- ONDO showed a 14% gain but faced an upside barrier near the $1 level.

- Despite the recovery, overall market sentiment towards ONDO remained weak.

As with the overall market, ONDO (On Temperature Finance) followed Bitcoin (BTC) It has rebounded and recorded a recovery gain of more than 14% since July 8.

Ondo Finance, a leading issuer of tokenized securities, posted a 4% gain on July 10. This is the Pyth network complete.

This partnership will allow Ondo’s USDY/USD price feed to be available on over 60 blockchains.

So, with gains of over 10% since Monday, can the ONDO bulls take more gains? Or is the uptrend over?

What will the bull do next?

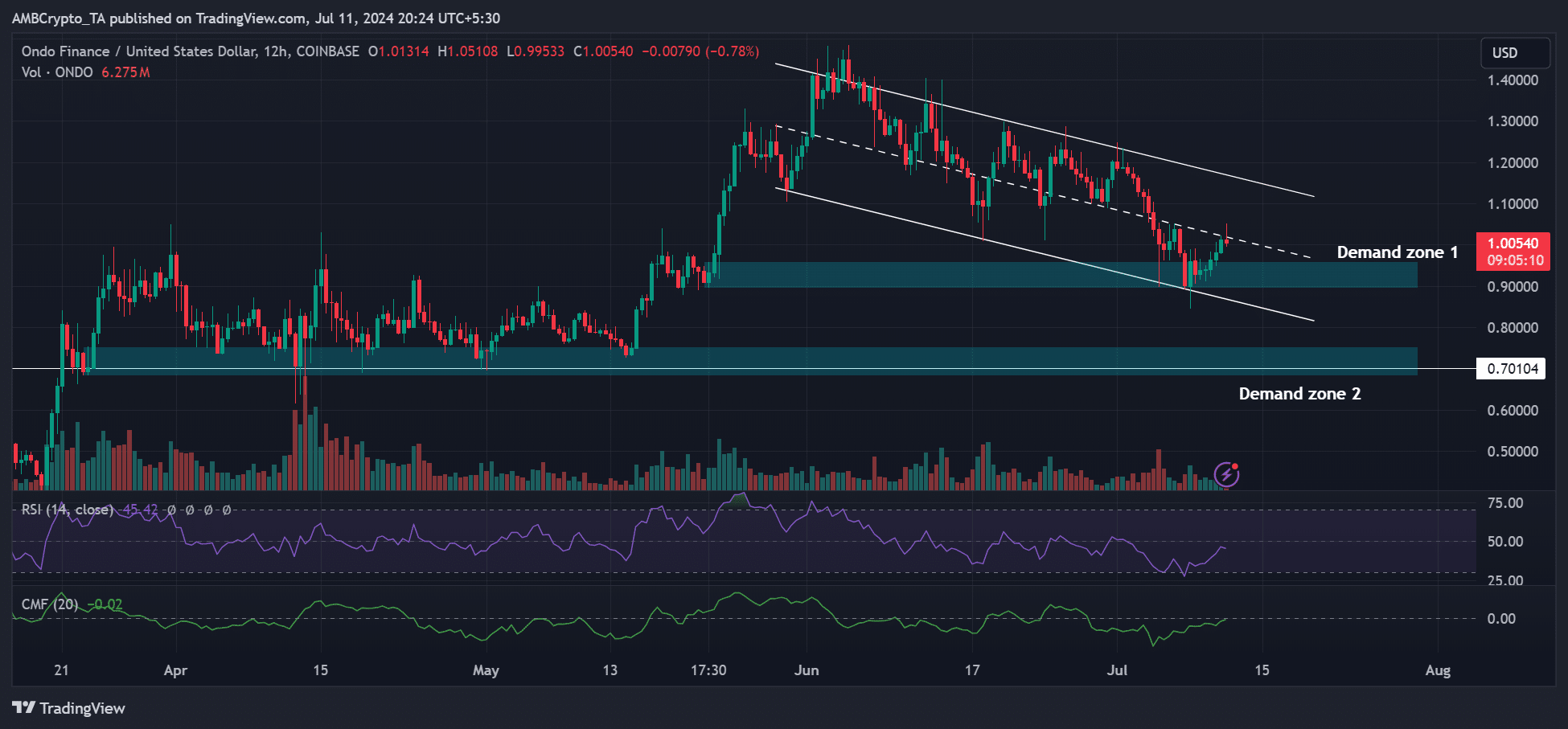

Source: ONDO/USDT, TradingView

ONDO’s impressive recovery, which started from the first demand zone and the bullish order block at $0.9, has met with immediate resistance at the time of writing.

Based on price chart indicator readings up to the time of writing, both the RSI (Relative Strength Index) and CMF (Chain Money Flow) were in neutral positions.

This suggests that buying pressure and capital inflows have improved, but there has been considerable room for additional upside momentum.

Moreover, the price has not closed above $1 on the 12-hour chart, which means that the market structure for ONDO on a larger time frame has not yet turned bullish at the time of writing this article.

Therefore, if BTC fails to recover $60k in the short term, ONDO may retest Demand Zone 1.

However, if ONDO closes above $1 and targets the range high of the descending triangle, bulls can use market leverage to demand an additional 10% upside.

Weak sentiment on temperature finance

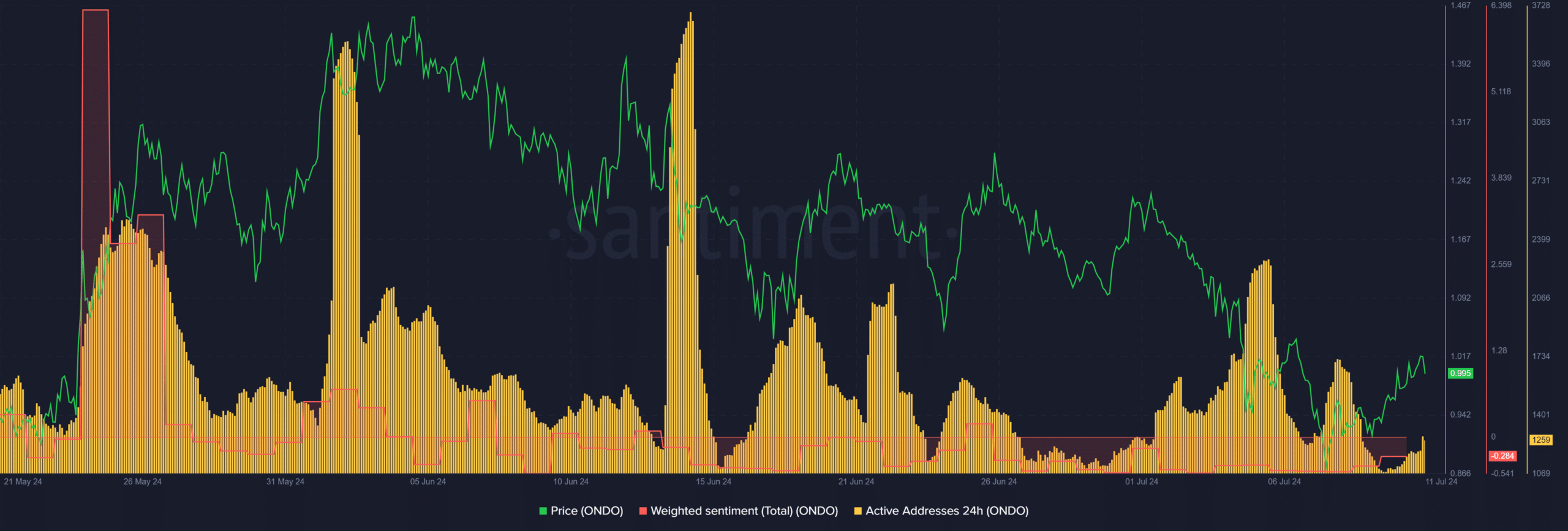

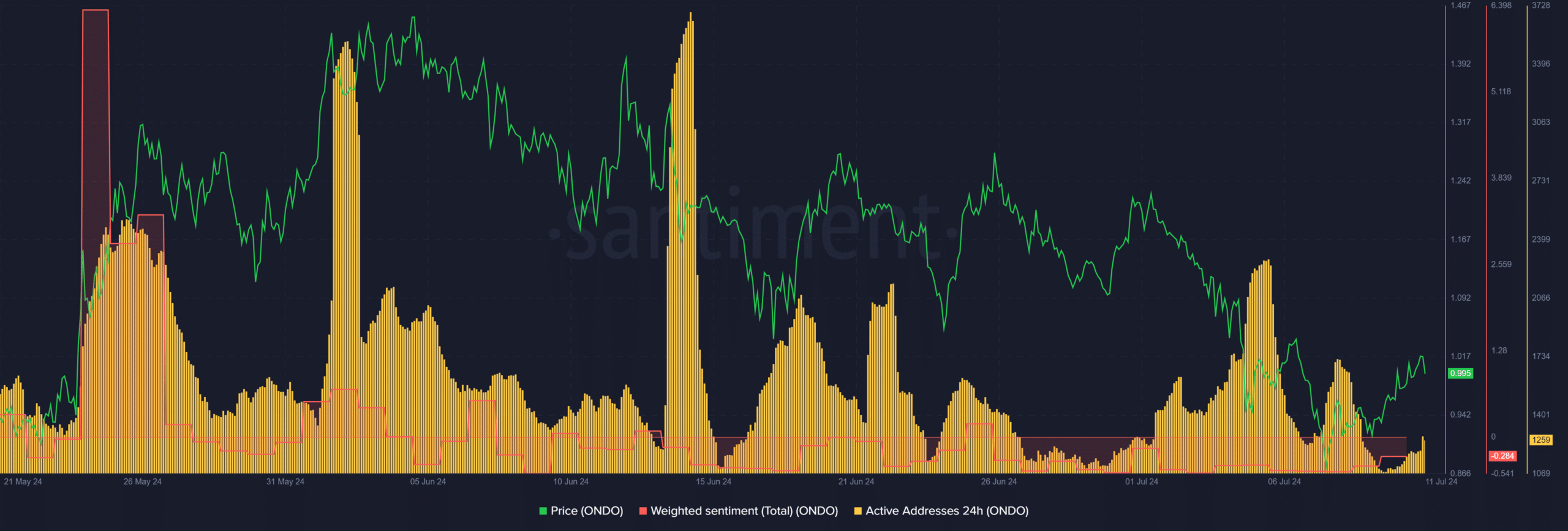

Source: Santiment

According to Santiment data, ONDO’s strength may be delayed further due to weak sentiment as revealed by the negative Weighted Sentiment.

Read Ondo Finance (ONDO) price prediction for 2024-25

Additionally, the daily active addresses, marked in yellow, have decreased significantly since July 5th. This means that there are fewer users or addresses trading ONDO, which could further delay further upside.

However, if BTC shows strength, the above argument may be proven wrong.