- Bitcoin’s plunge below $59,000 triggered significant market liquidations, particularly affecting altcoins.

- Analysts advise to pause altcoin accumulation due to current market uncertainty and weak signals.

In a dramatic 24-hour period, global cryptocurrency markets plunged 4.7% as the price of Bitcoin (BTC) fell below the crucial $59,000 mark.

This downtrend spread across the market and had a serious impact on altcoins.

While Bitcoin struggles to hold its ground, the altcoin sector’s market cap has fallen significantly, from $1.3 trillion at the start of the month to $953 billion at the time of writing.

Bitcoin’s recent drop below $59,000 signals a significant turning point in the cryptocurrency market, reflecting overall uncertainty and triggering widespread selling.

The downtrend has raised doubts about the continued health of the bull market, and Bitcoin has tested support levels several times, an indicator of potential market weakness.

On Crypto Banter’s “The Ran Show,” analysts say: Highlighted The fact that Bitcoin is teetering on the lower end of its trading range suggests that repeated tests of this level could signal an impending market shift.

Stay away from altcoins

In this turbulent market environment, experts advise investors to be especially cautious about altcoins.

Recent patterns and market data suggest that altcoins, which have been significantly impacted by Bitcoin’s long-term price correction, are experiencing a cooling period.

Analysts at Crypto Banter noted that while altcoins typically have recovery periods, the current market conditions are not conducive to an immediate rebound.

Citing PENDLE as an example, the analyst said the altcoin experienced a notable downturn due to external market pressures rather than protocol issues, showing that altcoin investments can be volatile in uncertain times.

Analysts advise focusing on robust on-chain data and avoiding being swayed by fleeting social media trends.

Crypto Banter analysts also noted FTX’s recent moves, which could potentially return more funds to users than initially lost, hinting at a positive turnaround in market liquidity that could support a recovery.

The analyst highlighted Bitcoin’s long-term value proposition despite short-term volatility, comparing its market cap growth to major financial institutions and traditional assets like gold.

Solana: A Case Study on Volatility

While analysts have advised caution on altcoins, it makes sense to look at Solana (SOL), the third-largest altcoin on the market, as a concrete example of how a market downturn can impact altcoins.

Solana was heavily affected. In the last 24 hours alone, the price of SOL fell 7.3%, trading at $134.83 at the time of writing. This decline was due to a short spike related to: Expectations for a potential ETF.

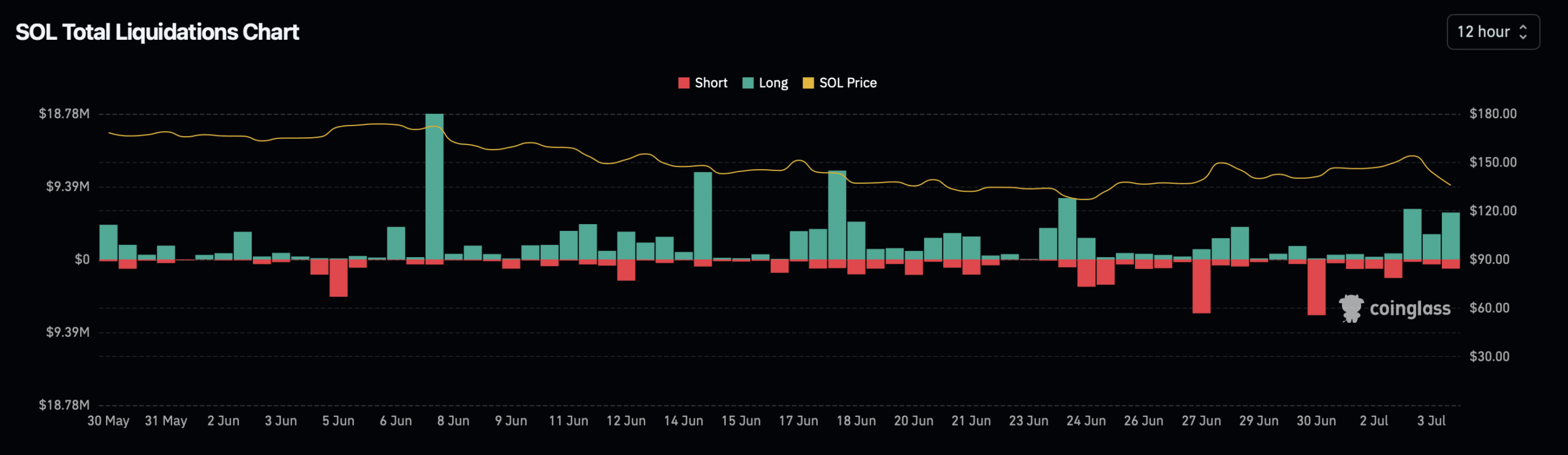

The decline in Solana’s value has had a significant impact on traders. CoinglassOver the past day, 106,449 traders faced liquidations totaling $289.26 million.

Of these, Solana-related liquidations amounted to approximately $12.55 million, mainly from long positions. Specifically, Solana long liquidations amounted to $10.76 million, while short positions amounted to $1.8 million.

Source: Coinglass

Read our Bitcoin (BTC) Price Prediction 2024-25

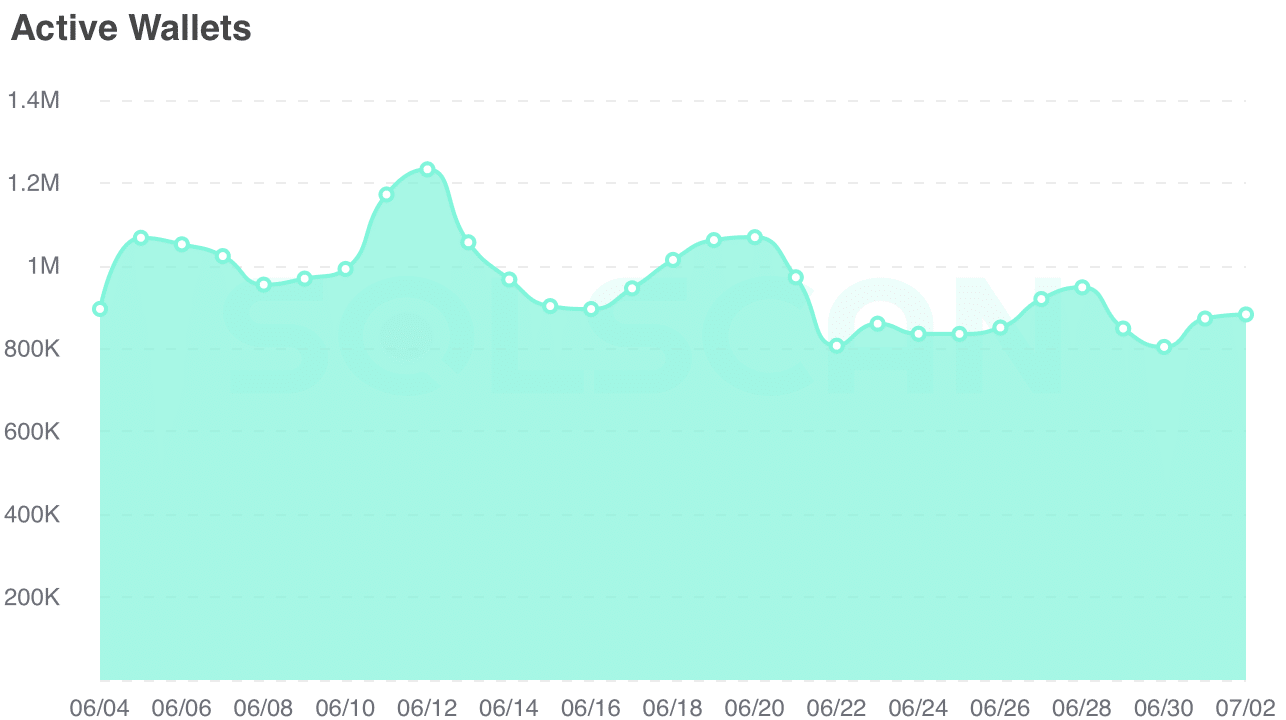

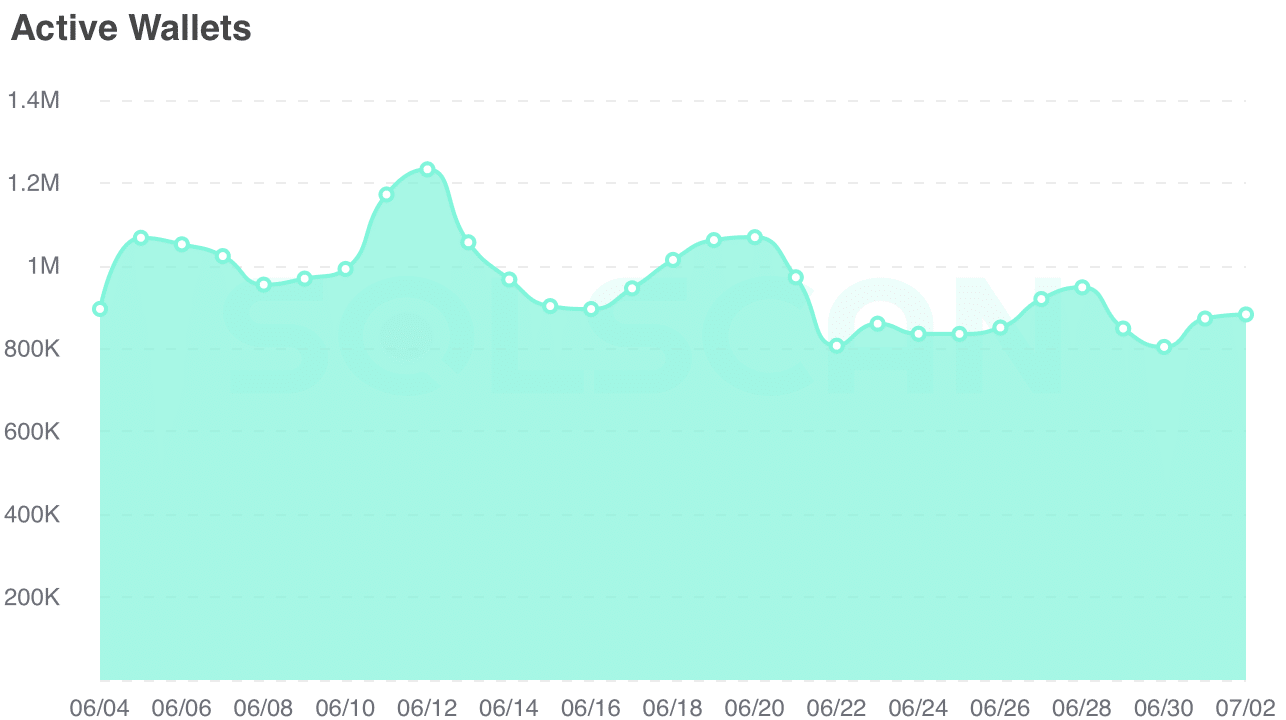

The recession appears to be affecting Solana’s on-chain activity. AMBCrypto’s view Soul Scan Indicates that the number of active addresses has decreased significantly.

The number of addresses, which had been over 1.2 million last month, has fallen to 882,000 at the time of writing, showing that user participation is decreasing in the current market situation.

Source: Solscan