Popular analyst Michael van de Poppe shares a list of altcoins that could bounce back stronger after the last drop. This comes as the crypto market bounces off the recent correction that saw Bitcoin (BTC) test the $49,000 floor.

Portfolio rebalancing is a preferred investment strategy among intentional traders, especially during periods of market volatility. To effectively manage risk, traders should diversify their investments across promising cryptocurrency narratives, establish a clear exit strategy, and maintain a disciplined dollar-cost averaging approach.

Best Altcoins Picked by Analysts as Markets Attempt Recovery

Van de Poppe observes how altcoins are performing after the correction. He points out that Ethereum (ETH) DeFi is bouncing back stronger than Solana DeFi tokens, which shows the potential of the ecosystem. He also observes commendable performance in the meme coins, AI, and DePIN categories.

“If you look at the data, you should be positioning for AI and DePIN, meme coins, or ETH DeFi. You should be positioning for the biggest bounces because these bounces are more likely to continue the trend as traders start allocating to the hype coins or the strongest bounces,” Van de Poppe said.

Vitensor (TAO)

The analyst recently predicted a 5-10x increase in the potential of AI-based cryptocurrency TAO, which has gained 70% from its lows. This surge has caught the attention of many traders. Michaël van de Poppe is not the only one who is bullish. Other experts also think that Bittensor tokens are a strong investment and expect further increases.

“TAO could be an attractive choice if you’re looking to generate significant upside in your portfolio. Its current market cap is an impressive $2 billion, reflecting TAO’s strong performance and potential,” said Lucky, a seasoned Bitcoin investor.

Meanwhile, TAO, a leader in the artificial intelligence (AI) sector, has shifted market sentiment from bearish to bullish. This shift is due to the growing global demand for AI technology. The relative strength index (RSI) also indicates that bulls are in control, as the RSI remains above the midpoint of 50.

Read more: What is Altcoin Season? A Comprehensive Guide

AAVE

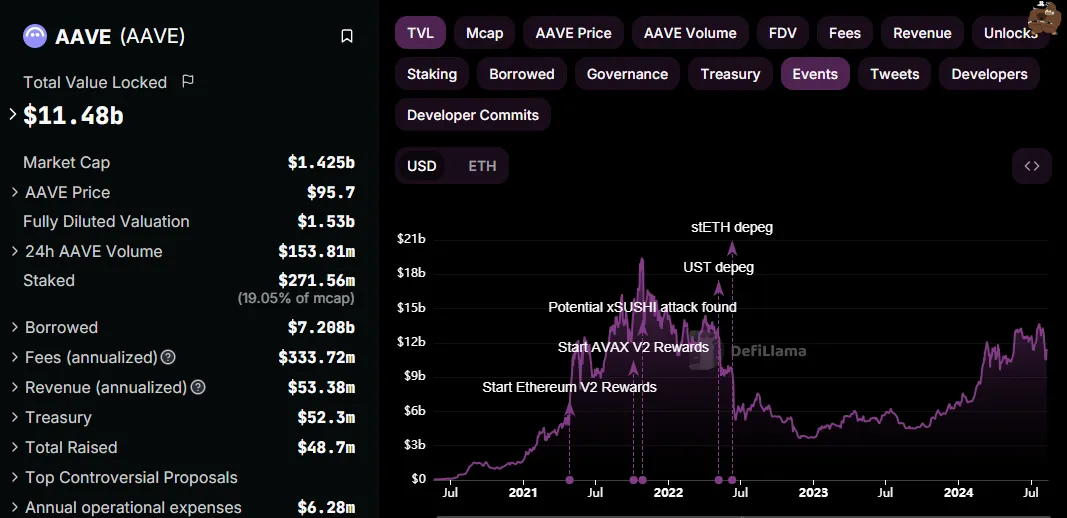

Michael van de Poppe also pointed to AAVE as a promising asset, noting the significant accumulation against Bitcoin and the formation of higher highs against the USDT stablecoin, both of which are signs of growing bullish momentum. He observed that AAVE is in a horizontal consolidation phase and that there has been no significant price decline, which he sees as a strong indicator.

In addition to the bullish technical outlook, AAVE’s on-chain metrics are also favorable. The Aave blockchain boasts a total value locked (TVL) of approximately $11.5 billion against a market cap of over $1.4 billion. This valuation suggests significant upside potential, says van de Poppe.

In particular, Aave DAO recently launched its first $100 million yielding loan with a major partner. This move, which shows how tokenization and blockchain technology can revolutionize the issuance and management of bonds and securities, could bode well for the AAVE token.

Evo

Michaël van de Poppe also highlights AEVO as a promising buy, pointing out the forecast and options market. From a technical perspective, he has found a bullish divergence in the Relative Strength Index (RSI), which shows higher lows compared to lower highs in price, indicating that bullish momentum is growing.

Van de Poppe additionally identifies a falling wedge pattern on the AEVO 1-day chart, which suggests a potential bullish breakout. This pattern is widely known as a bullish reversal signal, and is confirmed when the price breaks the upper trendline. The profit target for this pattern is usually calculated by adding the maximum distance between the upper and lower trendlines to the breakout point.

Read more: 11 Cryptocurrencies to Add to Your Portfolio Before Altcoin Season

Analysts have not highlighted any projects on their radar for the DePIN category. Nevertheless, experts are already looking at Lumerin (LMR), Destra Network (DSYNC), AIOZ Network (AIOZ), StorX Network (SRX), Storj (STORJ).

Investors are actively preparing for the altcoin season despite skepticism that capital turnover will occur. Nevertheless, it is a safer option to be ahead of the curve than to be afraid of missing out. Nevertheless, traders and investors should also do their own research.

disclaimer

BeInCrypto is committed to unbiased and transparent reporting in compliance with the Trust Project guidelines. This news article aims to provide accurate and timely information. However, readers are encouraged to independently verify facts and consult with experts before making any decisions based on this content. Please be advised that our Terms of Use, Privacy Policy, and Disclaimer have been updated.