As the launch of a spot Ethereum ETF nears completion, there are a number of predictions emerging, some of which are bearish on the price of ETH, while others are betting on a parabolic rally.

One of the many predictions that caught BeInCrypto’s attention was the potential for ETH to replicate the performance of Bitcoin (BTC).

Could a 200% increase be possible due to Ethereum whales changing positions?

On July 9, an anonymous analyst from X Follis posted that an Ethereum ETF could move altcoin prices in a similar way to Bitcoin’s performance between 2023 and 2024. During that time, Bitcoin surged from $26,000 to reach an all-time high of $73,750.

“An Ethereum ETF is about to launch and the ETH chart looks exactly like BTC before its +200% surge last year,” Police shared.

At the time of writing, ETH is trading at $3,108. According to traders, the price of ETH will reach $9,324 in a year or so.

It’s not impossible, but it would require a surge in demand for the prediction to come true.

However, Spot On Chain revealed that whales withdrew $50.3 million worth of ETH in the early morning hours of July 10. The on-chain data provider notes that this is the first significant accumulation since speculation about the impact of Ethereum ETH began.

Read more: How to Invest in Ethereum ETFs

This accumulation contrasts with the situation a few days ago when whales sold off $12 million worth of altcoins. Furthermore, data from Glassnode shows that Ethereum whales have left circulation and are now buying cryptocurrencies in large quantities.

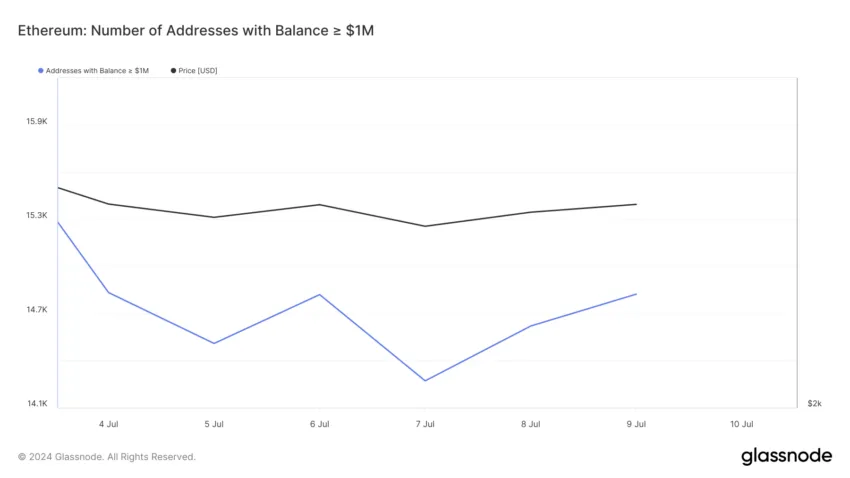

The number of addresses holding more than $1 million in ETH is evidence of this behavior. On July 7, this indicator was at 14,217. However, as of this writing, this number has increased to 14,823, reflecting increased demand for cryptocurrencies and optimism about the approval of a spot Ethereum ETF.

ETH Price Prediction: Almost Like BTC, But Not Exactly

Compared to BTC, the price of ETH has experienced a bigger correction. From May 28 to July 9, the price of Ethereum has fallen by 24.65%.

On the other hand, Bitcoin fell by 19.43%, showing that Bitcoin still outperformed ETH despite the bullish signals.

However, historically, deeper corrections provide opportunities for higher prices. Interestingly, the daily ETH/USD chart shows a double bottom formation of such an effect.

A double bottom pattern occurs when two lows form near similar rectangular price levels, indicating a potential bullish reversal.

Before the Ethereum ETF incident, the last time the cryptocurrency formed a similar pattern was in January 2024. Three months later, the ETH price rose 81.94% to $4,067.

If something similar happens, the price of ETH will be trading around $5,625 by the end of September. However, if the bulls defend ETH at $2,934, the short-term outlook for the token will remain bullish.

Read more: Ethereum ETF Explained: What It Is and How It Works

If this is true, ETH could enter the $3,555 resistance zone. Additionally, if an Ethereum ETF is launched in the next week or two, the price of this altcoin could attempt to break $3,758.

However, if ETH faces a bearish market with little positivity after the launch of its financial product, the price may fall.

disclaimer

In accordance with the Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without prior notice. Always conduct your own research and consult with a professional before making any financial decisions. Please be advised that our Terms of Use, Privacy Policy and Disclaimer have been updated.