- Long-term holders had low confidence in ARB.

- ARB rose 6% and most market indices were bullish.

Last month was a bloody battle for several cryptocurrencies, including: Arbitrage (ARB), Because it lost a significant amount of value, all ARB investors were forced out of the business.

However, there has been a slight uptick over the past 24 hours. Could this change investors’ market position?

Arbitrum’s risk status

CoinMarketCap’s data Arbitrum’s price has dropped by more than 25% in the past month, IntoTheBlock, meanwhile, posted a tweet highlighting the surprising event.

Depending on the Twitter, At the time of writing, 0% of ARB investors had “made a profit.”

AMBCrypto’s analyze ARB’s breakeven price was found to be $0.67-$0.74, meaning that most investors bought the token at a price higher than the aforementioned levels.

In fact, investors who held ARB for 1-2 months were much more numerous than long-term holders who held tokens for more than a year, reflecting the low confidence of long-term investors.

Source: IntoTheBlock

However, there have been signs of recovery over the past 24 hours, and if this continues, some investors could see profits. The token price has surged by more than 6% over the past day.

At the time of writing, ARB was trading at $0.7197 and had a market cap of over $2.32 billion, making it the 34th largest cryptocurrency.

Will ARB continue to outperform?

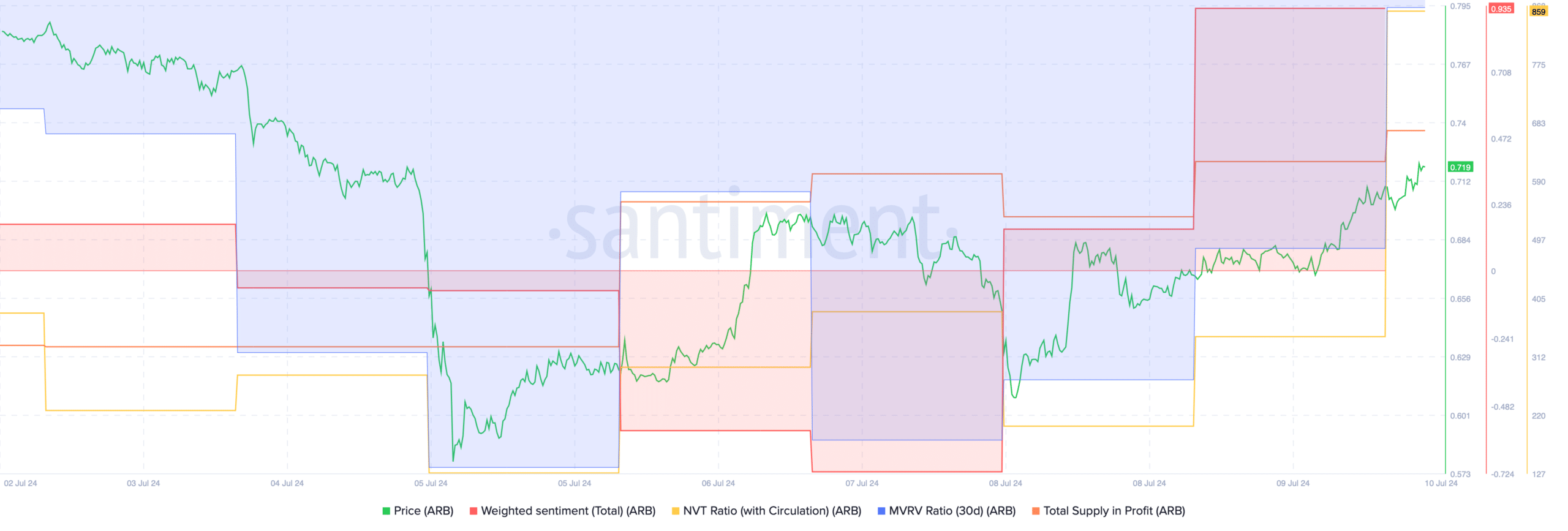

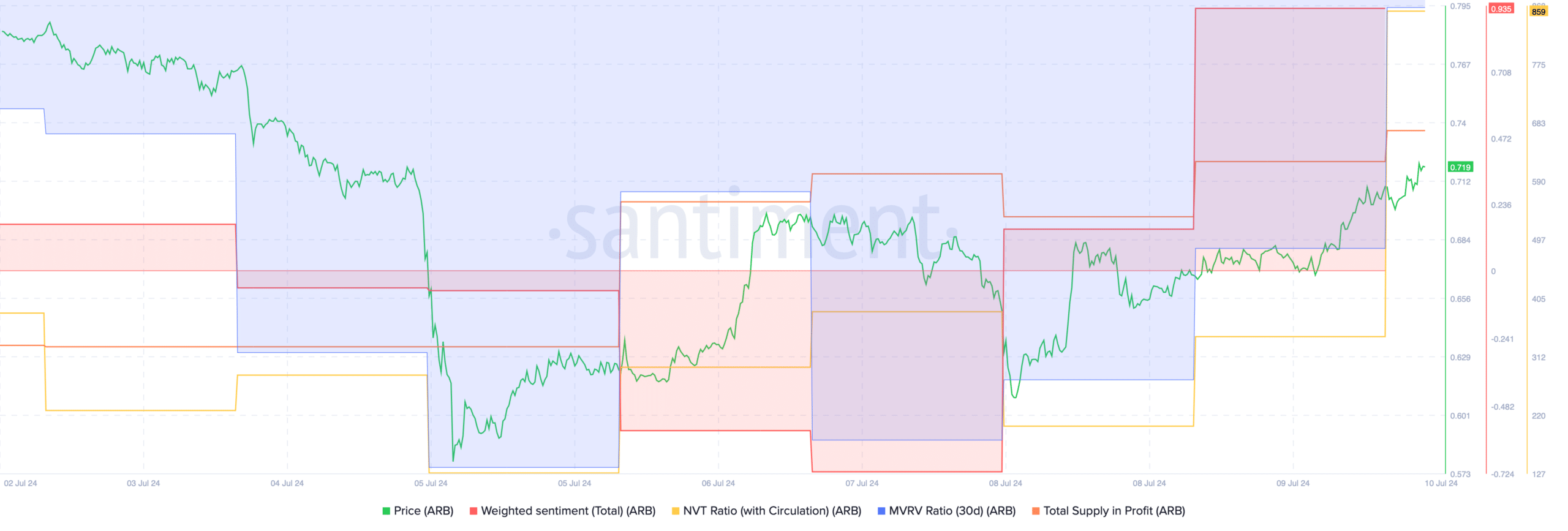

Since the last 24 hours have been favorable for investors, AMBCrypto planned to analyze the token’s on-chain data to determine the probability that ARB will continue its upward trend.

According to our analysis of Santiment’s data, Arbitrum’s weighted sentiment has improved dramatically over the past few days, clearly indicating that bullish sentiment surrounding the token is dominant in the market.

ARB’s profit supply also increased last week due to the recent price increase. Another bullish signal was the improved MVRV ratio on July 9.

Nevertheless, the NVT ratio surged. A rise in the indicator means that the asset is overvalued, which suggests that a price correction is likely in the coming days.

Source: Santiment

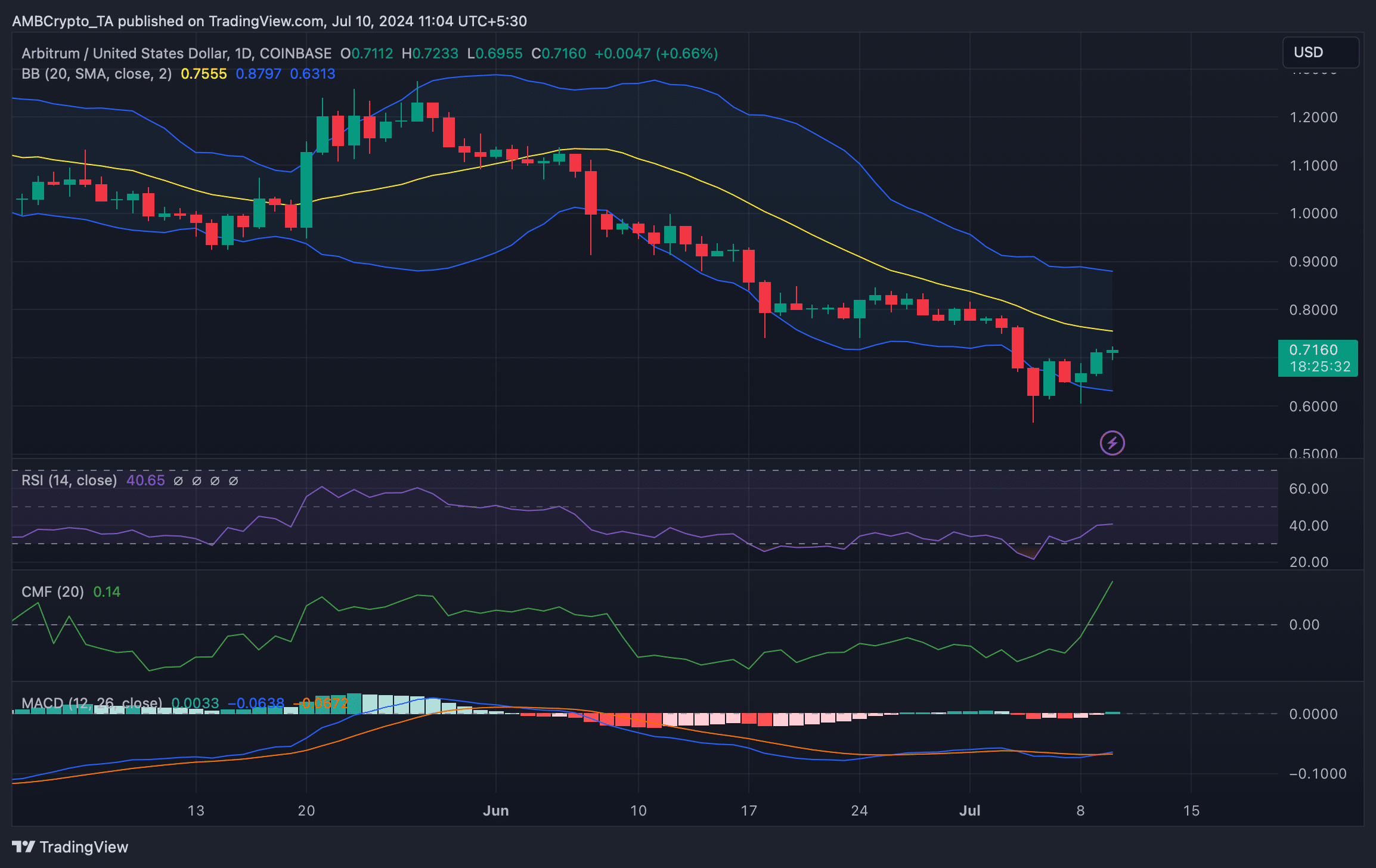

I then checked the daily chart of the token to get a better idea of which direction it was heading. It was notable that most market indicators were bullish on the token.

For example, Chaikin Money Flow (CMF) has seen a sharp rise.

Realistic or not, here it is. ARB’s market cap in BTC terms

The Relative Strength Index (RSI) moved north. The MACD for ARM showed a bullish crossover. All of this suggests a continued price rally.

Additionally, the ARB price has reached the lower limit of the Bollinger Bands, which usually leads to a price bounce.

Source: TradingView