- According to key indicators, Ethereum could potentially reach $5,000 in the coming months.

- Despite this, some other market indicators turned bearish and flashed red.

Hype all around Ethereum (ETH) The ETF has been on a tear recently, and as the launch date approaches, investors’ expectations for the altcoin king have also been rising, with many expecting the launch of the spot ETF to be the catalyst for a new bull market for cryptocurrencies.

Ethereum ETFs Make the rounds

In this context, IntoTheBlock recently shared: Twitter It highlights something very interesting. According to the on-chain analytics platform, $126 million worth of ETH was withdrawn from exchanges this week. This number suggests that investors are considering accumulating ETH.

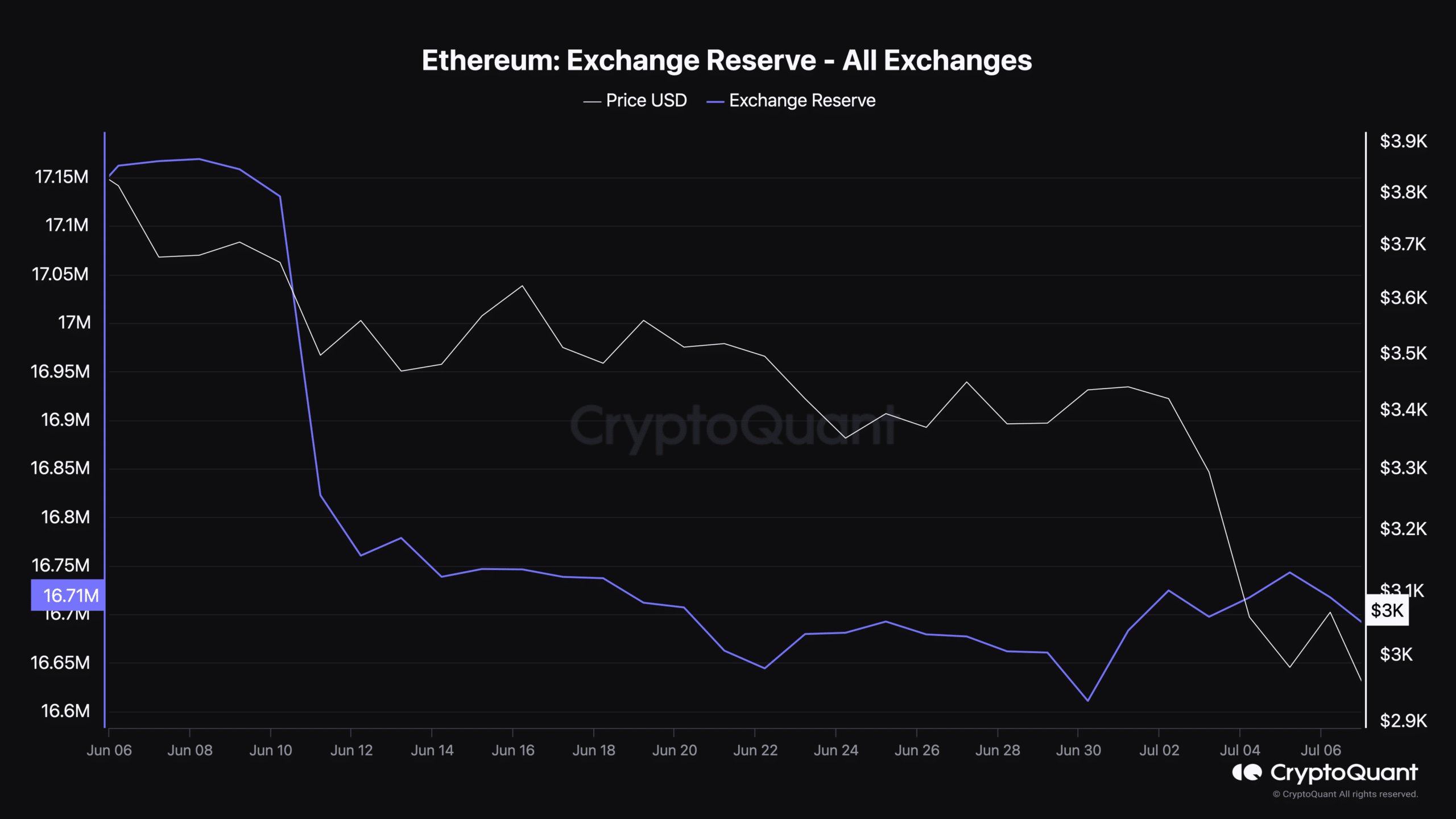

AMBCrypto’s Analysis on CryptoQuant data We have a similar story. We have seen a sharp drop in token exchange holdings, reflecting increased buying pressure.

Source: CryptoQuant

What’s notable is that this happened just days before the long-awaited launch of the Spot ETH ETF. Connecting the dots, investors can expect the price of the altcoin king to skyrocket after the launch.

Additionally, the Coinbase premium for ETH was also in the green, indicating strong buying sentiment among US investors.

Source: CryptoQuant

In addition to this, AMBCrypto Reported Before Investors are showing confidence in ETH. For example, the buy/sell ratio of ETH has shown a noticeable surge above the value of 1 in recent weeks, indicating a change in market dynamics. Here, a buy/sell ratio above 1 is a strong indicator of aggressive buying by bulls.

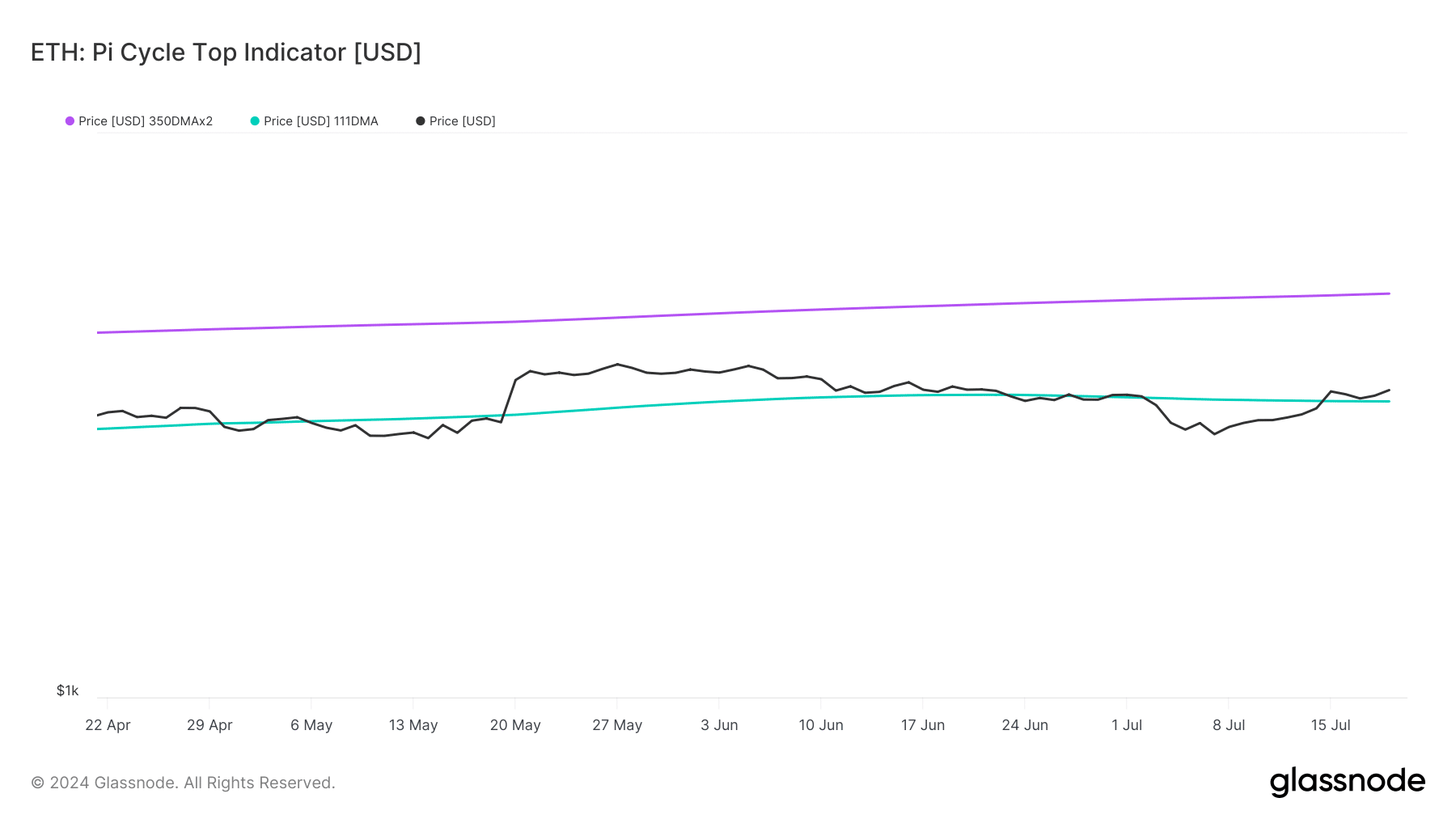

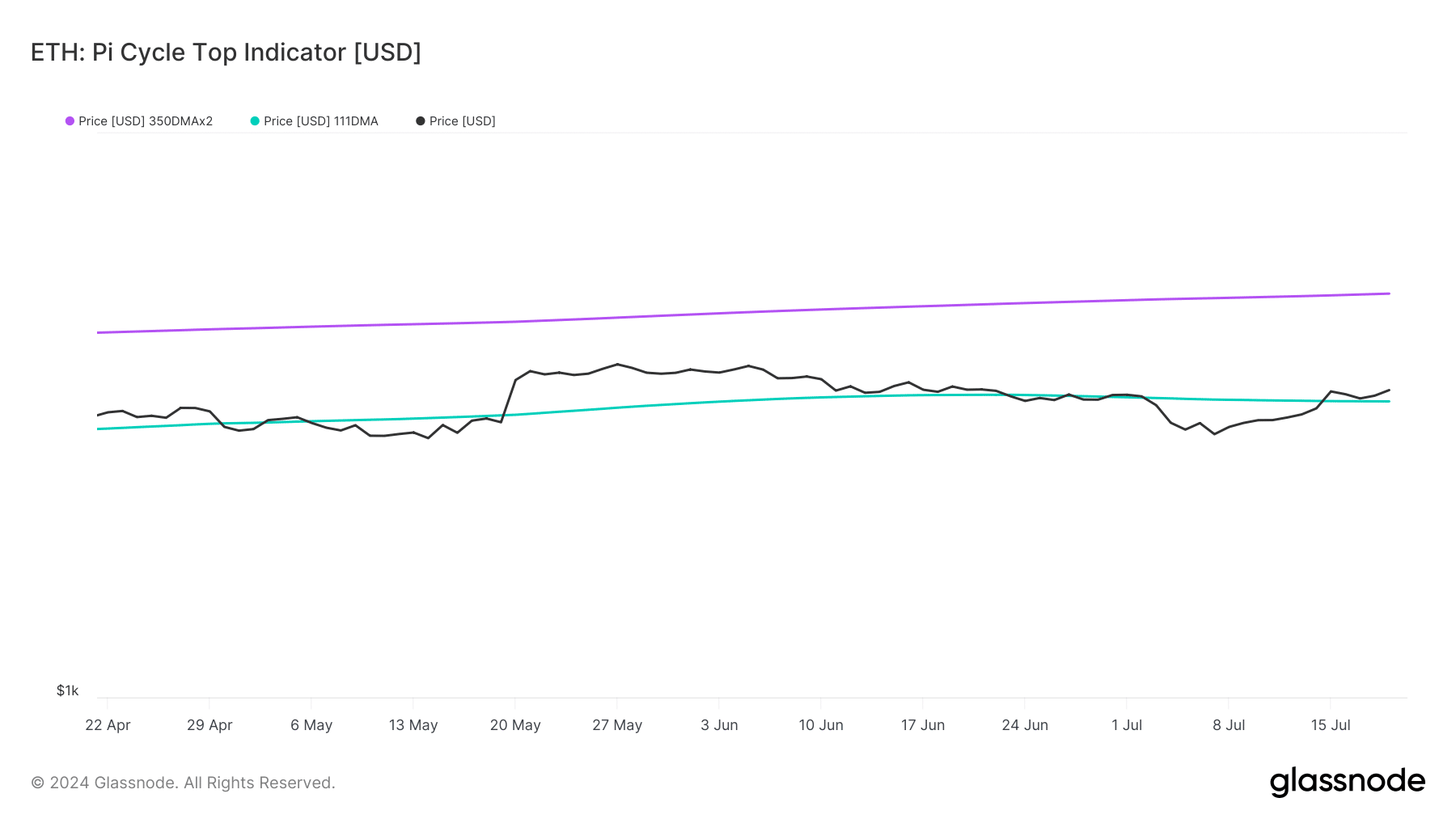

We then looked at data from Glassnode to see where Ethereum might go if this rally continues.

According to the Pi Cycle Top indicator, the price of ETH has started to move above a possible market bottom. If we believe the indicator, ETH could reach $5,000 in the coming months.

Source: Glassnode

Is there any chance of further uptrend?

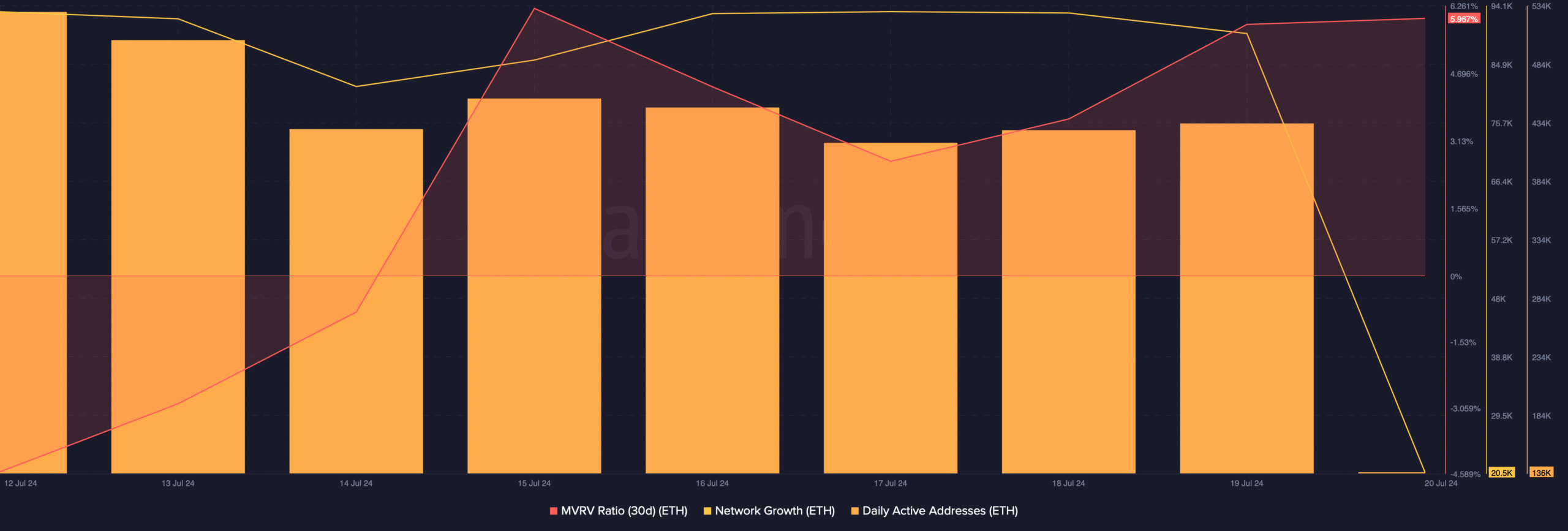

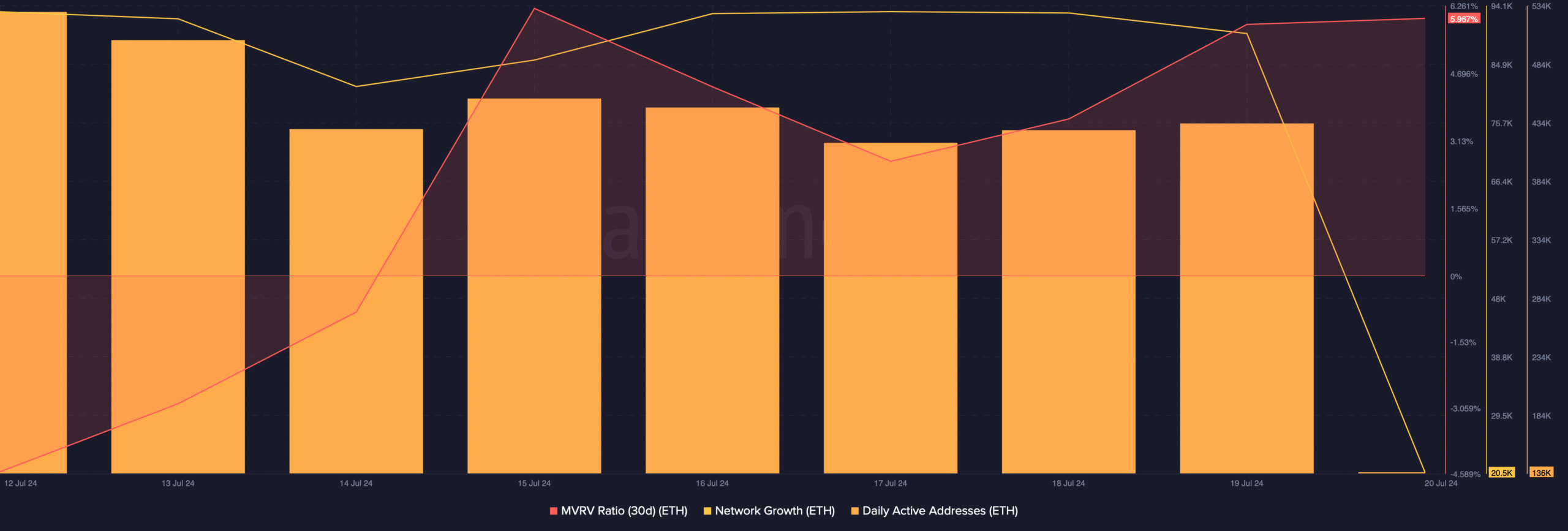

AMBCrypto evaluated the data from Santiment to see if there is a path towards $5,000 in the short term. We found a sharp increase in the MVRV ratio, which can be inferred as a bullish signal.

At the time of writing, Ethereum’s MVRV ratio was over 5.97%. Ethereum’s network growth was also high, indicating that more addresses were created to transfer tokens. Additionally, daily active addresses remained stable over the past week, reflecting strong network activity.

Source: Santiment

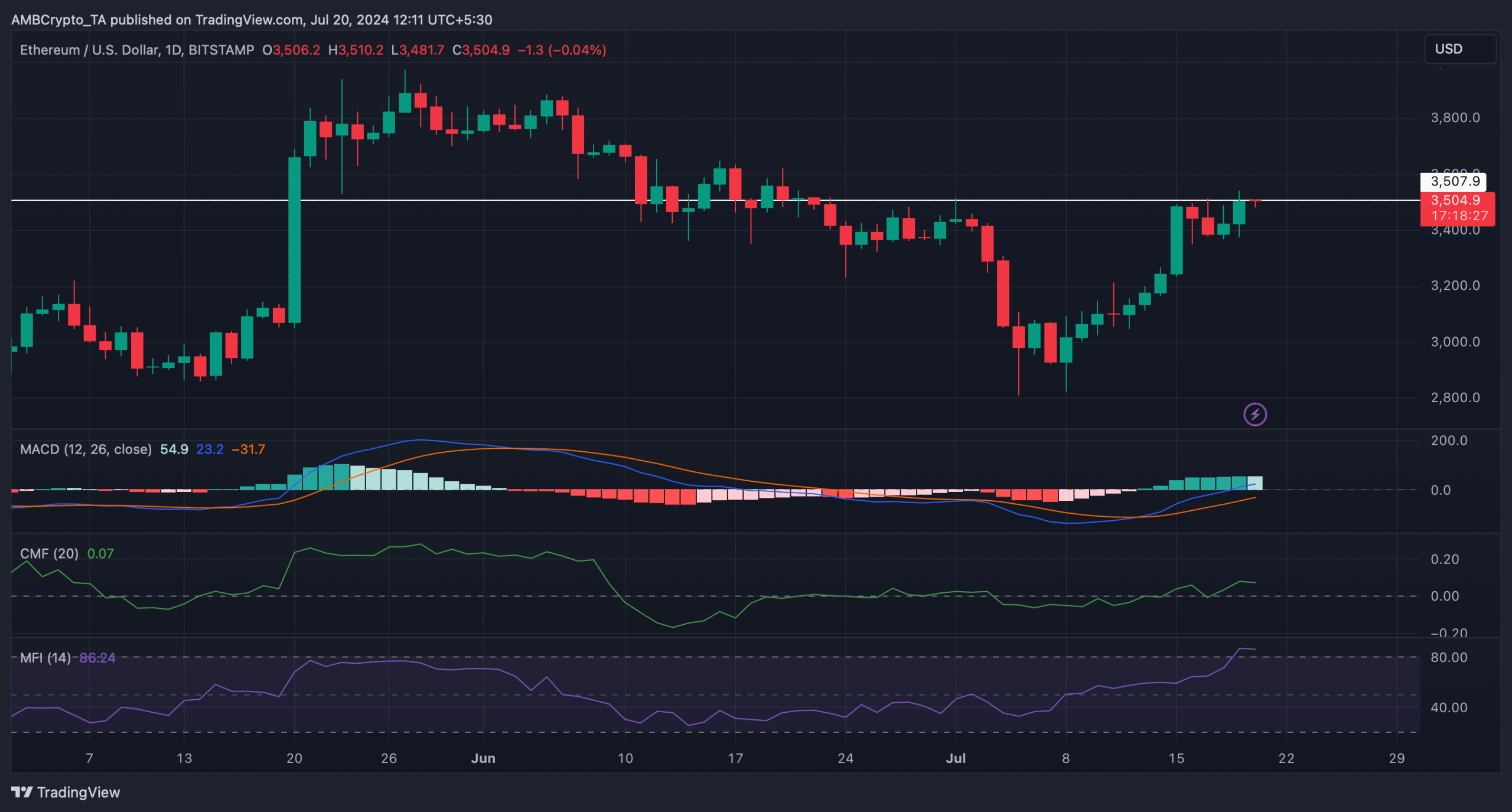

Finally, the technical indicator MACD showed a clear bullish lead in the market. However, at the time of writing, ETH was testing a key resistance level. A breakout of that level is essential for ETH to continue its bullish rally.

The Money Flow Index (MFI) is in the overheated buying zone and may exert selling pressure in the short term.

read Ethereum (ETH) Price Prediction 2024-25

Additionally, Chaykin Money Flow (CMF) also recorded a decline.

Taking these indicators together, we can see that it may take more time for ETH to break above the resistance level on the chart.

Source: TradingView