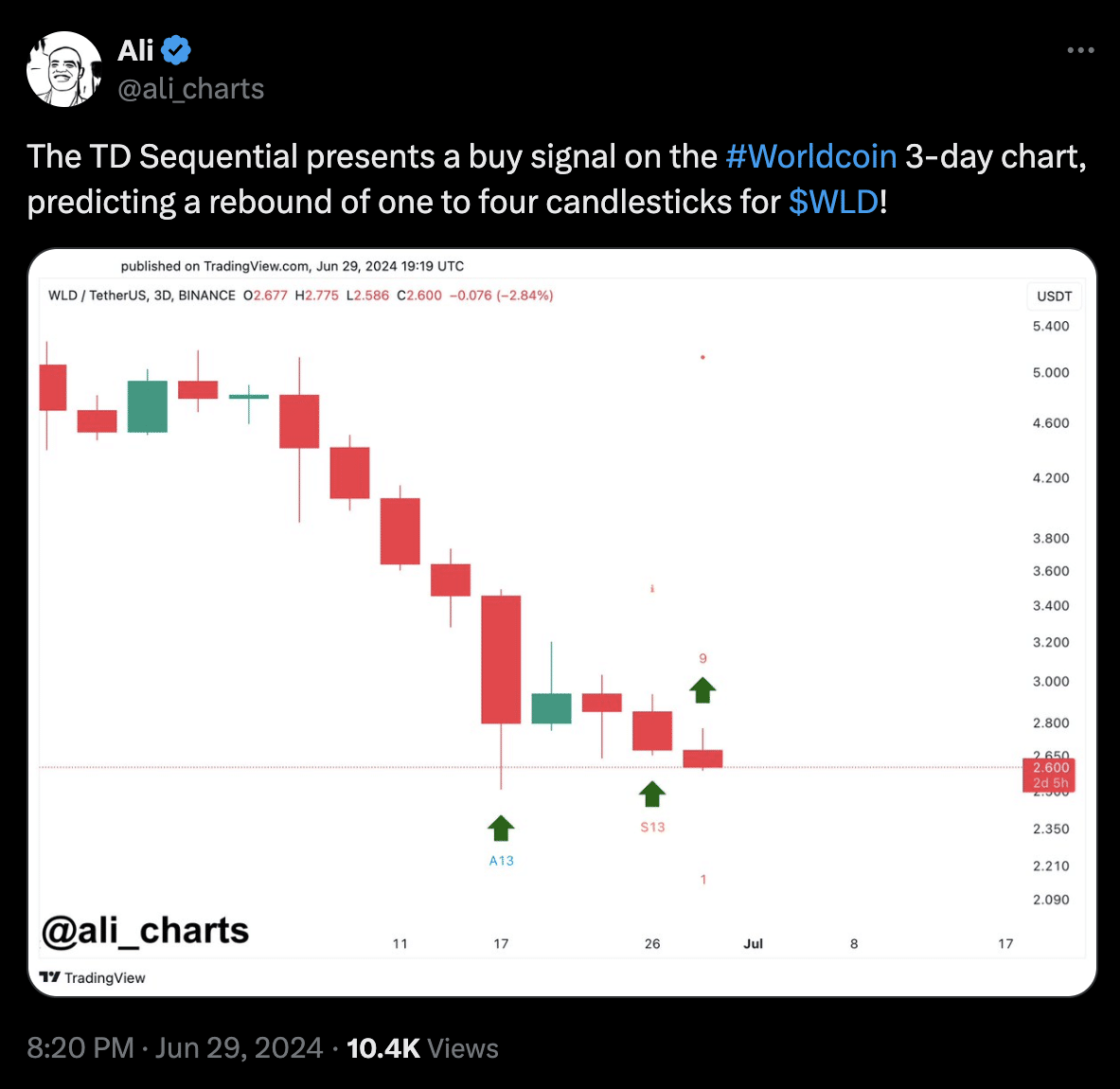

- WLD’s 3-day WLD chart shows that sellers are exhausted and prices are ready for a surge.

- Past analysis of other indicators points to a rally of $3 or more.

WorldCoin (WLD), the native token of the open-source digital identity platform, has shown signs that it is ready to trade at higher prices, crypto analyst Ali Martinez noted in a post on X (formerly Twitter).

According to Martinez, the Tom DeMarc (TD) Sequential flashed a buy signal on WLD’s 3-day chart. TD Sequential is a technical analysis tool that identifies precise periods of trend exhaustion.

This is done by looking at the two-stage setup. One represents nine candlestick stages where you can spot a sell signal after the price has risen. The other is established using a 13 candlestick countdown.

In this case, the buy signal is found after the seller gets tired, which was the case with Worldcoin.

Source: X

At the time of writing, the price of WLD was $2.52, which is up 49.08% over the last 30 days.

Therefore, the signals shown in the technical settings mean that the token may be on the verge of saying goodbye to some of these losses. If this happens, the price of Worldcoin may reach $30.5 as its first target.

Another indicator that can help validate the price increase is the correlation between the cryptocurrency and Avalanche (AVAX). Recently, AMBCrypto explained why the price of AVAX may continue to rise.

In this case, WLD can do the same thing. The evidence reflected in the correlation matrix was 0.96. This correlation matrix ranges from -1 to +1.

-1 or close to it means that the two cryptocurrencies are not moving in the same direction.

However, when the matrix is close to a +1 reading, it indicates a strong directional move. Therefore, a price increase in AVAX and WLD is something that can happen in the short term.

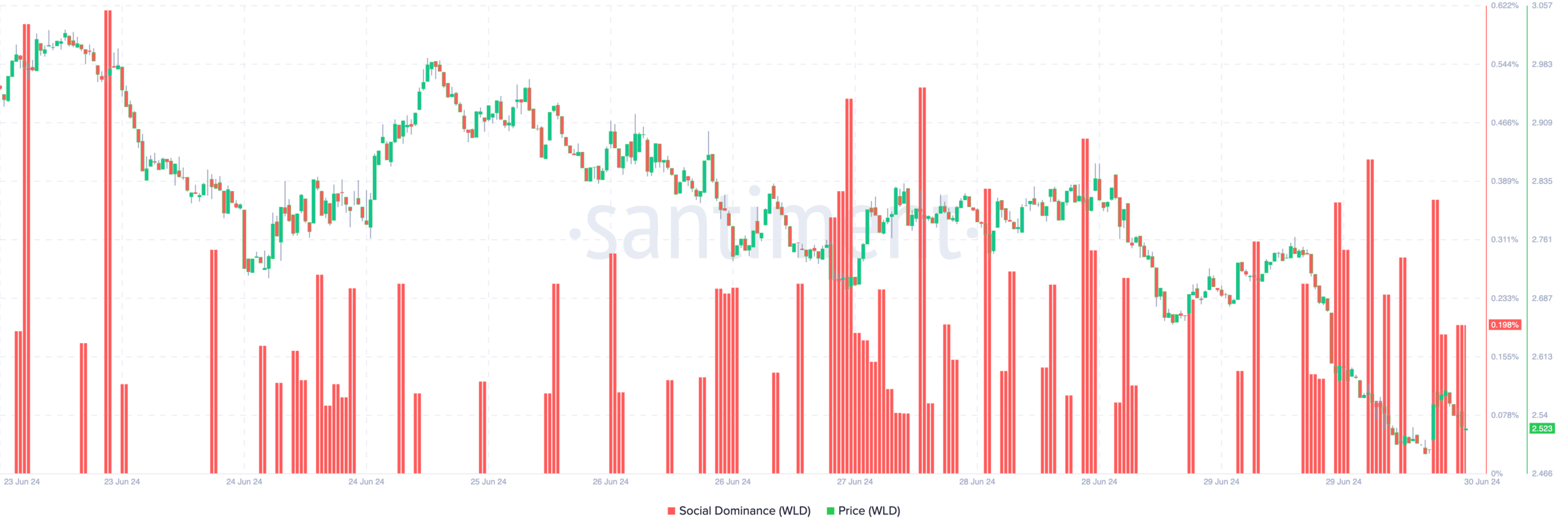

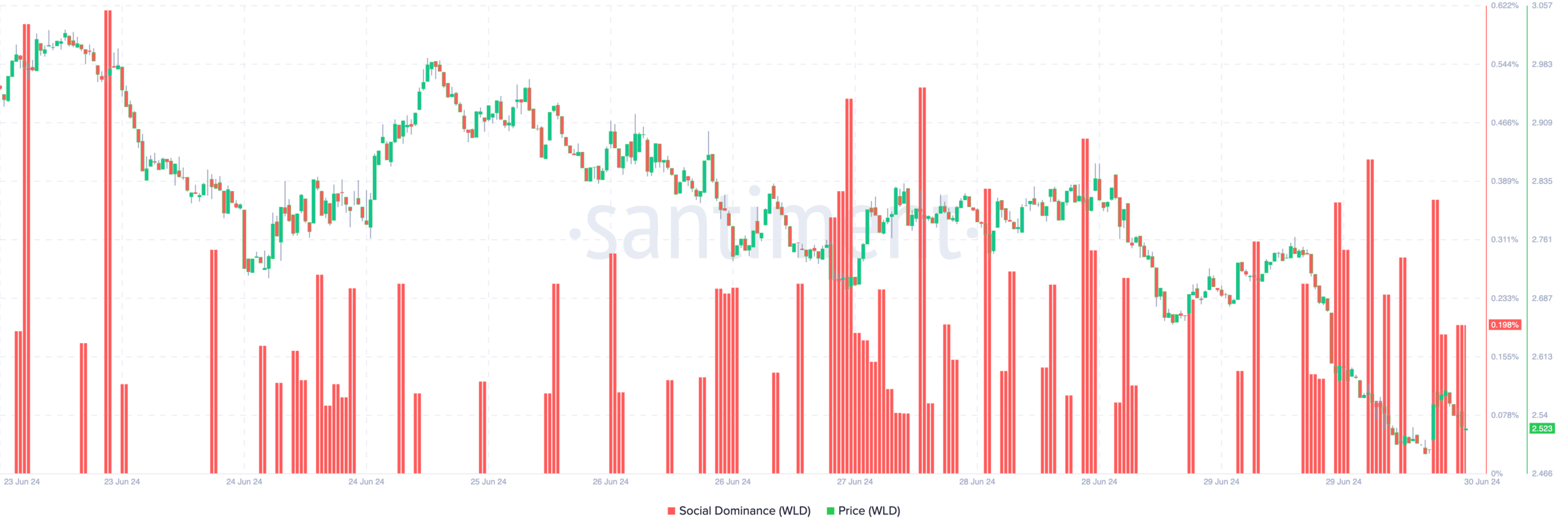

Additionally, we assessed WorldCoin’s social dominance. According to Santiment, WorldCoin’s social dominance jumped to 0.198%.

Social dominance refers to the proportion of discussions in the media that mention a particular asset or phrase. An increase indicates improved discussion about the project.

But the decline in the index means that conversations about the asset are declining. Historically, increased social dominance helps create a buzz that leads to higher demand.

Source: Santiment

Previously, this caused the price of WLD to rise. This may be the case again. Therefore, it may be reasonable to expect a price increase of $3 or more. However, market participants should be careful.

Is your portfolio green? Check out the Worldcoin Profit Calculator

If the discussion about World Coin becomes heated, its social dominance may increase to an extreme degree. This may indicate a local high in the price and hints at a possible correction.

However, if this does not happen, WLD could experience a notable uptick in the coming weeks.