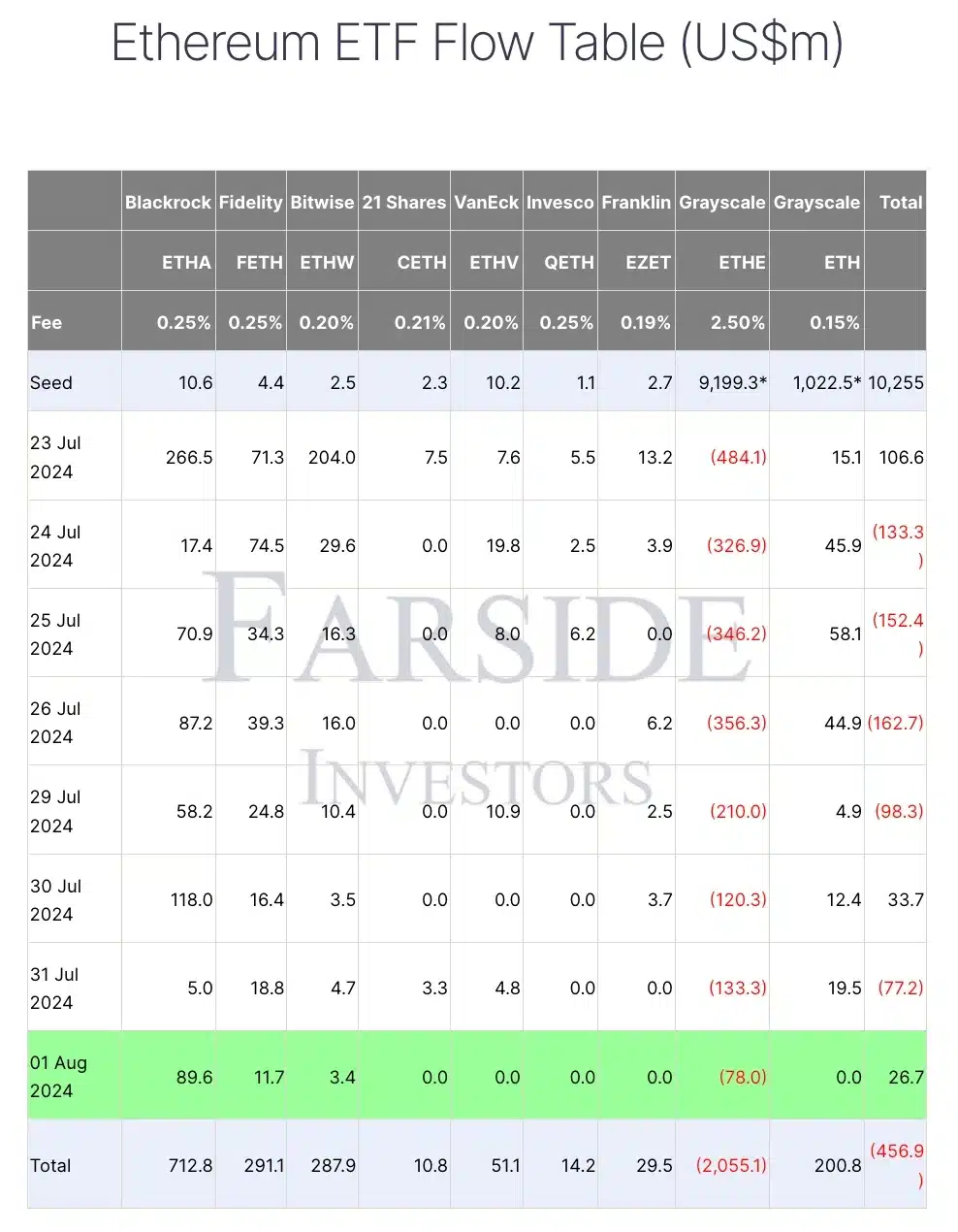

- On August 1, there was a net inflow of $26.7 million into US Ethereum ETFs, led by ETHA.

- A $2 billion outflow from the Grayscale Ethereum Trust (ETHE) has caused a major shakeup for investors.

Despite continued cumulative outflows exceeding $2 billion from the Grayscale Ethereum Trust (ETHE), recent trends in U.S. spot Ethereum (ETH) exchange-traded funds (ETFs) paint a contrasting picture.

Ethereum ETF Flow Analysis

On August 1, the Ethereum ETF saw a notable turnaround, recording net inflows of $26.7 million.

This positive change was primarily driven by $89.6 million in inflows into BlackRock’s iShares Ethereum Trust (ETHA).

Meanwhile, ETHE recorded inflows of $78 million, according to data from Farside Investors.

Source: Farside Investors

Commenting on X, prominent investor and entrepreneur Ted Pillows said:

“The Ethereum ETF saw net inflows of $33.7M. BlackRock bought $118M of $ETH. ETH is just getting started, my bag is ready.”

Trend change

This development is particularly noteworthy given that the Ethereum ETF has seen primarily outflows since its launch on July 23.

Except for July 23, July 30, and August 1, the trend was generally negative.

In particular, while the Grayscale Ethereum Trust (ETHE) experienced the largest outflows since the launch of the ETH ETF, inflows into BlackRock’s iShares Ethereum Trust (ETHA) far outpaced outflows around August 1, showing a major shift in the ETF market.

It is important to highlight that, unlike the eight Ether ETFs that were introduced as “new” funds on July 23, the Grayscale Ethereum Trust (ETHE) is an established trust that provides institutional exposure to Ether.

Prior to the recent switch, ETHE held a whopping $9 billion worth of Ether.

However, as of August 1, outflows from ETHE have exceeded 22% of its initial value, showing a significant shift in investor sentiment despite the overall positive movement in Ether ETF inflows.

Dedic’s unique perspective on Ether

Despite the recent positive changes in ETH ETF performance, not all investors are happy. Simon Dedic, founder and CEO of Moonrock Capital, echoed the sentiment, saying:

“Despite the launch of the ETF, $ETH was the worst performing MTD among the top 50 assets.”

However, he suggested that given ETH’s current poor performance, this situation could be an attractive buying opportunity.

“Turn off your emotions for a moment and tell me this isn’t one of the easiest purchases you’ve ever made.”

At the time of writing, ETH was trading at $3,143.34, down 1.67% over the last 24 hours.

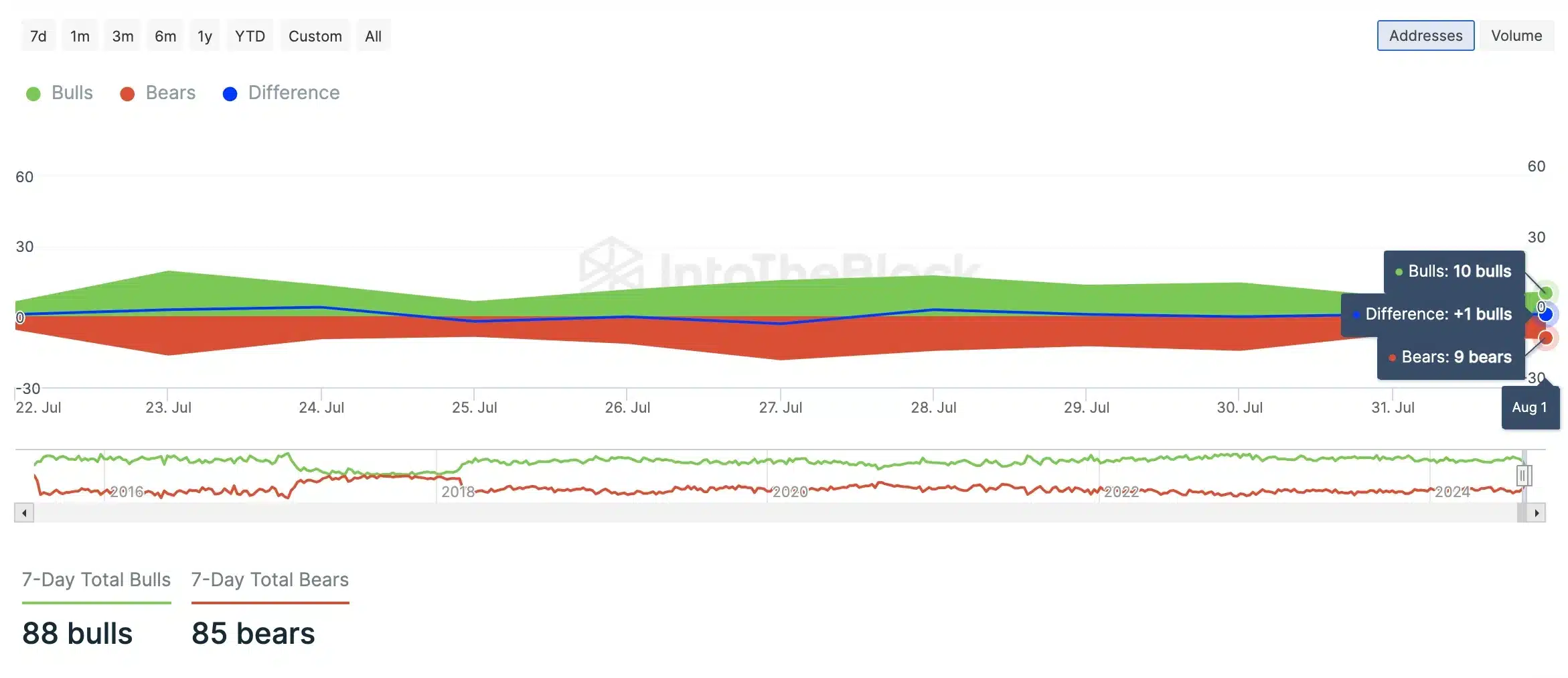

However, despite this decline, analysis by AMBCrypto using data from IntoTheBlock shows that bullish sentiment is outpacing bearish sentiment.

Source: IntoTheBlock