- Both ETH and BNB saw price declines last week.

- Despite the bullish pattern, market indicators for ETH and BNB were bearish.

Best altcoins like: Ethereum (ETH) and B&B Last week the chart was underperforming as it remained red. However, recent analysis points to an update that suggests an imminent trend reversal.

In fact, if that is true, ETH and BNB could see huge upside.

Are Altcoins Ready for a Rally?

CoinMarketCap’s data ETH has seen a 7% price correction over the past week. At the time of writing, the king of altcoins was trading at $3,230 and had a market cap of over $388 billion.

Likewise, BNB bears have dominated the market over the past week. The coin’s price has fallen by more than 2% over the past seven days. At the time of writing, BNB is trading at $578 and has a market cap of over $84 billion.

However, the trends of these altcoins may change in the coming days.

Popular cryptocurrency analyst Mustache recently wrote: Twitter It shows a significant development. According to the tweet, the altcoin has been forming a textbook cup and handle pattern over the past few years.

Source: X

This suggested that altcoins would soon begin a bullish rally, which meant that ETH and BNB would also see increases in price.

Therefore, AMBCrypto planned to take a closer look at the state of these coins and see if this suggests an upcoming rally.

Status of ETH and BNB

AMBCrypto’s Analysis on CryptoQuant data It was revealed that BTC exchange holdings were increasing, which means there was a lot of selling pressure on the token. However, the situation in the derivatives market looked very optimistic.

The token’s funding ratio was green, meaning that long traders were dominant and willing to pay short traders. Also, the taker buy/sell ratio indicated that buying sentiment was dominant in the futures market.

Source: CryptoQuant

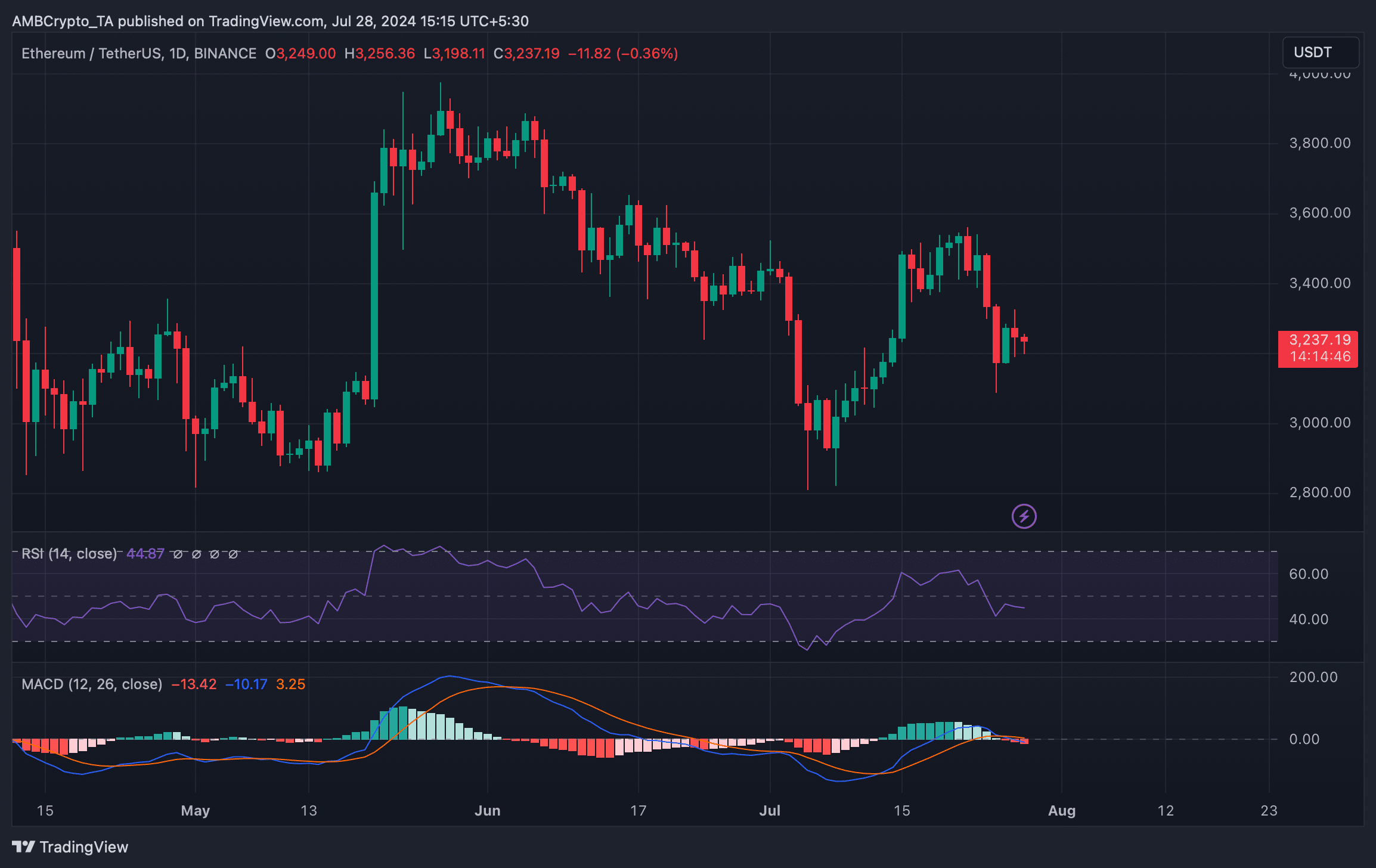

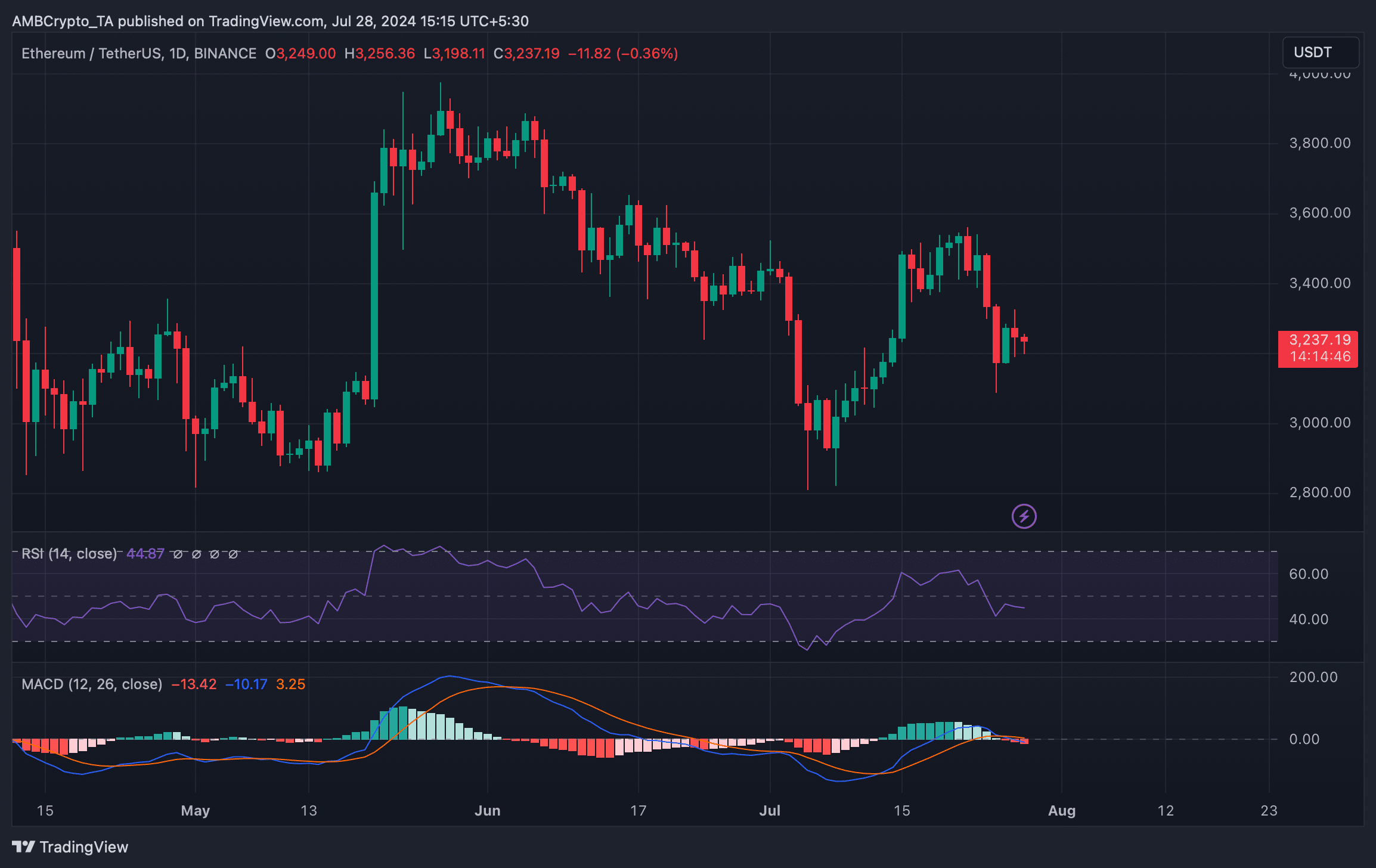

Then I checked the daily chart of Ethereum. I noticed that the technical indicator MACD showed a bearish crossover.

ETH’s Relative Strength Index (RSI) also recorded a downtrend, suggesting that investors may have to wait a bit longer to see ETH turn bullish again.

Source: TradingView

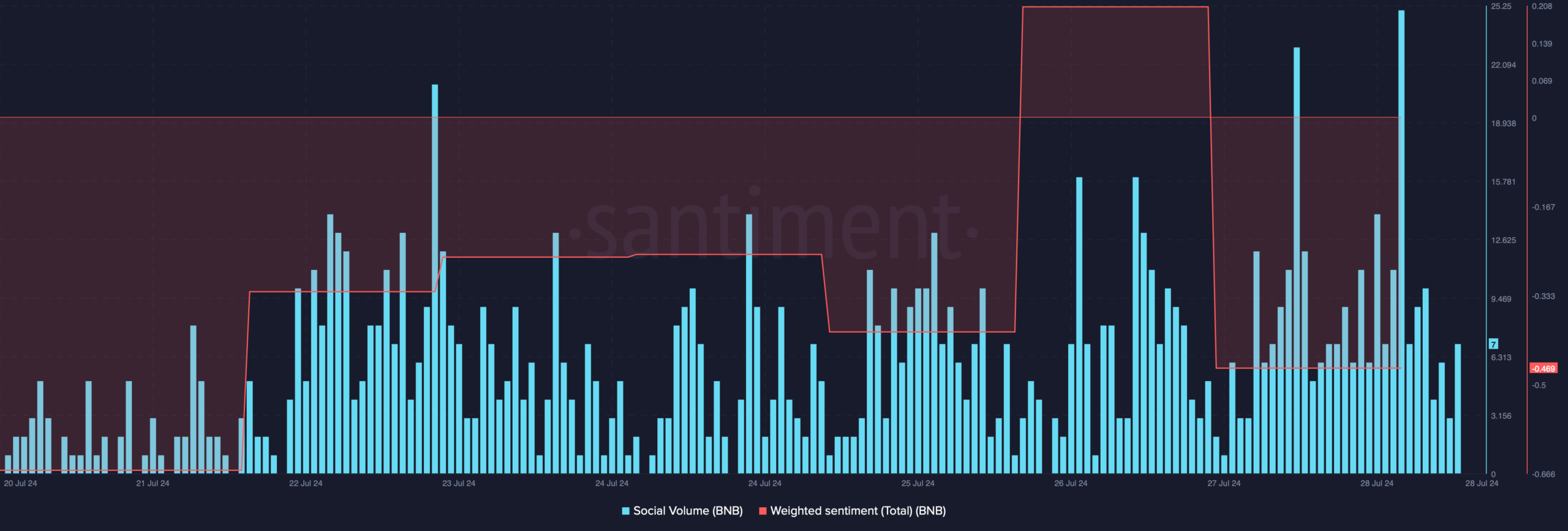

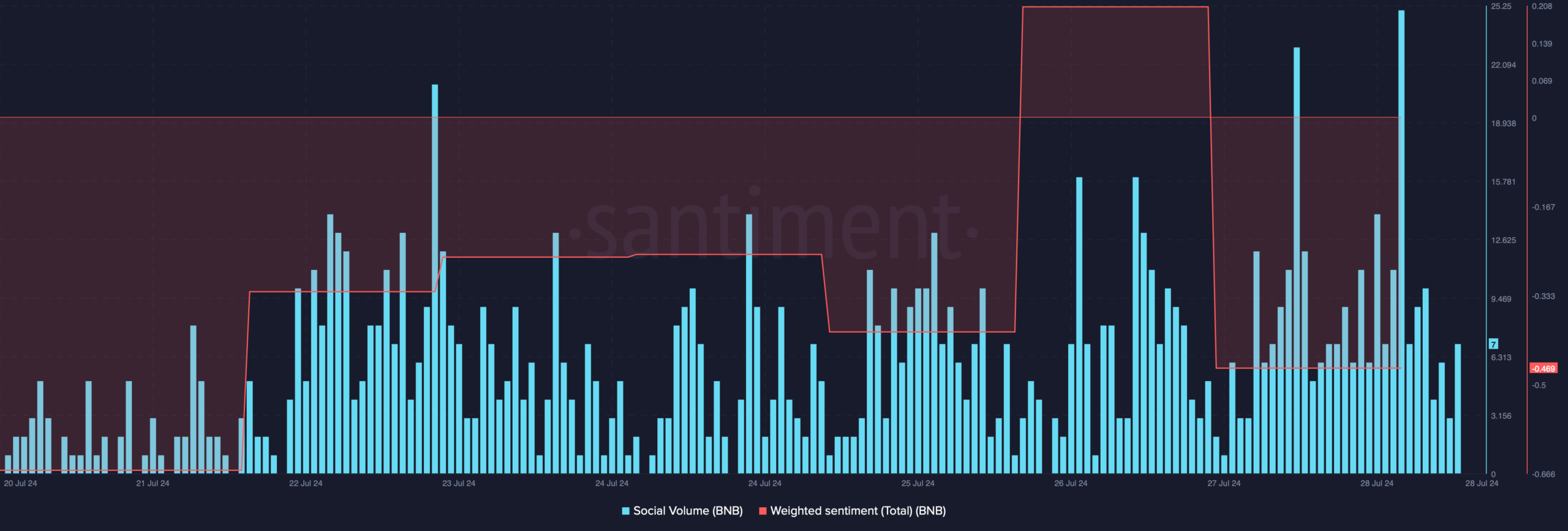

Then we checked what was happening with BNB. The coin’s social volume has been on the rise over the past week, which reflects its popularity.

However, the coin’s weighted sentiment still remained in the negative territory, clearly indicating that bearish sentiment surrounding BNB is dominant in the market.

Source: Santiment

read Ethereum (ETH) Price Prediction 2024-25

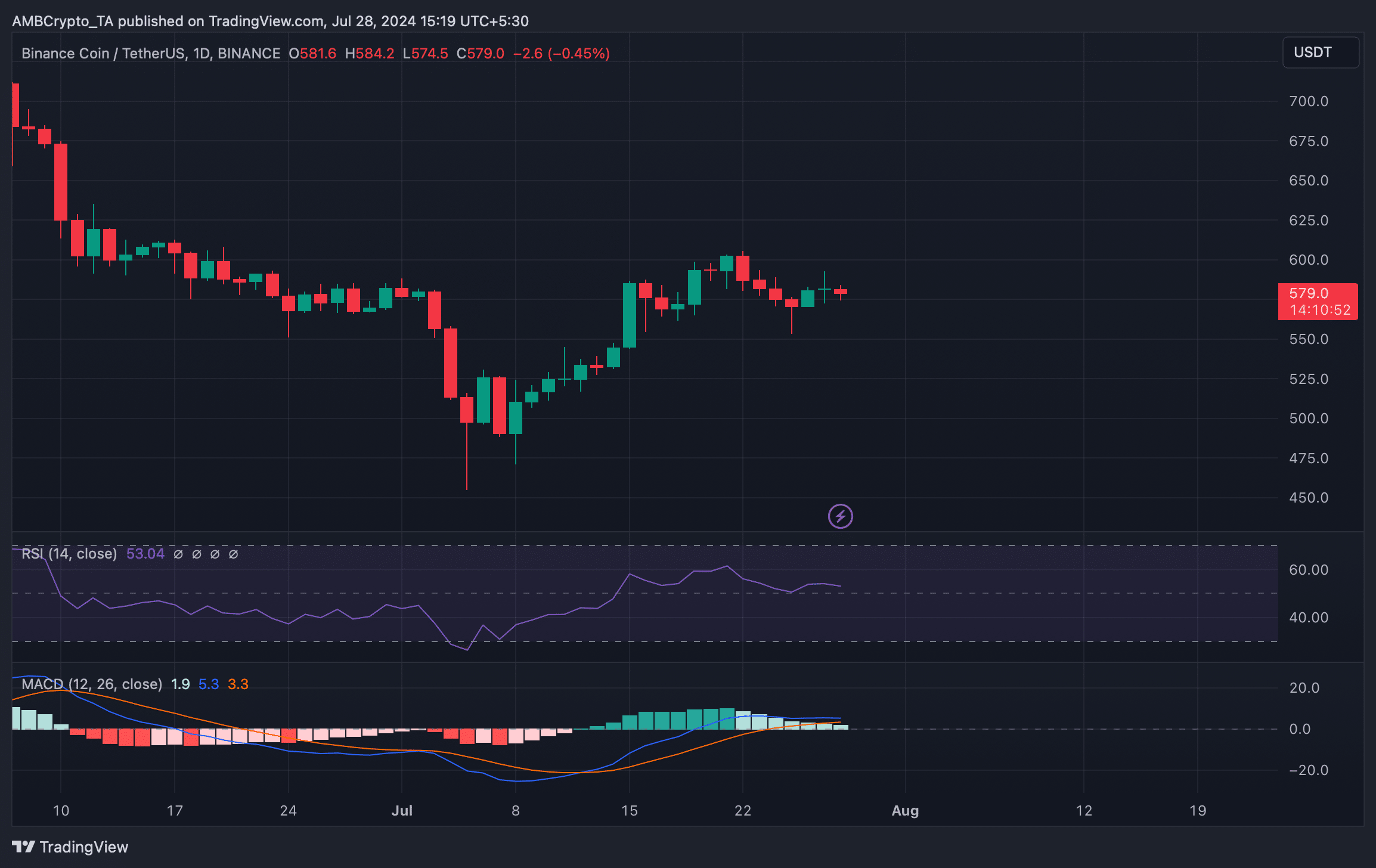

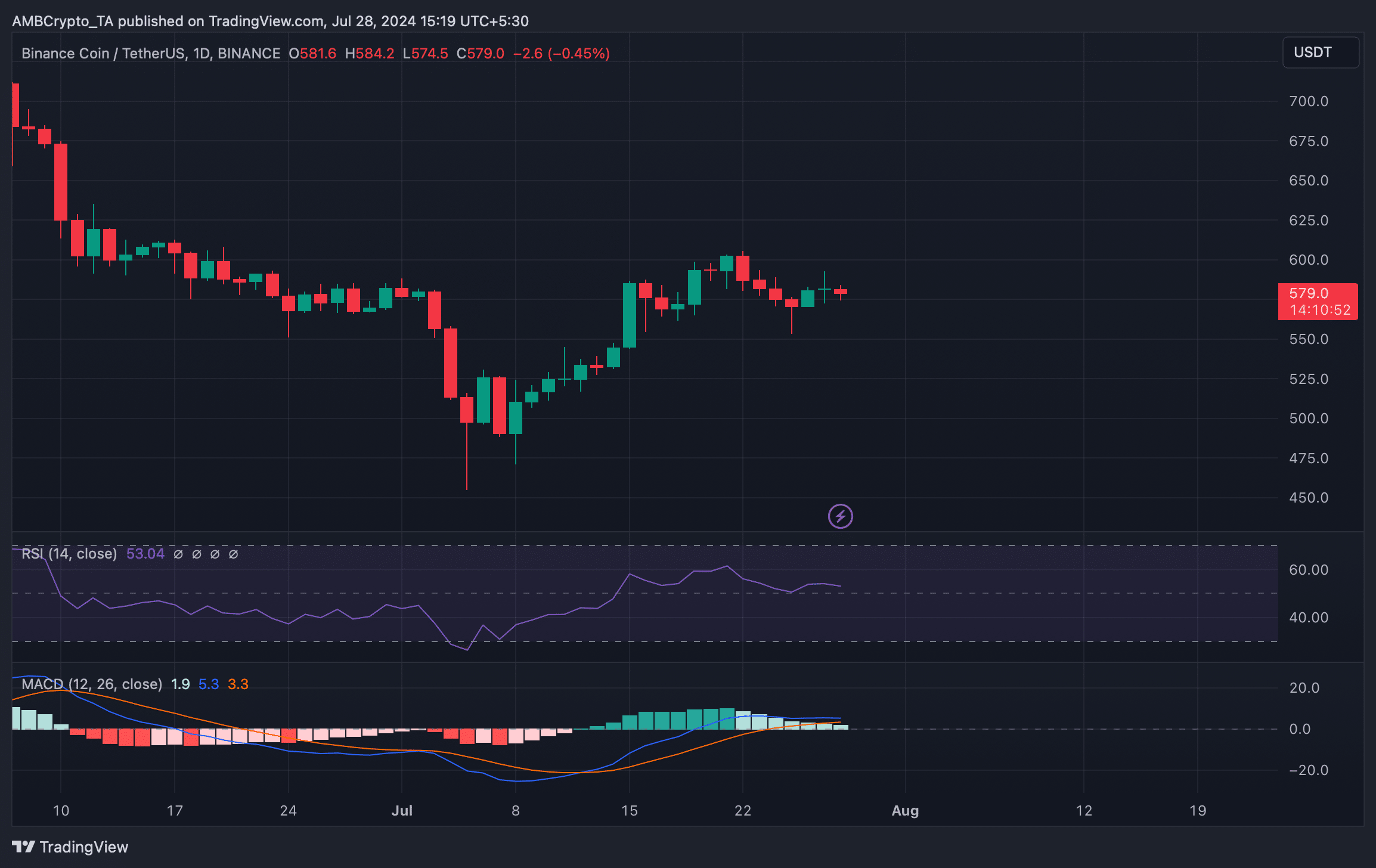

Like Ethereum, BNB’s technical indicators have also shown a downtrend. For example, the MACD showed that a price correction is possible.

Additionally, the Relative Strength Index (RSI) also pointed slightly south.

Source: TradingView