Zcash (ZEC), a decentralized cryptocurrency created to improve privacy in the blockchain space, has seen its price rise by a whopping 90% over the past 30 days.

This surge has put ZEC among the top three altcoins. Trading at $41.36, this analysis explains why the coin is unable to maintain its momentum..

Storm Gathers for Zcash Stellar Rally

On July 12, ZEC was priced at around $23.81, meaning that the current price is almost twice its value back then. But that’s not the only thing that has changed.

According to CoinGecko, the market cap also increased significantly. On the same day, the cryptocurrency was trading near the aforementioned price. Zcash’s market cap was $360.68 million.

For context, market cap is a product of price and supply. The project has a maximum supply of 21 million, the same as Bitcoin (BTC), but only 15.11 million in circulation. At the time of writing, the market cap has increased to $625.72 million, indicating that the price increase was instrumental in this significant jump.

Read more: 7 Best Privacy Coins of 2024

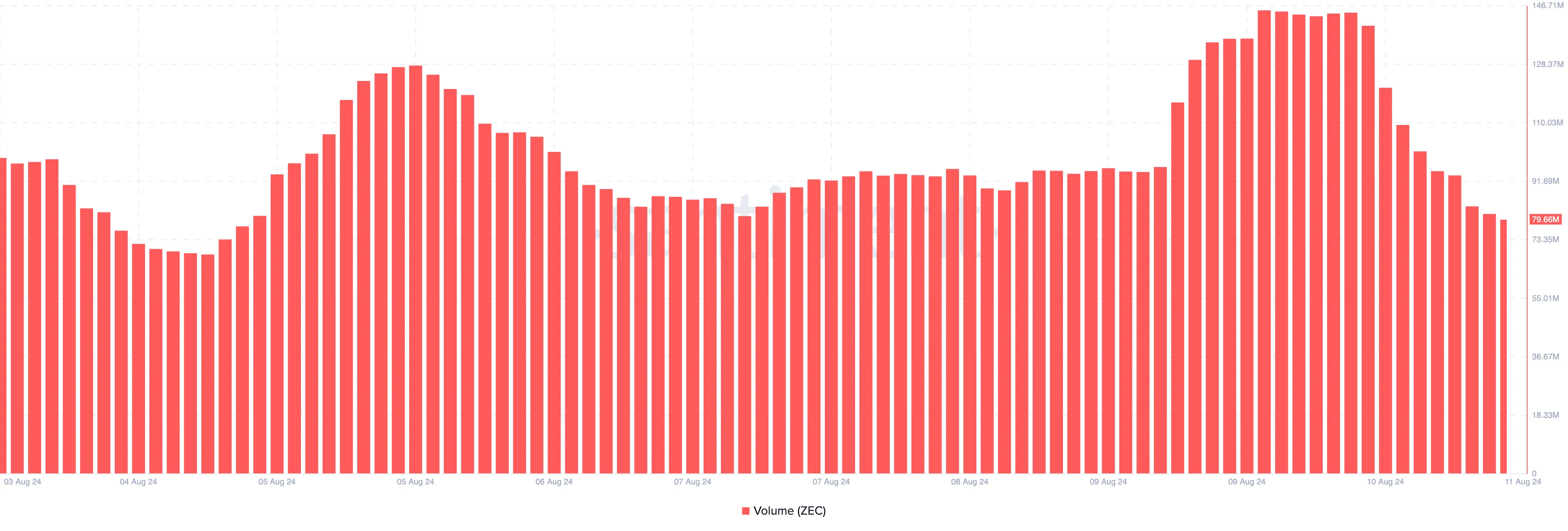

Despite this increase, ZEC’s trading volume has taken a different path. On August 10, Zcash’s trading volume was over $145 million, indicating a lot of interest in the cryptocurrency. However, as of this writing, this indicator has decreased by 44.99% to $79.66 million.

In general, increasing volumes along with rising prices are a bullish signal, indicating that there is more buying power than selling. Conversely, if volumes decrease in this situation, the bulls are losing control, and the price of the relevant cryptocurrency is at risk of losing some of its value. Therefore, if volumes continue to decrease, the price of ZEC could fall below $41 in the short term.

ZEC Price Prediction: End of bullish day, then rebound

ZEC’s notable uptrend began in July, during which the coin rose from under $18 to $34.75 on August 3. Shortly after, the price faced a rejection, falling to a swing low of $25.43.

However, as the bullish momentum increased, the coin reached a high of $42.97. Meanwhile, the Relative Strength Index (RSI) is at 77.02 at the time of writing. RSI is a technical indicator that measures the speed and magnitude of price changes to determine momentum.

It also tells you if the cryptocurrency is overbought or oversold. A reading above 70.00 means the coin is overbought, while a reading of 30.00 means it is oversold. In the case of oversold conditions, the cryptocurrency price may reverse to the upside.

So for ZEC, the next one could be a retracement. Using the Fibonacci retracement levels, which are indicators that help identify support and resistance, the price of ZEC could drop to $37.18 in the short term.

Read more: Zcash (ZEC) Price Prediction 2024/2025/2030

However, a bounce from this level could halt another downtrend. Instead, ZEC could surpass $42.97 and possibly test the $44 area, especially if buying pressure builds.

disclaimer

In accordance with the Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions may change without prior notice. Always do your own research and consult with a professional before making any financial decisions. We inform you that our Terms of Use, Privacy Policy, and Disclaimer have been updated.