- BNB has been struggling with gains and losses over the past few hours.

- Despite the fluctuations, the price remained in the $590 range.

Binance Coin (BNB) showed strength throughout the previous trading session, reaching one of its highest price levels in months.

However, looking at a shorter time frame, BNB appears to be in a downtrend, suggesting a temporary decline or consolidation following the recent uptrend.

Despite this short-term decline, BNB’s long-term accumulated profits are still intact.

Binance slips to smaller timeframes

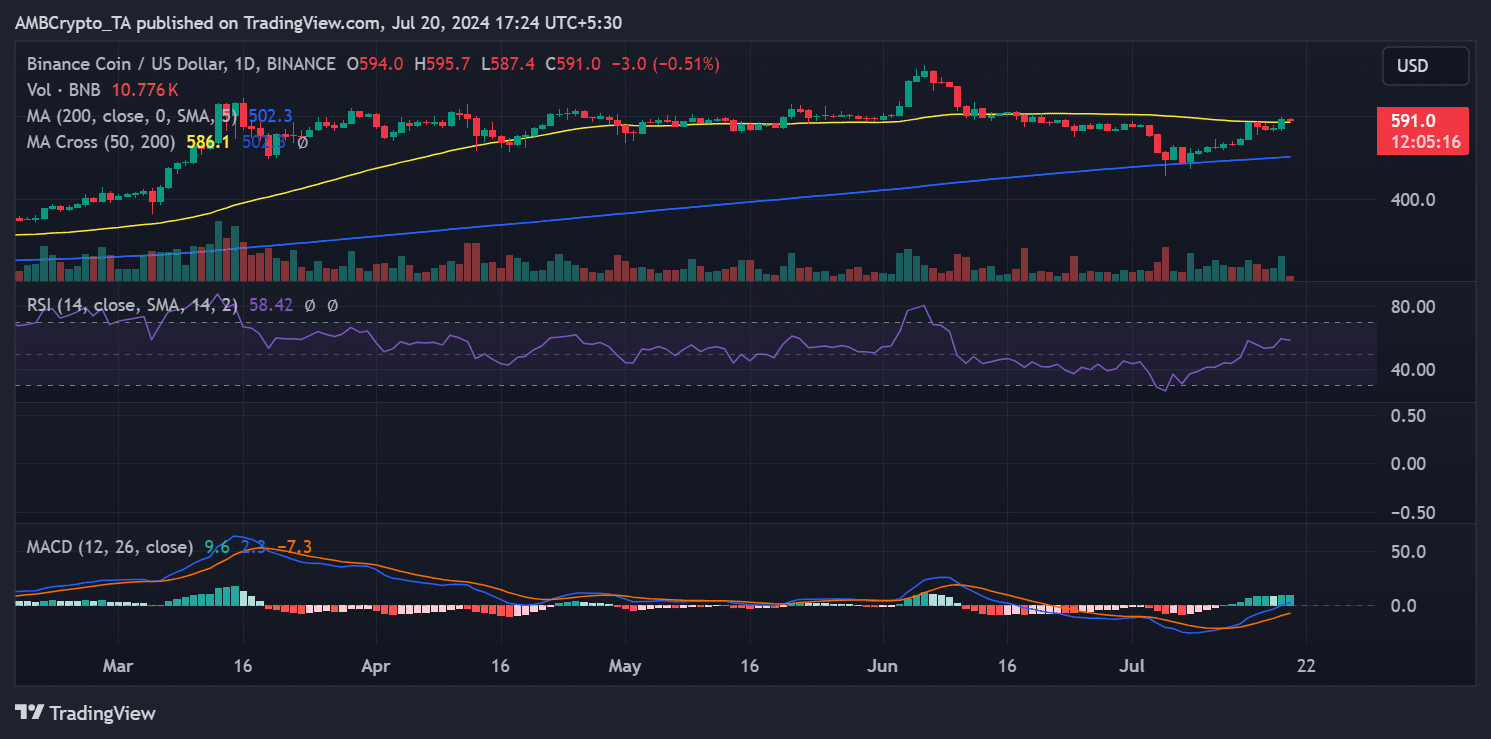

Analysis of Binance Coin (BNB) on different time frames reveals distinct market trends and trends. On the daily time frame, BNB has shown strong performance, rising by more than 3% in the last 24 hours and accumulating more than 10% in the past week.

These figures indicate a solid medium-term bullish trend and suggest positive sentiment and buying interest among investors.

Conversely, a more detailed view using the 1-hour timeframe showed a slight pullback, with BNB down nearly 1%. This drop may seem minor, but it could indicate short-term profit-taking following the recent rally or a market correction.

A comprehensive view of Binance price trends

The daily timeframe analysis of Binance Coin showed a significant bullish trend in the last trading session. The chart showed a 3.86% gain, with a closing price of around $594, up from the opening price of around $572.

This peak is close to the price level that BNB reached a month ago, when it was around $599. The price has since been on a downward trend.

At the time of writing, BNB has dropped slightly to around $591. Despite this minor drop of less than 1%, BNB can still maintain its position in the $590 price range.

This shows that the recent uptrend has largely held up despite the small sell-off.

Source: TradingView

Moreover, technical indicators continued to support the bullish outlook for BNB. The Relative Strength Index (RSI) is trending above the neutral line, indicating continued buying pressure.

Also, there has been no significant decline in the current momentum. This position of the RSI suggests that market sentiment is still positive and the bullish trend is still valid.

BNB can recover profits

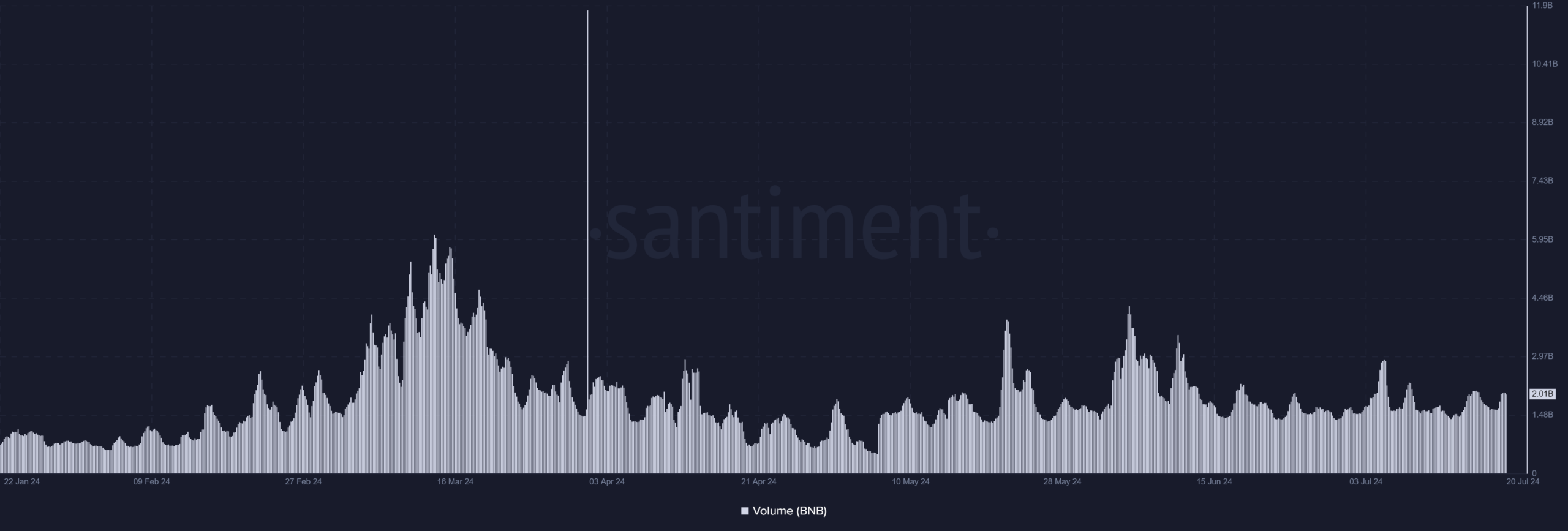

Binance Coin (BNB) trading volume analyzed by Santiment shows steady activity, with volumes remaining strong across consecutive trading sessions.

On July 19, BNB’s trading volume surpassed $2 billion, and similar levels are observed in the current session. This stability in trading volume indicates that market participation has not weakened, suggesting continued interest and participation from traders.

Source: Santiment

Read Binance (BNB) Price Prediction 2024-25

It is particularly noteworthy that volumes remained high despite a slight price drop of less than 1%. This stability in volumes often acts as a buffer against significant price drops, as it suggests a balanced dynamic between buying and selling pressure.

The strong trading volume currently underway could help BNB maintain or even increase its market value as the trading day progresses.