Grayscale Investments has launched two new cryptocurrency trusts for Bittensor (TAO) and Sui crypto (SUI), further strengthening its commitment to the blockchain industry.

Launched on August 7, this new option gives accredited investors the opportunity to get early access to cutting-edge tokens before they are launched as formal exchange-traded funds (ETFs).

“With the launch of the Grayscale Bittensor Trust and the Grayscale Sui Trust, we continue to provide investors with familiar products that enable access to cutting-edge tokens in the ongoing evolution of the cryptocurrency ecosystem,” said Rayhaneh Sharif-Askary, Head of Product and Research at Grayscale.

Why Grayscale Wants More Exposure to Bittensor and SUI Crypto

Grayscale Bittensor Trust focuses on Sui Crypto and TAO, with TAO becoming Bittensor’s primary token.

The platform uses tokens to encourage contributions to open source AI and to drive the convergence of AI and blockchain. Bittensor’s mission is to incentivize developers and enable decentralized AI to thrive.

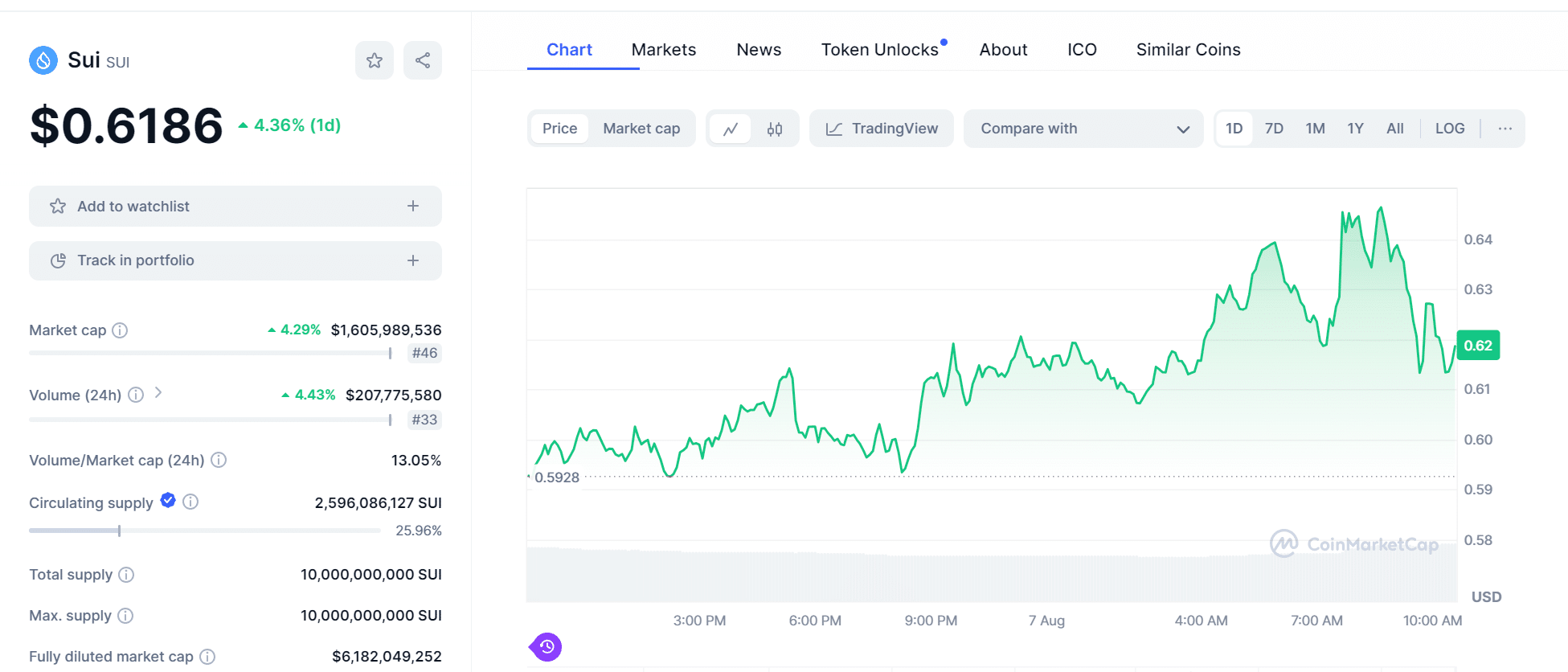

At the same time, Sui Trust is dedicated to the SUI token. Sui is a turbocharged layer 1 blockchain geared towards scalable DApps worldwide.

It is important to note that these new trust products are not available to retail traders.

According to a press release from Grayscale, both the Bittensor and Sui Trusts are open only to qualified individuals and accredited institutional investors.

“We are excited to add Bittensor and Sui to our product family, as we believe Bittensor is at the center of the growth of decentralized AI and Sui is redefining smart contract blockchain,” Rayhaneh Sharif-Askary, Grayscale’s head of products and research, said in a statement.

Discover: 17 Best Altcoins to Buy in August 2024

Grayscale’s Legacy and Market Position

Grayscale’s new Bittensor and Sui trusts, like the Bitcoin trust ‘GBTC’, allow whale investors to access crypto assets without having to acquire tokens directly.

This approach provides a way to ride the wave of new technologies while avoiding operational difficulties and regulations.

Meanwhile, Grayscale’s Ethereum Trust has been bleeding since its July launch, with recent outflows topping $2 billion by early August. The good news is that this outflow could set the stage for a bullish ETH rally as the market finds its balance.

Explore: Mark Cuban’s Bitcoin Theory: Decoding Silicon Valley’s Support for Trump

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes only and does not constitute investment advice. You may lose all your capital.