- AVAX active addresses have recently increased by 34.46%.

- A key support level of $19.48 could start a reversal.

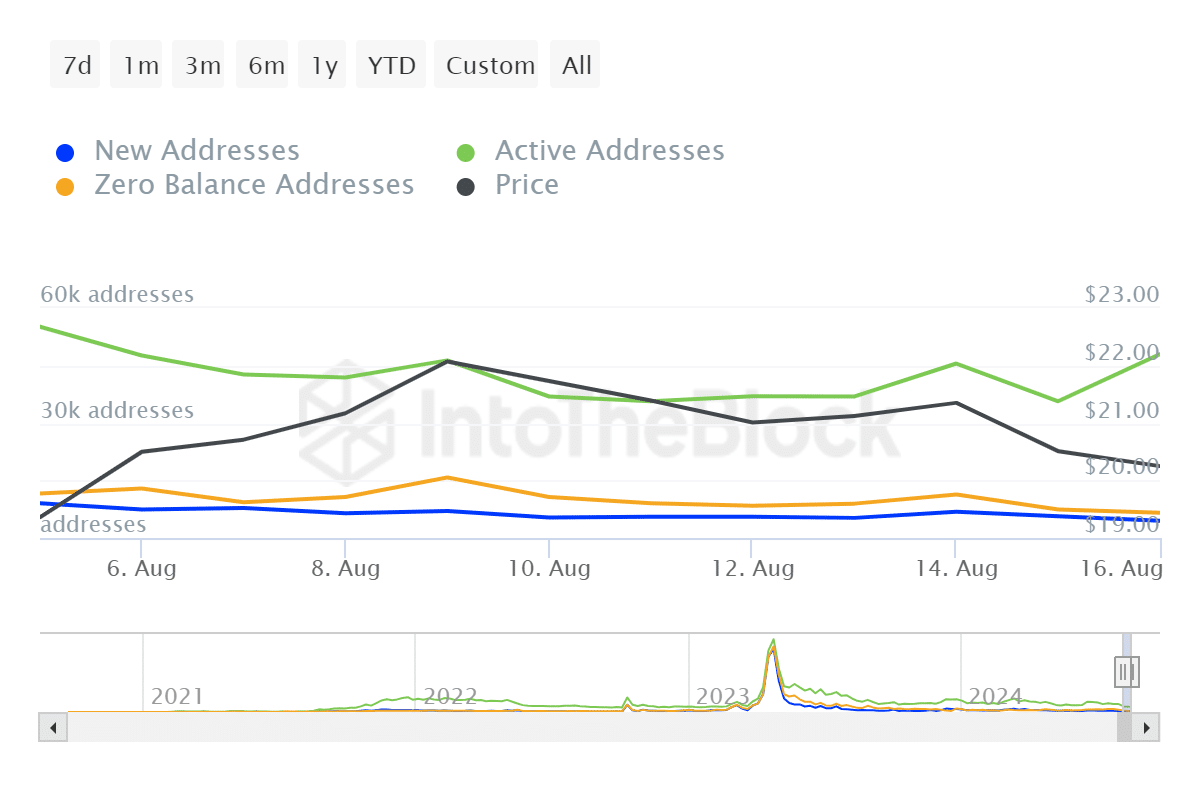

Avalanche (AVAX) has seen increased on-chain activity recently, which could be an indicator of renewed investment interest in the altcoin.

AMBCrypto looked at Coinglass data and found that active AVAX addresses surged by 34.46%, indicating that more investors are starting to use the Avalanche network.

Source: IntoTheJacket

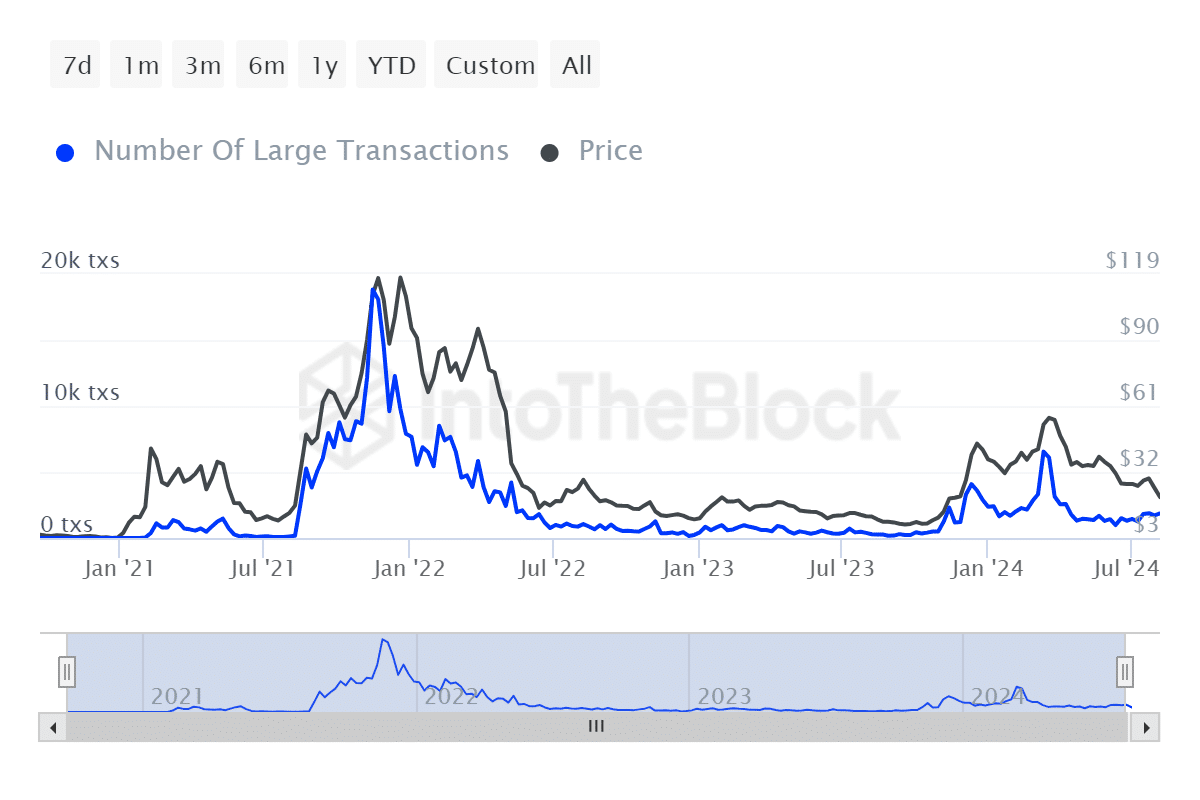

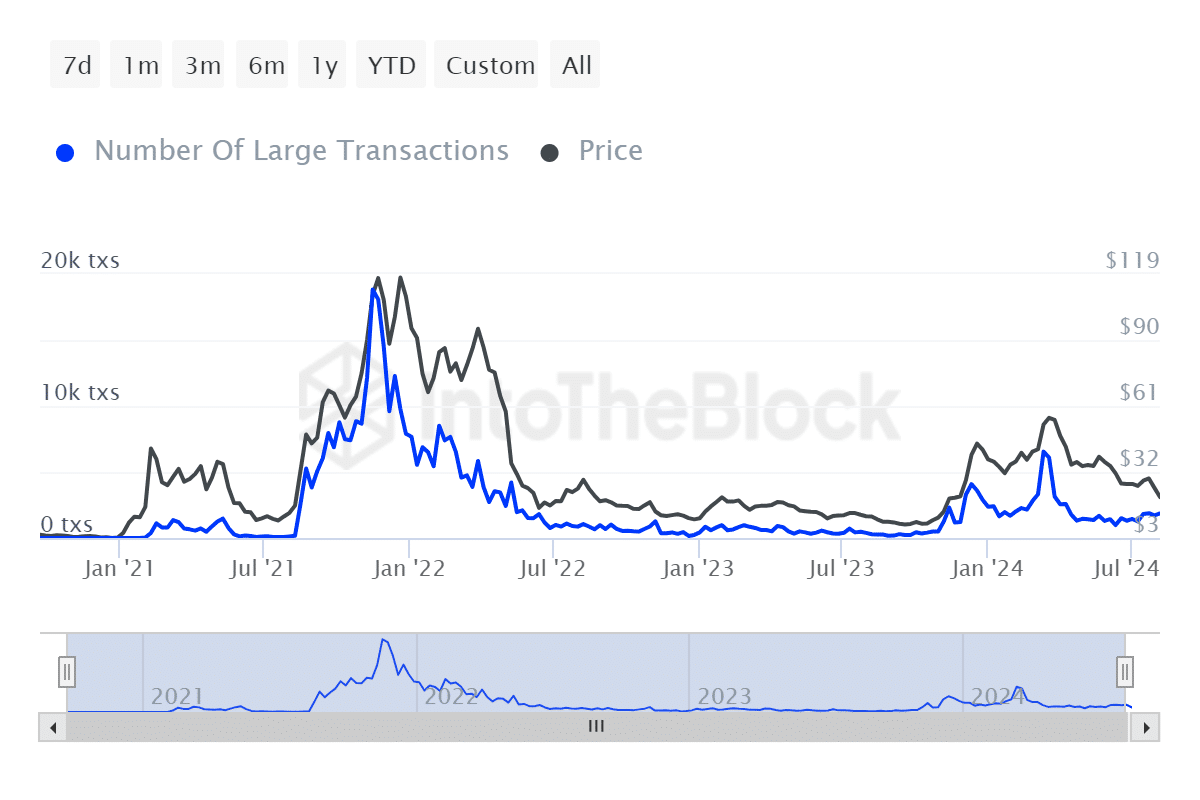

AVAX volume trading increases

Along with the increase in active addresses mentioned earlier, large transactions increased by 9.45%. This often indicates an increased presence in the market of whales or institutional investors.

As both retail and whales continue to grow, we can see that a wide range of AVAX holders are participating.

Source: IntoTheBlock

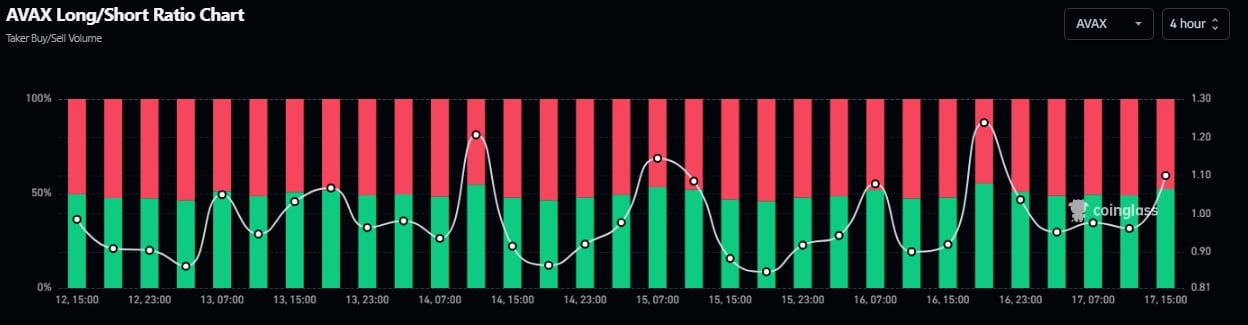

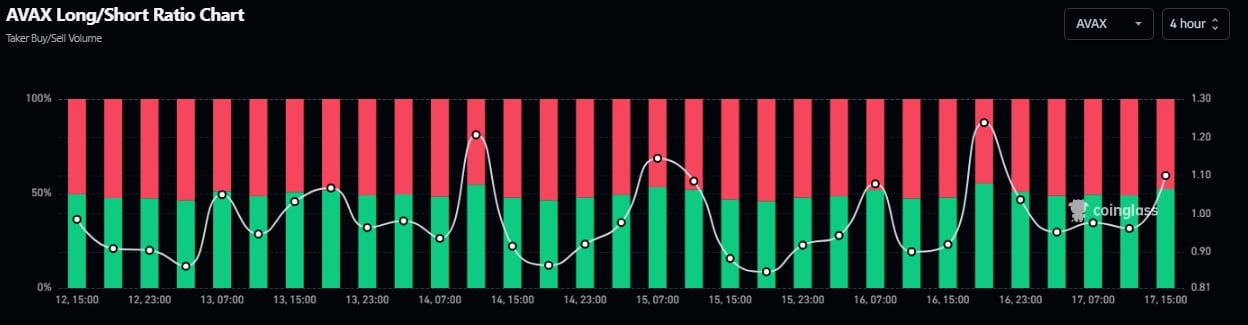

The AVAX long/short ratio showed a balanced market with a position range of around 50%. This balance, coupled with the recent increase in on-chain activity, indicates a market at a decision point.

This indecisive attitude can potentially create a climate of volatility when a clear trend emerges.

Source: Coinglass

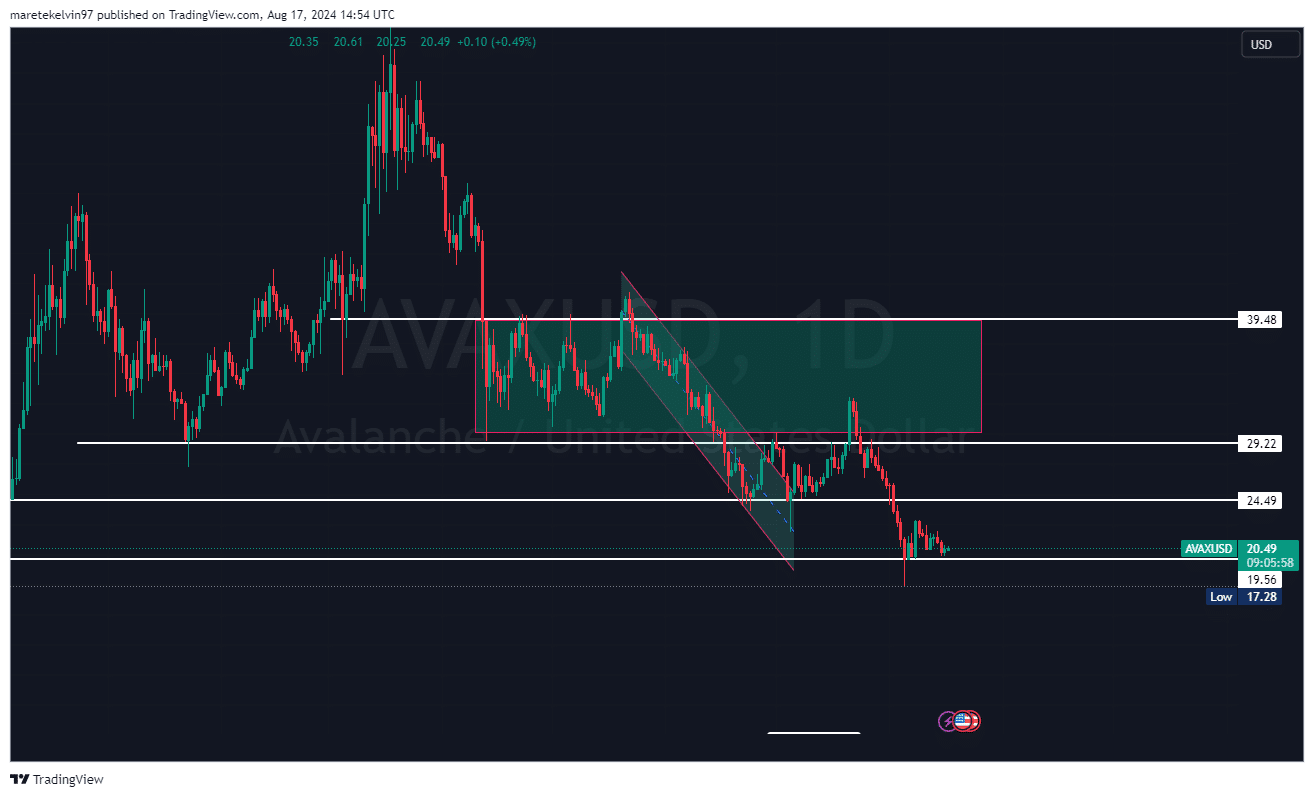

AVAX approaches important support levels.

The price of AVAX has been under stress recently. In particular, the token is consolidating above the major support level of $19.48. Historically, this point has provided a solid base during past declines.

Source: TradingView

Setting the stage for a potential twist

If AVAX crosses a significant support level and sees a surge in on-chain activity, several events could occur. If $19.48 holds, the price could surge above $25.

The growing participation in the network means that there is demand to accommodate such an event.

Realistic or not, here is the AVAX market cap in BTC terms:

Despite the recent price struggle, the increase in on-chain activity has meant a ray of hope for bulls. The emerging support level of $19.48 will draw a line in the sand.

If this level holds and the on-chain momentum continues, AVAX may be entering a trend reversal.