- Solana dominates Ethereum in terms of network speed.

- The price of SOL has risen by more than 3% in the last 24 hours.

Solana (SUN) It has gained popularity over the years due to its strong network activity. Blockchain is back in the news today as one of its key indicators has reached a milestone, clearly highlighting the reliability and efficiency of blockchain.

And while that was happening, the price action of the said altcoin also turned bullish on the charts.

Solana moves faster than others

SolanaFloor, a popular X handle that shares updates related to the blockchain ecosystem, recently posted: Twitter Highlighting this new development, Solana’s actual transactions per second have surpassed 1,000, reaching 1,005, according to the same report.

This clearly reflects the effectiveness and speed of blockchain. To look at this more specifically, AMBCrypto looked at SOL. Ethereum (ETH) Statistics. Meanwhile, SOL’s highest recorded TPS was over 7k, while ETH’s reached 62 tx/s. Likewise, SOL also dominated ETH in terms of real-time TPS.

Source: Chainspect

AMBCrypto took a look at Artemis. data To better understand the network activity of the blockchain, our analysis shows that Solana’s daily transactions have gained some momentum in the past month.

At the time of writing, this figure was 47.3 million. However, despite the increase in transactions, the number of daily active addresses on the blockchain has not increased significantly in the past month. In terms of captured value, things are not looking good either. This is because fees and revenues have been decreasing over the past few weeks.

Source: Artemis

Bullish turn on the chart

Meanwhile, Solana’s bulls have been showing their prowess by painting SOL’s daily and weekly charts in green.

According to CoinMarketCapSOL has risen by over 3% in just 24 hours. At the time of writing, Solana is trading at $139.89 and has a market cap of over $64 billion, making it the 5th largest cryptocurrency.

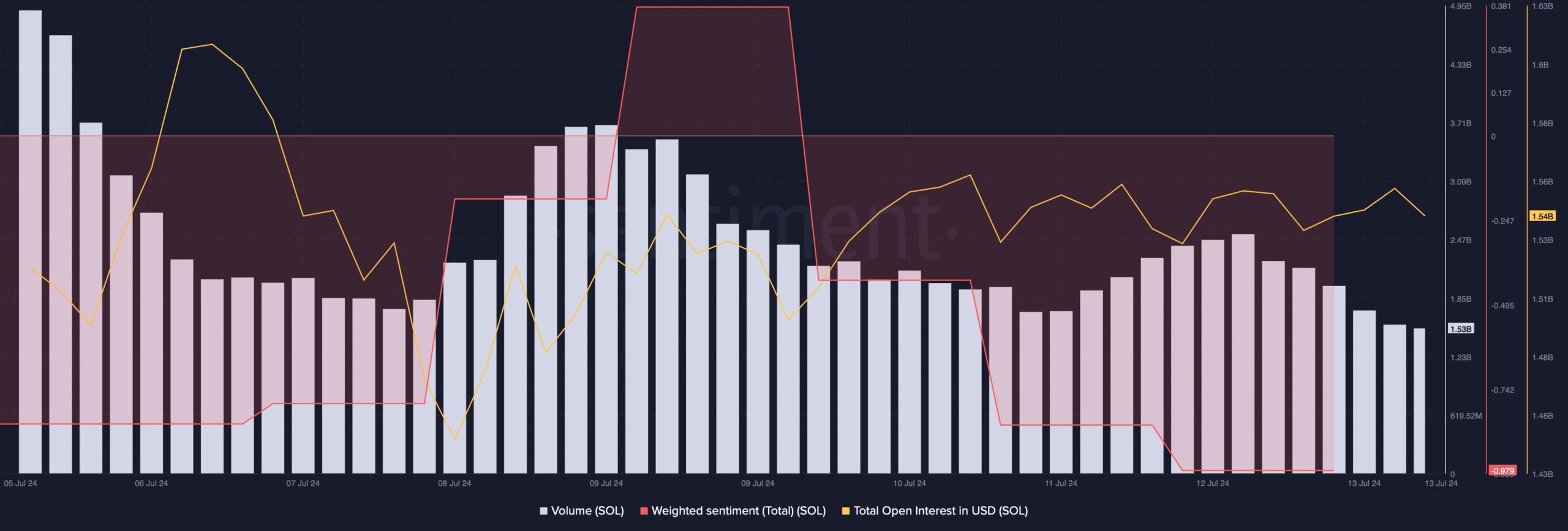

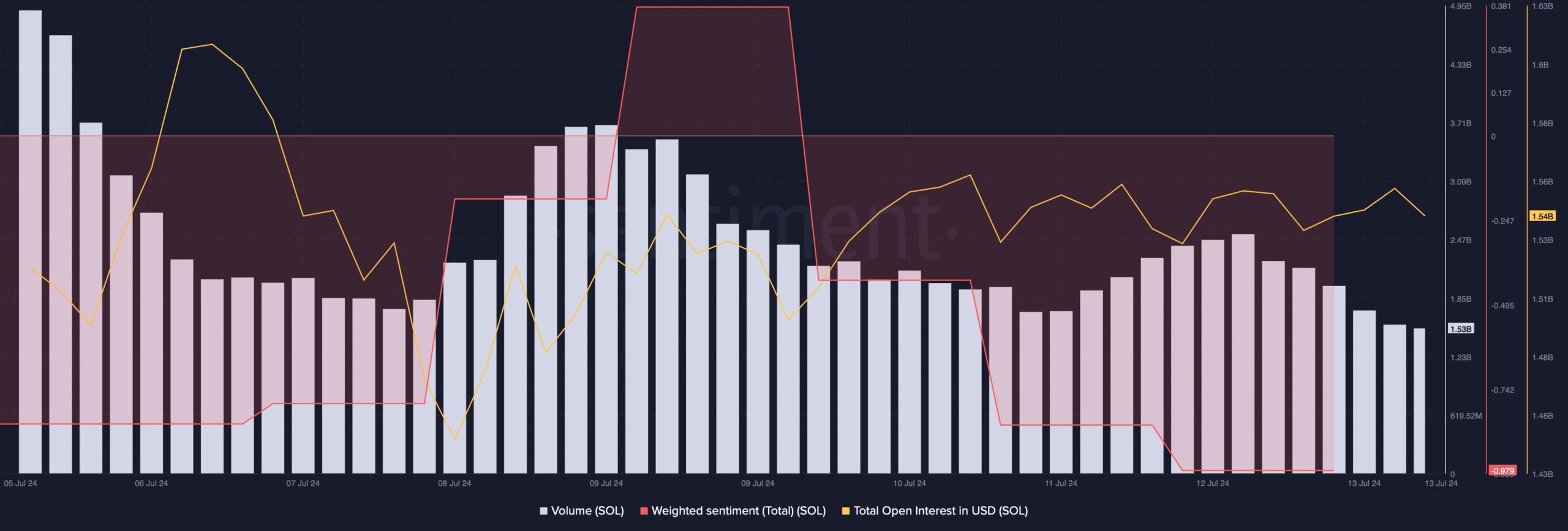

We then checked SOL’s on-chain data to see if the newfound bullish momentum would continue. SOL’s volume has been down over the past week while its price has been up. This is generally perceived as a bearish signal. Open interest has also moved sideways, indicating a few days of slow movement.

It is also surprising that the weighted sentiment for SOL has declined, as it shows that bearish sentiment is dominant across the cryptocurrency markets.

Source: Santiment

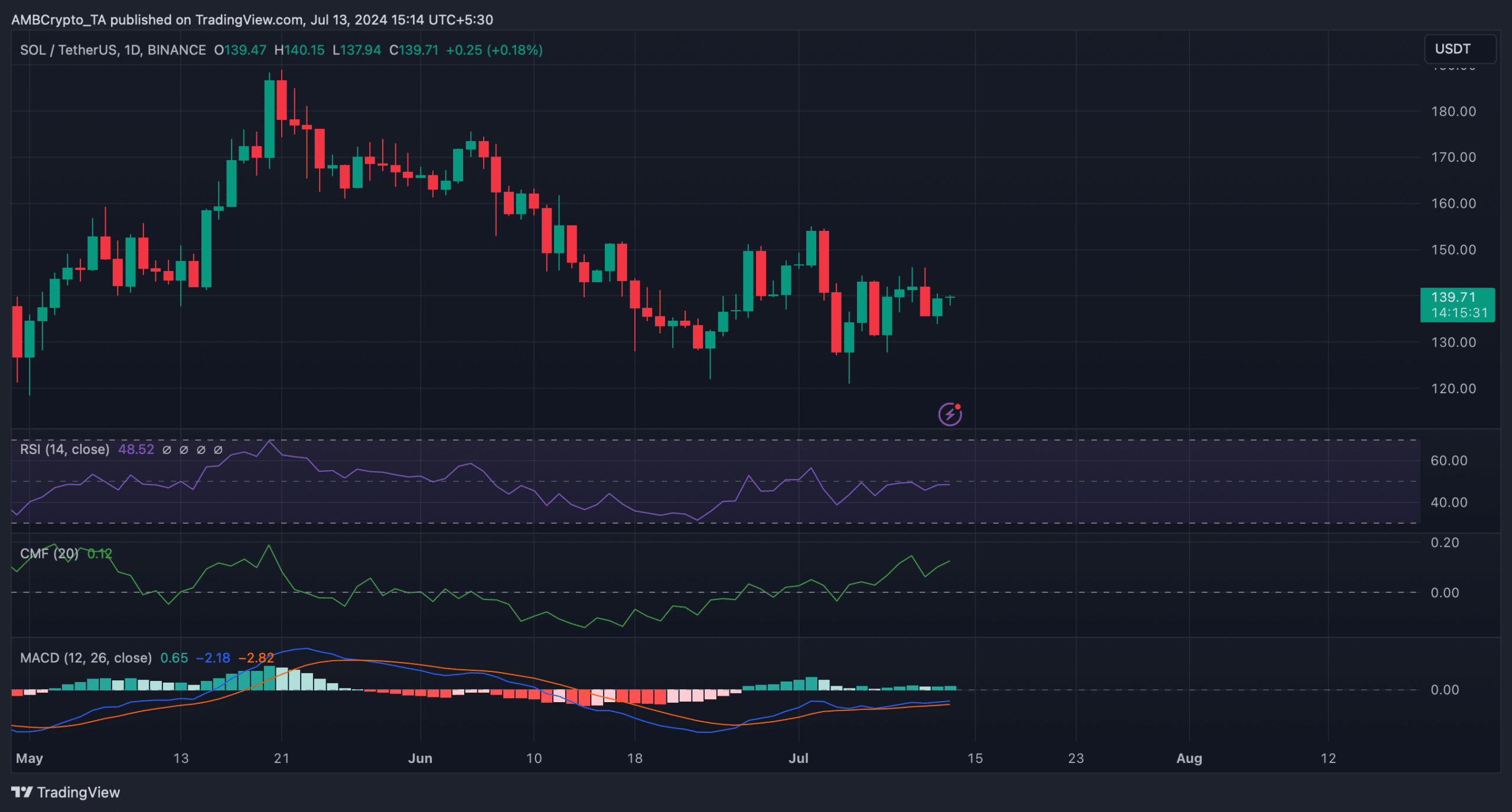

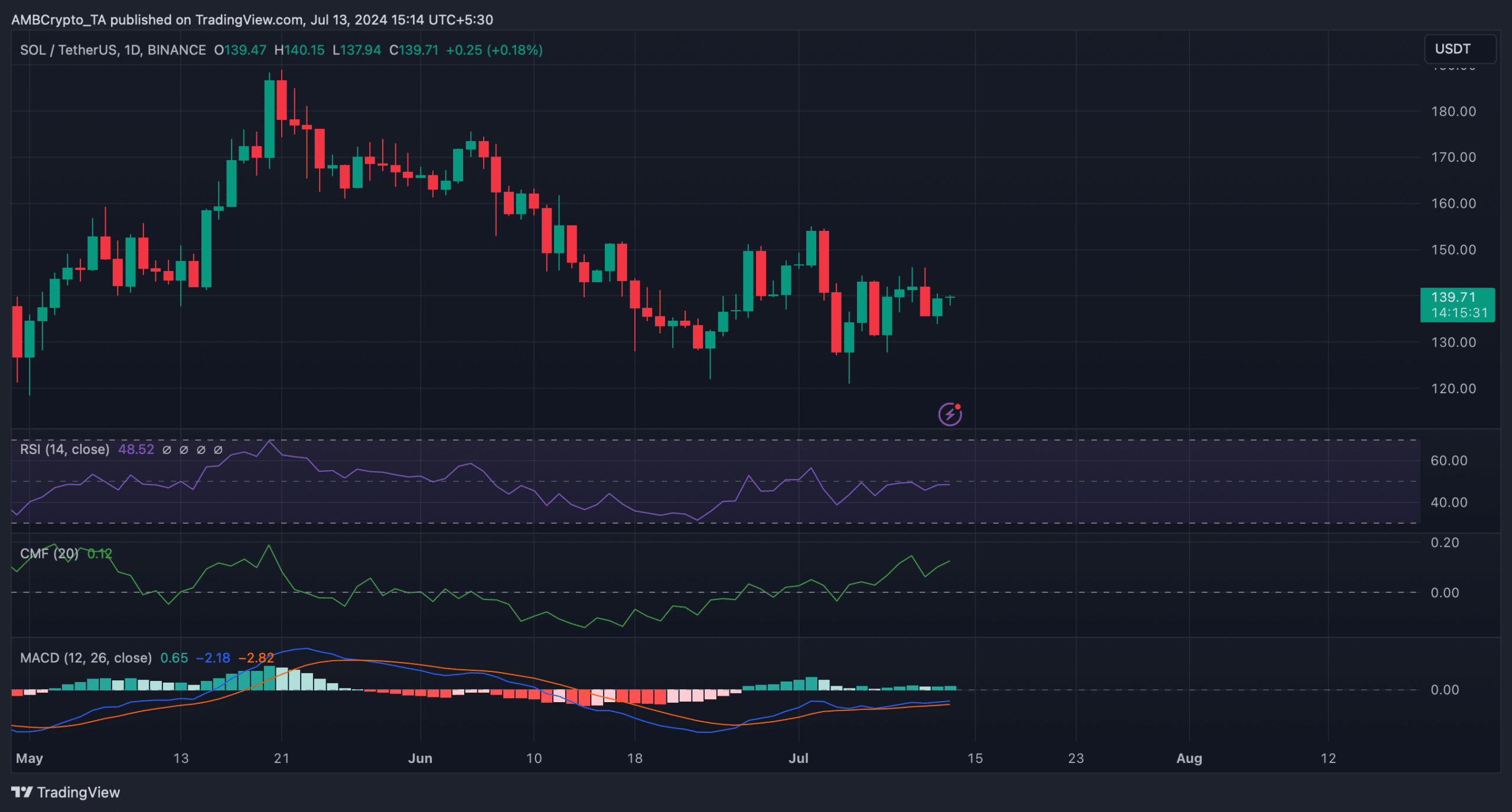

Despite this, most technical indicators remained bullish on the chart.

For example, both the RSI (Relative Strength Index) and the CMF (Chaikin Money Flow) have been in an uptrend. The MACD has shown a clear bullish edge in the market, highlighting the high possibility that SOL will rise again.

Source: TradingView

Is your portfolio green? Check this out: SOL Profit Calculator

If the uptrend continues, investors could see SOL reach $147.4 in the coming days, as liquidations will likely increase at that level.

However, if a bearish takeover occurs, SOL could fall to $133 in the coming days.

Source: Hyblock Capital