Mantle (MNT), an Ethereum Layer 2 (L2) project, has been gaining widespread attention recently.

MNT is a cryptocurrency in its own right and has outperformed tokens on other blockchains in its category, but this analysis focuses on recent developments.

A drop in Mantle TVL has ripple effects on the network

According to DeFiLlama, Mantle’s total value locked (TVL) reached an all-time high of $636.5 million on July 24. Commonly referred to as TVL, this measures the value of assets locked or staked in the protocol.

The higher the TVL, the more trustworthy the network is to be seen as being profitable. However, a decreasing TVL means that market participants are withdrawing previously locked tokens.

Just 7 days after reaching its peak, Mantle’s TVL has decreased to $589.13 million. This decrease shows a growing trend of decreasing benefits and yields for the lending, staking, and cross-chain protocols developed by Mantle.

Read more: What is Mantle Network? A Guide to Layer 2 Solutions for Ethereum

The decline also appears to have affected the MNT price. A few days ago, the price of this cryptocurrency was up by double digits. However, the uptrend was then broken by profit taking. Since then, MNT has struggled to bounce back and is trading at $0.75 at the time of writing.

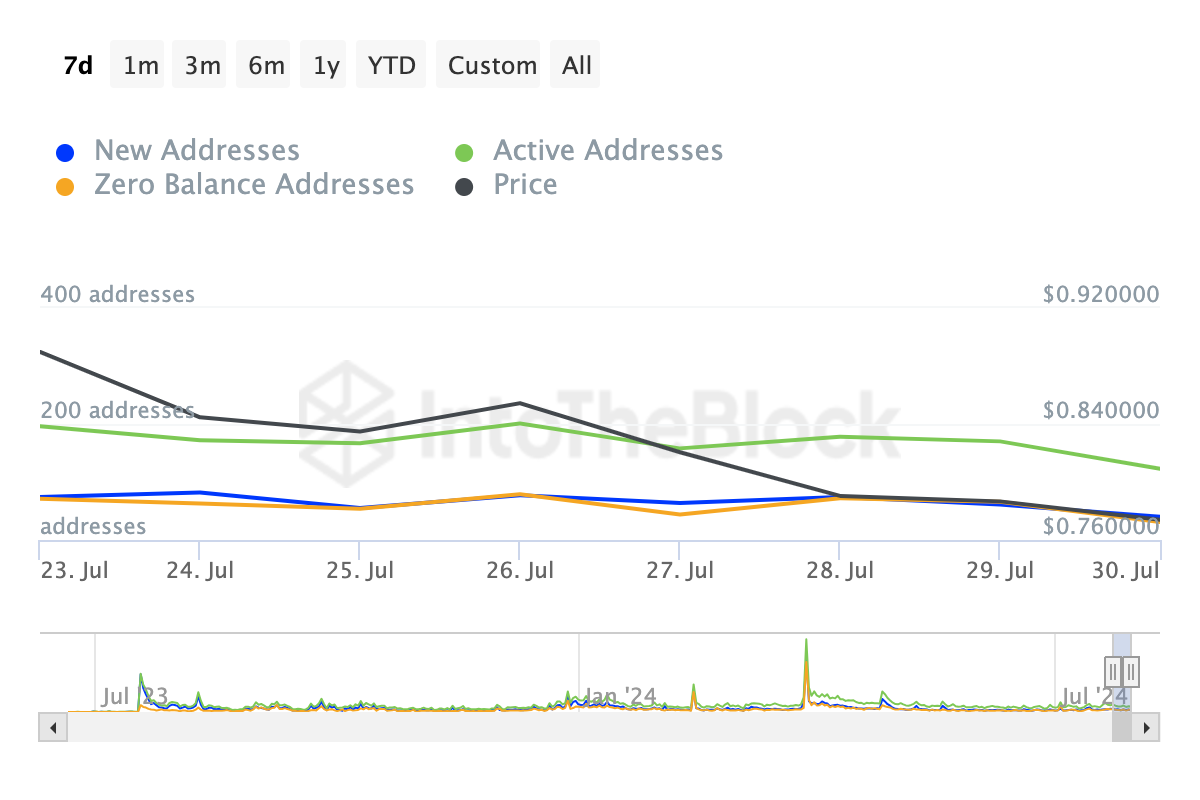

Additionally, data from IntoTheBlock indicates that Mantle network activity has struggled to recover. To get a clearer picture of network activity, BeInCrypto examines the status of active and new addresses.

In simple terms, active addresses estimate the number of users on the blockchain. An increasing number means there is a lot of interaction with the native token, which can be bullish for the price. A decreasing number means otherwise.

New addresses, on the other hand, track the number of transactions that occur for the first time on the blockchain. As a measure of momentum, an increase in the number suggests increased adoption, while a decrease suggests decreased demand.

As shown above, Mantle’s active, new, and zero-balance addresses have all decreased over the past 7 days, reflecting a decrease in interaction with the MNT token. If this continues, the price of MNT may struggle to recover from recent lows.

MNT Price Forecast: Downward Pressure Continues

The Moving Average Convergence Divergence (MACD) has fallen into negative territory on the daily chart. MACD is a technical indicator that uses the relationship between two exponential moving averages (EMA) to determine momentum and price trends.

In the chart below, the 26-day EMA (orange) is above the 12-day (EMA), indicating seller dominance and bearish momentum. If the shorter EMA were above the longer EMA, the trend would have been bullish.

If the trend continues, MNT may not be able to avoid another downtrend, and the Fibonacci correction series gives us an idea of the levels the token can reach. If selling pressure increases, the price of MNT may fall to $0.70, where the 23.6% Fibonacci level is located.

Read more: Layer 2 Crypto Projects for 2024: The Best Picks

However, if buying pressure surges and network activity increases, this argument may be invalidated. If this happens, MNT may bounce to $0.83 or even $0.89.

disclaimer

In accordance with the Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without prior notice. Always conduct your own research and consult with a professional before making any financial decisions. Please be advised that our Terms of Use, Privacy Policy and Disclaimer have been updated.