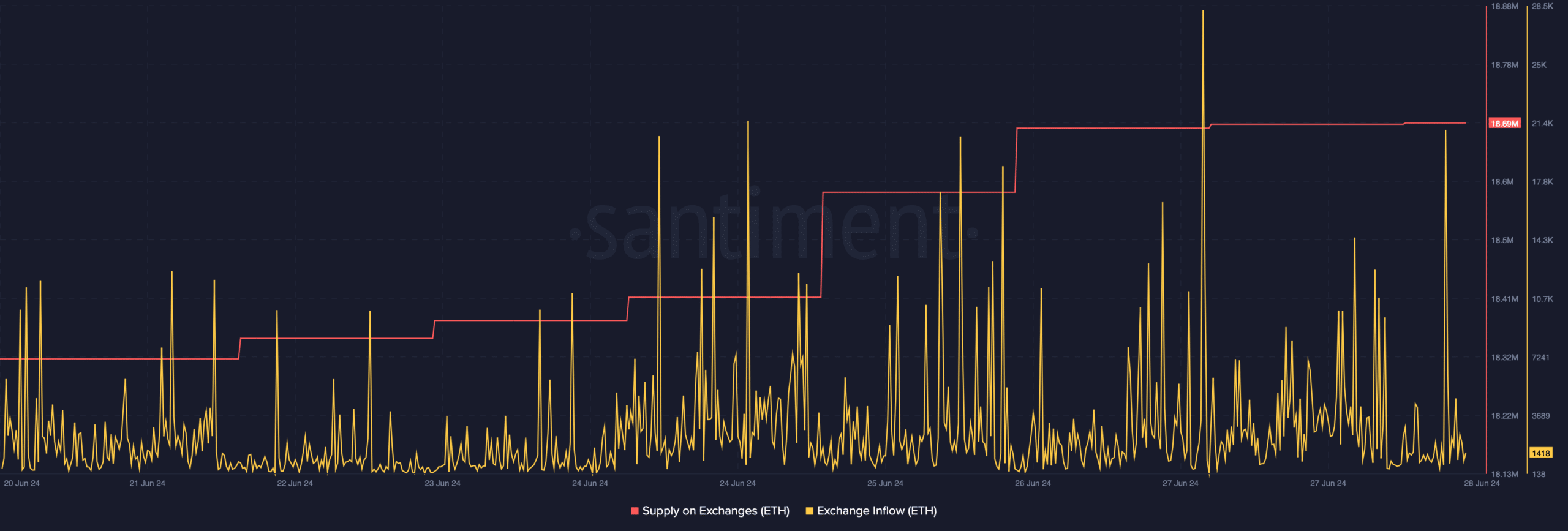

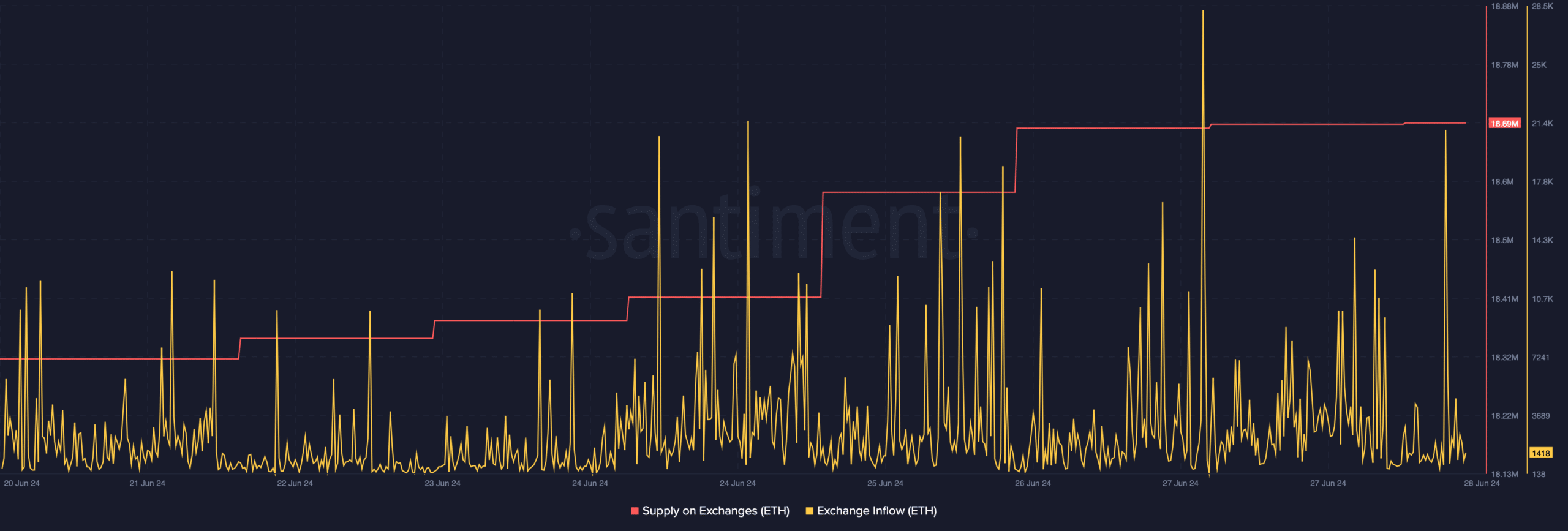

Nonetheless, according to Santiment’s data, token selling pressure was high, which appears to have been driven by an increase in the supply of ETH on exchanges.

Exchange inflows may also surge, increasing selling pressure and limiting ETH price growth.

Source: Santiment

Is your portfolio green? Check it out ETH Profit Calculator

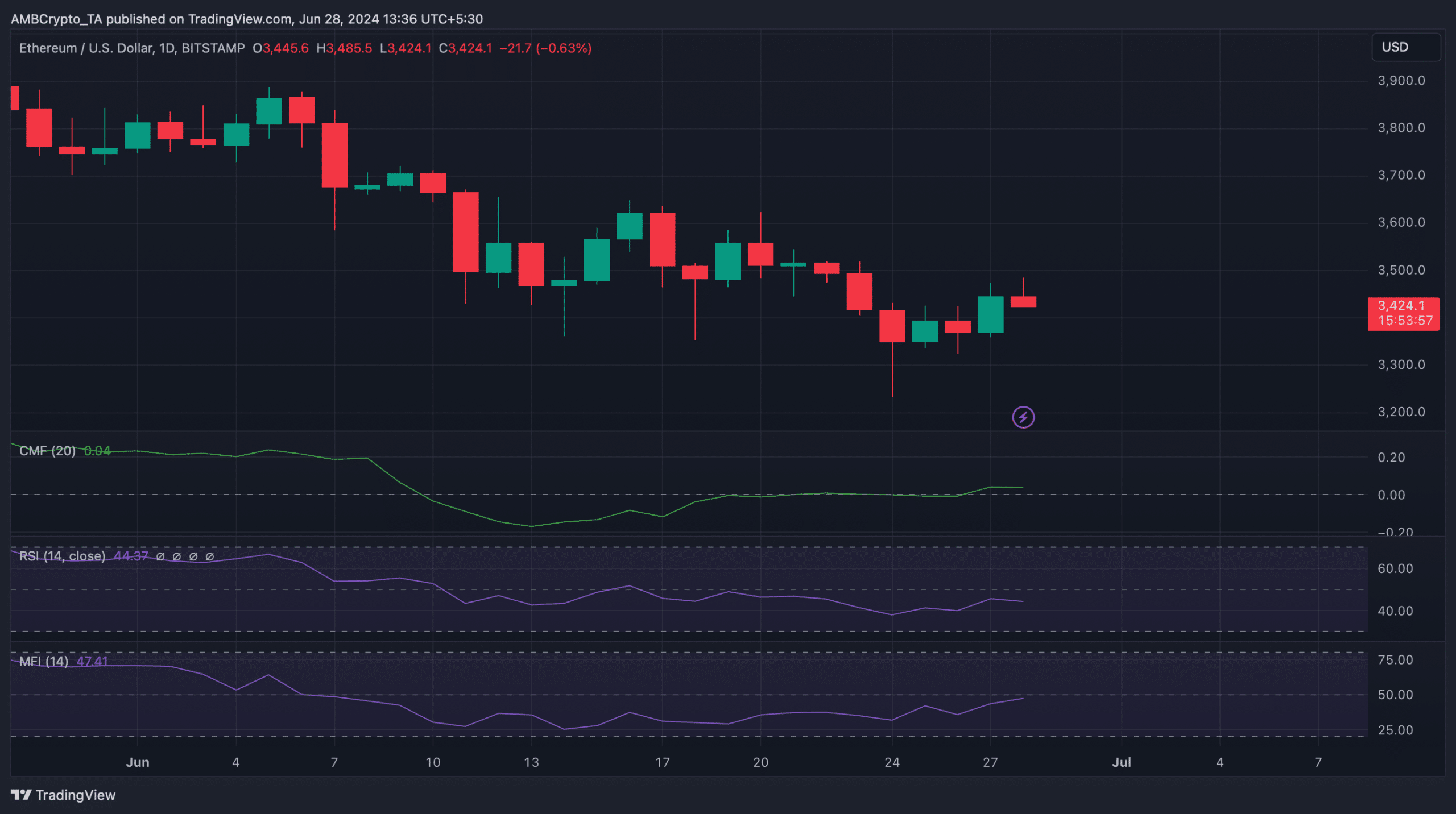

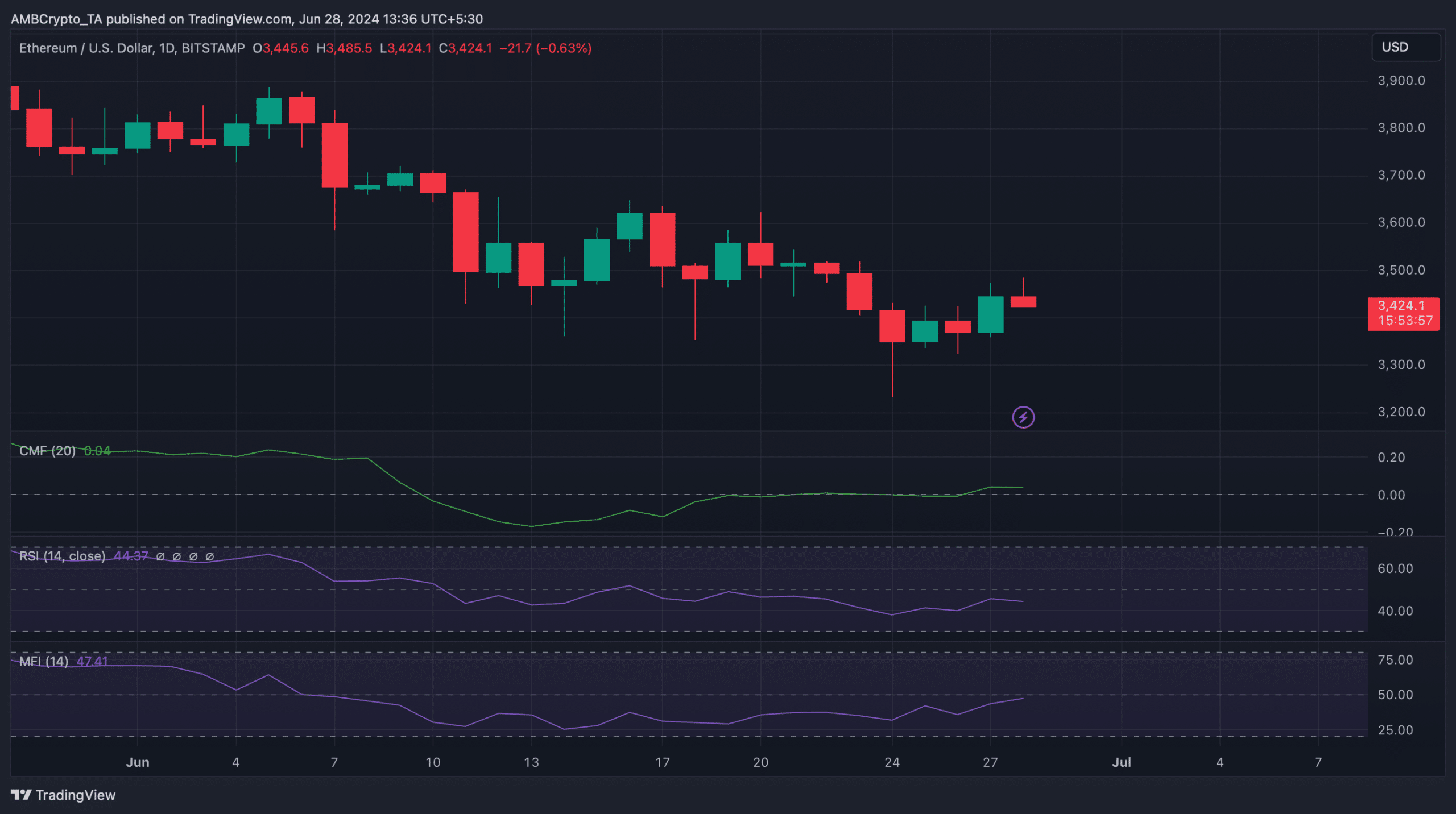

Similar to the previously mentioned indicators, some market indicators also remained bearish for the token. For example, Ethereum’s Relative Strength Index (RSI) and Chaikin Money Flow (CMF) have both moved sideways near their respective neutral points.

Nonetheless, the Money Flow Index (MFI) was strong moving north, indicating continued price gains.

Source: TradingView