- Binance Coin was unable to defend the gains it made earlier this month.

- The price is likely to move towards $500 next before a recovery begins.

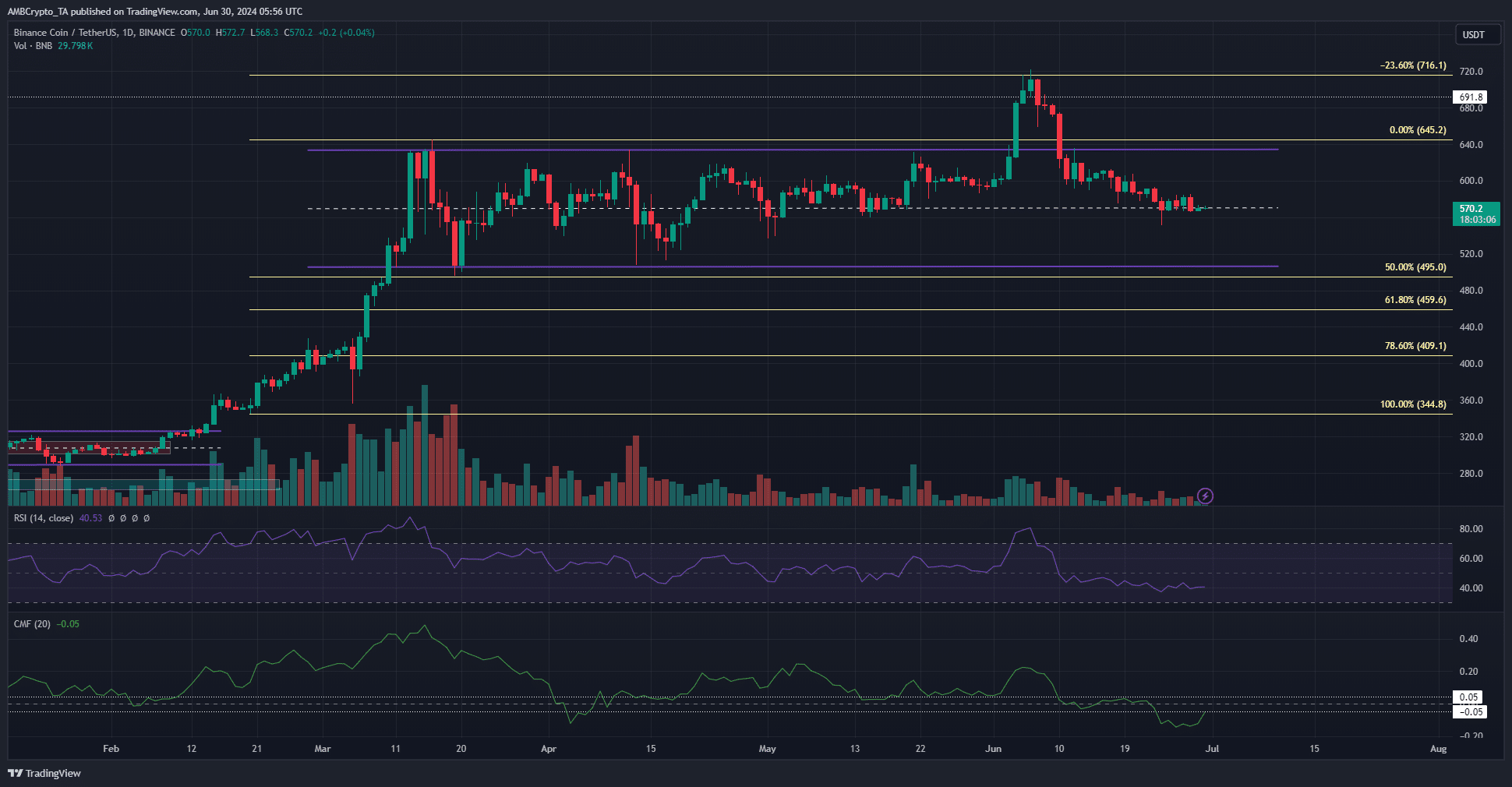

Binance Coin (BNB) bulls were unable to defend against a breakout above the $635 resistance level. The price returned to the $570 support zone at the time of writing. Technical indicators emphasized bearish expectations.

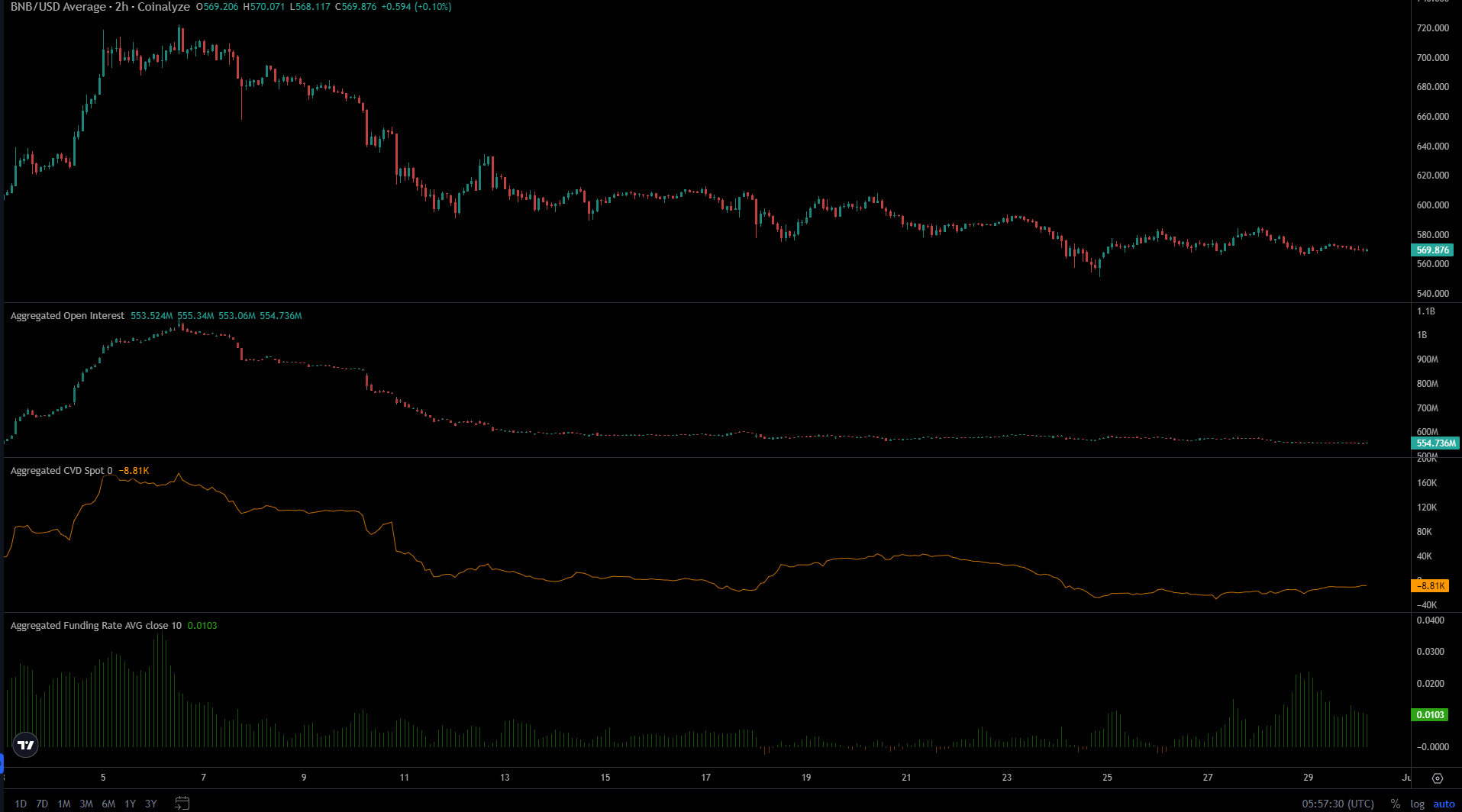

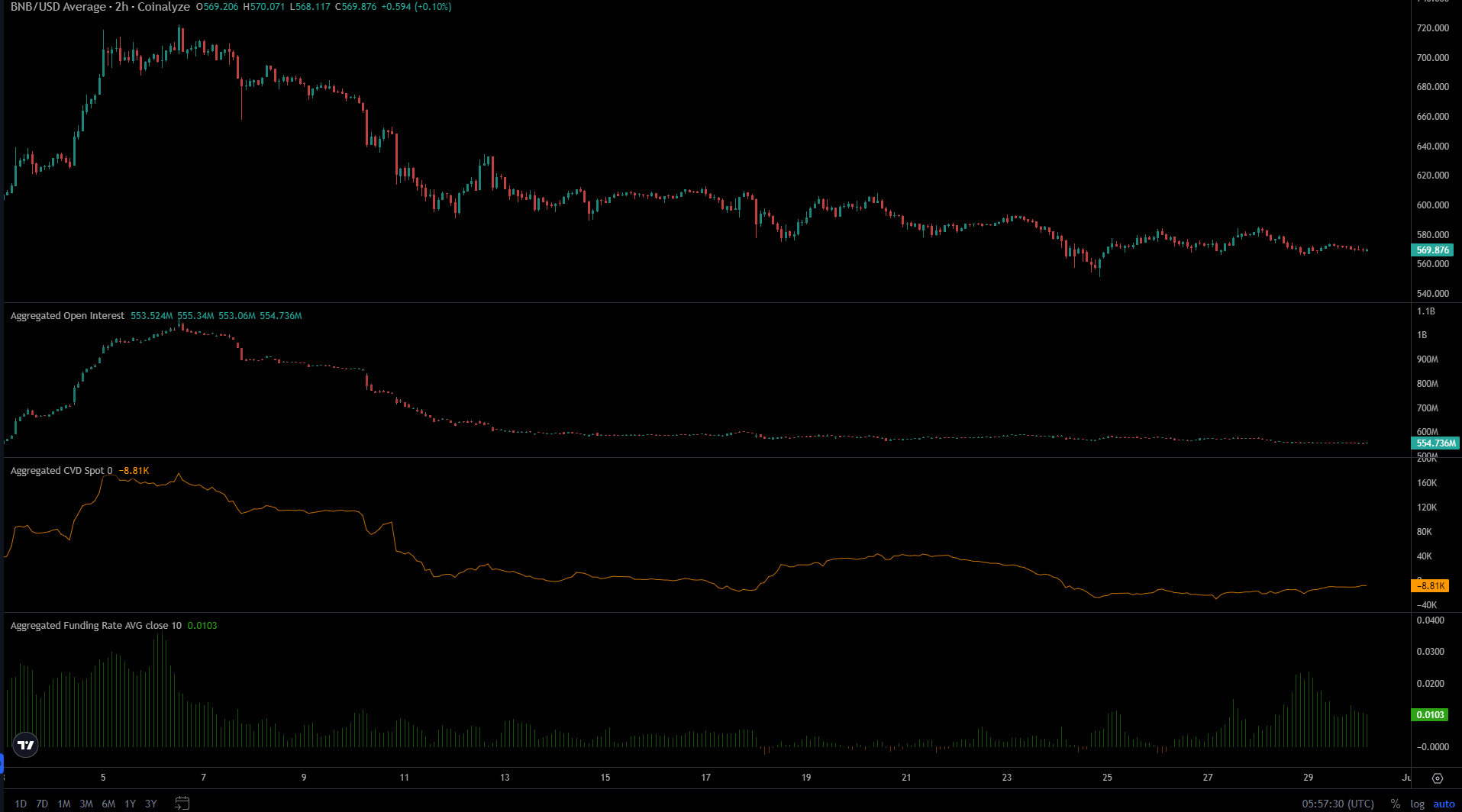

The data from the gift market was also dismal. On the 29th, the mood seemed to be turning bullish, but this was not accompanied by an increase in open interest.

What should traders expect this week as speculators wait for the next trend to take hold?

The retracement to the midpoint was not encouraging.

Source: BNB/USDT on TradingView

In the first week of June, Binance Coin saw a huge rally, reaching a new all-time high of $717. The Fibonacci level was the 23.6% extension and technical resistance, which caused the price to fall.

The previous range high at $635 was expected to halt the decline, but that did not happen. The mid-range level of $570 was tested as support and remained there over the past week.

The daily RSI was at 40, indicating bearish momentum. CMF was -0.05 and has seen strong capital outflows from the BNB market recently. Together they indicated that further losses were likely.

Liquidity in the $550 and $520 areas is likely to drive prices ahead of a bullish recovery.

The slow rise in spot demand was a hopeful sign.

Source: Coinalyze

Since June 6, Open Interest has been trending downward. It plummeted from $1.068 billion that day to $618.2 billion on June 12. This downward trend has continued, with OI at $554 billion at the time of writing.

Read Binance Coin (BNB) Price Prediction 2024-25

A similar trend was seen for spot CVD. An attempt at recovery occurred from June 19 to 22, but faltered due to lack of consistent demand.

Over the past two days, spot CVD has started to rise slowly. Funding ratios have also increased, suggesting that speculators may be turning bullish again.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.