The US SEC has given final approval for the first US spot ETH ETF. Trading is scheduled to begin tomorrow, July 23.

Today, July 22, the U.S. Securities and Exchange Commission accepted the securities filings of several spot Ethereum (ETH) exchange-traded funds (ETFs), allowing trading to begin as scheduled on Tuesday.

The SEC has approved ETH ETF products from eight issuers, including asset management giants Fidelity, Blackrock, VanEck, 21Shares, and Bitwise.

The SEC initially approved the above ETH ETF application in late May, but companies were waiting for the S-1 filing (registration of new securities) to be approved before they could officially begin trading. Last week, the SEC notified issuers that they needed to finalize their S-1 documents by July 17 to receive approval to begin trading on July 23.

How will the ETH price react?

The outlook for ETH prices after the launch of a spot ETF is uncertain, according to a report from Kaiko Research released today. The firm noted that demand was “not overwhelming” when a futures-based ETH ETF was launched last year.

The ETH price has fallen by about 2.5% over the past 24 hours and is currently trading near $3,400. Earlier today, analysts at IntoTheBlock noted that the Ethereum price is facing significant resistance at the $3,500 level.

As with spot Bitcoin (BTC) ETFs in general, analysts and the industry as a whole see the launch of a spot ETF product as a bullish sign for broader adoption. Since the ETF is traded on traditional exchanges via brokerage accounts, more traditional investors will now have access to the two largest cryptocurrencies by market cap through a medium they are already comfortable trading.

First Bitcoin, now Ethereum

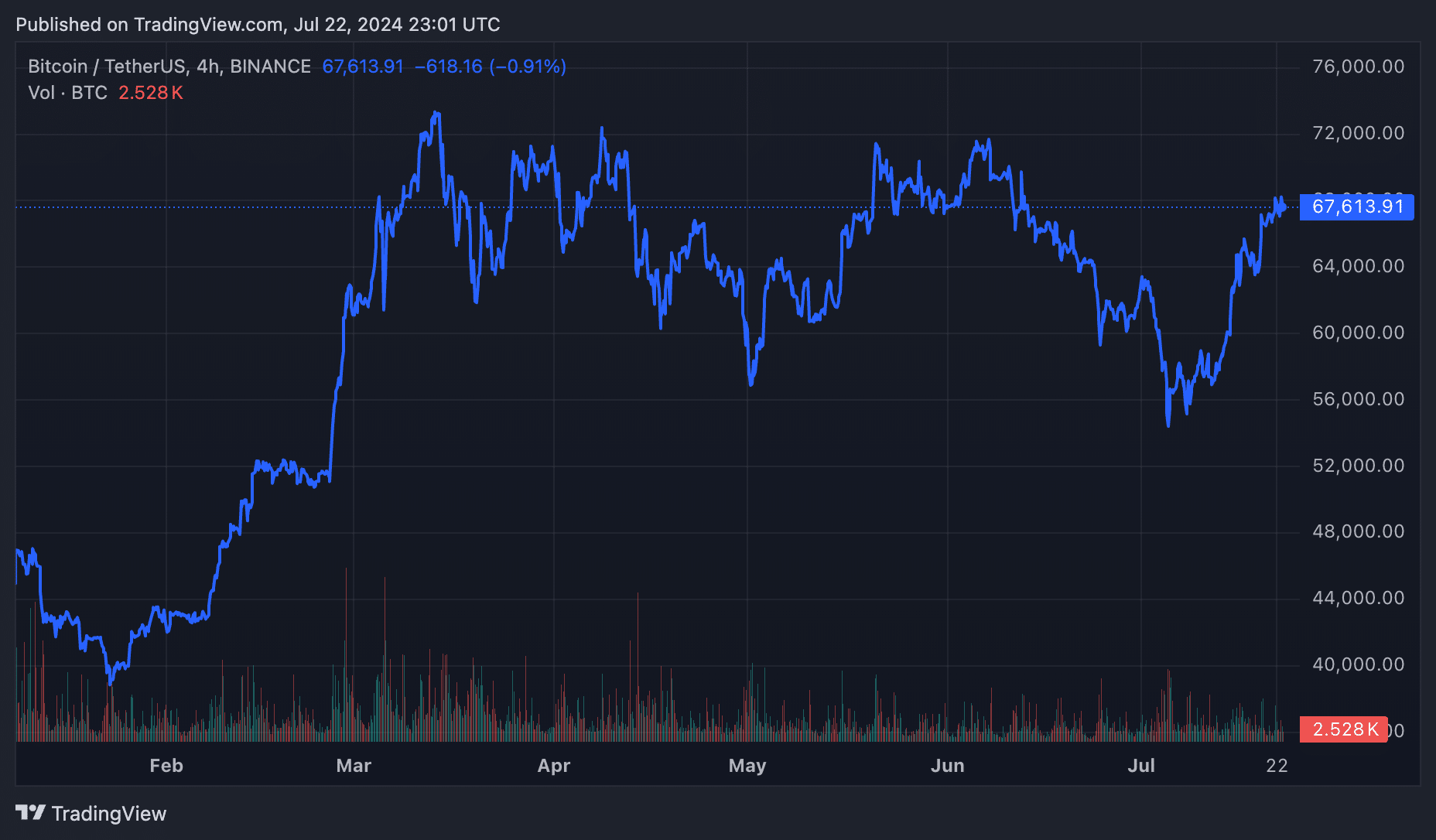

The Spot BTC ETF was approved for trading in the US in January.en, has seen record inflows. Since spot BTC ETF trading began in January, the Bitcoin price has risen by nearly 50% and is currently trading near $67,700.