- According to the data, XRP whales did not participate in the overall market sell-off.

- Long-term holders also refrained from selling, suggesting that the token price could rebound.

Despite the market being so depressed, Ripple (XRP) whales decided not to fan the flames. Instead, they decided to buy more tokens.

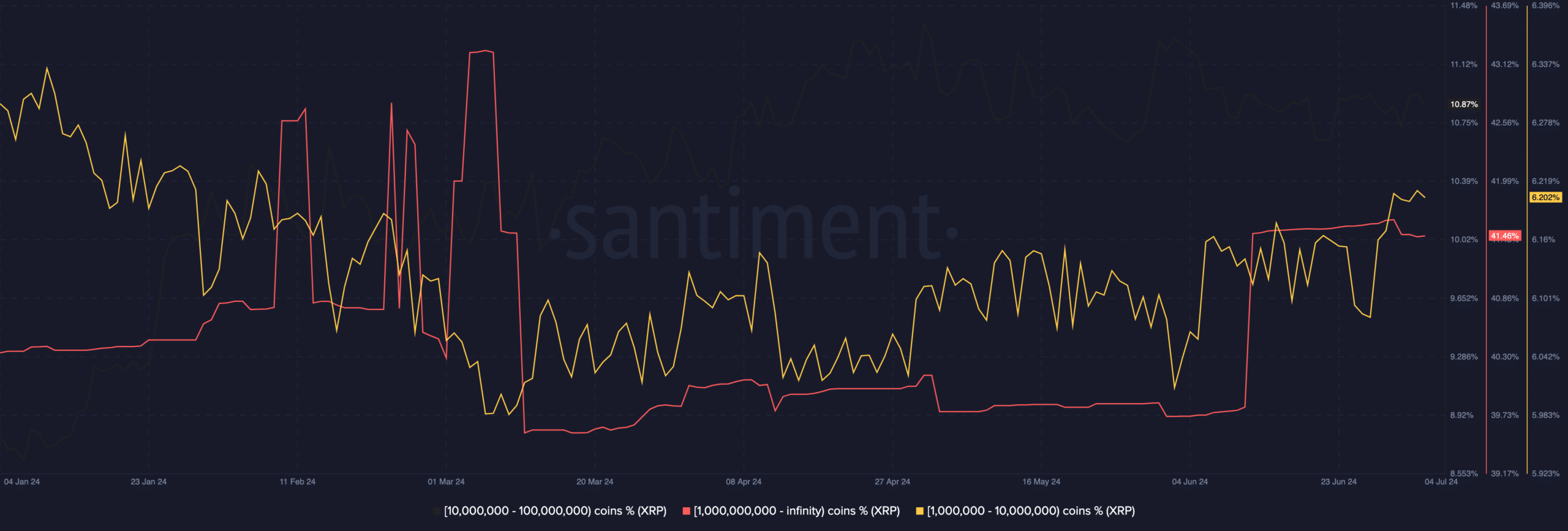

According to Santiment, addresses holding more than 1 billion XRP tokens accounted for approximately 39.81% of XRP holders in mid-June. However, at the time of writing, that percentage had increased to 41.46%.

Big business provides an escape route

For the group of 1 million to 1 million, the balance increased from 6.08% to 6.20%. Whales are entities that hold large amounts of cryptocurrency. Therefore, their actions have a significant impact on the price.

When something like the recent accumulation happens, prices stabilize in a downtrend, and in some cases bounce back.

Source: Santiment

At the time of writing, the price of XRP was $0.43, which is down 6.52% in the last 24 hours. However, due to recent whale activity, the price is likely to stabilize around the mentioned price or head towards $0.45.

However, it is important to note that whale accumulation alone will not be enough to stop the price from falling. As a result, at AMBCrypto we decided to evaluate what else is happening on the chain ourselves.

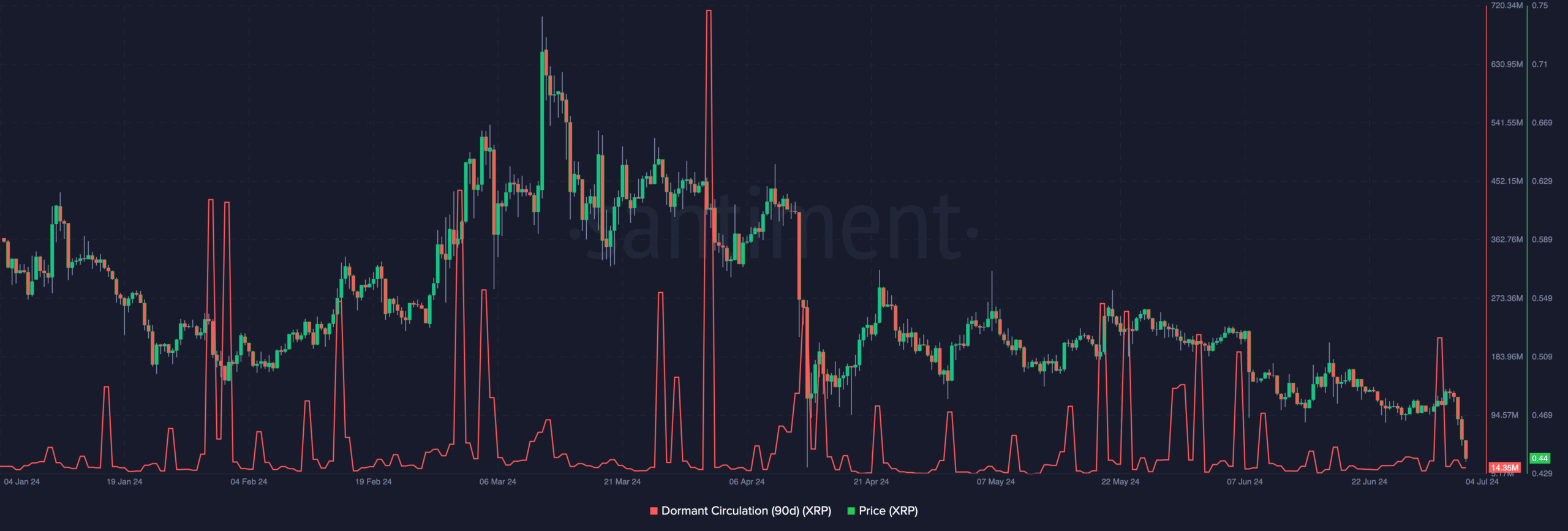

One of the metrics we looked at was dormant circulation, which tracks how quickly long-held tokens engage in trading activity.

As the dormant circulation increases, it means that older tokens are moving from their own custody to active trading. When this happens, it means that token holders are ready to sell.

XRP price expected to rise above resistance line

This has resulted in a price drop. However, the opposite happens when the dormant circulation is low, which was the case at the time of writing. On July 1, XRP’s 90-day dormant circulation skyrocketed.

However, at the time of writing, this has decreased to 14.35 million. This decrease suggests that long-term holders of the token have not moved their assets from cold wallets.

If this price continues, XRP could avoid another crash as initially mentioned.

Source: Santiment

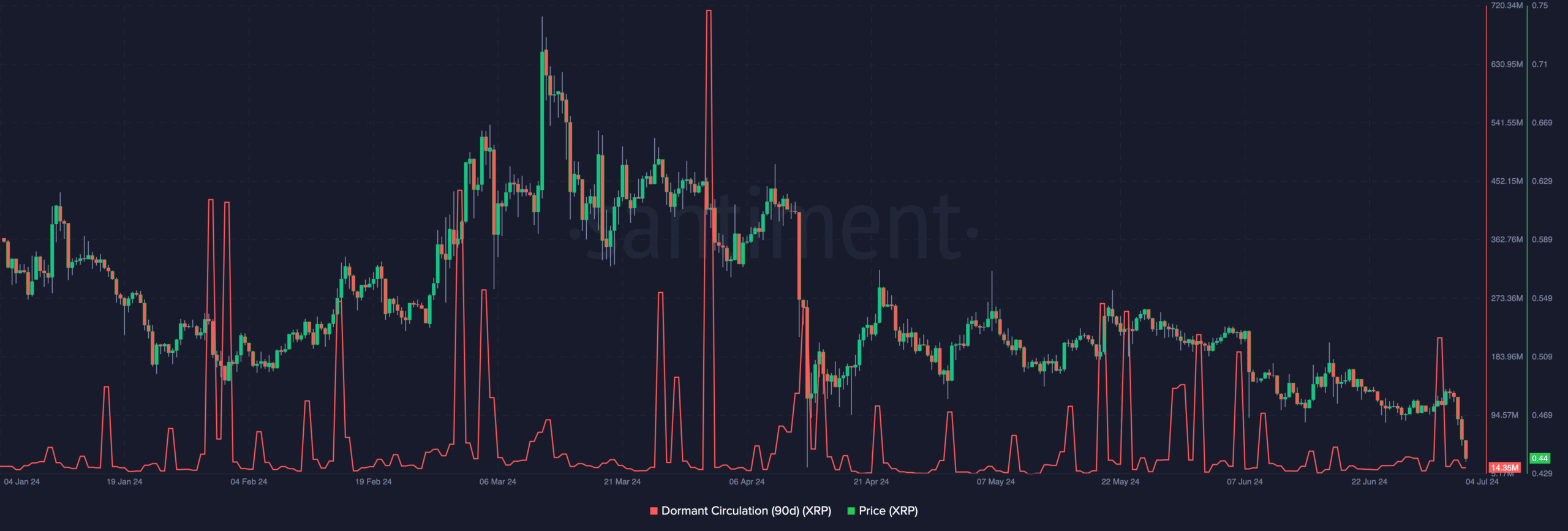

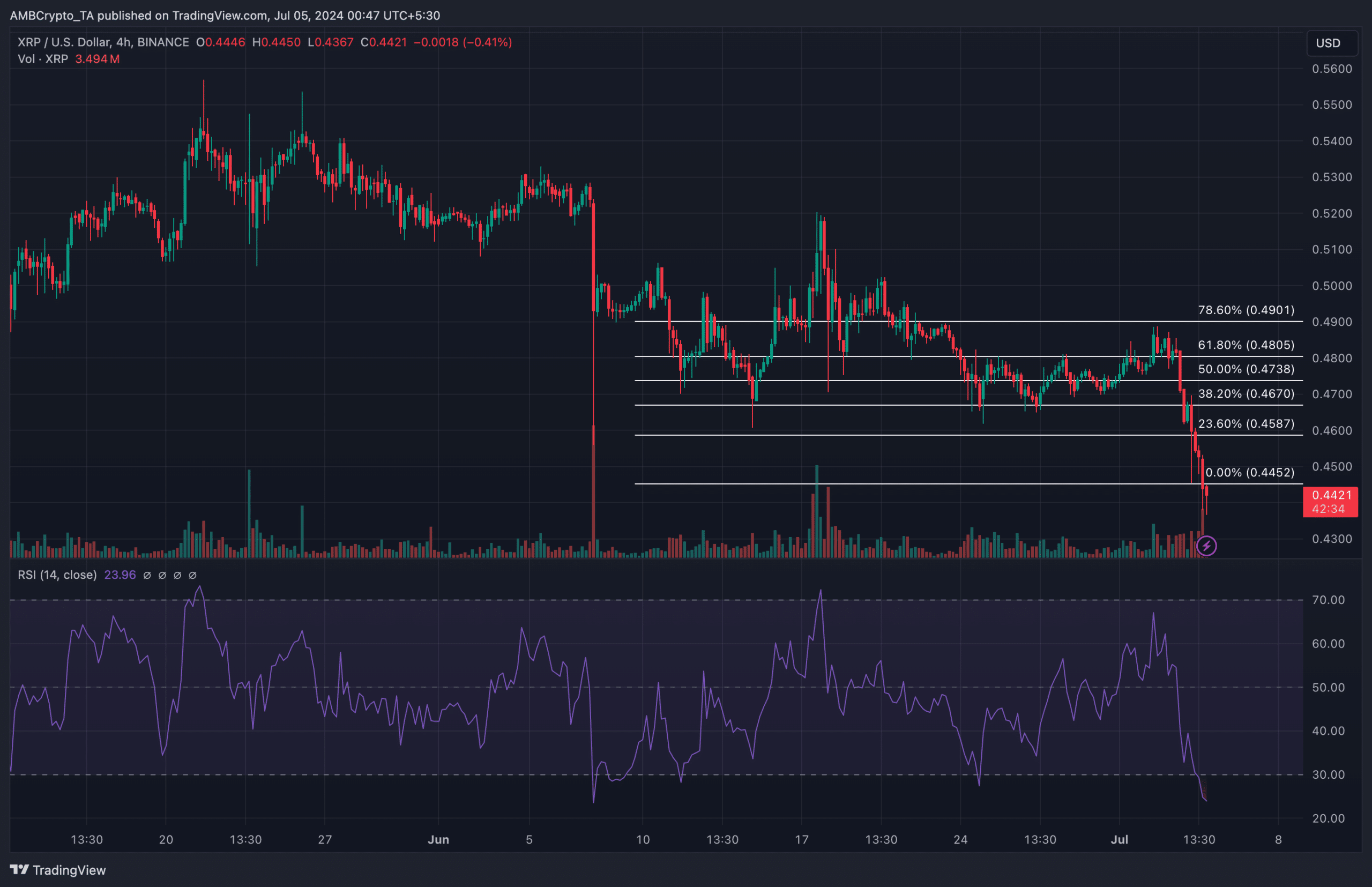

We also analyzed the potential of XRP from a technical perspective. According to the daily chart, the Relative Strength Index (RSI) was at 23.96. RSI measures momentum using the magnitude of price changes.

A reading above 70 indicates that the asset is overbought. However, anything below this indicates oversold conditions.

Therefore, XRP was oversold, indicating that the price could be on the verge of a bounce. To identify possible targets, AMBCrypto looked at the Fibonacci correction indicator, which identifies potential support and resistance levels.

Source: TradingView

Read our Ripple(XRP) Price Prediction 2024-2025

As you can see in the chart above, if XRP bounces off the lows, the price could reach the 23.6% Fibonacci level at $0.45.

However, if selling pressure builds and whales join in, this prediction could be invalidated.