- The January low that triggered the rally to $4,000 was tested again in the early hours of July 5.

- It’s still too early to say whether Ethereum has bottomed, but investors can wait until next week for more clarity.

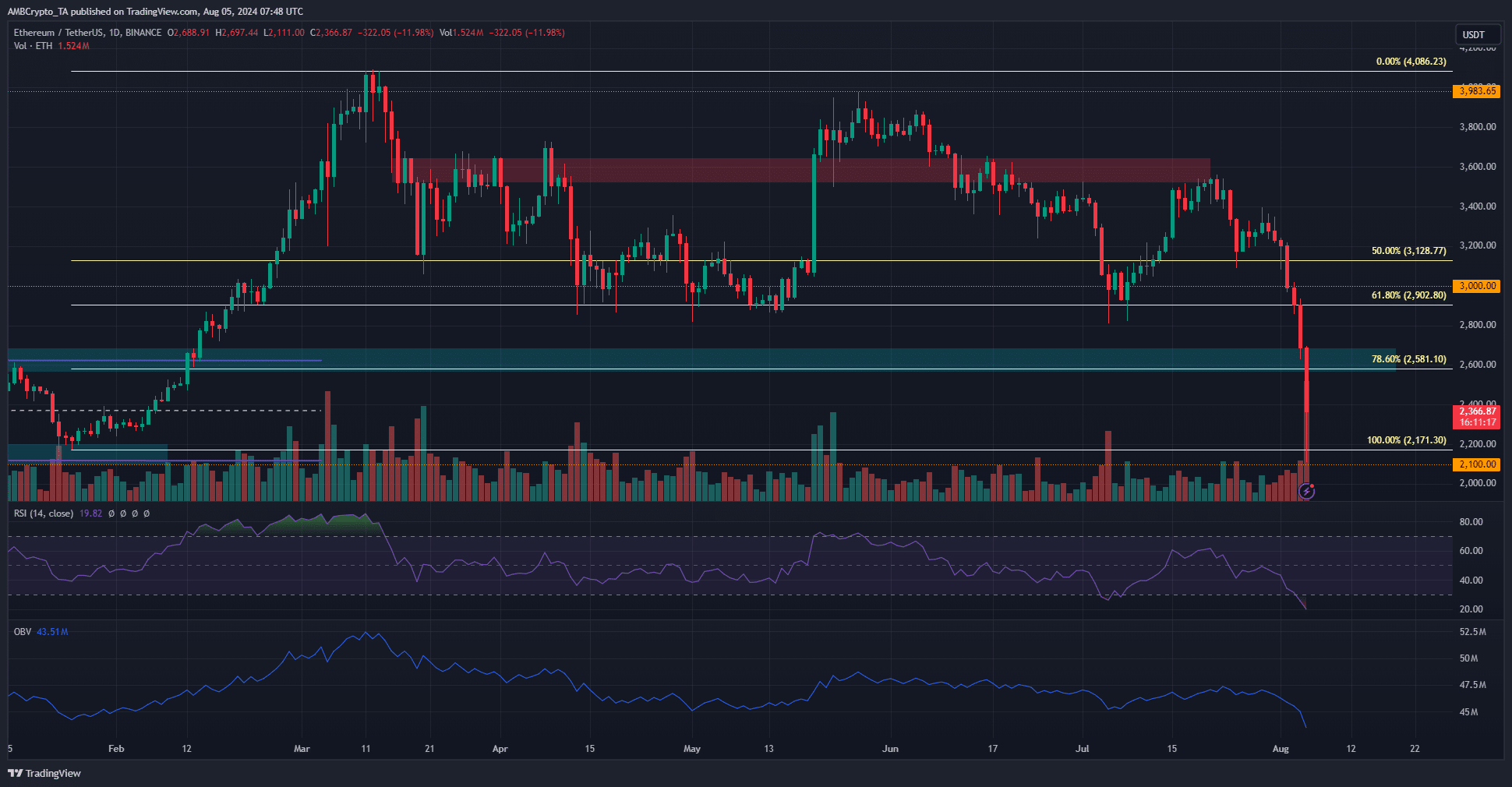

Ethereum (ETH) has crashed to its lowest level since January in the past few hours, falling below 2.9k and then falling 27.5% over the next 12 hours.

At the time of writing, ETH has bounced from a low of $2,100 to $2,366, up 12.17%.

Smart investors who bought close to $20 million when prices were $2,900 to $3,100 were wrong this time, and the previous perfect performance was clouded.

The launch pad for the February rally was tested again.

Source: ETH/USDT on TradingView

The price crash of the past few days has been brutal. In just 24 hours, $346.5 million worth of Ethereum liquidations occurred on the Ethereum market. The daily RSI has fallen to 19, the lowest since August 18, 2023.

The daily session is not yet closed, but as things stand, the rally from earlier this year has completely regressed. The $2.5k-$2.6k zone is likely to act as resistance on the way up.

OBV has made a new low to implement the idea of extreme selling. The trading volume for the day was 1.55 million ETH and continues to increase to reach a 2024 high.

While this may be a good reason to buy, conservative traders and investors would like to see the price reclaim key support and hold above it for a few days before they feel confident enough to bid up.

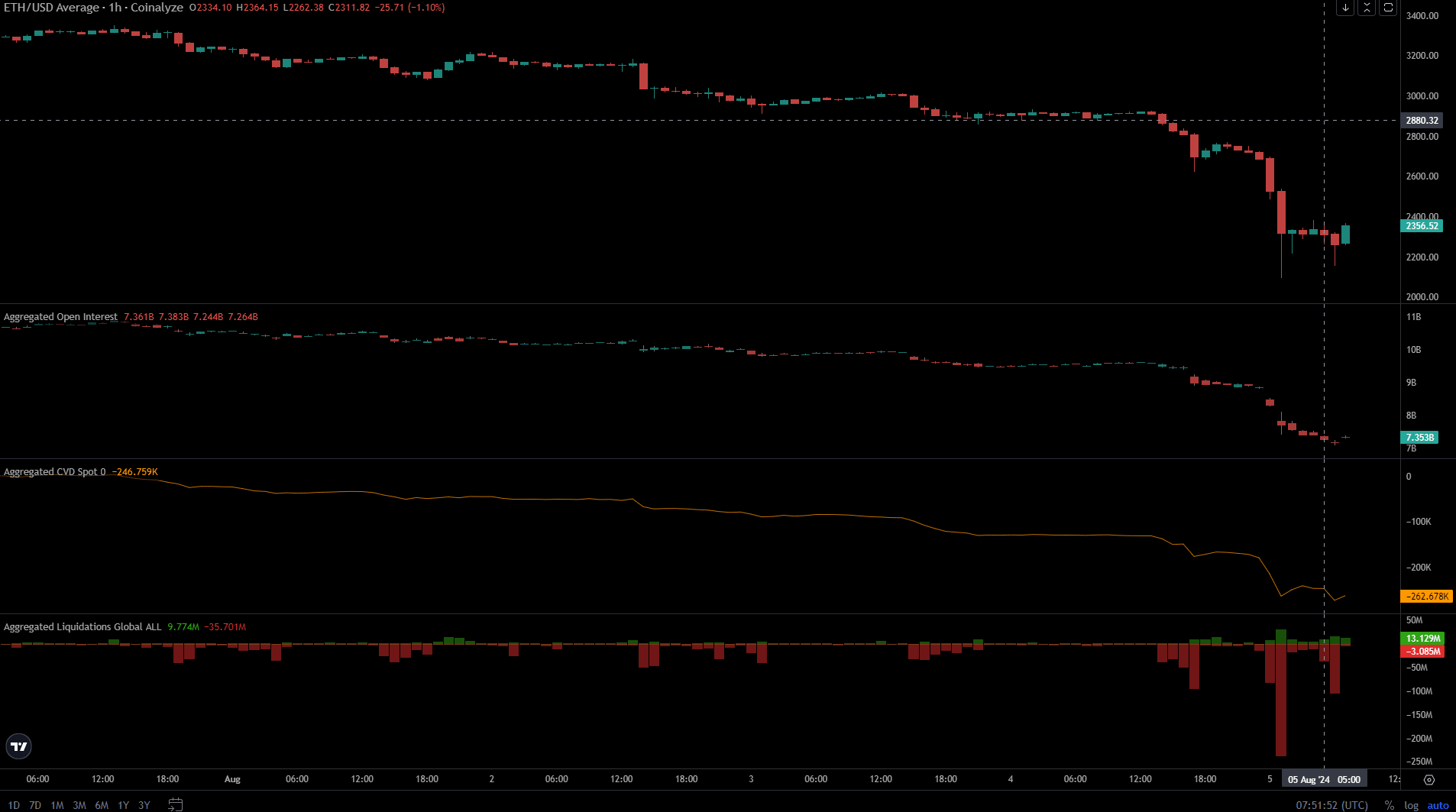

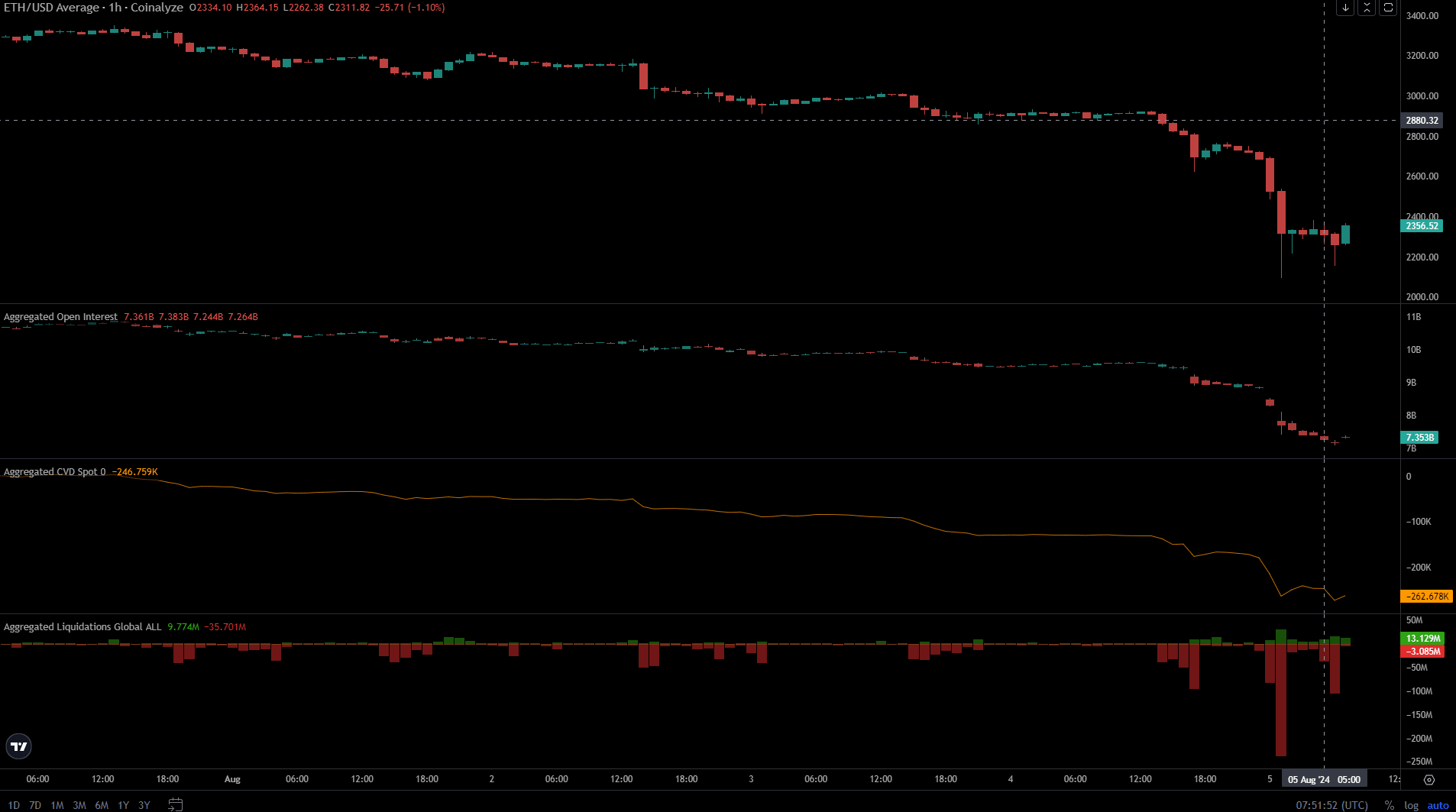

The futures market has wiped out ETH traders en masse.

Source: Coinalyze

This market crash is not a good time to engage in leveraged trading, and over 270,000 crypto traders learned this over the weekend. Open interest has fallen from $9.9 billion on August 3rd to $7.35 billion at the time of writing.

Is your portfolio green? Check out our ETH yield calculator

Spot CVD fell deeper, supporting the idea of a strong selloff. Liquidations over the past few days have been mostly long, as expected.

A bounce to $2,500 is possible, but selling pressure could mount in the New York trading session.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.