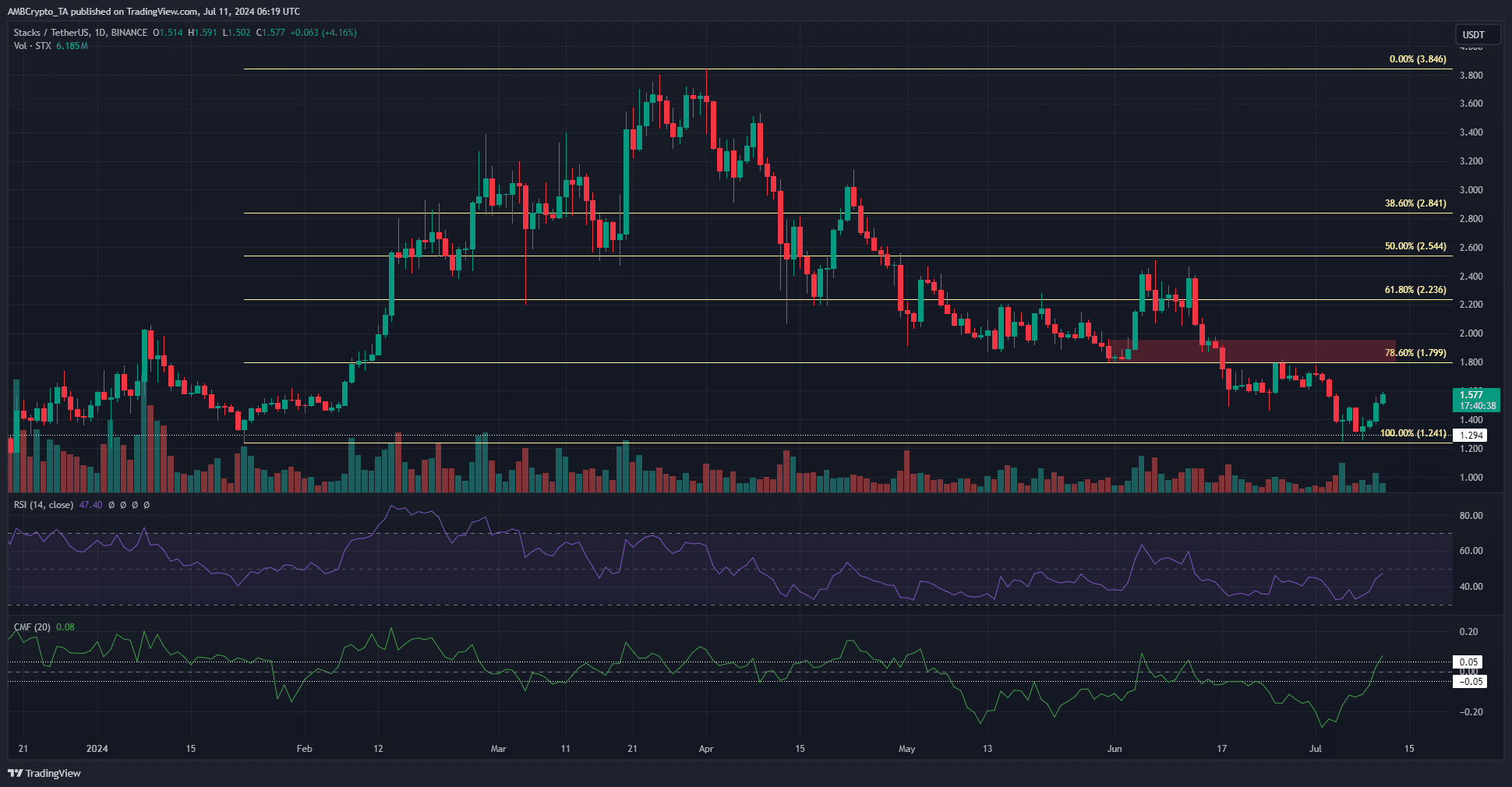

- The long-term structure is down, with $2 being a key psychological resistance level.

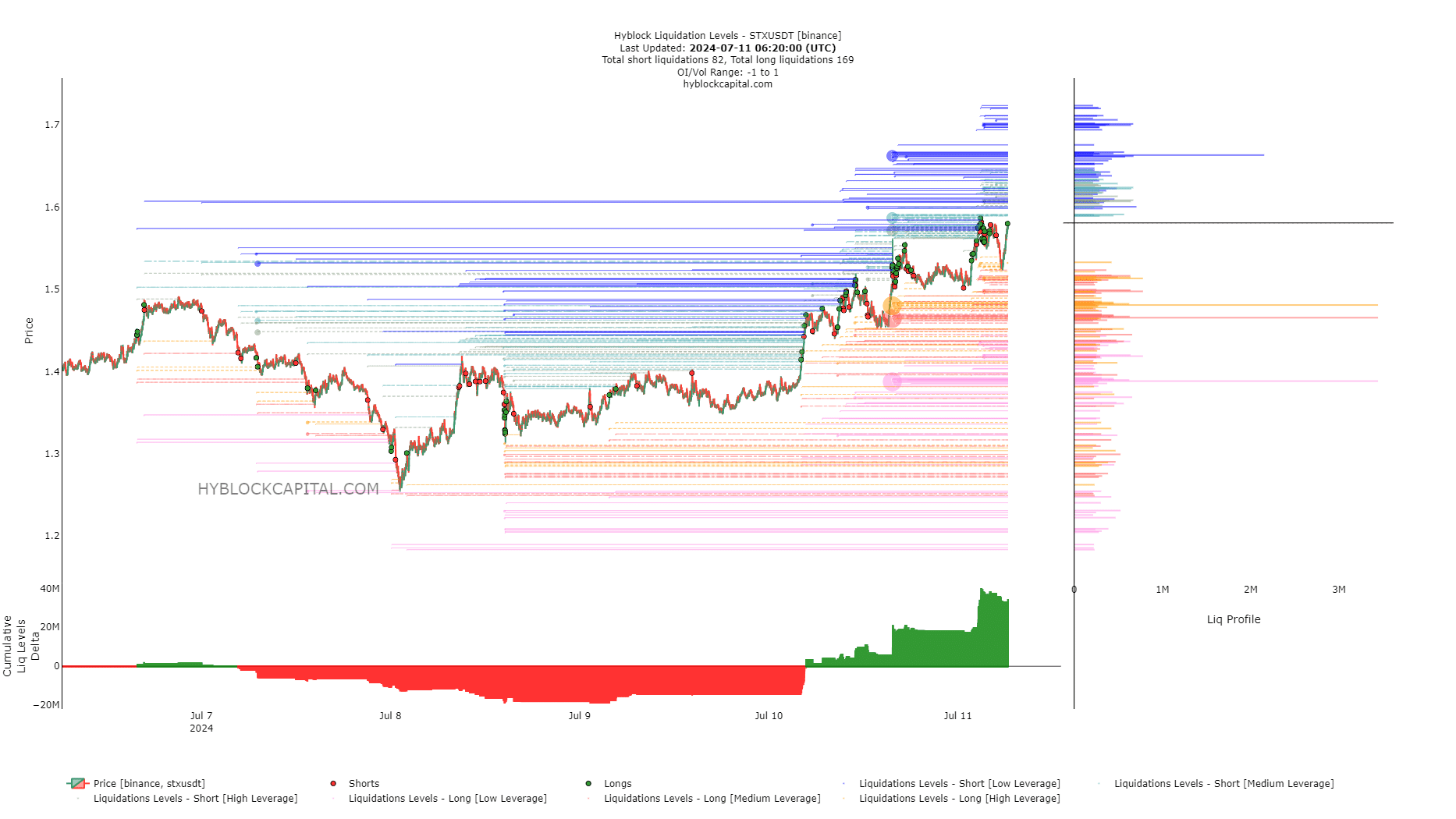

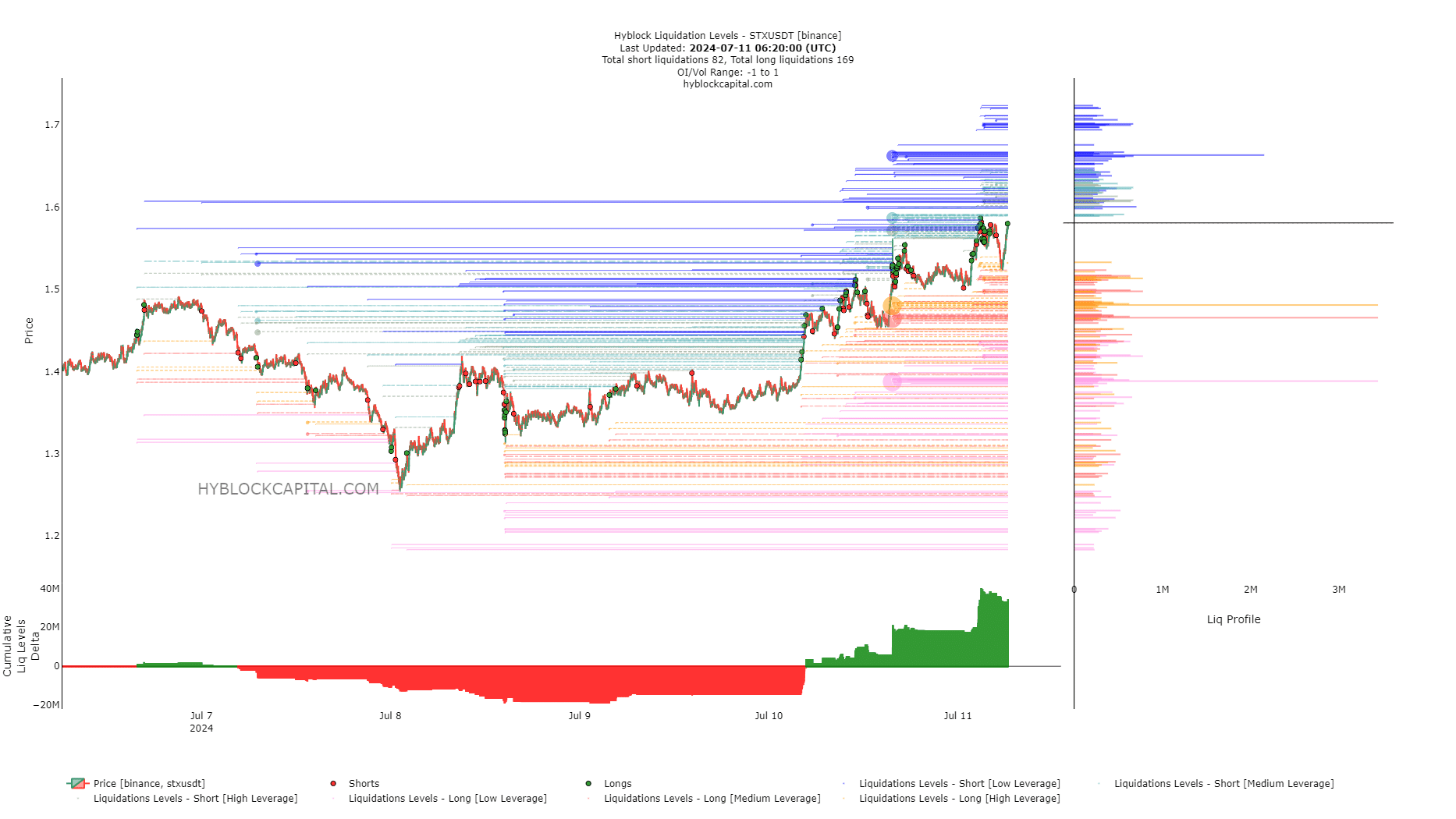

- Traders should be prepared for a drop in price below short-term support levels due to liquidation at that level.

Stacks (STX) price has risen by 25.8% over the past 3 days. It has risen by 13.25% over the past 24 hours, while Bitcoin (BTC) has fallen by 1.75% over the same period. BTC also saw increased volatility early Thursday.

The price jumped from $57,000 to $58,300, then reversed the entire bounce and jumped back to $58,000. STX bulls were able to capitalize on the short-term uptrend swing in Stacks, but will it be able to break the higher time frame trend?

$1.80 is the next target, but traders should temper their enthusiasm.

Source: STX/USDT on TradingView

The lower time frame was encouraging for the bulls. The $1.3 support level from early 2024 was retested and defended, sending prices higher. The lower time frame resistance of $1.50 was also broken.

The CMF on the daily chart poked its head above +0.05, signaling strong capital flows into the market. The RSI was at 47 and still bearish, but a move above 50 is expected and could be an early signal of a trend change.

So bulls can expect a move to $1.8 from here. However, the higher time frame market structure such as daily is still bearish. $1.8-$2 is a supply zone where sellers are overflowing.

Should investors expect higher volatility from STX soon?

Source: Highblock

The move above $1.50 on July 10th spurred the bulls, but may have also set the stage for a liquidity hunt south. The cumulative face value delta was very positive, with long liquidations outnumbering shorts.

This may cause the price to fall, forcing long-term liquidation.

Realistic or not, STX’s market cap in BTC terms is as follows:

At $1.46 and $1.48 there were two clusters, medium leverage and high leverage.

$1.51 is the current support level, but with liquidity just below it, the price could move towards $1.45 and then towards the resistance levels of $1.8-$2 in the coming days.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.