- BlackRock recently bought $199 million worth of ETH, taking advantage of the price drop.

- Although some accumulation has been observed, particularly in whales, the retail industry remains fearful.

Given the latest discounted Ethereum (ETH) price, it is expected that buyers will return to the market.

Unless more selling pressure is expected in the future, it is essential to follow the activity of the ETF as it has driven demand for ETH.

Recent data shows that bears are in a downtrend after their aggressive attack on the market last week. Some Bitcoin (BTC) ETFs are taking advantage of this, with BlackRock, for example, buying $199 million worth of ETH on August 6.

This was a significant increase compared to the amount BlackRock purchased the previous day.

Source: farside.co.uk

Blackrock previously halted accumulation on August 2nd as selling pressure intensified. It resumed on August 5th and added $47.1 million worth of ETH.

The net buying pressure that day was $98.4 million, compared to $48.8 million the previous day.

This increase over the past two days indicates that confidence has returned after the recent sell-off. It also indicates that the ETF is taking advantage of the ETH price discount.

Despite this, most other ETH ETFs are either sitting idle or adding only small amounts.

At the other end of the spectrum, the most notable one was the Grayscale ETHE ETF, which experienced outflows. It also had the highest annual expense ratio at 2.5%.

This created selling pressure worth $39.7 million during the August 6 trading session.

Outflows have been noticeably lower than in the last week of July, showing a lack of interest in selling at discounted prices.

Is ETH accumulation gaining popularity?

There is no doubt that ETH has seen renewed selling pressure over the past two days, but how much buying pressure is there now?

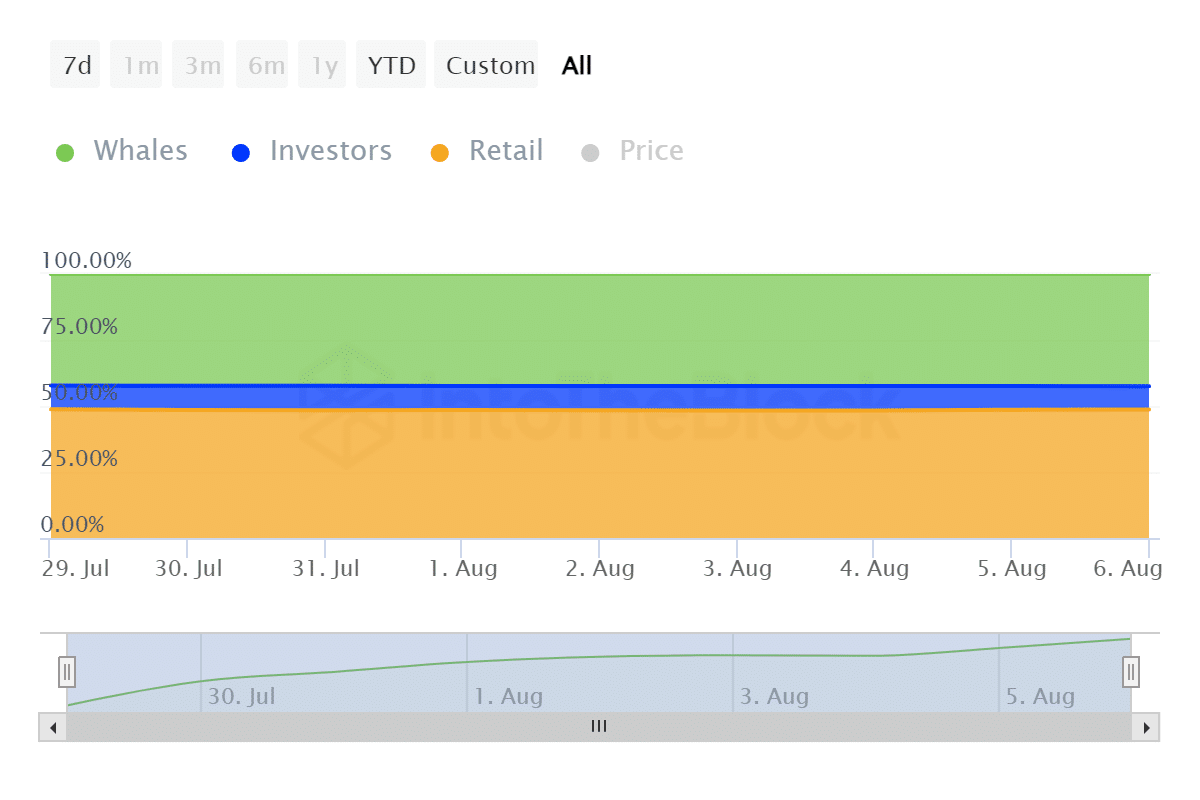

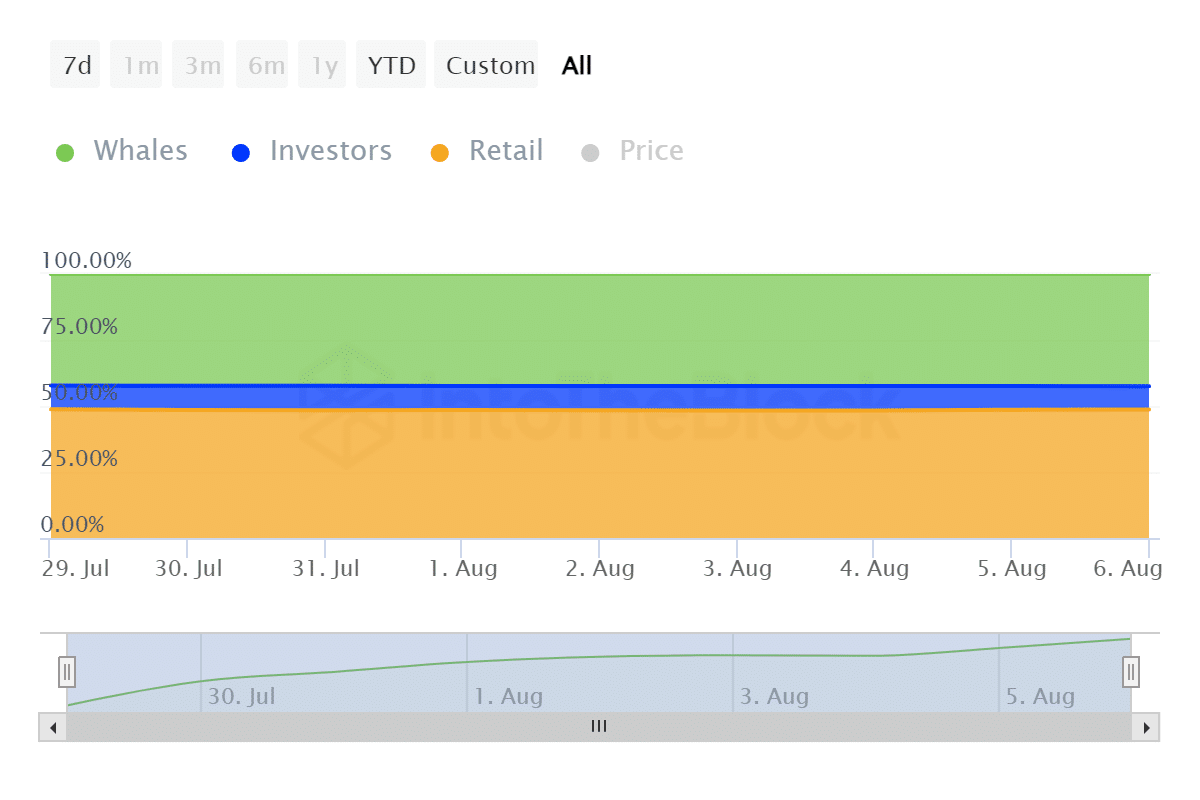

We compared the ETH concentration before and after the crash and the results are as follows:

Just 7 days ago, whales held 56.66 million ETH, investors held 12.2 million ETH, and retail traders held 65.43 million ETH, representing 42.19%, 9.09%, and 48.72%, respectively.

According to the latest data, whales hold 57.13 million ETH, investors hold 11.93 million ETH, and retail holds 65.39 million ETH.

Source: IntoTheBlock

The above findings indicate that whales have been increasing their holdings during the downturn. Investors and retail traders are holding less ETH at the time of writing than they did a week ago.

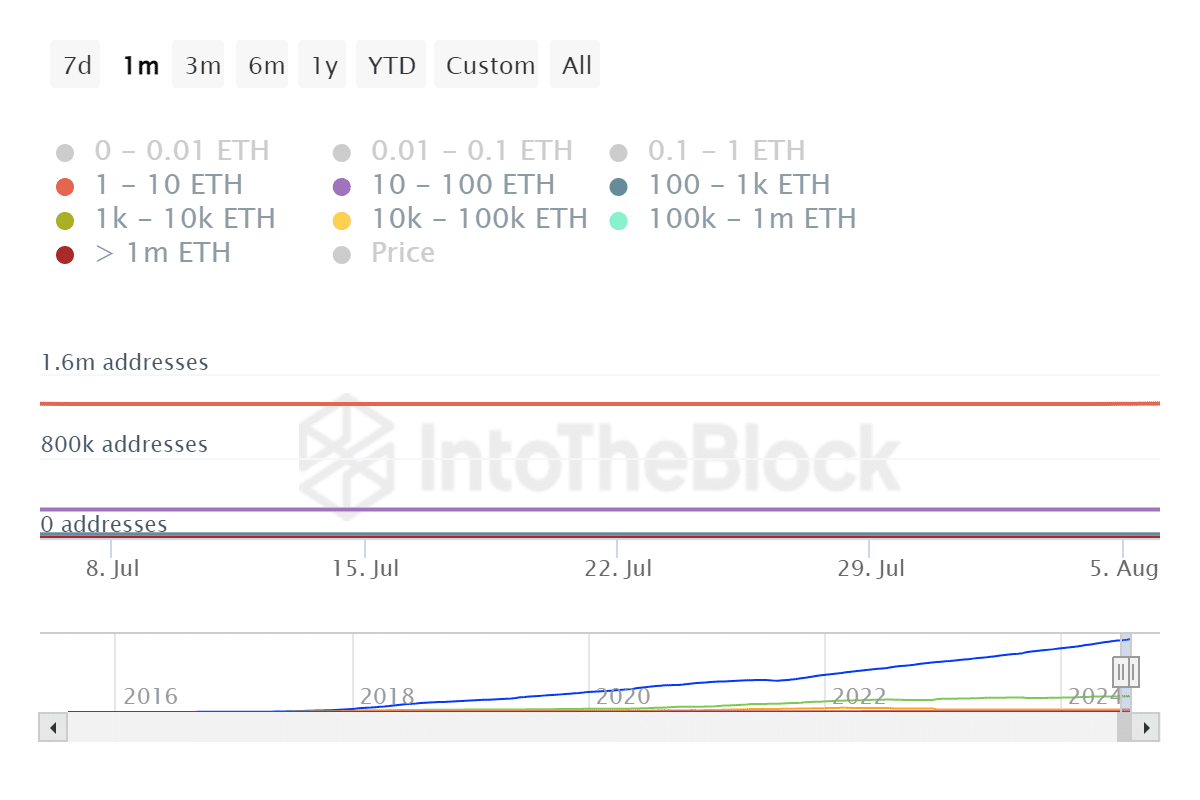

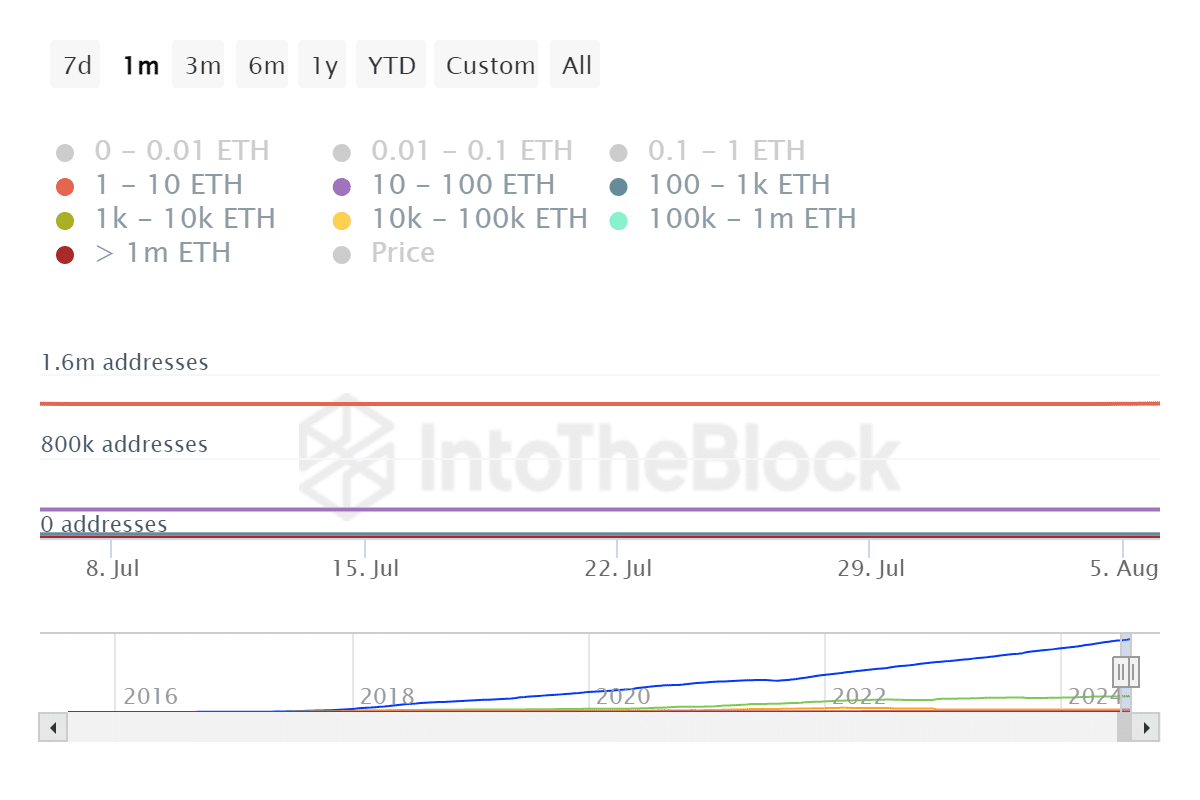

We also decided to look into address holdings to see what type of whales are accumulating.

Source: IntoTheBlock

Read our Ethereum (ETH) Price Prediction 2024-25

According to our research, there were 5 addresses that held more than 1 million ETH in the last 30 days. The number of addresses holding between 100,000 ETH and 1 million ETH decreased from 93 to 92.

The number of addresses in the 10,000–100,000 ETH range decreased by 32. The category of addresses holding 10–100 ETH showed a net positive result, going from 281,750 addresses to 282,530 addresses.