- TIA is one of the biggest gainers over the last 24 hours.

- Celestia’s sales increased by more than 120%.

Celestia (TIA) is currently ranked between 60th and 62nd in terms of market cap. However, its recent performance is particularly noteworthy, emerging as one of the biggest gainers in the last 24 hours.

The rise in the rankings demonstrates the surge of investor interest and market activity surrounding TIA.

Celestia, showing continuous upward trend

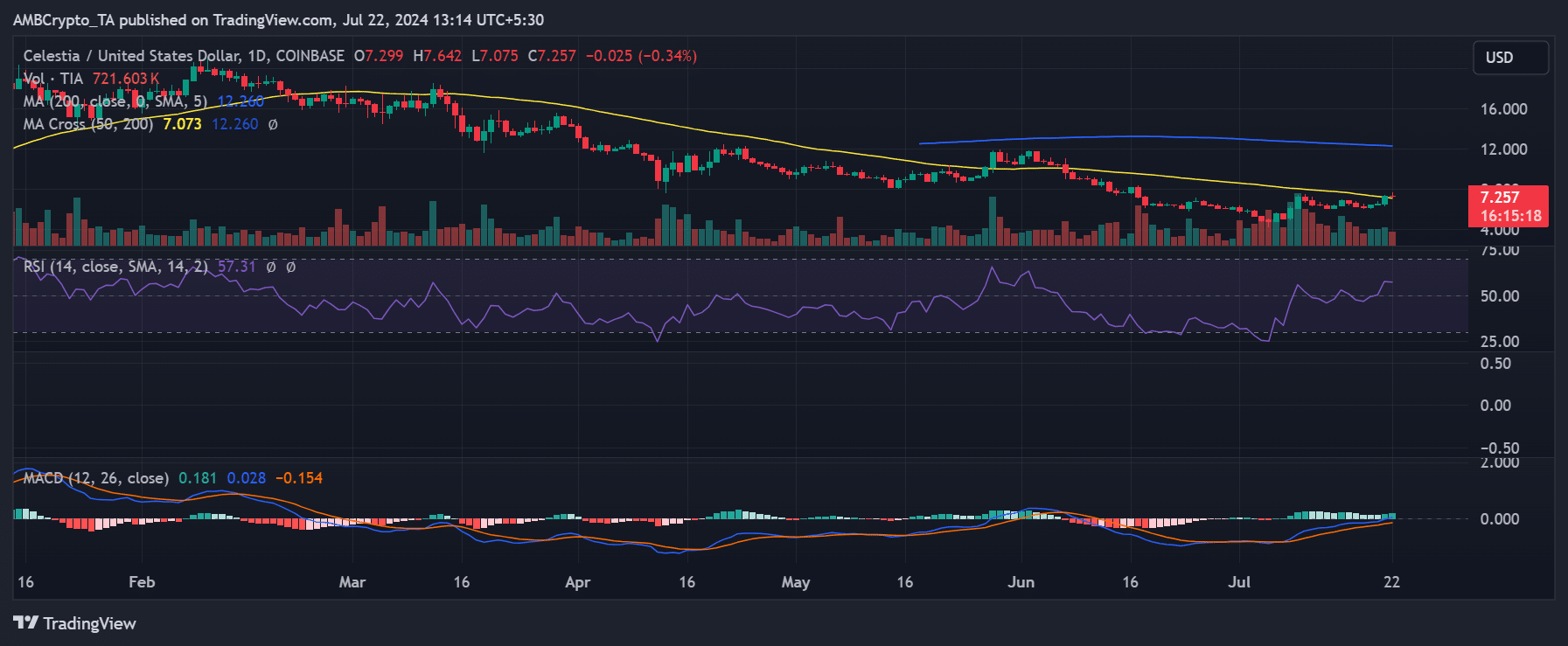

According to AMBCrypto’s analysis, Celestia has recently shown a positive trend on the daily timeframe chart.

The asset experienced a significant gain of 11.52% at the close of trading on July 21, rising from around $6.50 to around $7.20.

This rise is a reversal after three consecutive days of declines, and means Celestia is in its third consecutive day of positive trends.

Source: TradingView

The current price is holding the $7.2 range but is struggling to maintain its initial momentum. This observation suggests a consolidation phase or potential hesitation among traders to push the price higher without additional catalysts.

Additionally, analysis of Celestia’s Moving Average Convergence Divergence (MACD), a trend-following momentum indicator, shows a positive signal, but the MACD line has not yet crossed the zero line.

Volume activity increases

According to CoinMarketCap, Celestia has performed impressively on the 24-hour gainers chart, which shows it fluctuating between the 1st and 2nd positions.

The company has now gained 11% in the last 24 hours, and this growth has been reflected in its market cap, which is now over $1.4 billion. The market cap has also increased by more than 11%.

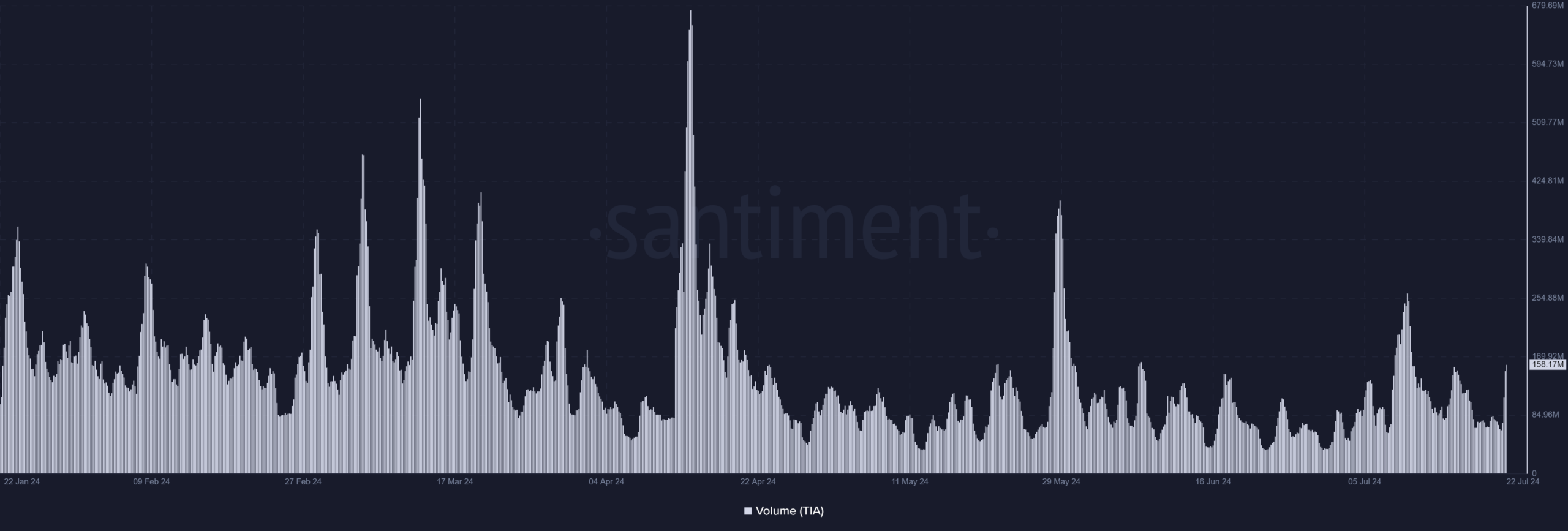

Source: Santiment

Celestia’s trading volume has seen even more significant growth, with data showing it surging by over 120% in the last 24 hours, to over $159 million.

However, an analysis of Santiment’s trading volumes shows that while there has been a notable spike in volumes, it is not the highest we have seen this month.

What’s next for TIA?

The upward trend in Celestia’s volume and price suggests a convergence, indicating that increased trading activity is supporting the current price action.

This synchronization often indicates a healthy market reaction where price changes are supported by significant trading volume, providing a solid foundation for the observed price trend.

However, Celestia’s current market trends foreshadow a decisive moment as a constant tug-of-war is underway between buyers and sellers.

Realistic or not, here is the TIA market cap in BTC terms.

These conflicts are important factors in determining the future price direction of Celestia.

If buyers dominate, demand can outpace supply, leading to a sustained upward movement. On the other hand, if sellers dominate, selling pressure can build, causing prices to fall.