According to on-chain data, long-term Ethereum holders have recently been increasing their total share of the cryptocurrency’s supply.

Currently, Ethereum HODLers hold the majority of the ETH supply.

According to data shared by market intelligence platform IntoTheBlock in a post on X, the supply of long-term Ethereum holders has been increasing recently. “Long-term holders” (LTH), as defined by IntoTheBlock, are ETH investors who purchased ETH more than a year ago.

Statistically, the longer an investor holds a coin, the less likely they are to sell it at any point. Therefore, these LTHs that tend to be long-term holders include those investors who are least likely to sell in the market.

One way to track the behavior of these HODLers is through the total supply they hold. The chart below shows the supply trend for Ethereum since early 2024.

Looks like the value of the metric has been going up over the last few months | Source: IntoTheBlock on X

As you can see in the graph above, Ethereum LTH supply has been on an upward trend so far this year. This increase has continued over the past few weeks, with this indicator rising more sharply than usual.

But the thing to keep in mind is that when this indicator is rising, it doesn’t mean that these HODLers are currently buying. Rather, it means that there was some accumulation a year ago and these coins are now mature enough to be part of the cohort.

Nonetheless, the increase in this indicator is naturally a bullish signal for cryptocurrencies, suggesting that HODLing behavior is on the rise among investors.

Following the recent rally, Ethereum LTH now holds around 78% of the asset’s total circulating supply, meaning that the majority of the supply is currently locked in the hands of these holders who are not readily willing to sell.

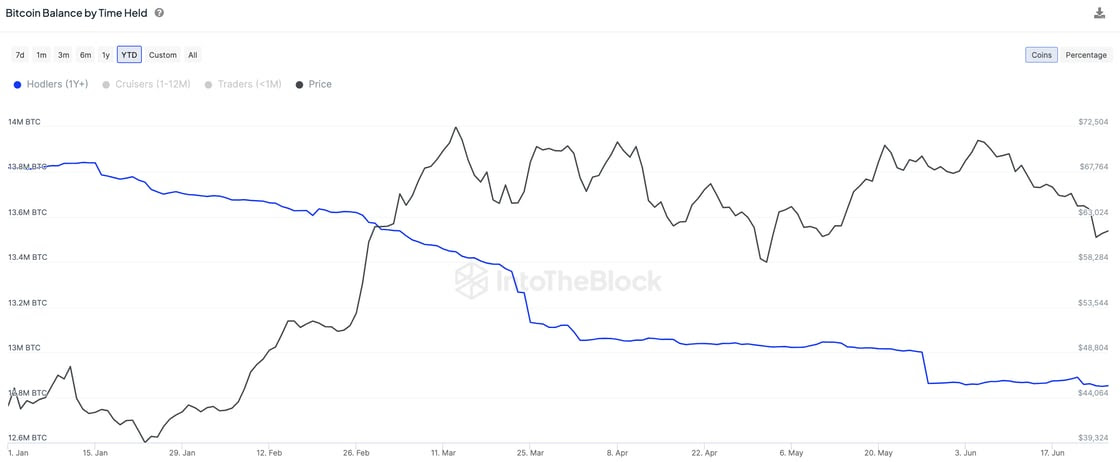

While ETH has seen this bullish development in terms of LTH, this has not been the case for Bitcoin. As the analytics firm points out in another X post, BTC HODLers have been reducing supply throughout the year.

The value of the metric appears to have been going down recently | Source: IntoTheBlock on X

While buying has a one-year delay, selling doesn’t have that weirdness. This is because as soon as the coin is sent to the blockchain, its age is reset to 0 and it is immediately removed from the group.

In May, Bitcoin LTH sold around 160,000 BTC, which is worth a whopping $10.1 billion at current exchange rates. However, sales slowed down last month, with around 40,000 BTC distributed, worth $2.5 billion.

ETH Price

At the time of writing, Ethereum is trading around $3,500 and is up more than 5% over the past seven days.

The price of the asset seems to have been on the rise over the last day or so | Source: ETHUSD on TradingView

Dall-E, Featured image from IntoTheBlock.com, Charts from TradingView.com