- KAS has fallen 11.80% over the last 7 days.

- Despite the downward trend, the trend is still up.

On June 30, KAS surged 20% in a matter of days, as reported by AMBCrypto. However, a week later, KASPA fell 11.80%, causing panic among long-term KASPA holders.

Despite the decline, the market is optimistic with positive market sentiment. Therefore, various analysts are predicting a surge in market cap. KAS market cap has surged over the past 30 days, outpacing PEPE and ICP.

Cryptocurrency analyst @Sukie shared her predictions for X (formerly Twitter), saying:

“$KAS reaching $100B+ MC is not about being a moon boy. In 2017, bull $XRP reached $130B when there was much less money in the market. The last bull run $BNB went from $3B to $108B MC. No other crypto can beat Kaspa’s fundamentals.”

Historical data suggests that KAS is positioned to experience exponential growth in market cap. Market cap growth generally means that KAS price and user activity will continue to surge in the near future.

Market sentiment

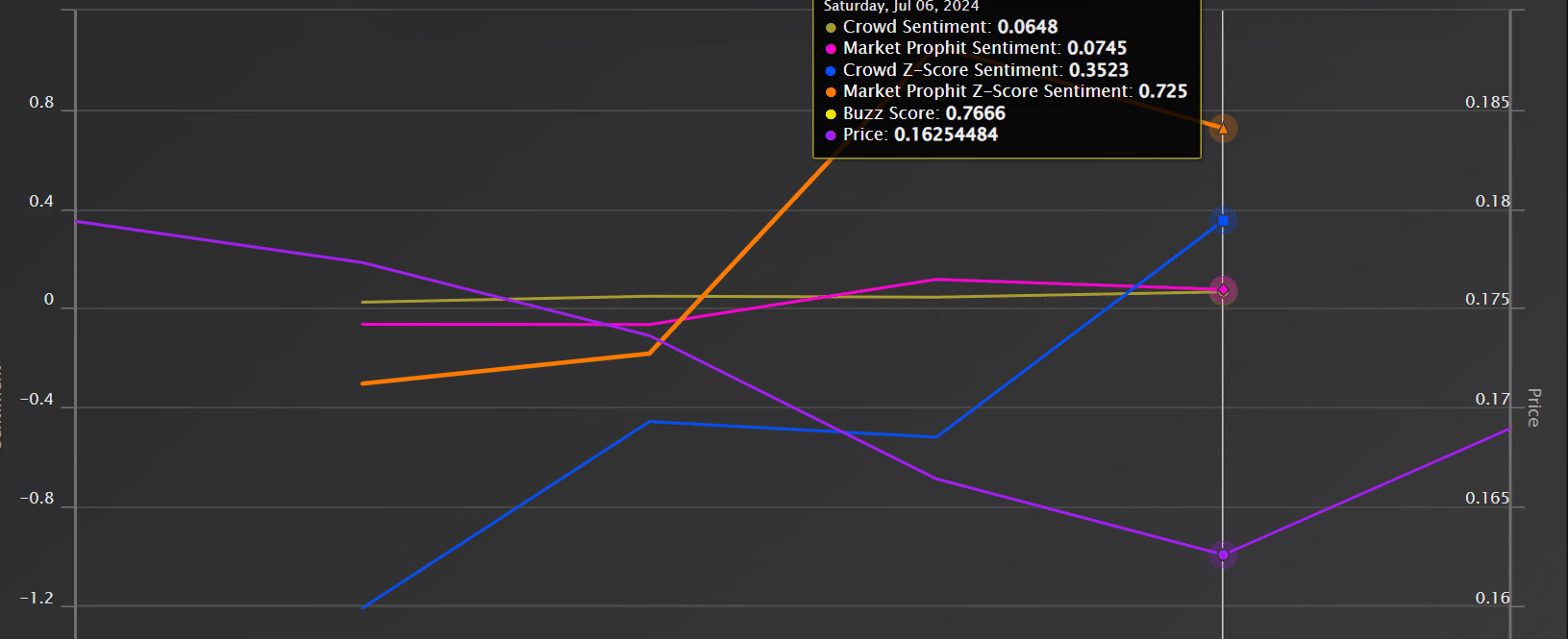

Source: Market Prophit

According to Market Prophit, KASPA continues to enjoy positive market sentiment.

In fact, the crowd sentiment is 0.06 and the Z-score is 0.35, while the overall market sentiment is 0.07. The positive market sentiment shows that users and investors are optimistic about the future potential of KASPA.

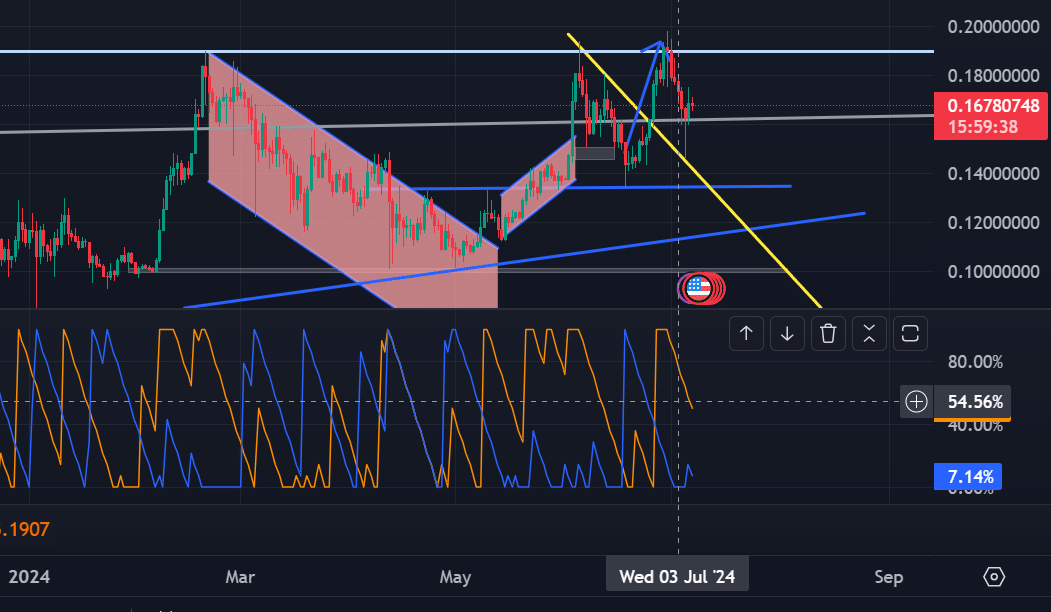

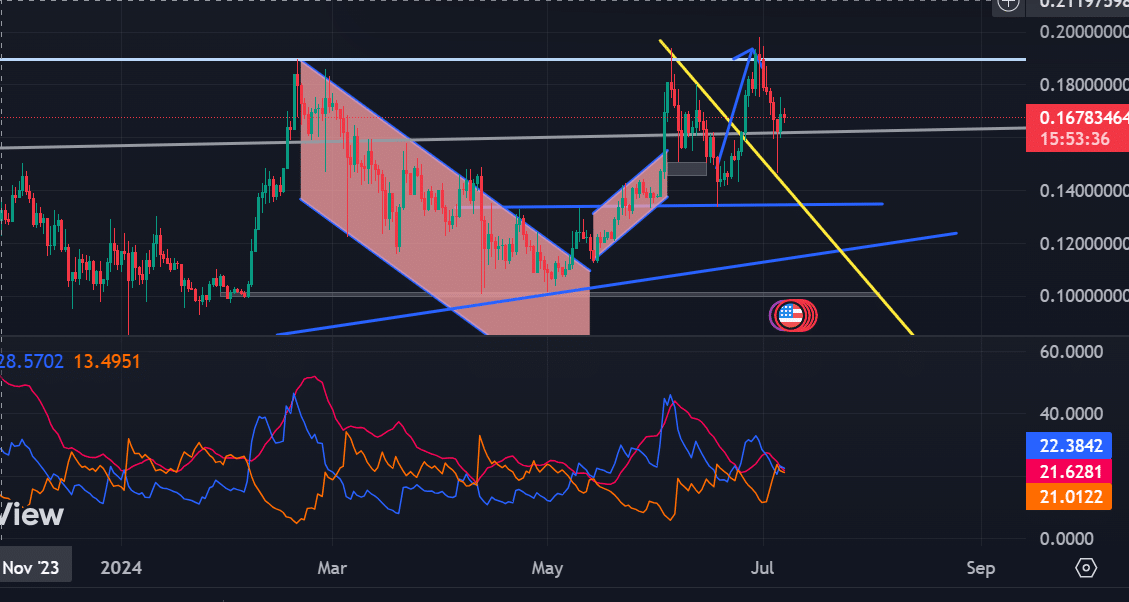

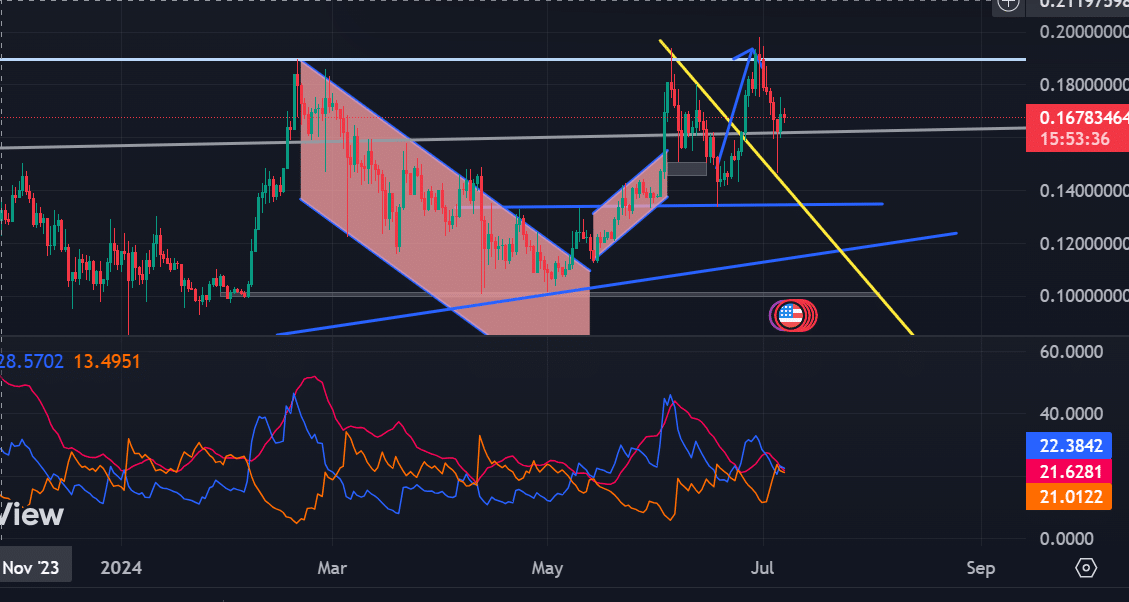

What the KAS price chart shows

At the time of writing, the Aroon line of KAS is in a strong uptrend. Specifically, the Aroon rising from 50 is above the Aroon falling from 7.

When the Aroon lines are set up like this, the uptrend is strong and likely to continue. Likewise, it shows that the price is within market value.

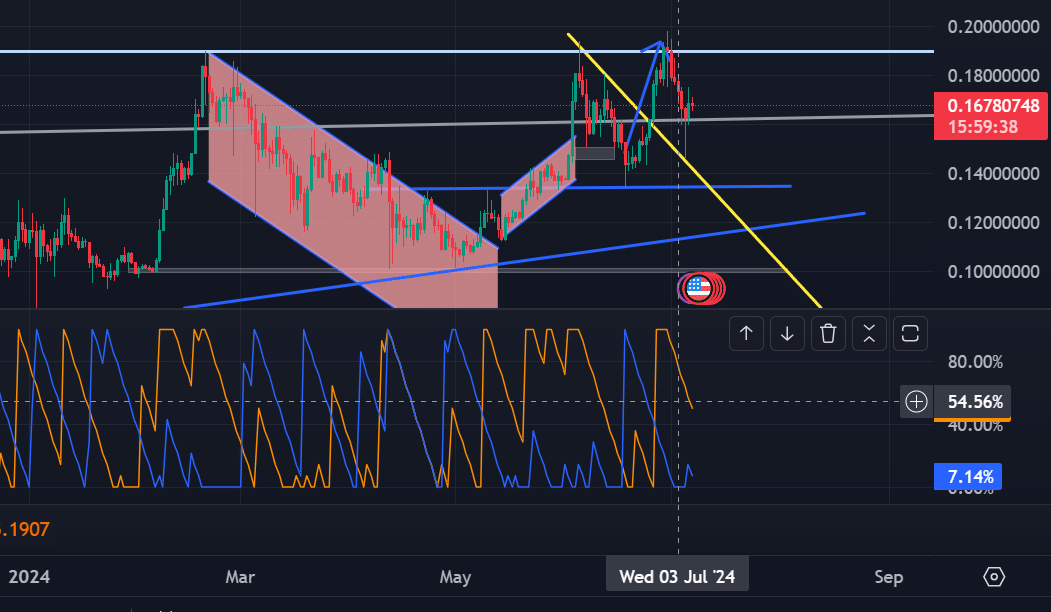

Source: Tradingview

The Directional Movement Index further supports this: at the time of writing, the positive index of 22 (blue) is higher than the negative index of 21 (red).

These settings mean that KASPA is well positioned, and continued positive market sentiment is expected to drive further uptrends.

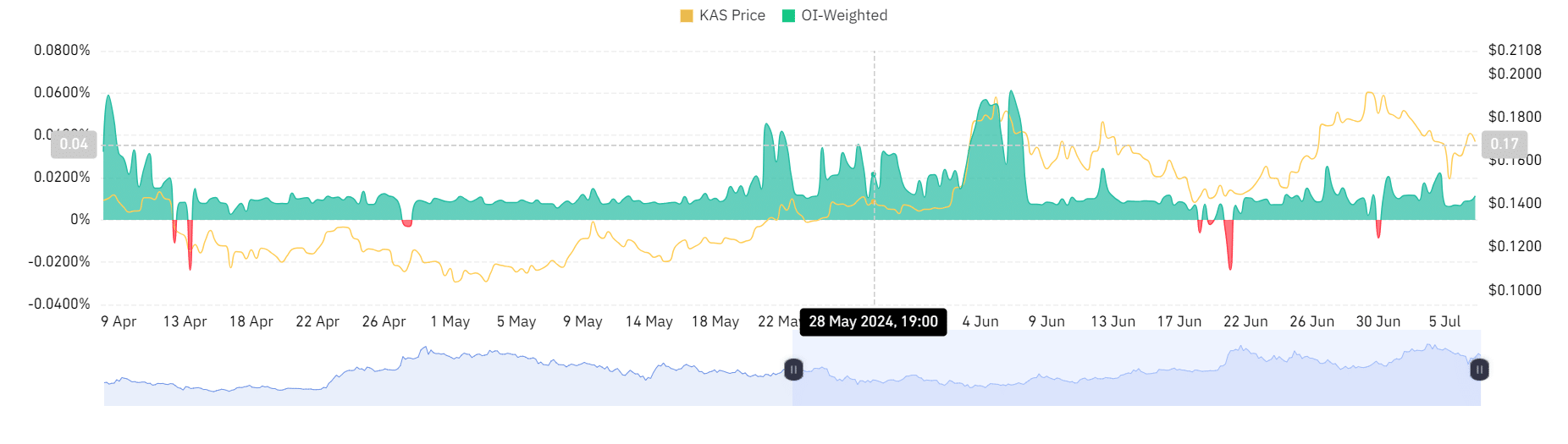

Source: Tradingview

Looking at the OI weighted funding ratio, it has been generally positive over the past seven days, according to AMBCrypto’s analysis.

A positive weighted funding ratio means that there is more demand for long positions than for short positions, so traders pay a premium to hold positions, which is bullish sentiment.

Source: Coinglass

Can KAS maintain its upward trend?

According to Kaspa analysis by AMBCrypto, the price action is largely in an uptrend. KAS reached an all-time high of $0.194 and then saw a short-term price decline, but the trend remained unchanged.

At the time of writing, KAS is trading at $0.1688 after a 24-hour gain of 1.64%. Having previously reached the $0.194 resistance level, a break from this area would see the price surge to a new all-time high of $0.23.

Therefore, if losses continue on the weekly chart, the price may decline to the support level of $0.15.