- Ethereum whales have been actively requesting deposits over the past few days.

- ETH has been in a downtrend after failing to sustain a recovery attempt.

Ethereum (ETH) has experienced a range of price volatility in recent times, with attempts at recovery often being thwarted by successive declines.

At the same time, there was a noticeable influx of ETH into exchanges, mainly due to whales transferring large volumes.

While one might think that this massive inflow would immediately push prices down, further analysis provides additional information.

Ethereum Whales Deposit More ETH

According to recent data from Lookonchain, whale wallets have deposited 10,000 Ethereum coins to the Binance (BNB) exchange, which is worth $31 million.

This transaction followed a pattern that had originated from a specific whale address, which had transferred a total of 30,000 ETH (equivalent to $94 million) to Binance since July 1.

This wallet is one of several that have moved large amounts of Ethereum to exchanges in recent days.

Ethereum net deposits increase

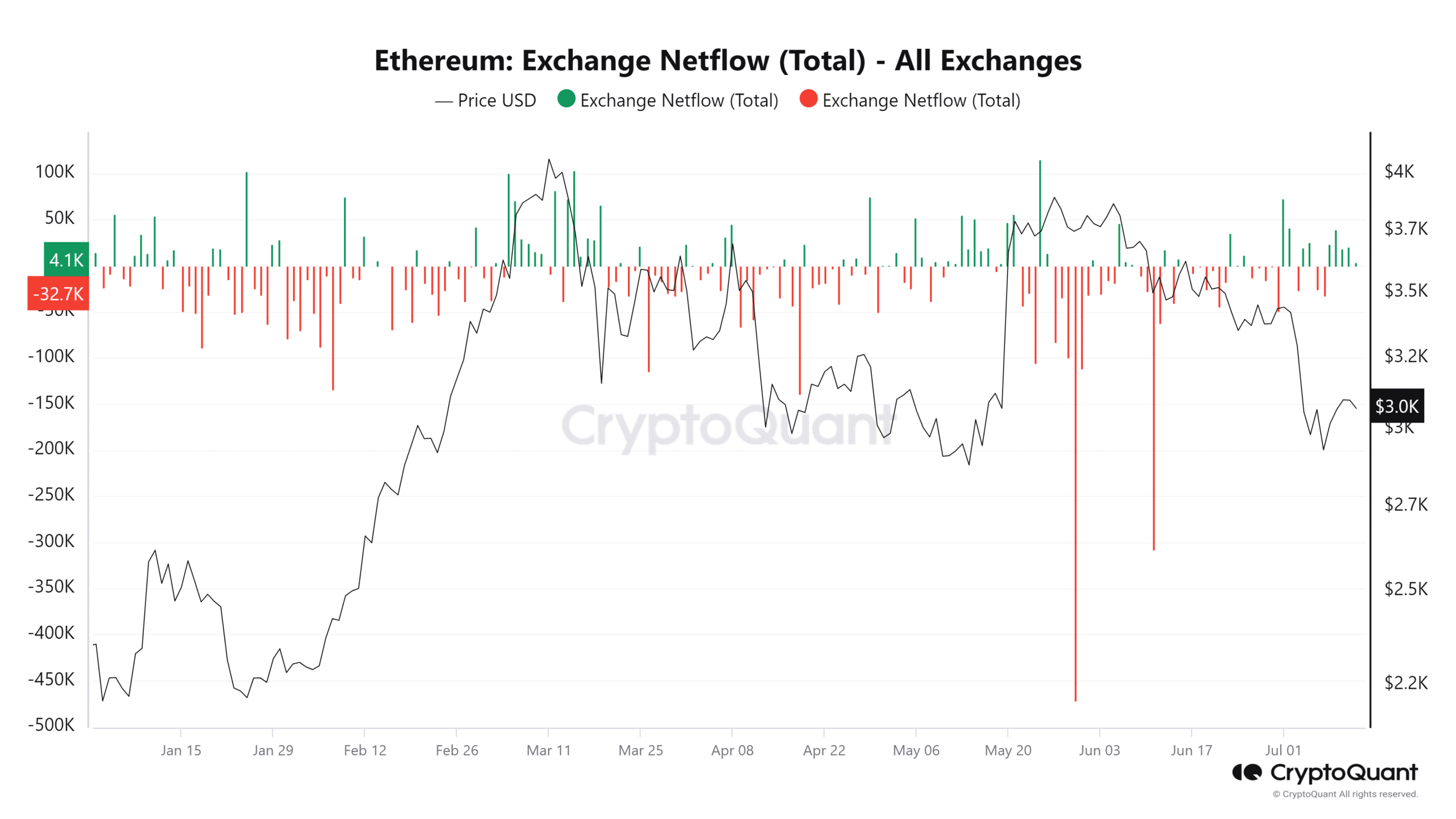

AMBCrypto’s analysis of Ethereum netflow via CryptoQuant shows that since the beginning of this month, there has been more inflow into exchanges than outflow.

According to data, there were significant inflows to exchanges earlier this month, with over 72,000 ETH (around $250 million) flowing into exchanges.

Source: CryptoQuant

There have been only three net outflows throughout the month, which suggests that more Ethereum has been deposited than withdrawn in recent days.

Additionally, significant deposits from large whale accounts appear to have had a significant impact on this pattern.

The reserves of currency exchange offices are maintained at an appropriate level.

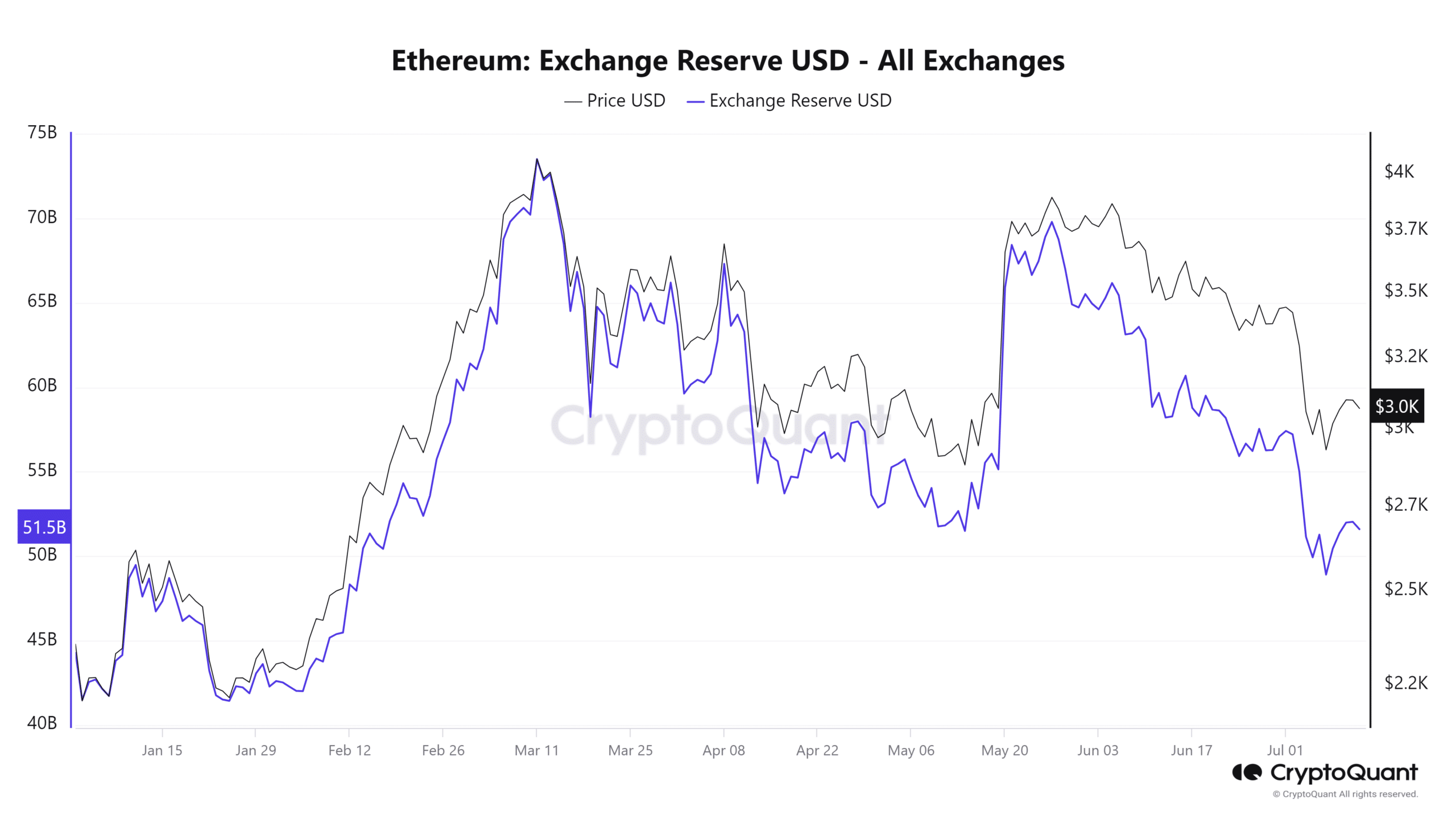

Despite the recent surge in Ethereum inflows to exchanges, overall exchange holdings have not seen a corresponding increase.

An analysis of the currency reserves chart shows that there has been a slight uptrend over the past few days, but it has been relatively small compared to the overall downtrend.

At the time of writing, reserves stood at about $52 billion, down from more than $57 billion earlier this month.

This suggests that the decline in Ethereum value may have contributed to the decline in the dollar value of exchange reserves.

Source: CryptoQuant

Read our Ethereum (ETH) Price Prediction 2024-25

Also, Ethereum transaction volume increased, but remained relatively stable, hovering around the 16 million range. Therefore, the change in transaction volume was not significant.

At the time of writing, Ethereum was trading at around $3,071, down around 1%.