Prominent crypto educator and analyst Duo Nine asked the question no one wanted to hear: “What if there is no altcoin season?” and presented several data points to back up his rhetoric.

Altcoin season is an informal term to describe a phase where investing in altcoins can yield higher returns than pouring capital into Bitcoin (BTC).

Analyst Explains Altcoin Season Delay

After the fourth Bitcoin halving, the next major focus in the cryptocurrency market, aside from the approval and launch of an Ethereum ETF (exchange-traded fund), was the anticipation of the altcoin season. Typically, several major events lead to this phase.

First, new capital flows into the cryptocurrency market, initially into stablecoins, Bitcoin or Ethereum. These assets are prioritized as they are perceived as more stable than cryptocurrencies with smaller market caps. Next, this capital inflow triggers a market rally.

Finally, the profits and additional capital generated from these assets start flowing into altcoins. This capital rotation is what starts the altcoin season. According to the Altcoin Season Index, the cryptocurrency market is currently still in Bitcoin season.

Negative Flows in Ethereum ETFs

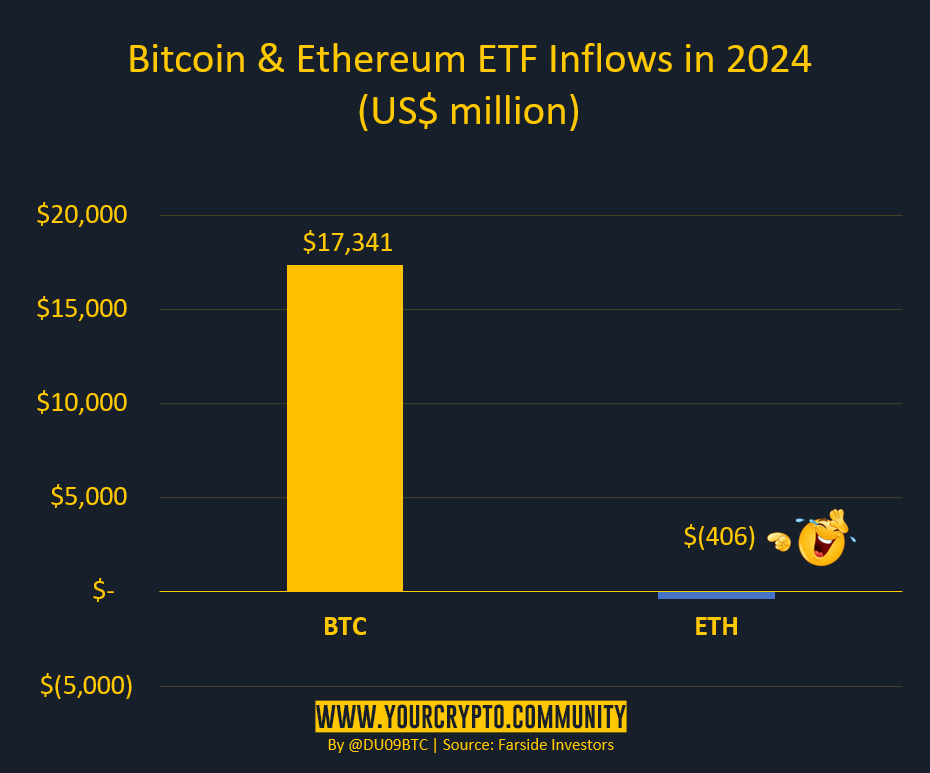

Duo Nine describes a scenario where the sequence leading to the altcoin season is not fully realized. He suggests that investing entirely in altcoins could be problematic, and points to the negative movement of the Ethereum ETF as a worrying sign.

“Since January 2024, Bitcoin ETFs have attracted over $17 billion in net investment after the Grayscale sale. Ethereum’s ETF launched in July. Net balance? -$406 million,” the analyst wrote.

Read more: What is Altcoin Season? A Comprehensive Guide

The Ethereum ETF’s negative flows came as Grayscale’s client redemptions were underway after the company converted its trust to an ETF. Before the physical ETF was approved, the Grayscale Bitcoin Trust (GBTC) allowed investors to redeem their shares for USD. Now, with the launch of the BTC and ETH ETFs, clients are choosing to sell their Bitcoin and Ethereum to redeem their shares, contributing to the negative flows.

According to the analyst, Grayscale’s clients have sold $2.3 billion worth of ETH since July, but ETF buying pressure hasn’t been enough to offset this selling. Duo Nine sees no difference in altcoin season once the Solana ETF launches.

However, it is important to recognize that the ETH ETF market is still in its early stages. In this context, it is important to understand that while the short-term outlook for spot Ethereum ETFs may be bearish, the medium- to long-term outlook remains bullish.

In retrospect, it took a while for Bitcoin to bounce after the launch of the spot BTC ETF on January 11. The pioneering cryptocurrency tumbled horizontally for a month or so before expanding northward.

“The reason why Bitcoin prices aren’t rising as investors buy new Bitcoin ETFs is because GBTC outflows and BTC sell-offs are greater than the inflows from the other 10 Bitcoin ETFs combined. As initial ETF demand wanes, we expect even bigger price declines,” economist Peter Schiff said at the time.

Since the Ethereum ETF launched on July 23rd, less than a month ago, ETH has had ample time to find its price. If Grayscale’s customer redemptions ease, ETH ETF flows could stabilize positively, with capital flowing into Ethereum rotating into altcoins.

Bitcoin Dominance Breakthrough

The analyst also based his argument on the ‘no altcoin season’ on the breakout seen on the Bitcoin dominance chart, suggesting that BTC is outperforming altcoins, suggesting a lack of confidence in the latter. According to CoinGecko data, BTC dominance is currently at 53.8%.

This turnout appears to be driven by market uncertainty amidst volatile narratives such as global geopolitical tensions, political turmoil in the US, and recession fears. This has led investors to support Bitcoin, which has led to a flight to safe haven assets, as BTC is seen as a better haven than altcoins.

Nonetheless, some investors see Bitcoin’s high dominance as an opportunity to accumulate altcoins at lower prices. When Bitcoin’s dominance is high, altcoins can be undervalued relative to Bitcoin, providing a buying opportunity for those who believe in the long-term potential of a particular altcoin.

Read more: 11 Cryptocurrencies to Add to Your Portfolio Before Altcoin Season

Based on the chart above, Bitcoin dominance continues to rise, but is approaching a critical resistance point, which could see altcoins make headway. However, amid skepticism about the altcoin season, some say that even if it comes, it may not be as severe as it was in 2017 and 2020.

“This story has been put out by Bitcoin maxis every cycle and it has not worked. Eventually some of the Bitcoin supply will flow into ALT when dominance starts to plummet. There will come a time when dominance drops below 45% and that will happen in this cycle as well,” added another X user.

Despite the delayed altcoin season, analysts are already keeping an eye on several altcoins this month, with some rekindling hopes that the delay doesn’t necessarily mean a complete absence.

disclaimer

BeInCrypto is committed to unbiased and transparent reporting in compliance with the Trust Project guidelines. This news article aims to provide accurate and timely information. However, readers are encouraged to independently verify facts and consult with experts before making any decisions based on this content. Please be advised that our Terms of Use, Privacy Policy, and Disclaimer have been updated.