- SAND has found strong support recently as the bulls look to break out of the current pattern.

- Derivatives data showed a downtrend, with some expecting a bullish rebound.

As the bear market in the SAND market triggered another liquidation rally, price action struggled to stay above key support levels.

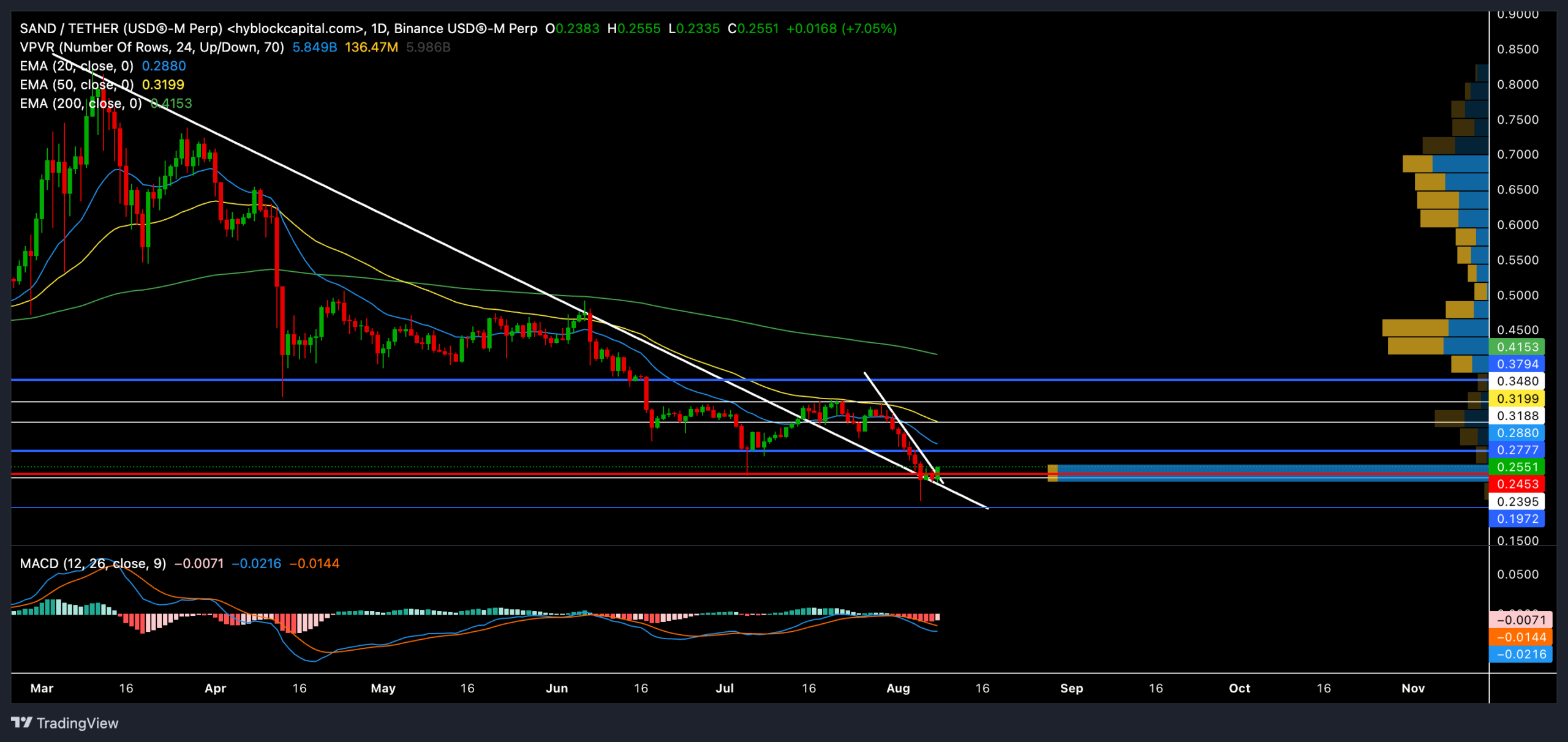

A bounce from the 50 EMA has led to a downtrend towards the support level of $0.23 at the time of writing.

The bulls will now try to break the bearish boundary, especially as the price approaches the high liquidity zone. At the time of writing, SAND is trading at almost $0.24, up almost 5% over the past day.

Can a bull stop bleeding?

Source: TradingView, SAND/USDT

SAND Bear found new strength after bouncing off the 200-day EMA (green) in early June. During the decline, the price action fell below the 20-day and 50-day EMA, reflecting strong bearish dominance.

What is notable here is that the 200-day EMA coincided with the trendline resistance line (white) at the time, causing downward pressure.

The resulting downtrend has seen the price drop by nearly 49% in just two months. However, support at the $0.23 level has revived some hopes of a bullish recovery at the time of writing.

Meanwhile, SAND found a close above the long-term trendline resistance line, flipping it to support on the daily chart.

This altcoin has also formed a classic falling wedge pattern. The recent bullish bounce from $0.23 support could set the stage for bulls to break out of this pattern.

If the bulls find a strong close above the current pattern, SAND could find a way to test the $0.28-$0.31 resistance range before reversing to the downside.

On the other hand, if the price action breaks below the immediate support level of $0.23, the altcoin may experience a prolonged downtrend before bouncing back.

The MACD line has reaffirmed the overall bearish dominance in the SAND market. However, buyers should be wary of a potential bullish crossover on the MACD line.

This crossover confirms that selling pressure has eased and could help SAND retest its short-term EMA.

Derivatives Data Disclosure THIS

Source: Coinglass

The overall long/short ratio is 0.9869, indicating a slight preference for short positions. However, the top trader on Binance (BNB) has a long/short ratio of 2.6873.

Realistic or not, here is the SAND market cap in BTC terms:

Despite a slight short bias across the board in the long/short ratio, other indicators such as account ratio, top trader positions, funding ratio, and liquidations suggest an overall bullish sentiment towards SAND.

Increased volume and open interest indicate growing market interest, which could potentially drive further price action.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.