- Ethereum Ranks #1 as Most Profitable Blockchain

- There is a close relationship between fees and transactions.

The latest statistics on blockchain revenue are out, and despite the increased competition, the Ethereum network is in the lead. Not only that, the clear lead confirms that it is still the most dominant blockchain right now.

According to the report, Ethereum has earned an impressive $2.7 billion in fee revenue over the past 12 months. The network is ahead of the second-place Bitcoin network, which earned $1.43 billion. This is an impressive lead, and shows just how far ahead it is of its competitors.

Ethereum’s dominant position in terms of fees signals that it will remain the most preferred smart contract network in 2024. Its leadership in this space has allowed it to remain the network of choice for most dapps and users.

This could also be a sign that layer 2 networks are doing a good job of addressing the shortcomings of the Ethereum mainnet.

What causes Ethereum fees to rise?

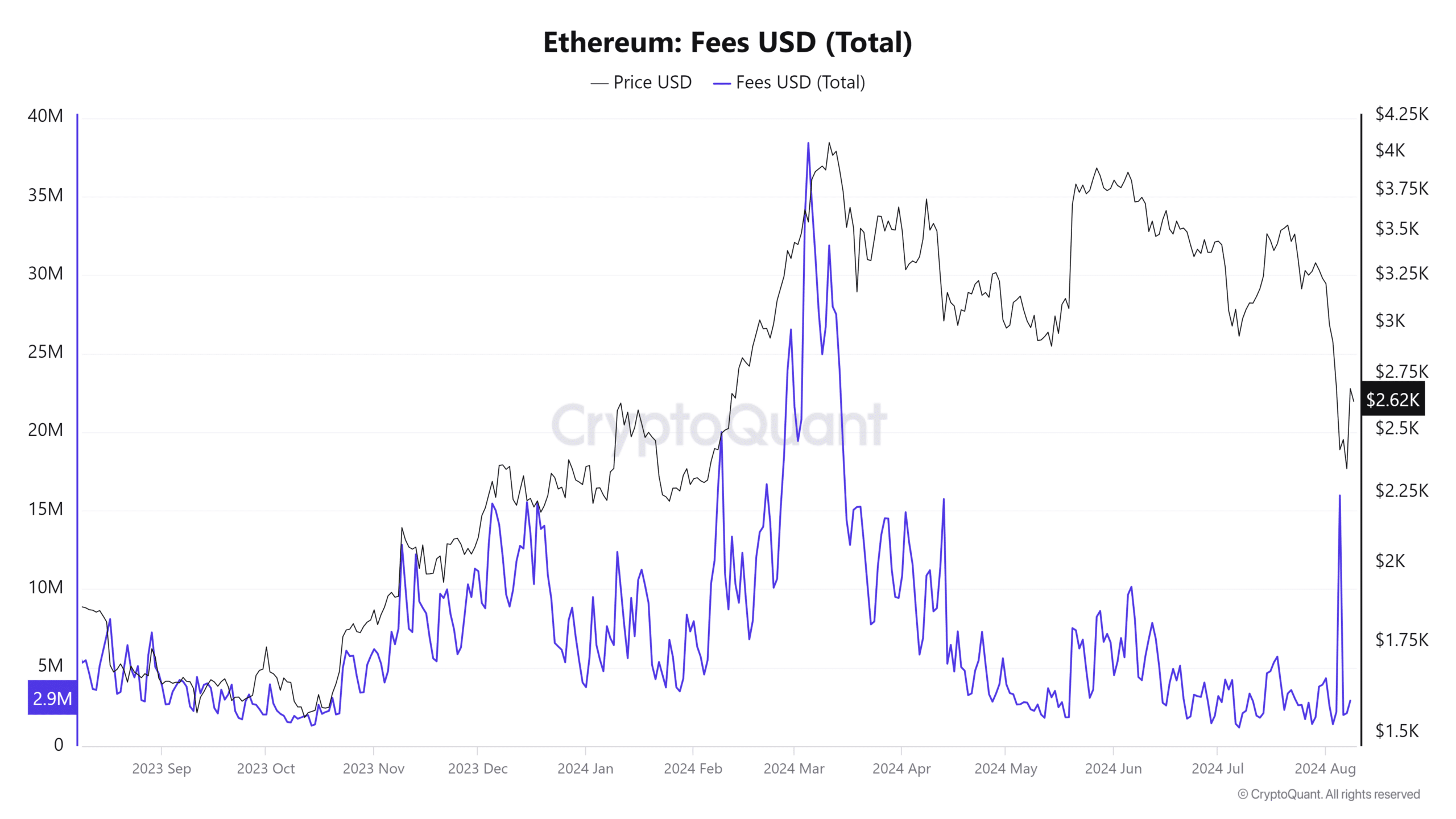

If you look at the Ethereum daily fee chart over a 12-month period, it becomes clear that Ethereum fees are directly tied to the ETH price.

For example, the highest single-day fee the network has ever earned in the past 12 months was $38.42 million on March 5.

Source: CryptoQuant

Ethereum has been in a strong bullish trend for the past few weeks, and this surge occurred near ETH’s current 2024 high. This is consistent with the observation that demand for ETH within the ecosystem tends to increase during bull markets, indicating strong utility. It also occurred during one of the most volatile days on the market.

Likewise, we observed the second highest Ethereum fee spike at the peak of the recent market crash, with fees peaking at $15.97 million on August 5. This coincided with a day when the market was characterised by high volatility, with a bullish wave breaking out and cancelling out the bearish trend.

The lowest network fee recorded on a single date was $1.19 million on July 7.

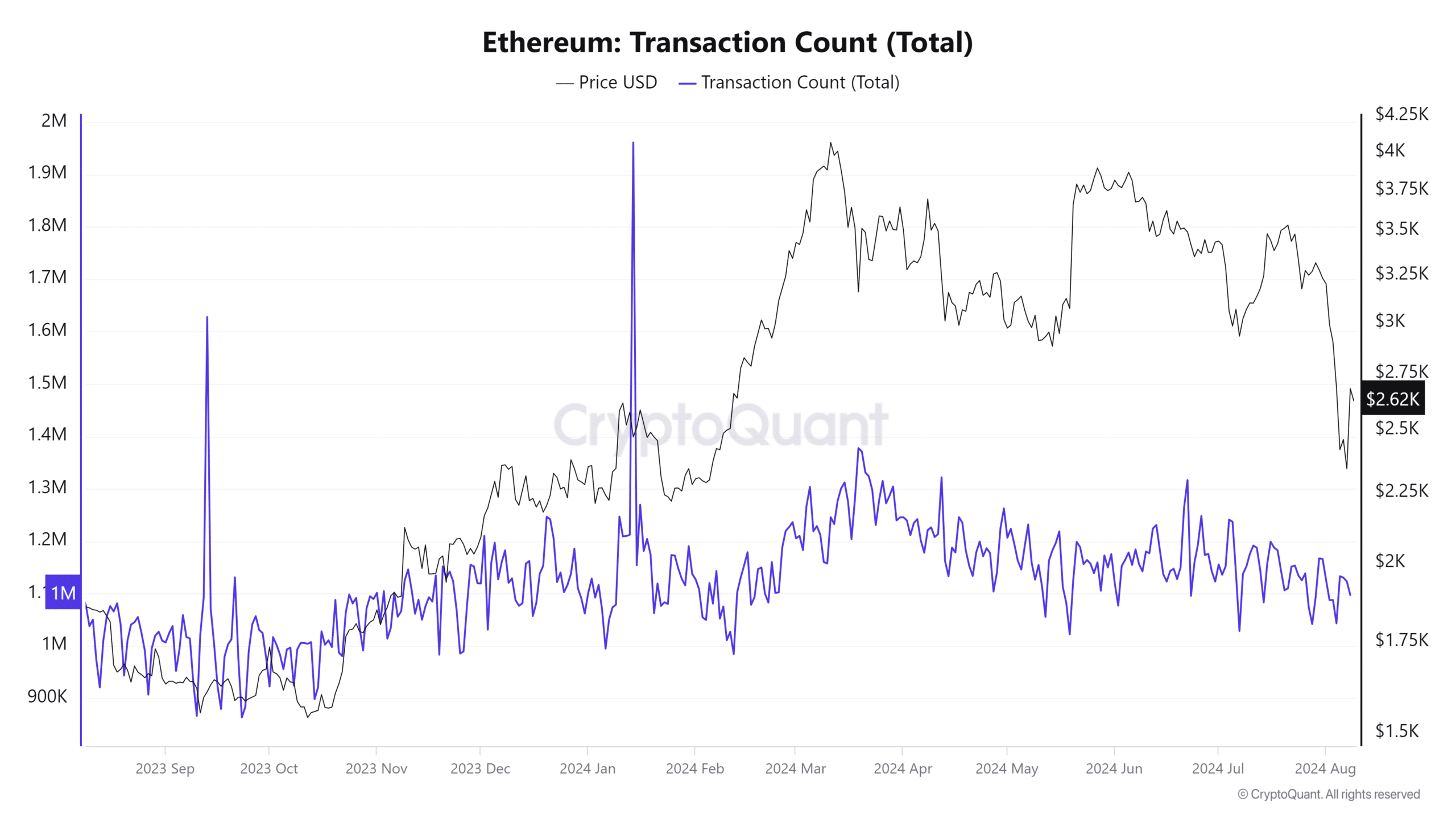

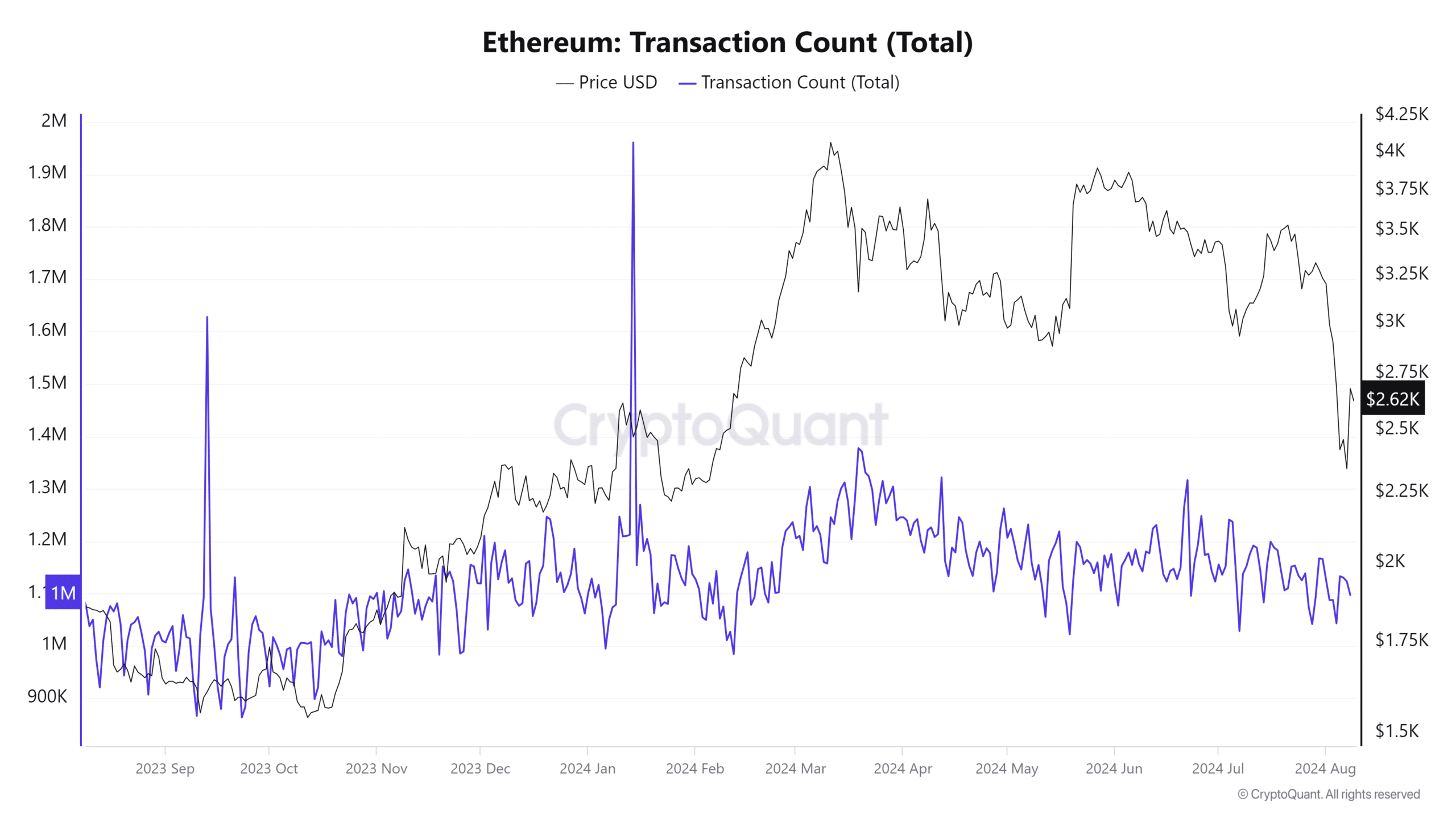

Fees are charged along with transactions, and Ethereum network transactions are as follows: The highest daily number of transactions observed over the past 12 months peaked on June 14, at 1.96 million. Meanwhile, the lowest number over the same period was just over 863,000 transactions on September 23.

Source: CryptoQuant

Unlike the correlation with price, trading did not show a significant correlation with fees, mainly because the highest fees were observed on days when the ETH price was high.