- Polymarket now takes 6% of the transaction fees on the Polygon network.

- However, MATIC’s price movement has not been affected by recent growth.

Prediction Platform Polymarket Now it’s one of the key drivers. Polygonal Proof of Stake (POS) network transaction fees. According to recent data from Blockworks, prediction sites now account for 6% of transaction fees on the Ethereum L2 Polygon network.

“This application now accounts for 6% of total transaction fees on Polygon PoS.”

Source: Blockworks

In fact, Dan Smith, an on-chain analyst at Blockworks, argues that the recent surge in transaction fees is due to the recent increase in users and translation volume on Polymarket. The platform hit a record $100 million in June thanks to increased betting on the U.S. election.

Interestingly, the prediction site is outpacing legacy media in predicting that Joe Biden will lose the election. Its live odds feature makes it a favorite among punters in sports, politics, and everything in between.

But the big question is whether MATIC can benefit from this momentum.

Will Polymarket’s success help MATIC?

According to venture capitalists, Evan LutherUnlike other cryptocurrency market segments, the prediction category is still popular.

“While other narratives are cooling off, prediction markets are hot. Total value locked on top platforms has grown by nearly 70% year-to-date in 2024, with PolyMarket up more than 40%.”

However, despite the significant traction of Polymarket in June, MATIC fell 19% on the chart. However, the decline was not limited to MATIC, especially since the overall market also suffered a decline.

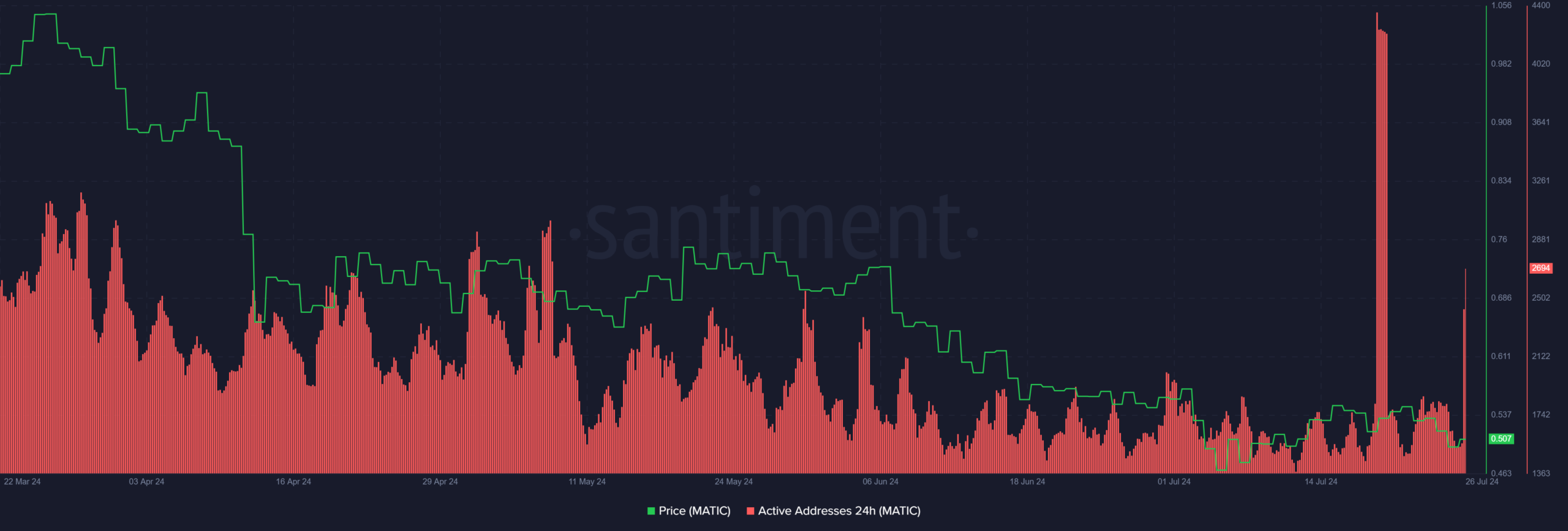

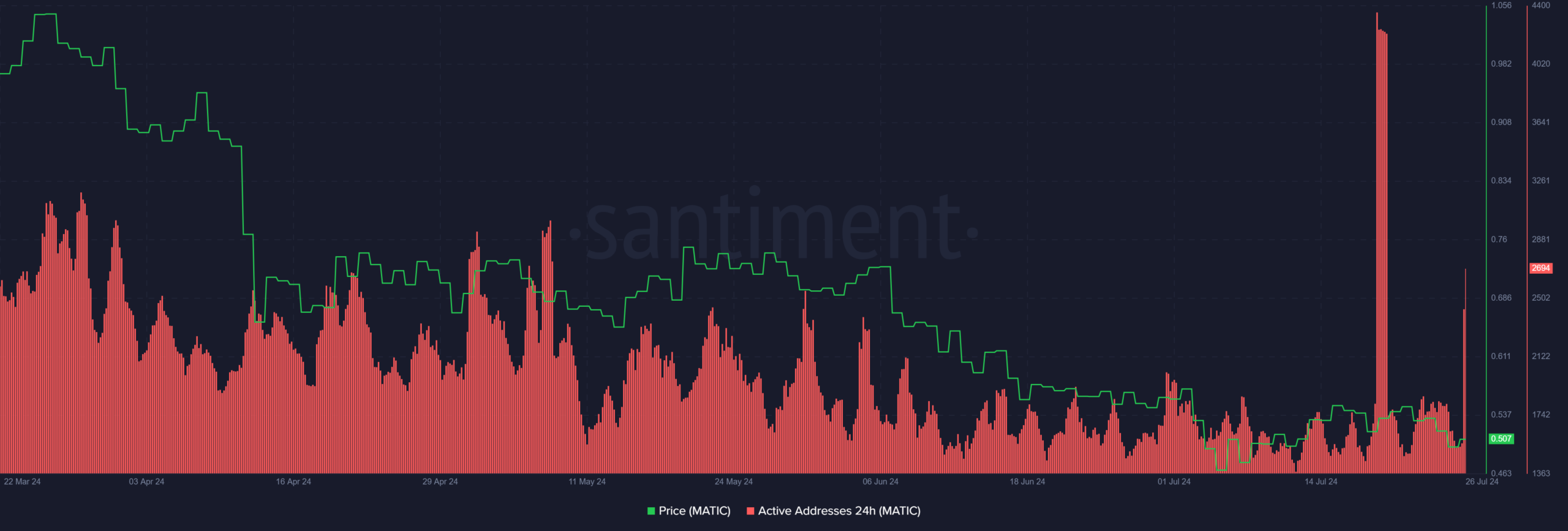

On the network side, MATIC saw an increase in daily active addresses in July compared to June. The July surge on the 19th was Demonstration test The ECB (European Central Bank) has made a decision regarding tokenized assets on its network.

Source: Santiment

Simply put, the MATIC network effect has been fueled by tokenized asset speculation, with volumes comparable to those recorded by Polymarket in June.

At the time of writing, daily active users appear to have surged again, seemingly taking advantage of the recent relief rally that saw Bitcoin (BTC) retest $67,000.

In other words, Polymarket’s popularity helps increase Polygon’s network revenue, but has little effect on MATIC’s price.

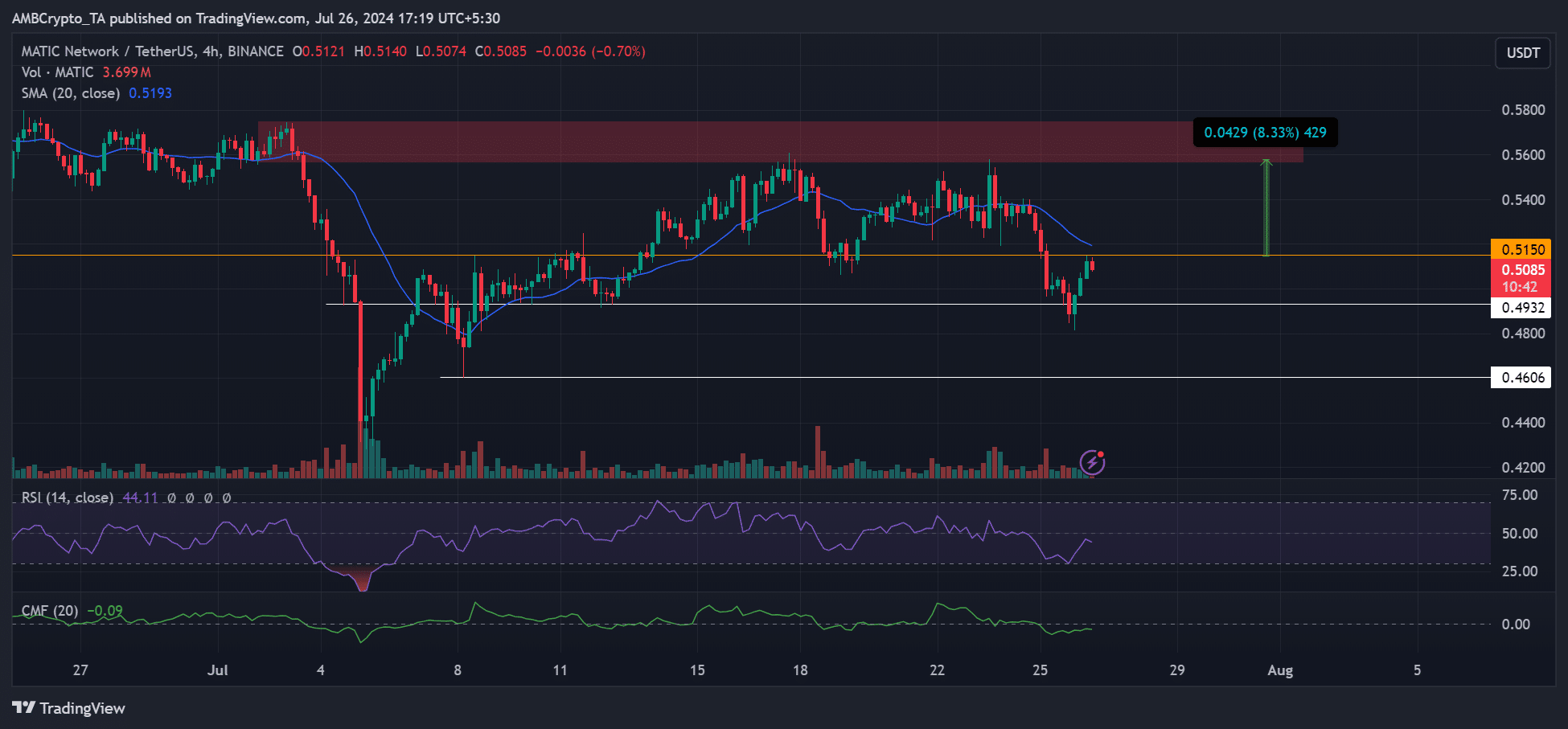

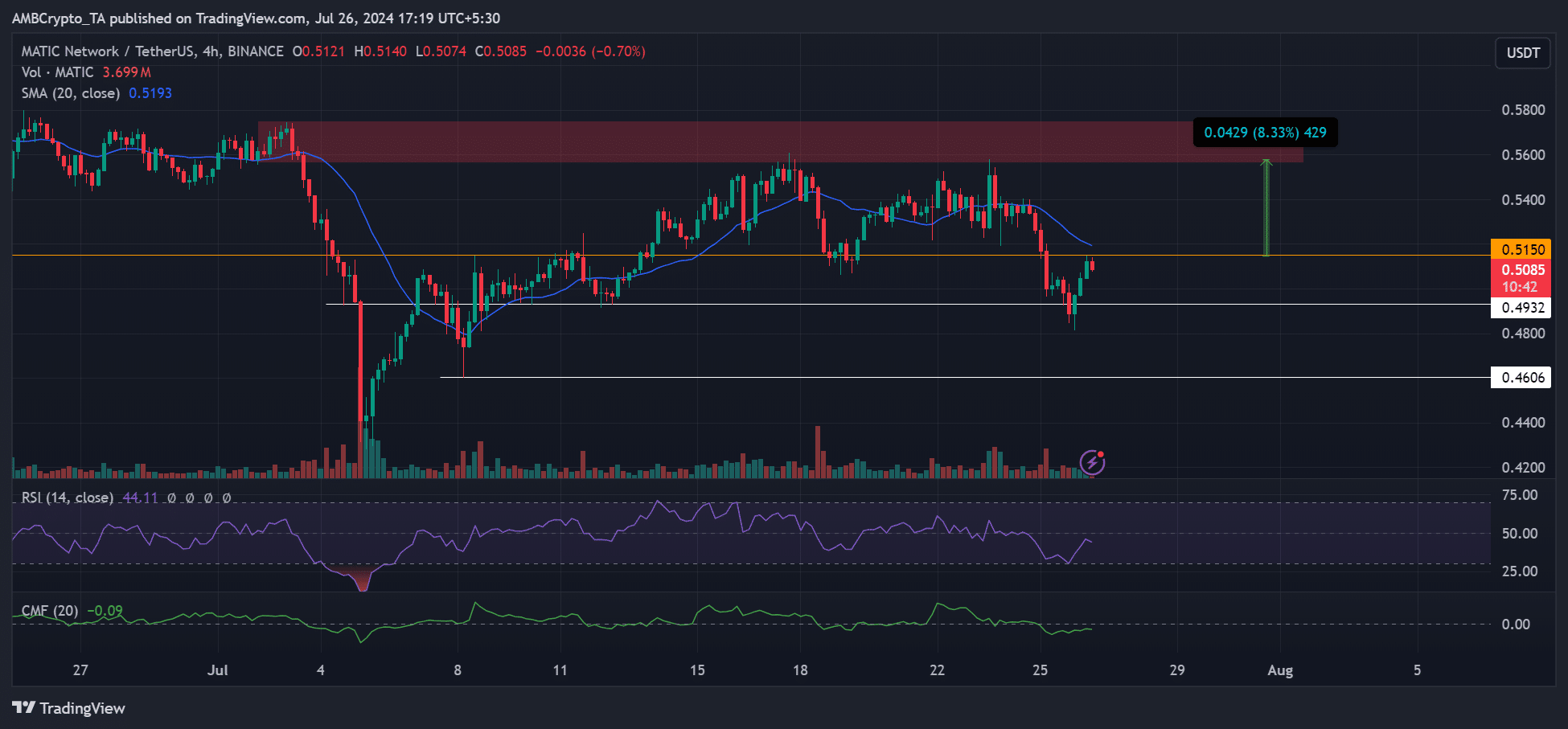

Source: MATIC/USDT, TradingView

On the price chart, the recent bounce faced resistance at $0.5. Weak buying pressure, as indicated by the below-average reading of the RSI (Relative Strength Index), meant that $0.51 was a significant hurdle.

Low CMF (Chain Money Flow) indicates weak capital inflows, further highlighting that a move above the 20-day SMA (simple moving average) could be problematic on the 4-hour chart.

Therefore, if the bounce from the hurdle calms down, MATIC could fall to $0.49.

However, if the bulls break through the barrier amidst continued bullish momentum, with Bitcoin (BTC) hitting $70,000, MATIC could rally by another 8% to $0.56.