- TON is stuck in a tight range below $7.

- Can Altcoins Break Out of a Sideways Trend?

From mid-August Toncoin (TON) is trading within a narrow price range. Friday’s relief bounce saw Bitcoin (BTC) tap $64,000, but it failed to generate much movement on TON’s price chart. In fact, it was still stuck within the $6.4 and $7 price levels.

But given the improving sentiment in the cryptocurrency market over the weekend, at what levels should TON speculators be wary?

Will TON break out of its sideways trend?

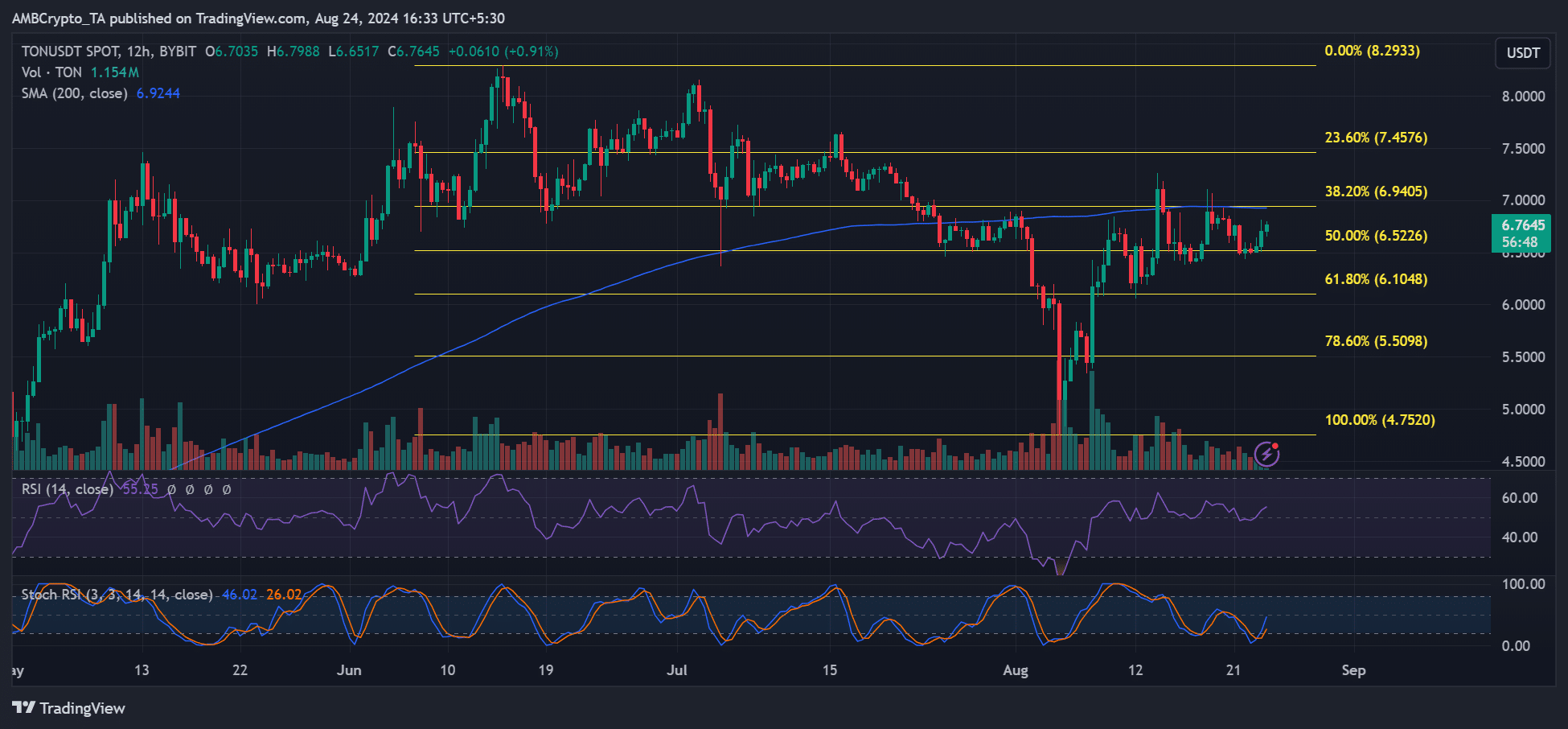

Source: TON/USDT, TradingView

On the upper time frame chart, the 200-day SMA (simple moving average) has been a key level of price rejection three times since mid-July. This creates a key dynamic resistance level. At the time of writing, the dynamic resistance level coincides with the 38.2% Fibonacci level ($7).

In short, $7 is still an important resistance level for traders in the short term. By extension, the price chart reading is tilted toward a possible extension of the sideways structure. This outlook is further illustrated by the demand shift, as indicated by the RSI (Relative Strength Index) swinging between neutral and 60 points.

However, the recent price action also recorded a local bottom where the 200-day SMA is the neckline resistance. This pattern is a typical bullish formation, and a breakout could push TON to the 23.6% Fibonacci level ($7.45). If the bulls reach that target, there is an additional 7% upside.

Liquidity Cluster-Based Key Objectives

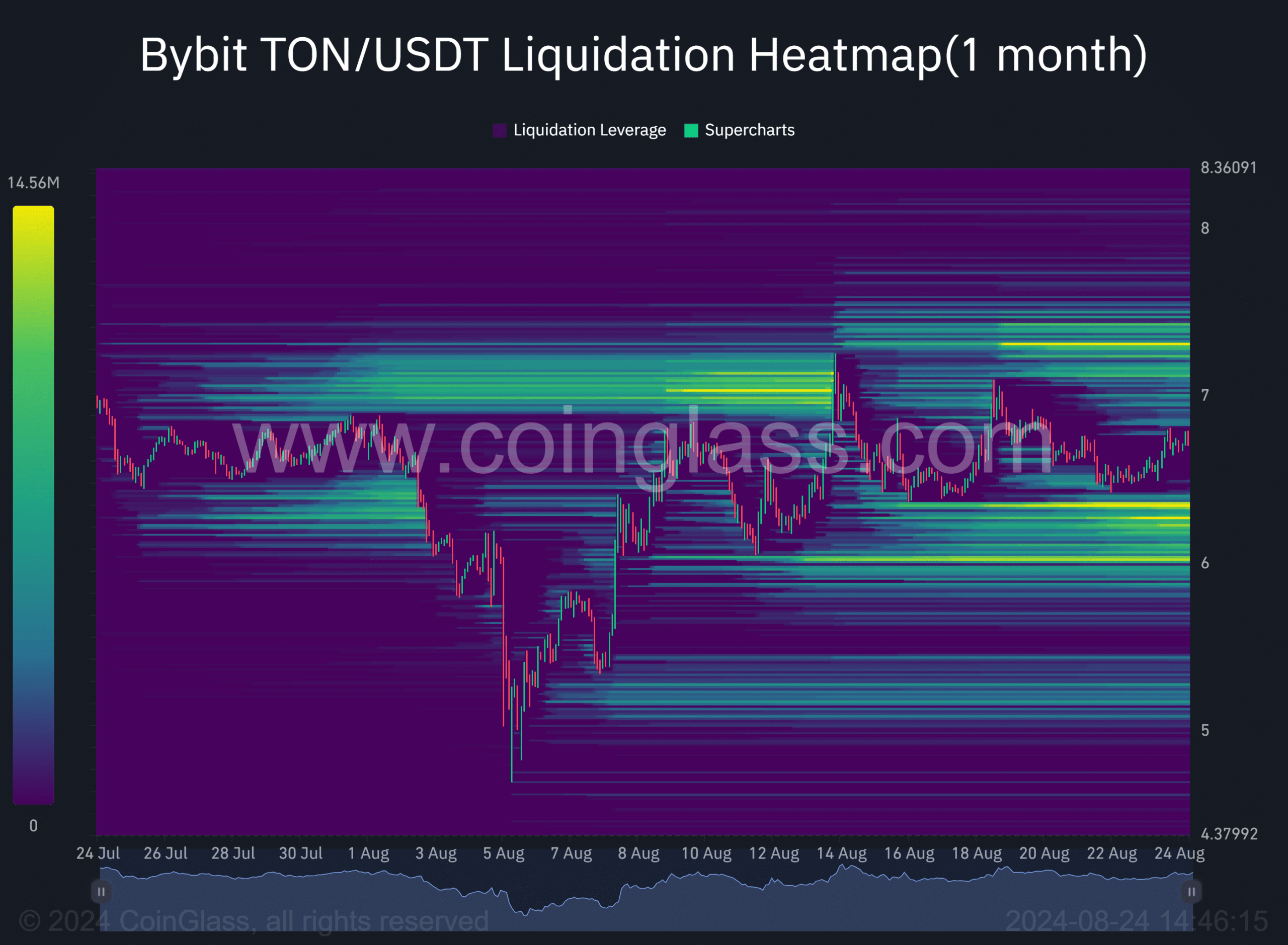

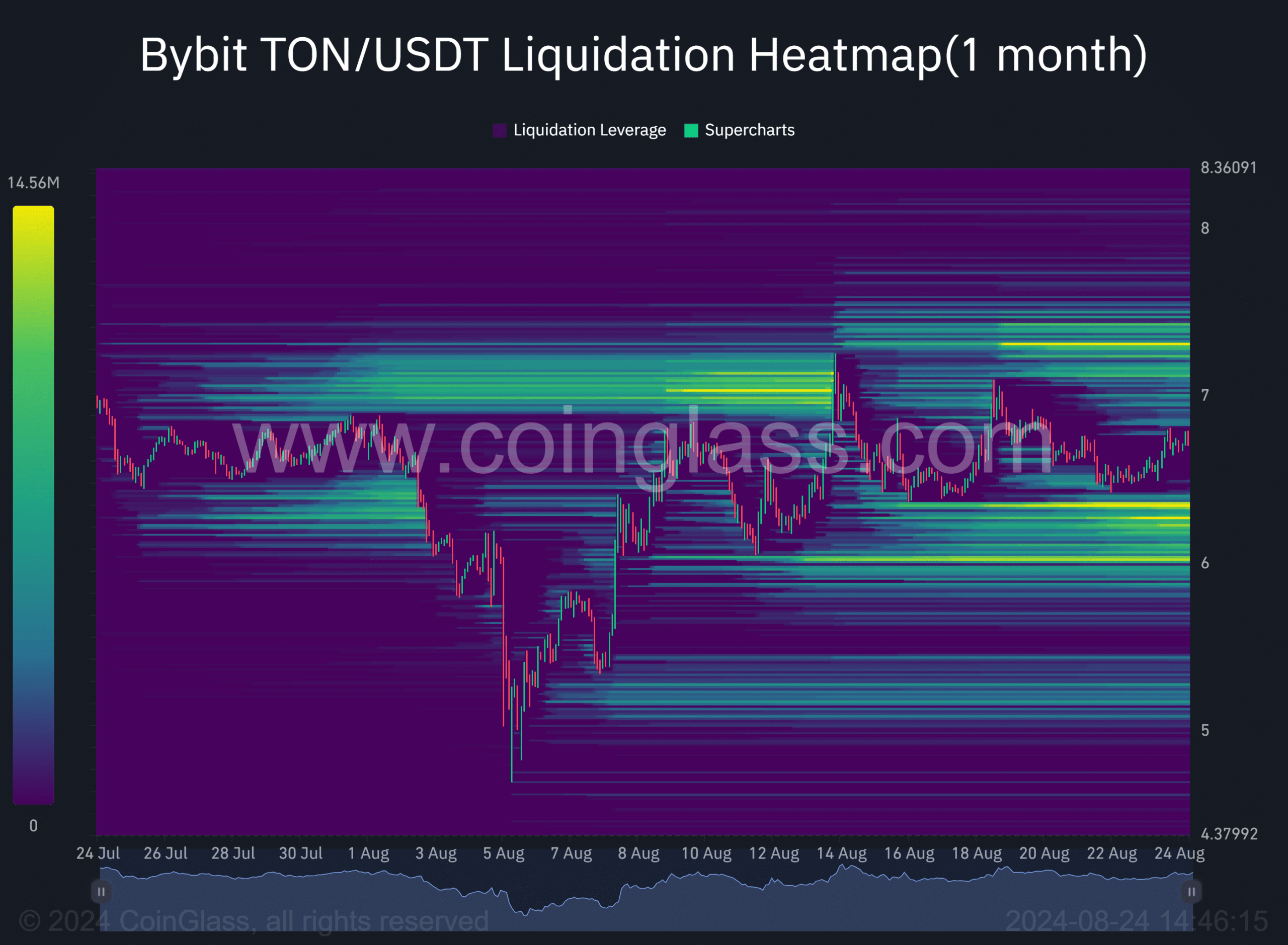

Source: Coinglass

According to Coinglass liquidity data, TON had major liquidity clusters (light orange levels) at $7.3, $6.3, and $6.0. There was more liquidity above $6 than at $7.3. These levels could be major price inflection points. The location of liquidity on both sides of the price action further supported the idea of a sideways structure.

Read Toncoin (TON) Price Prediction 2024-2025

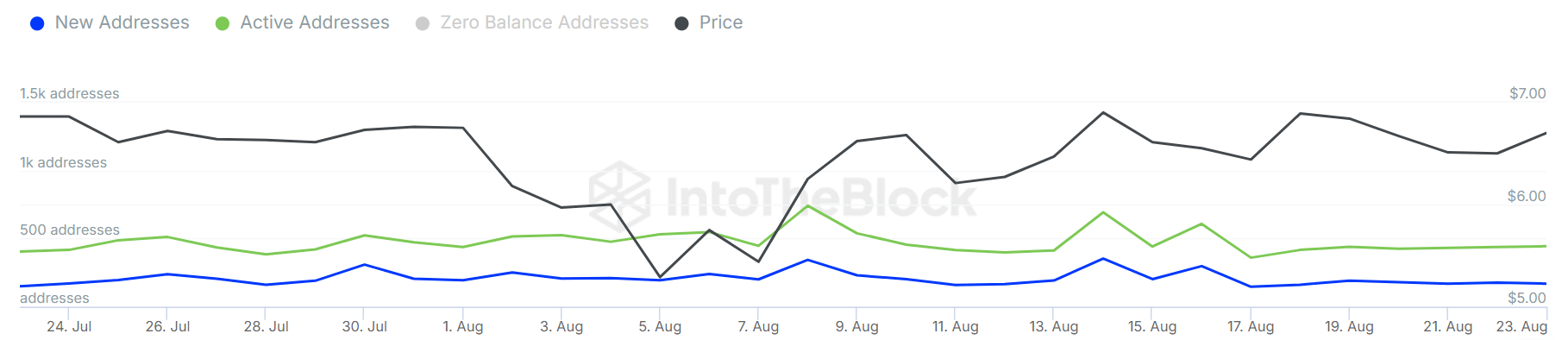

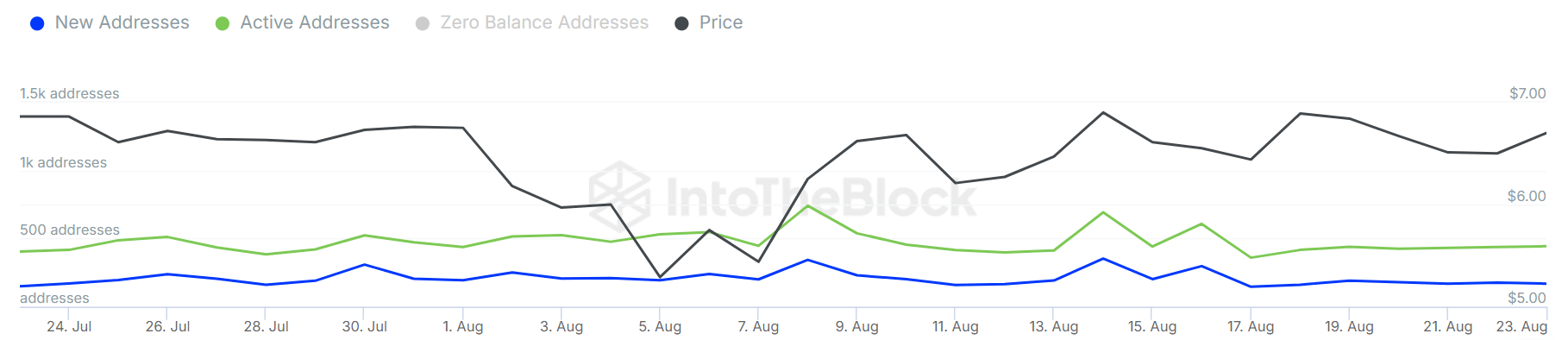

Finally, TON’s network activity has been growing slowly, as indicated by the nearly flat active addresses since August 17. Slow network activity indicates little user interest in the altcoin, which could undermine a strong recovery.

Source: IntoTheBlock

However, a long-term rally in BTC could boost TON’s value, invalidating the aforementioned neutral outlook. Therefore, it is also worth tracking the movements of the king coin.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.