- The price of XRP has risen more than 12% over the past seven days.

- Most indicators and market indicators are showing a bearish trend for the token.

Ripple (XRP) Last week, the price showed a promising rally with double-digit growth. The good news is that the token is on the verge of breaking out of a long-term bullish pattern, so things could turn even more bullish in the coming weeks.

XRP’s Multi-Year Bullish Pattern

CoinMarketCap’s data Last week, XRP bulls dominated the market, with the price rising by more than 12% over the past seven days.

At the time of writing, the token was trading at $0.5948 and had a market cap of over $33 billion, making it the 7th largest cryptocurrency. Meanwhile, the token was preparing to break out of its multi-year bullish pattern.

Popular cryptocurrency analyst Milkybull wrote: Twitter The price chart shows a 6-year bullish pennant pattern. According to the tweet, the pattern appeared on the XRP chart in 2018-2019 and has been consolidating within the chart since then.

At the time of writing, it was on the verge of a breakout. If a breakout occurs, the token could start another bullish rally. In fact, a possible bullish rally could push XRP to all-time highs in the coming weeks or months.

Source: X

Could XRP Finally Find a Breakthrough?

AMBCrypto plans to look at the token’s on-chain data to see if there is a possibility of a breakthrough in the near future.

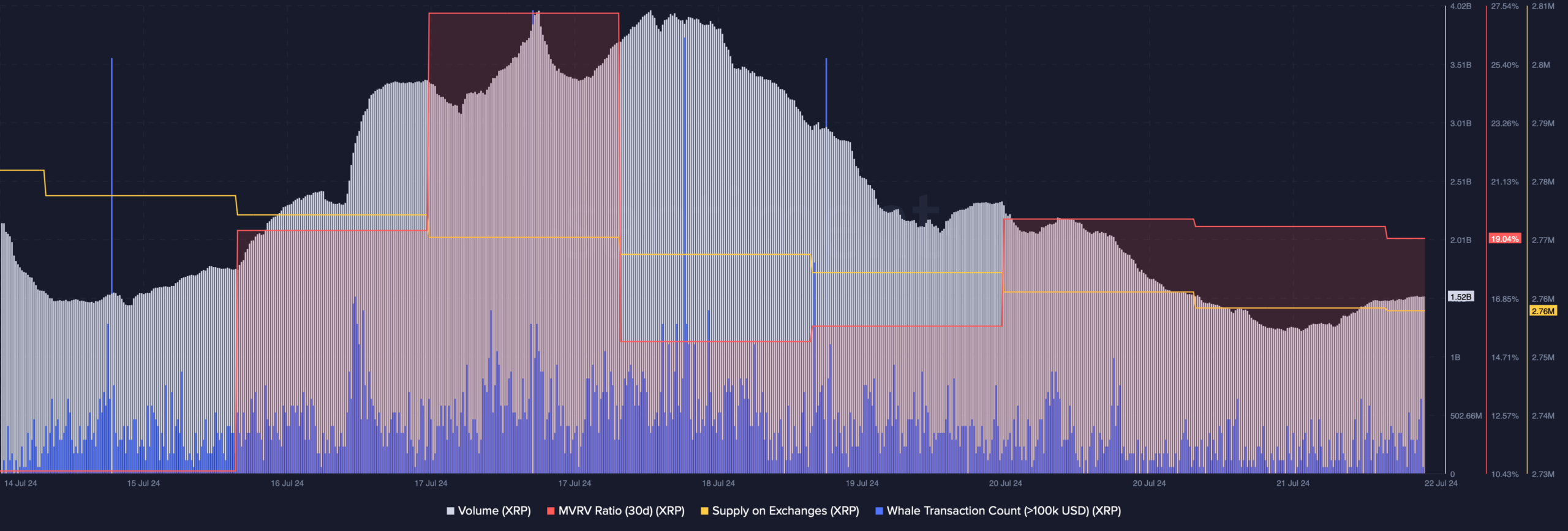

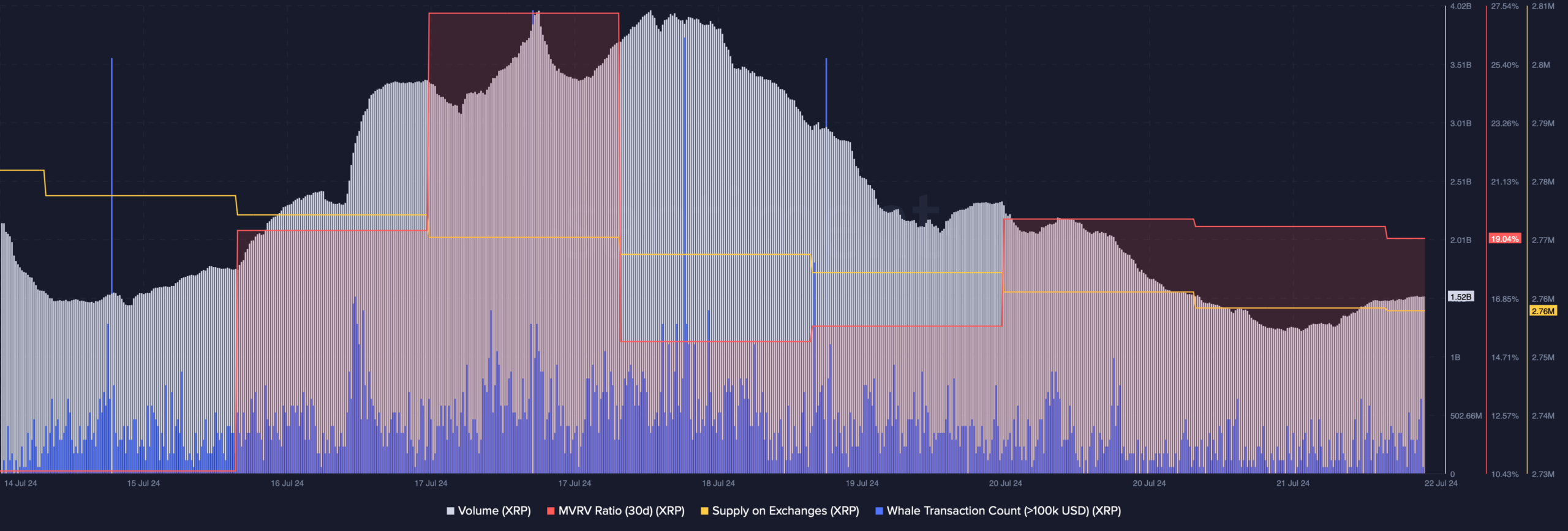

Our analysis of Santiment’s data showed that the supply of XRP on exchanges was decreasing, which clearly meant that investors were increasing their accumulation.

However, the rest of the indicators have been quite bearish. For example, the token’s MVRV ratio has been down over the past week. Trading volume has also been down, suggesting that the current bullish price trend may not continue.

Also, the number of whale trades for XRP has decreased, suggesting that whales are not actively trading the token. Another bearish indicator is Fear and Greed Index, At the time of writing, it measured 69%.

This means that the market is in a “greed” phase, which often causes prices to adjust.

Source: Santiment

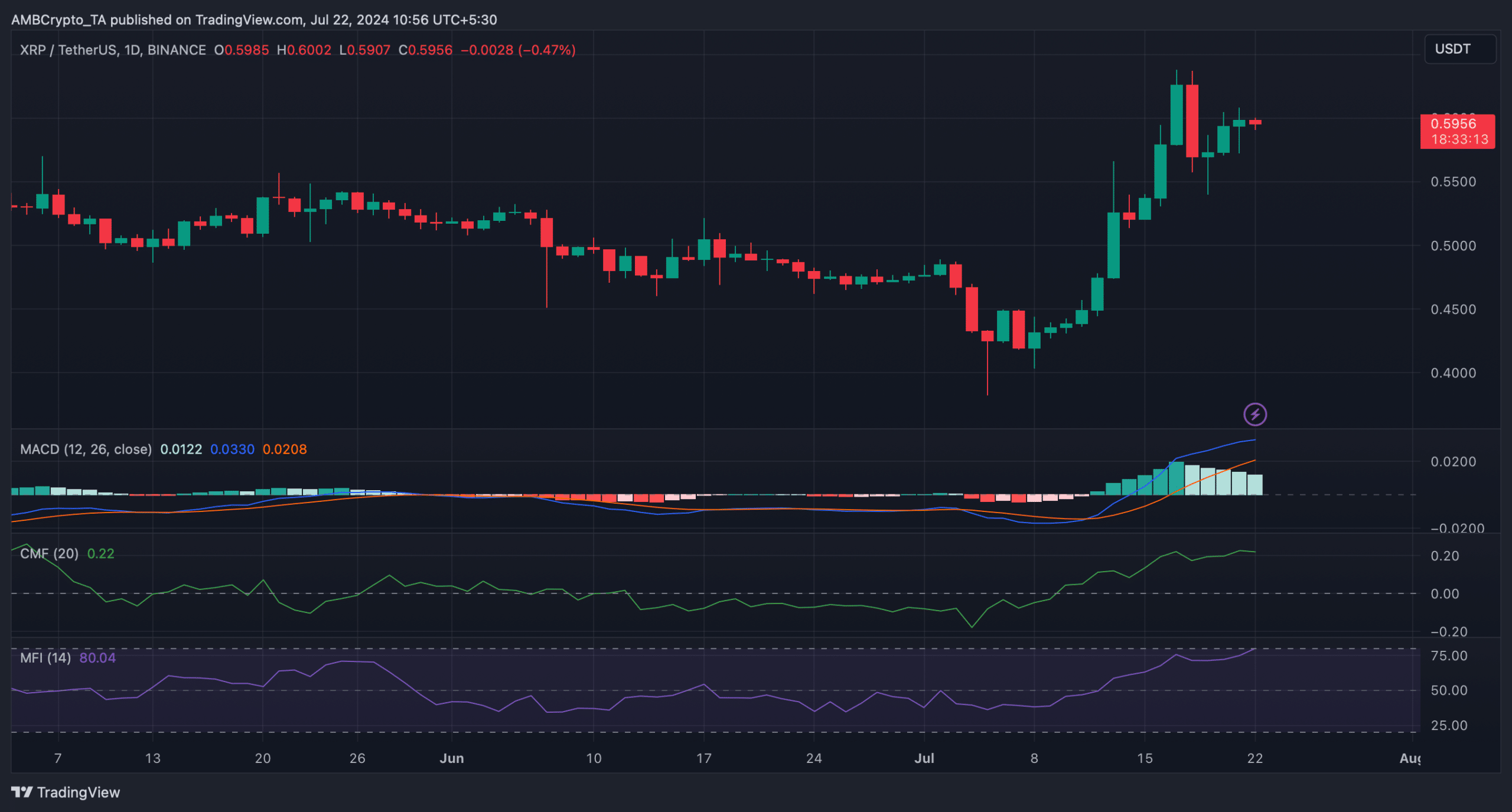

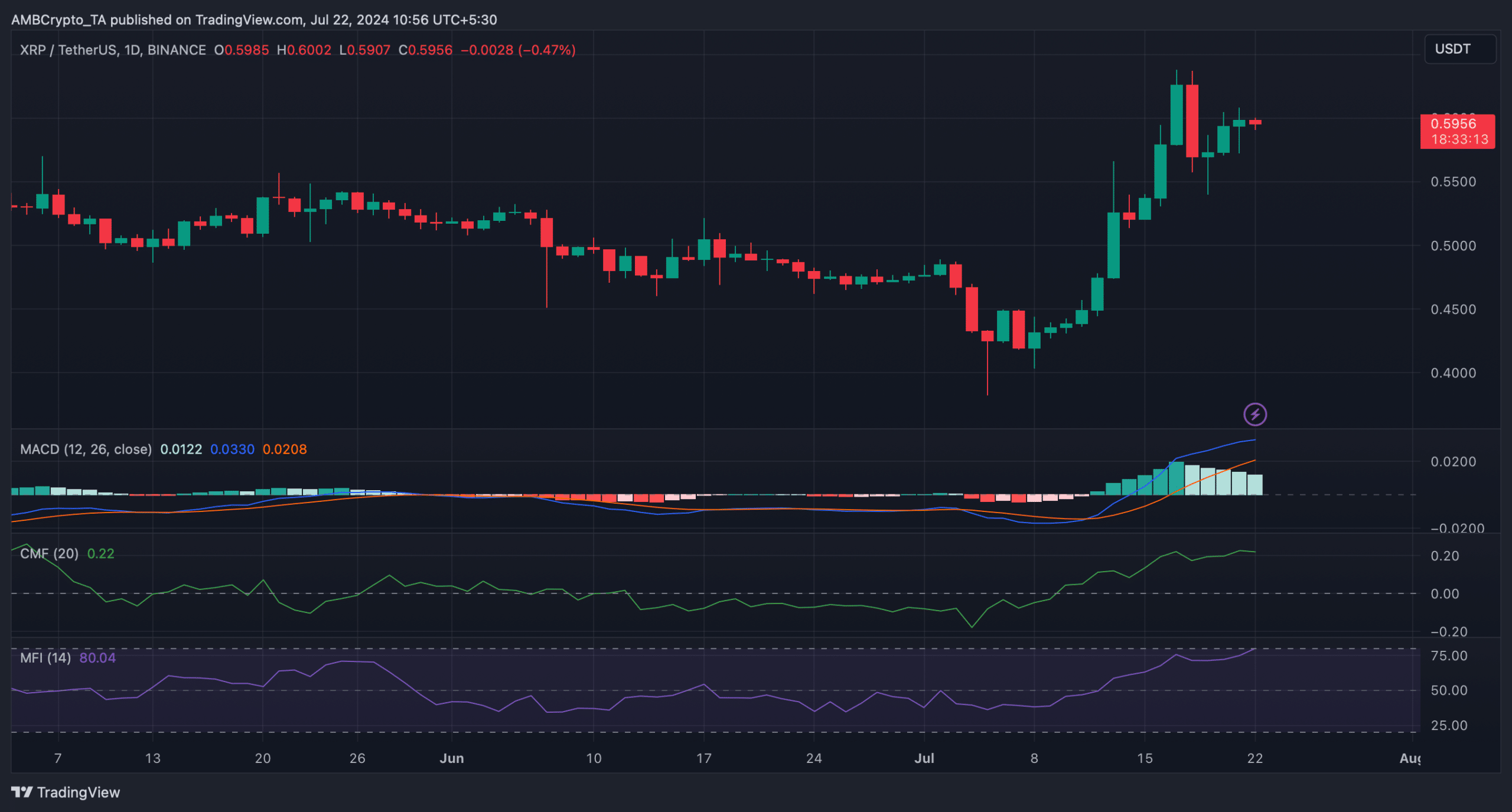

We then looked at the daily chart of the token. We found that the Money Flow Index (MFI) is about to enter the overbought zone, which could lead to increased selling pressure in the coming days.

read Ripple (XRP) Price Prediction 2024-25

Additionally, Chaikin Money Flow (CFM) also showed a slight downtrend, suggesting that it may take longer for XRP to break out.

Despite this, the MACD still favored the bulls.

Source: TradingView