- Dofwifhat experienced a strong downtrend, almost crashing to $1.

- However, things have changed in the last 24 hours, with WIF surging by 22%.

The cryptocurrency markets have been volatile over the past month. Volatility peaked on July 5, and the market almost crashed.

During the market decline, Bitcoin reached a two-month low of $49,577. All altcoins were hit by the decline, with $1 billion liquidations and a $300 billion drop in the crypto market.

So dogwifhat (WIF) has been down significantly like other altcoins and memecoins, continuing its downtrend for a month.

WIF, after weeks of decline, on the rise

Last week WIF experienced a significant decline, which was further exacerbated during the recent market crash. However, in a turn of events, dogwifhat reported a massive rally on the daily chart.

At the time of writing, WIF was trading at $1.70 after a 22% gain in the last 24 hours. This surge came after memecoin experienced strong downward momentum.

So on the daily chart, WIF shows strong upside activity that could lead to a sustained and full recovery.

Is WIF Safe from $1 Drop Fear?

Despite the rise on the daily chart, WIF is still showing weakness. Over the past 7 days, WIF is down 26.34%, with a 37% drop in volume on the daily chart.

As AMBCryto previously reported, the decline in dogwifhat had analysts concerned that it would fall further below $1. However, with the recent surge on the daily chart, the market believes that the price could go higher if the uptrend continues.

According to AMBCrypto’s analysis, despite the uptrend on the daily chart, WIF was experiencing a strong downtrend. Looking at the Directional Movement Index, the downtrend is strong, with the negative index of 28 above the positive index of 17.

Source: Tradingview

The Aroon line also further proves that the downtrend is strong, as the Aroon downtrend is at 85.71%, which is above the Aroon uptrend at 21.43%.

Source: Tradingview

Likewise, RVGI showed that the WIF downtrend remains below zero at -0.4355 and below the signal line at -0.4339.

Source: Santiment

Looking more closely, analysis of Santiment data shows that open interest per exchange has decreased over the past week, falling from a high of $146.7m to $109.1m at the time of writing.

However, over the past 24 hours, WIF open interest per exchange has increased. The decline suggests that investors are liquidating positions rather than opening new ones.

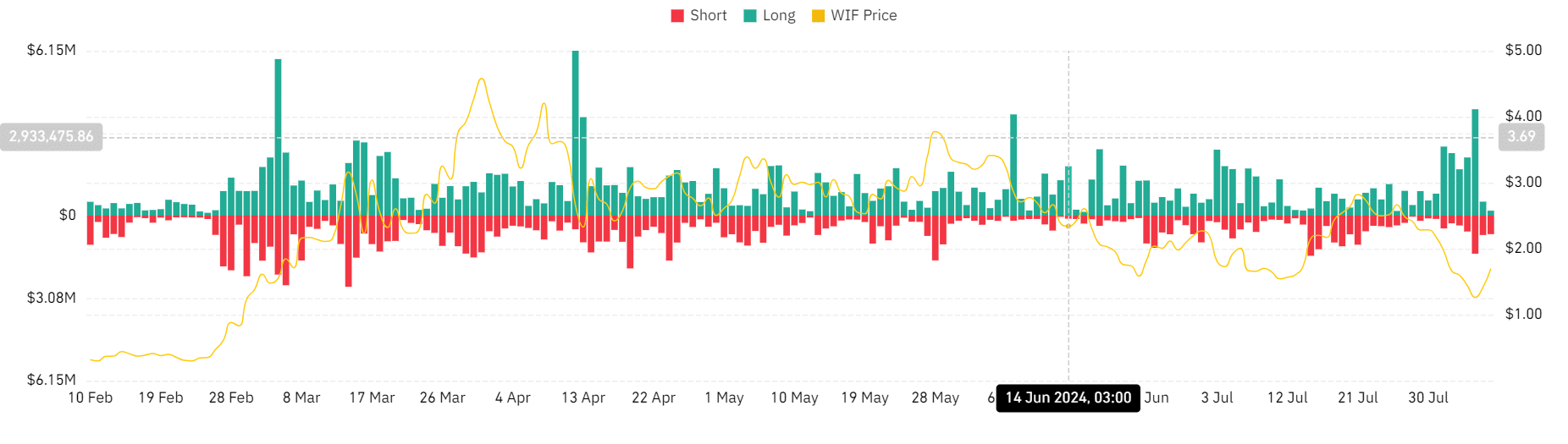

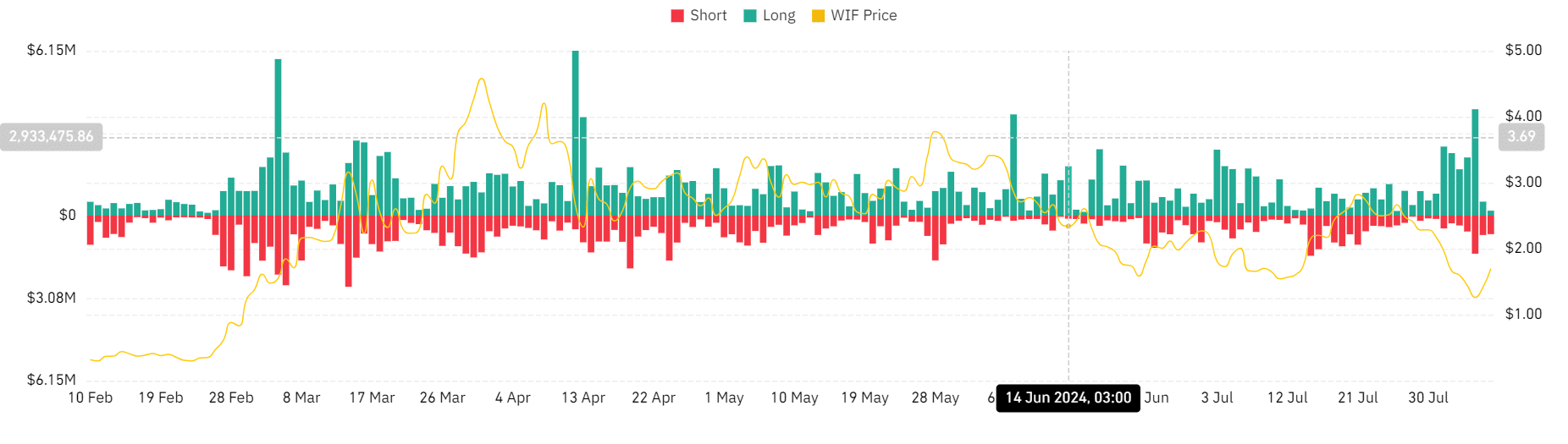

Source: Coinglass

Finally, according to Coinglass data, WIF has seen an increase in long position liquidations over the past seven days.

Realistic or not, WIF’s market cap in BTC terms is as follows:

Looking at the uptrend on the daily chart, we can see that short-term liquidations have increased, while long-term positions remain at fairly low levels.

So if the uptrend continues on the daily chart, WIF will try to reach a significant resistance level around $2.3. However, if the overall market sentiment continues, dogwifhat will not be able to escape the risk of a drop to $1.05.